0001805833FALSE4235 Redwood AvenueMarina Del ReyCalifornia00018058332024-05-092024-05-090001805833us-gaap:CommonStockMember2024-05-092024-05-090001805833sst:RedeemableWarrantsMember2024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 9, 2024

System1, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39331 | | 92-3978051 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | |

4235 Redwood Avenue Marina Del Rey, California | | | | 90066 |

(Address of principal executive offices) | | | | (Zip Code) |

(310) 924-6037(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | | SST | | New York Stock Exchange |

| Redeemable warrants, each whole warrant exercisable for one Class A Common Stock share at an exercise price of $11.50 per share | | SST.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition

On May 9, 2024, System1, Inc. (the “Company”) issued a press release announcing financial results for its quarter ended March 31, 2024. The full text of the Company’s press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such a filing.

The Company makes reference to certain non-GAAP financial measures in the press release. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures and reasons for why the Company believes these non-GAAP financial measures are useful are contained in the attached press release.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | System1, Inc. |

| | | |

| Date: | May 9, 2024 | By: | /s/ Tridivesh Kidambi |

| | Name: | Tridivesh Kidambi |

| | Title: | Chief Financial Officer |

System1 Announces First Quarter 2024 Financial Results

All Key Financial Results Above the High-End of Guidance Range

•Revenue Decreased $11.2 Million Over Prior Quarter to $84.9 Million

•Gross Profit Decreased 25% Over Prior Quarter to $18.6 Million

•Adjusted Gross Profit Decreased 17% Over Prior Quarter to $31.2 Million

•GAAP Net Loss Decreased 46% Over Prior Quarter to $14 Million

•Adjusted EBITDA Decreased $9.6 million Over Prior Quarter to $0.4 Million

•Company Provides Second Quarter Guidance of: $88 Million to $90 Million of Revenue and $5 Million to $7 Million of Adjusted EBITDA

LOS ANGELES, CA – May 9, 2024 – System1, Inc. (NYSE: SST) (“System1” or the “Company”), an omnichannel customer acquisition marketing platform, announced its financial results for the first quarter of 2024.

“We are pleased to report a strong start to the year, with our headline Q1 results exceeding the top end of our guidance ranges for Revenue, Adjusted Gross Profit and Adjusted EBITDA. We had a strong quarter of execution across our core initiatives and I am pleased we were able to deliver these results,” commented Michael Blend, System1’s Co-Founder & Chief Executive Officer. “Looking towards the remainder of 2024, we continue to remain optimistic around increased advertiser demand, and we are confident the investments in our RAMP platform leave System1 well positioned to take advantage of these trends.”

Tridivesh Kidambi, Chief Financial Officer of System1, commented, “We delivered first quarter financial results that exceeded our guidance, which was the result of some better-than-expected trends at the end of the quarter. We currently are expecting the favorable trends to continue and coupled with our cost reductions in the second half of last year, we expect to deliver year-over-year improvement in net loss and growth in Adjusted EBITDA for the remainder of the year. We significantly deleveraged last quarter, and we will continue to aggressively take advantage of opportunities to increase equity value going forward, while continuing to reduce our overall leverage.”

Note: Adjusted Gross Profit and Adjusted EBITDA are non-GAAP metrics that are defined and reconciled at the end of this release.

First Quarter 2024

•Successfully completed a modified “Dutch auction” tender offer in January of 2024, repurchasing $63.7 million of term debt for a purchase price of $40.9 million, exclusive of fees and expenses. This brought the total debt repaid between November 2023 and January 2024 to $155 million.

•Significant enhancements to RAMP released throughout the quarter focused on automation, with more than 90% of Owned & Operated customer acquisition advertising decisions now automated.

•Released several improvements to RAMP Partner Portal, including enhanced reporting and self-serve functionality for Network Partners.

Second Quarter 2024 Guidance

The Company expects for the second quarter of 2024:

•Revenue between $88 million and $90 million.

•Gross Profit between $20 million and $22 million.

•Adjusted Gross Profit between $33 million and $35 million.

•Adjusted EBITDA between $5 million and $7 million.

