The Charles Schwab Corporation Announces Pricing of $13.1 Billion Secondary Offering of Its Common Stock Held by an Affiliate of The Toronto-Dominion Bank

February 10 2025 - 11:33PM

Business Wire

The Charles Schwab Corporation (NYSE: SCHW) (the “Company” or

“Charles Schwab”) today announced the pricing of the previously

announced secondary offering by TD Group US Holdings LLC, an

affiliate of The Toronto-Dominion Bank (“TD”), of 165,443,530

shares of the Company’s common stock at $79.25 per share. The

secondary offering is expected to close on February 12, 2025,

subject to customary closing conditions.

Following the completion of the secondary offering and the

previously announced $1.5 billion share repurchase by the Company

from TD, TD will have disposed of all of its shares. Charles Schwab

will not receive any of the proceeds from the sale of shares of its

common stock.

The secondary offering was led by TD Securities and Goldman

Sachs & Co. LLC.

Charles Schwab has filed a registration statement (including a

prospectus) and a preliminary prospectus supplement with the SEC

for the secondary offering to which this communication relates. A

final prospectus relating to the offering will be filed with the

SEC and may be obtained, when available, for free by visiting EDGAR

on the SEC website at www.sec.gov. Alternatively, any underwriter

or any dealer participating in the offering will arrange to send

you the prospectus and the final prospectus supplement, when

available, if you request them by contacting (i) TD Securities

(USA) LLC, 1 Vanderbilt Avenue, New York, NY 10017, telephone: 1

(855) 495-9846 or by email at TD.ECM_Prospectus@tdsecurities.com;

or (ii) Goldman Sachs & Co. LLC, Attn: Prospectus Department,

200 West Street, New York, NY 10282, telephone: 1 (866) 471-2526,

facsimile: (212) 902-9316 or by email at

Prospectus-ny@ny.email.gs.com.

This announcement shall not constitute an offer to sell or the

solicitation of any offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

Forward-Looking Statements

This press release contains forward-looking statements that

involve substantial risks, uncertainties and assumptions that could

cause actual results to differ materially from those expressed or

implied by such statements. These forward-looking statements

include statements regarding the offering and the share repurchase,

the Company’s plans, objectives, expectations and intentions and

the financial condition, results of operations and business of the

Company. These forward-looking statements are subject to risks and

uncertainties, including, among other things, risks related to the

ability of the Company to consummate the offering and the share

repurchase and the risks described in the company’s most recent

reports on Form 10-K and Form 10-Q, which have been filed with the

Securities and Exchange Commission and are available on the

company’s website (www.aboutschwab.com/financial-reports) and on

the Securities and Exchange Commission’s website (www.sec.gov). The

Company makes no commitment to update any forward-looking

statements.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with 36.5 million active brokerage

accounts, 5.4 million workplace plan participant accounts, 2.0

million banking accounts, and $10.10 trillion in client assets.

Through its operating subsidiaries, the company provides a full

range of wealth management, securities brokerage, banking, asset

management, custody, and financial advisory services to individual

investors and independent investment advisors. Its broker-dealer

subsidiary, Charles Schwab & Co., Inc. (member SIPC,

https://www.sipc.org), and its affiliates offer a complete range of

investment services and products including an extensive selection

of mutual funds; financial planning and investment advice;

retirement plan and equity compensation plan services; referrals to

independent, fee-based investment advisors; and custodial,

operational and trading support for independent, fee-based

investment advisors through Schwab Advisor Services. Its primary

banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an

Equal Housing Lender), provides banking and lending services and

products.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210129939/en/

MEDIA Mayura Hooper, 415-667-1525

public.relations@schwab.com

INVESTORS/ANALYSTS Jeff Edwards, 817-854-6177

investor.relations@schwab.com

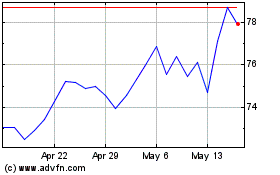

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Jan 2025 to Feb 2025

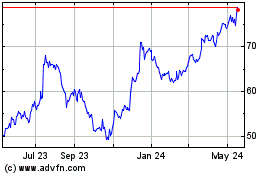

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Feb 2024 to Feb 2025