GLOBALT Investments LLC and Synovus Financial Corp. (NYSE:SNV)

today announced the completion of a transaction through which the

leadership team of GLOBALT has purchased the firm from Synovus and

now operates as an independent entity.

Led by President William H. Roach Jr., GLOBALT is now an

independent provider of managed exchange-traded fund (ETF) and

equity portfolios that help advisors and institutions manage

ongoing changes in the global marketplace. As part of this

transaction, GLOBALT’s entire executive leadership team will remain

with the firm, ensuring continuity and the same focus on client

service and investment performance that has marked the first 32

years of the GLOBALT story. The firm operated independently before

its acquisition by Synovus in 2002. Gary Fullam, chief investment

officer and one of the firm’s founders, continues to lead the

investment management team.

“Our relationship with Synovus, which has grown and thrived over

the past two decades, remains strong, and my colleagues and I look

forward to continuing to build on all that our respective teams

have accomplished on behalf of so many Synovus clients,” said

Roach. “Diversity has been and continues to be a defining pillar of

the organization, and ownership reflects that commitment. As we

embark on the next stage of our growth story, my GLOBALT colleagues

and I could not be more excited about the opportunities to expand

our relationships and deliver our differentiated ETF solutions to a

broader range of financial advisors, institutions and

individuals.”

“We believe GLOBALT has a strong future as an independent

investment advisor, enabled to explore a wide range of additional

partners and potential client relationships,” said Synovus

Chairman, CEO and President Kevin Blair. “Our working relationship

with the GLOBALT team provided valuable expertise to our clients,

and we look forward to our continued partnership and their

success.”

Founded in 1991, GLOBALT has built a strong reputation for

providing risk-controlled, diversified portfolios of ETFs and

equities to its clients, which range from financial advisors to

small, mid-sized and large institutional investors. The firm was

among the first to build a suite of asset allocation strategies

constructed solely using ETFs and trademarked the innovatETF

Strategies® brand in 2003.

As of Sept. 30, 2023, the firm has nearly $3 billion in assets

under management and 32 years of experience, making it one of the

longest-tenured firms in the ETF-managed portfolio space, with

solutions available across a range of leading platforms, including

Envestnet and others.

The transaction officially closed on Sept. 30, 2023. Specific

terms are not being disclosed.

For more information, please visit globalt.com.

About GLOBALT Investments

GLOBALT Investments was founded in 1990 and federally registered

with the SEC in 1991. The firm is a Registered Investment Adviser

offering advisory services to institutions and individuals by way

of Separately Managed Accounts, Wrap Fee Programs, and Model

Portfolios. GLOBALT is a leader in building portfolios that focus

on the changes in the global marketplace. For more information,

please visit globalt.com.

About Synovus Financial Corp.

Synovus Financial Corp. is a financial services company based in

Columbus, Georgia, with approximately $61 billion in assets.

Synovus provides commercial and consumer banking and a full suite

of specialized products and services, including private banking,

treasury management, wealth management, mortgage services, premium

finance, asset-based lending, structured lending, capital markets

and international banking. Synovus has branches in Georgia,

Alabama, South Carolina, Florida and Tennessee. Synovus is a Great

Place to Work-Certified Company and is on the web at synovus.com

and on Twitter, Facebook, LinkedIn and Instagram.

Cautionary Statement Regarding Forward-Looking

Information

This press release contains statements that constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995 including, but not limited

to, Synovus’ expectations or predictions of future financial or

business performance or conditions. Forward-looking statements are

typically identified by words such as “believe,” “expect,”

“anticipate,” “intend,” “target,” “estimate,” “continue,”

“positions,” “plan,” “predict,” “project,” “forecast,” “guidance,”

“goal,” “objective,” “prospects,” “possible,” or “potential,” by

future conditional verbs such as “assume,” “will,” “would,”

“should,” “could” or “may”, or by variations of such words or by

similar expressions. These forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made and we assume no duty to update forward-looking statements.

Actual results may differ materially from those contemplated by

such forward-looking statements.

These forward-looking statements are made to provide the public

with management’s current expectations with regard to foregoing

transaction. Although Synovus believes the expectations reflected

in forward-looking statements are reasonable, there can be no

assurances such expectations will prove to be accurate. Security

holders are cautioned such forward-looking statements involve risks

and uncertainties. Certain factors may cause results to differ

materially from those anticipated by the forward-looking statements

made in this release. Such factors may include, without limitation,

the risks and uncertainties discussed and described in (i) Synovus’

annual report on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) on February 24, 2023, including the risks

described in Part 1, Item 1A, “Risk Factors” thereof, and (ii) the

other reports filed with the SEC. Many of these risks and

uncertainties are beyond the ability of Synovus to control, nor can

Synovus predict, in many cases, all of the risks and uncertainties

that could cause its actual results to differ materially from those

indicated by the forward-looking statements. The forward-looking

statements contained in this release speak only as of the date of

this release, and the Company expressly disclaims any obligation or

undertaking to report any updates or revisions to any such

statement to reflect any change in the Company’s expectations or

any change in events, conditions or circumstances on which any such

statement is based, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231002002420/en/

Chris Sullivan Craft & Capital (212) 473-4442

chris@craftandcapital.com Audria Belton media@synovus.com

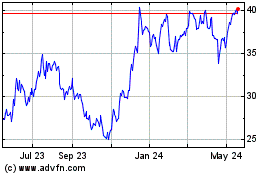

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Jan 2025 to Feb 2025

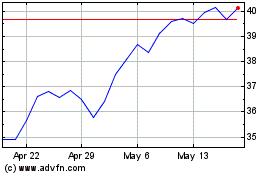

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Feb 2024 to Feb 2025