Transcontinental Realty Investors, Inc. reports Earnings for Quarter Ended September 30, 2022

November 10 2022 - 3:30PM

Business Wire

Transcontinental Realty Investors, Inc. (NYSE:TCI) is reporting

its results of operations for the quarter ended September 30, 2022.

For the three months ended September 30, 2022, we reported net

income attributable to the Company of $378.4 million or $43.79 per

diluted share, compared to a net income of $26.2 million or $3.04

per diluted share for the same period in 2021.

Financial Highlights

- We collected approximately 99% of our rents for the three

months ended September 30, 2022, comprised of approximately 98%

from multifamily tenants and approximately 99% from office

tenants.

- Total stabilized occupancy was 94% at September 30, 2022, which

includes 96% at our multifamily properties and 68% at our

commercial properties.

- On September 16, 2022, VAA completed the sale of 45 properties

for $1.8 billion, resulting in gain on sale of $738.7 million to

the joint venture. In connection with sale, we received an initial

distribution of $182.8 million from VAA. We plan to use our share

of the proceeds to invest in income-producing real estate, pay down

debt and for general corporate purposes.

- In connection with the VAA sale, we sold Sugar Mill Phase III,

a 72 unit multifamily property in Baton Rouge, Louisiana for $11.8

million, resulting in gain on sale of $1.9 million. We used the

proceeds to pay off the $9.6 million mortgage note payable on the

property and for general corporate purposes.

Financial Results

Rental revenues decreased $2.1 million from $9.6 million for the

three months ended September 30, 2021 to $7.6 million for the three

months ended September 30, 2022. The decrease in rental revenue is

primarily due to the sale of 600 Las Colinas in 2021 and the sale

of Toulon in the first quarter of 2022.

Net operating loss decreased $1.8 million from $4.6 million for

three months ended September 30, 2021 to $2.8 million for the three

months ended September 30, 2022. The decrease in net operating loss

is primarily due to a reduction of legal costs related to the

arbitration settlement in 2021 offset in part by net operating

profit from the sale of 600 Las Colinas in 2021.

Net income attributable to the Company increased $352.1 million

from $26.2 million for the three months ended September 30, 2021 to

$378.4 million for the three months ended September 30, 2022. The

increase in net income is primarily attributed to our share of the

gain on the sale of the 45 properties by VAA, offset in part by tax

expense from the sale.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real

estate investment company, holds a diverse portfolio of equity real

estate located across the U.S., including office buildings,

apartments, shopping centers, and developed and undeveloped land.

The Company invests in real estate through direct ownership, leases

and partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables.

TRANSCONTINENTAL REALTY

INVESTORS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollars in thousands, except

per share amounts)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2022

2021

2022

2021

Revenues: Rental revenues

$

7,570

$

9,628

$

22,310

$

30,183

Other income

749

406

1,566

2,474

Total revenue

8,319

10,034

23,876

32,657

Expenses: Property operating expenses

4,701

5,610

12,541

16,500

Depreciation and amortization

2,193

2,935

6,840

9,473

General and administrative

2,756

2,813

7,348

8,549

Advisory fee to related party

1,434

3,234

6,885

10,144

Total operating expenses

11,084

14,592

33,614

44,666

Net operating loss

(2,765

)

(4,558

)

(9,738

)

(12,009

)

Interest Income

8,087

5,155

18,807

14,518

Interest expense

(4,700

)

(5,910

)

(14,787

)

(19,096

)

Gain (loss) on foreign currency transactions

1,533

(1,639

)

19,437

1,185

Loss on extinguishment of debt

(1,166

)

(1,451

)

(2,805

)

(1,451

)

Equity in income from unconsolidated joint ventures

464,085

3,627

470,428

11,535

Gain on sale or write-down of assets, net

1,539

31,312

16,580

22,970

Income tax provision

(88,037

)

(156

)

(88,105

)

1,037

Net income

378,576

26,380

409,817

18,689

Net income attributable to noncontrolling interest

(225

)

(134

)

(503

)

(544

)

Net income attributable to the Company

$

378,351

$

26,246

$

409,314

$

18,145

Earnings per share Basic and diluted

$

43.79

$

3.04

$

47.38

$

2.10

Weighted average common shares used in computing earnings per share

Basic and diluted

8,639,316

8,639,316

8,639,316

8,639,316

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221110005105/en/

Transcontinental Realty Investors, Inc. Investor Relations Erik

Johnson (469) 522-4200

Investor.relations@transconrealty-invest.com

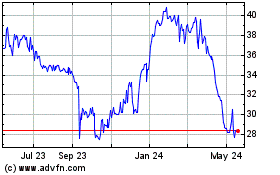

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

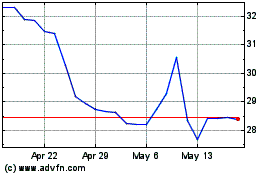

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Feb 2024 to Feb 2025