UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 29, 2024

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

SUZANO S.A.

Publicly-Held Company

Corporate Taxpayer ID (CNPJ/MF): 16.404.287/0001-55

Company Registry (NIRE): 29.3.0001633-1

NOTICE TO THE MARKET

São Paulo, May 29, 2024 – Suzano S.A. ("Suzano" or "Company") (B3: SUZB3 | NYSE: SUZ), in addition to the Notice to the Market released on May 17, 2024, informs its shareholders and to the market in general that, in the present date, it occurred the settlement of the fundraising carried out through the 11th (eleventh) issuance of common debentures, non-convertible into shares, unsecured, in three series, which were object of a public offer, according to the automatic distribution registration procedure, under the terms of Law 6.385, of December 7, 1976, as amended, CVM Resolution No. 160, of July 13th, 2022, as amended, and other applicable legal and regulatory provisions, with the following characteristics:

•Total Amount of the Issuance: BRL 5,900,000,000 (five billion nine hundred million reais) of which: (i) R$ 1,000,000,000.00 (one billion reais) refers to the first series debentures ("First Series Debentures”); (ii) R$ 4,000,000,000.00 (four billion reais) refers to the second series debentures ("Second Series Debentures”); and (iii) R$ 900,000,000.00 (nine hundred million reais) refers to the third series debentures ("Third Series Debentures” and, when together with the First Series Debentures and the Second Series Debentures, “Debentures”).

•Issuance Date: May 15, 2024.

•Term and Maturity Date:

•First Series Debentures: 8 (eight) years counted from the Issuance Date, maturing, therefore, on May 15, 2032;

•Second Series Debentures: 10 (ten) years counted from the Issuance Date, maturing, therefore, on May 15, 2034; and

•First Series Debentures: 12 (twelve) years counted from the Issuance Date, maturing, therefore, on May 15, 2036.

•Remuneration of the Debentures:

•First Series Debentures: The Unit Par Value or its balance, as the case may be, shall bear interest corresponding to the accumulated variation of 100% of the DI Rate, expressed as a percentage per annum, based on 252 Business Days, calculated and disclosed daily by B3 S.A. - Brasil, Bolsa, Balcão, in the daily report available on its website (http://www.b3.com.br) ("DI Rate”), plus a spread of 0.80% per annum, based on 252 Business Days;

•Second Series Debentures: The Unit Par Value or its balance, as the case may be, shall bear interest corresponding to the accumulated variation of the DI Rate, plus a spread of 1.00% per annum, based on 252 Business Days; and

•Third Series Debentures: The Unit Par Value or its balance, as the case may be, shall bear fixed interest corresponding to 6.1100% per year.

•Monetary Adjustment of the Debentures:

•First and Second Series Debentures: The Unit Par Value of the First Series Debentures and the Second Series Debentures or its respective balance, as the case may be, shall not be monetarily restated; and

•Third Series Debentures: The Unit Par Value or its balance, as the case may be, of the Third Series Debentures will be restated by the accumulated variation of the IPCA, published monthly by the IBGE, calculated exponentially and cumulatively pro rata temporis per Business Day, from the first Payment Date of the Third Series Debentures until the date of their effective payment, with the product of the restatement being incorporated into the Unit Par Value or the balance of the Unit Par Value of the Third Series Debentures automatically.

•Debenture Characteristics: The Third Series Debentures will have the incentive provided for in article 2 of Law 12,431, considering the fact that the Project (as defined in the Issue Deed) falls within the priority sector provided for in subparagraph (a) of item III of article 4 of Decree 11,964.

São Paulo, May 29, 2024.

Marcelo Feriozzi Bacci

Chief Financial and Investor Relations Officer

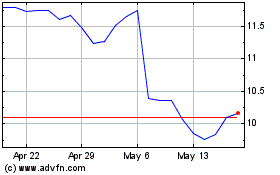

Suzano (NYSE:SUZ)

Historical Stock Chart

From May 2024 to Jun 2024

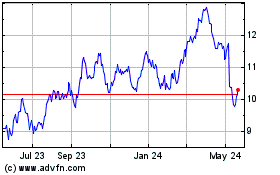

Suzano (NYSE:SUZ)

Historical Stock Chart

From Jun 2023 to Jun 2024