In reliance on the unreasonable efforts exception for forward-looking information provided under Regulation S-K, the Company is not reasonably able to provide a quantitative reconciliation of Adjusted EBITDA to net loss, the most directly comparable GAAP financial measures without unreasonable effort due to uncertainties regarding purchase accounting, stock-based compensation, taxes and other potential adjustments. The difference between Gross Profit and Adjusted Gross Profit is primarily depreciation and amortization related to the cost of revenues, which are estimated to be approximately $13 million. The variability of these items could have an unpredictable, and potentially significant, impact on the Company’s future GAAP financial results. For the first quarter of 2024, the Company expects interest expense in the range of $7.0 million to $7.5 million, depreciation and amortization expense in the range of $20 million to $21 million, and acquisition and restructuring costs to be in the range of $2.0 million to $2.5 million.

The Company’s achievement of the anticipated results is subject to risks and uncertainties, including those disclosed in its filings with the U.S. Securities and Exchange Commission. The outlook does not take into account the impact of any unanticipated developments in the business or changes in the operating environment.

About System1, Inc.

System1 combines best-in-class technology & data science to operate its advanced Responsive Acquisition Marketing Platform (RAMP). System1’s RAMP is omnichannel and omnivertical, and built for a privacy-centric world. RAMP enables the building of powerful brands across multiple consumer verticals, the development & growth of a suite of privacy-focused products, and the delivery of high-intent customers to advertising partners. For more information, visit www.system1.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release includes “forward-looking statements” “within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, particularly any statements or materials regarding System1’s future results. Forward-looking statements include, but are not limited to, statements regarding System1 or its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause System1’s actual financial results or operating performance to be materially different from those expressed or implied by these forward-looking statements. Readers or users of this press release should evaluate the risk factors summarized below, which summary list is not exclusive. Readers or users of this press release should also carefully review the “Risk Factors” and other information included in our registration statements on Form S-4 (including the related proxy statement/prospectus) with respect to the Business Combination with Trebia Acquisition Corp. each filed with the Securities and Exchange Commission (the “SEC”), as well as System1’s Form 10-K, Form 10-Q/As, Form 8-K and other reports filed with the SEC from time to time. Please

refer to these SEC filings for additional information regarding the risks and other factors that may impact System1’s business, prospects, financial results and operating performance following completion of the Business Combination.

Such risks, uncertainties and assumptions include, but are not limited to: (1) our ability to maintain our key relationships with network partners and advertisers, including our monetization arrangements; (2) our ability to collect, process, effectively utilize and safely store the first party data that we obtain through our services; (3) The performance of our responsive acquisition marketing platform, or RAMP; (4) changes in customer demand for our services and our ability to incorporate to such changes; (5) our ability to maintain and attract consumers and advertisers in the face of changing economic or competitive conditions; (6) our ability to improve and maintain adequate internal control over financial reporting and remediate identified material weaknesses; (7) our ability to successfully source and complete acquisitions and to integrate the operations of companies System1 acquires; (8) our ability to raise financing in the future as and when needed or on market terms; (9) our ability to compete with existing competitors and the entry of new competitors in the market; (10) changes in applicable laws or regulations impacting the business which we operate and our ability to maintain compliance with the various laws that our business and operations are subject to; and (11) our ability to protect our intellectual property rights. The foregoing list of factors is not exclusive.

Should one or more of these risks or uncertainties materialize, they could cause our actual results to differ materially from any forward-looking statements contained in this press release. System1’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the forward-looking statements for the purpose of their inclusion in this press release, and accordingly, do not express an opinion or provide any other form of assurance with respect thereto for the purpose of this press release. System1 will not undertake any obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. You should not take any statement regarding past trends or activities as a representation that such trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements.

Non-GAAP Measures: Adjusted Gross Profit and Adjusted EBITDA

Adjusted Gross Profit and Adjusted EBITDA are non-GAAP financial measures and represent key metrics used by System1’s management and board of directors to measure the operational strength and performance of its business, to establish budgets, and to develop operational goals for managing its business. Adjusted Gross Profit (Loss) is defined as gross profit plus depreciation and amortization related to cost of revenues. Adjusted EBITDA is defined as net income (loss) before interest expense, income taxes, depreciation and amortization expense, stock-based compensation expenses, deferred compensation, management fees, minority interest expense, restructuring charges, impairment and certain discrete items impacting a particular segment’s results in a particular period.

