UPDATE: Heavy Corporate Bond Supply As Investors Crave Yield

March 09 2010 - 9:44AM

Dow Jones News

Another robust round of corporate bond sales were on tap

Tuesday, following the fresh $12 billion in new issues sold a day

earlier. As the economy continues to improve, companies are keen to

take advantage of still low borrowing costs and investors are all

too happy to pick up investments offering higher yields than other

securities.

Swiss pharmaceutical giant Novartis AG (NVS) said it would offer

$4 billion of senior notes with proceeds earmarked for general

corporate purposes and to finance its acquisition of a 52% stake in

eye-care products maker Alcon from Nestle SA (NSRGY, NESN.VX),

according to the deal's prospectus.

Novartis Securities Investment Ltd. and Novartis Capital Corp.

last sold a combined $5 billion in bonds on Feb. 4, 2009, according

to Dealogic. Novartis AG served as the issuer parent.

"We expect high-grade new issue supply to accelerate from $15

billion priced in the first week of March to $20 billion to $25

billion this week, as issuers access the market after the earnings

season," according to Hans Mikkelsen at Bank of America Merrill

Lynch. He said that strong demand is also supporting higher supply

volumes.

There is "massive demand for IG cash," said Lindsey Spink,

portfolio manager at AXA. Most new issues are oversubscribed.

Other deals on offer include Amgen Inc.'s (AMGN) $1 billion

bonds, Anadarko Petroleum Corp.'s (APC) $750 million 30-year note

and Royal Bank of Scotland Group PLC's (RBS, RBS.LN)

benchmark-sized five-year issue. Denmark's largest bank, Danske

Bank (DANSKE.KO), is priming its benchmark-sized five-year offering

in the private placement Rule 144a market.

Real estate investment trust ProLogis (PLD) is also priming a

benchmark-sized offering of 10-year senior notes in order to pay

down its debt.

Smaller offerings from Georgia Power Co. and Transalta Corp.

(TAC, TA.T) are also on tap Tuesday.

"The reason [for the surge in supply] is straightforward--there

is a measured response to the calm in the market relating back to

concerns over Greece," said Scott MacDonald, director of research

at Aladdin Capital Holdings in Stamford, Conn. "There is a cautious

perception that sovereign risk has been somewhat reduced and this

gives investors a chance to return to the market."

To be sure, European credit markets began the week on the right

foot, with Greece's credit default swaps trading at 290 basis

points, a considerable improvement from a 400 basis point level

seen in early February, according to Gavan Nolan, vice president of

research at Markit. As overseas governments including Greece and

Portugal continue to find their fiscal footing, investor concern

has lessened and risk has taken a back seat to yield pick-up.

The tone in the high-grade market is "good," said Guy LeBas,

chief fixed-income strategist at Janney Capital Markets in

Philadelphia.

He pointed out that deals sold on Monday have also tightened in

the secondary market.

For instance, DirecTV Group Inc. (DTV), which sold a $3 billion,

three-part deal is seeing the five-year bond perform really well,

he said.

DirecTV Group Inc.'s (DTV) 3.50% issue due 2015 is currently bid

10 basis points better to 110 basis points over Treasurys,

according to one NY-based bond trader.

-By Kellie Geressy-Nilsen, Dow Jones Newswires; 212-416-2226;

kellie.geressy@dowjones.com

(Prabha Natarjan also contributed to this report.)

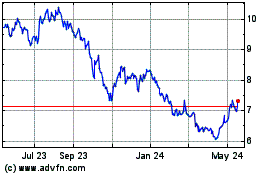

TransAlta (NYSE:TAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

TransAlta (NYSE:TAC)

Historical Stock Chart

From Jul 2023 to Jul 2024