Sonoco Completes Strategic Review, Announces Agreement to Sell Thermoformed and Flexibles Packaging (TFP) Business to TOPPAN Holdings Inc.

December 18 2024 - 4:00PM

Sonoco Products Company (“Sonoco” or the “Company”) (NYSE: SON), a

global leader in high-value sustainable packaging, today announced

it has entered into an agreement to sell its Thermoformed and

Flexibles Packaging business (“TFP”) to TOPPAN Holdings Inc.

(“Toppan”) for approximately $1.8 billion on a cash-free and

debt-free basis and subject to customary adjustments (the

“Transaction”).

The Transaction, which reflects the completion of

the previously announced strategic review of Sonoco’s TFP business,

is subject to customary closing conditions, including regulatory

approvals, and is expected to close in the first half of 2025. Net

proceeds from the transaction are expected to be used to repay

existing debt.

“The decision to sell our TFP business accelerates

our portfolio simplification strategy, streamlines our

organizational structure, and enables more focused capital

investments in our remaining industrial paper and consumer

packaging businesses,” said Howard Coker, Sonoco’s President and

Chief Executive Officer. “TFP is a great business with leadership

positions in its served markets. We greatly value TFP’s tenured

history as part of the Sonoco family, and I am personally proud of

their long-standing commitment to serve our customers with both

innovative and high quality packaging products. We will work

closely with Toppan to ensure a successful transition for our

employees, customers, and suppliers and wish the entire team all

the best in the future.”

Goldman Sachs & Co. LLC is acting as lead

financial advisor to Sonoco. RBC Capital Markets, LLC is also

acting as financial advisor to Sonoco. Freshfields LLP is acting as

Sonoco’s legal advisor. Houlihan Lokey is acting as lead financial

advisor to Toppan. Mitsubishi UFJ Morgan Stanley Securities Co.,

Ltd. is also acting as financial advisor to Toppan. Morrison &

Foerster LLP is acting as Toppan’s legal advisor.

About Sonoco:With net sales of

approximately $6.8 billion in 2023, Sonoco has approximately 22,000

employees working in more than 300 operations around the world,

serving some of the world’s best-known brands. With our corporate

purpose of Better Packaging. Better Life., Sonoco is committed to

creating sustainable products and a better world for our customers,

employees, and communities. Sonoco was named one of America’s Most

Responsible Companies by Newsweek. For more information on the

Company, visit our website at www.sonoco.com.

Forward-Looking Statements

Certain statements made in this communication are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Words such as

“accelerate,” “committed,” “enable,” “ensure,” “expect,” “future,”

“will,” or the negative thereof, and similar expressions identify

forward-looking statements.

Forward-looking statements in this communication

include, but are not limited to, the Company’s pending Transaction

and the anticipated timing thereof; the anticipated effects of the

divestiture on the Company’s portfolio simplification strategy,

streamlining of the Company’s organizational structure, and capital

investments in the Company’s remaining businesses; and the

Company’s expected use of the net proceeds of the divestiture.

These forward-looking statements are made based on

current expectations, estimates and projections about the Company’s

industry, management’s beliefs and certain assumptions made by

management. Such information includes, without limitation,

discussions as to guidance and other estimates, perceived

opportunities, expectations, beliefs, plans, strategies, goals and

objectives concerning the Company’s future financial and operating

performance. These statements are not guarantees of future

performance and are subject to certain risks, uncertainties and

assumptions that are difficult to predict.

Therefore, actual results may differ materially

from those expressed or forecasted in such forward-looking

statements. Risks and uncertainties include, among other things,

risks related to the pending Transaction, including that such

Transaction will not be completed on the timing or terms the

Company anticipates, or at all; the ability to receive regulatory

approvals for the Transaction in a timely manner, on acceptable

terms or at all, or to satisfy the other closing conditions to the

Transaction; the Company’s ability to realize anticipated benefits

of the Transaction, or that such benefits may take longer to

realize than expected; diversion of management’s attention; the

potential impact of the announcement or consummation of the

Transaction on relationships with employees, clients and other

third parties; the Company’s ability to execute on its strategy,

including with respect to portfolio simplification, organizational

streamlining, and capital investments, and achieve the benefits it

expects therefrom; and the other risks, uncertainties and

assumptions discussed in the Company’s filings with the Securities

and Exchange Commission, including its most recent reports on Forms

10-K and 10-Q, particularly under the heading “Risk Factors”.

Except as required by applicable law, the Company undertakes no

obligation to publicly update or revise forward-looking statements,

whether as a result of new information, future events or otherwise.

In light of these risks, uncertainties and assumptions, the

forward-looking events discussed herein might not occur.

Contact Information

Investors Lisa WeeksVice President

of Investor Relations & Communicationslisa.weeks@sonoco.com

843-383-7524

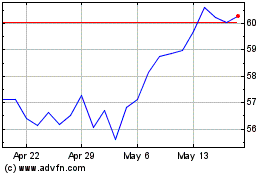

Sonoco Products (NYSE:SON)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sonoco Products (NYSE:SON)

Historical Stock Chart

From Jan 2024 to Jan 2025