System1 believes Adjusted Gross Profit and Adjusted EBITDA are relevant and useful metrics for investors because it allows investors to view performance in a manner similar to the method used by management. There are limitations on the use of Adjusted Gross Profit and Adjusted EBITDA and it may not be comparable to similarly titled measures of other companies. Other companies, including companies in System1’s industry, may calculate non-GAAP financial measures differently than System1 does, limiting the usefulness of those measures for comparative purposes.

Adjusted Gross Profit should not be considered a substitute for revenue. Adjusted EBITDA should not be considered a substitute for income (loss) from operations, net income (loss), or net income (loss) attributable to System1 on a consolidated basis that System1 reports in accordance with GAAP. Although System1 uses Adjusted Gross Profit and Adjusted EBITDA as financial measures to assess the performance of its business, such use is limited because it does not include certain costs necessary to operate System1’s business. System1’s presentation of Adjusted Gross Profit and Adjusted EBITDA should not be construed as indications that its future results will be unaffected by unusual or nonrecurring items.

Unaudited Condensed Statements of Operations

(In thousands)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Revenue | $ | 84,917 | | | $ | 121,118 | |

| Operating expenses: | | | |

| Cost of revenue (excluding depreciation and amortization) | 53,698 | | | 82,953 | |

| Salaries and benefits | 24,483 | | | 28,147 | |

| Selling, general, and administrative | 12,728 | | | 14,855 | |

| Depreciation and amortization | 19,804 | | | 19,392 | |

| Impairment of goodwill | — | | | — | |

| Total operating expenses | 110,713 | | | 145,347 | |

| Operating loss | (25,796) | | | (24,229) | |

| Other expense (income): | | | |

| Interest expense, net | 7,970 | | | 11,402 | |

| Gain from debt extinguishment | (19,676) | | | — | |

| Change in fair value of warrant liabilities | (251) | | | (1,409) | |

| Total other (income) expense, net | (11,957) | | | 9,993 | |

| Loss before income tax | (13,839) | | | (34,222) | |

| Income tax benefit | (48) | | | (3,829) | |

| Net loss from continuing operations | (13,791) | | | (30,393) | |

| Net loss from discontinued operations, net of tax | — | | | (12,533) | |

| Net loss | (13,791) | | | (42,926) | |

| Less: Net loss from continuing operations attributable to non-controlling interest | (3,254) | | | (6,757) | |

| Less: Net loss from discontinued operations attributable to non-controlling interest | — | | | (2,367) | |

| Net loss attributable to System1, Inc. | $ | (10,537) | | | $ | (33,802) | |

Unaudited Condensed Balance Sheets

(In thousands, except for par values)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| ASSETS | | | |

| | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 69,920 | | | $ | 135,343 | |

| Restricted cash, current | 7,231 | | | 3,813 | |

| Accounts receivable, net | 52,735 | | | 56,093 | |

| Prepaid expenses and other current assets | 9,791 | | | 6,754 | |

| Total current assets | 139,677 | | | 202,003 | |

| Restricted cash, non-current | 533 | | | 4,294 | |

| Property and equipment, net | 2,836 | | | 3,084 | |

| Internal-use software development costs, net | 12,545 | | | 11,425 | |

| Intangible assets, net | 278,336 | | | 297,001 | |

| Goodwill | 82,407 | | | 82,407 | |

| Operating lease right-of-use assets | 4,241 | | | 4,732 | |

| Other non-current assets | 484 | | | 524 | |

| Total assets | 521,059 | | | 605,470 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | 7,055 | | | 9,499 | |

| Accrued expenses and other current liabilities | 52,351 | | | 59,314 | |

| Operating lease liabilities, current | 2,375 | | | 2,333 | |

| Debt, net | 16,190 | | | 15,271 | |

| Total current liabilities | 77,971 | | | 86,417 | |

| Operating lease liabilities, non-current | 2,938 | | | 3,582 | |

| Long-term debt, net | 268,597 | | | 334,232 | |

| Warrant liability | 2,438 | | | 2,688 | |

| Deferred tax liability | 7,649 | | | 8,307 | |

| Other liabilities | 1,061 | | | 929 | |

| Total liabilities | 360,654 | | | 436,155 | |

| Commitments and contingencies (Note 7) | | | |

| Stockholders' equity: | | | |

| Class A common stock - $0.0001 par value; 500,000 shares authorized, 68,632 and 65,855 Class A shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 7 | | | 7 | |

| Class C common stock - $0.0001 par value; 25,000 shares authorized, 21,204 and 21,513 Class C shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 2 | | | 2 | |

| Additional paid-in capital | 850,202 | | | 843,112 | |

| Accumulated deficit | (718,199) | | | (707,662) | |

| Accumulated other comprehensive loss | (271) | | | (181) | |

| Total stockholders' equity attributable to System1, Inc. | 131,741 | | | 135,278 | |

| Non-controlling interest | 28,664 | | | 34,037 | |

| Total stockholders' equity | 160,405 | | | 169,315 | |

| Total liabilities and stockholders' equity | $ | 521,059 | | | $ | 605,470 | |

The following table reconciles net loss to Adjusted EBITDA for the periods presented ($ in millions).

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Net loss from continuing operations | $ | (13.8) | | | $ | (30.4) | |

| Plus: | | | |

| Income tax benefit | — | | | $ | (3.8) | |

| Interest expense | 8.0 | | | $ | 11.4 | |

| Depreciation and amortization | 19.8 | | | $ | 19.4 | |

| Other expense | (0.1) | | | $ | — | |

| Stock-based compensation & distributions to members | 4.0 | | | $ | (0.1) | |

| Impairment of goodwill | — | | | $ | 5.8 | |

| Loss on extinguishment of related-party debt | (19.7) | | | $ | (1.4) | |

| Non-cash revaluation of warrant liability | (0.3) | | | $ | — | |

| Acquisition and restructuring costs | 2.5 | | | $ | 4.2 | |

| | | |

| Adjusted EBITDA | $ | 0.4 | | | $ | 5.1 | |

The following table reconciles Revenue to Gross Profit and Adjusted Gross Profit for the periods presented ($ in millions).

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Revenue | $ | 84.9 | | | $ | 121.1 | |

| Less: Cost of revenue (excluding depreciation and amortization) | (53.7) | | | (83.0) | |

| Less: Depreciation and amortization related to cost of revenue | (12.6) | | | (12.4) | |

| Gross Profit | 18.6 | | | 25.8 | |

| Add: Depreciation and amortization related to cost of revenue | 12.6 | | | 12.4 | |

| Adjusted Gross Profit | $ | 31.2 | | | $ | 38.2 | |

Investors:

Brett Milotte

ICR, Inc.

Brett.Milotte@icrinc.com

v3.24.1.u1

Cover

|

May 09, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 09, 2024

|

| Entity Registrant Name |

System1, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39331

|

| Entity Tax Identification Number |

92-3978051

|

| Entity Address, Address Line One |

4235 Redwood Avenue

|

| Entity Address, City or Town |

Marina Del Rey

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90066

|

| City Area Code |

310

|

| Local Phone Number |

924-6037

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001805833

|

| Amendment Flag |

false

|

| Class A Common Stock, $0.0001 par value per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

SST

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants, each whole warrant exercisable for one Class A Common Stock share at an exercise price of $11.50 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, each whole warrant exercisable for one Class A Common Stock share at an exercise price of $11.50 per share

|

| Trading Symbol |

SST.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sst_RedeemableWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

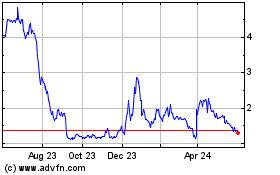

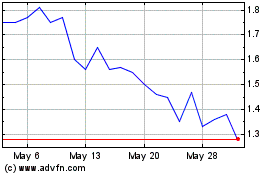

System1 (NYSE:SST)

Historical Stock Chart

From Apr 2024 to May 2024

System1 (NYSE:SST)

Historical Stock Chart

From May 2023 to May 2024