Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK)

(“Teck”) will present its strategy for generating value for

shareholders and stakeholders and lay out the company’s disciplined

investment pathway to grow copper production to 800,000 tonnes per

year before the end of the decade, at Teck’s 2024 Strategy Day on

November 5, 2024.

“Teck is uniquely positioned in our industry, with the ability

to deliver transformative near-term copper growth while

simultaneously returning significant cash to shareholders,” said

Jonathan Price, President and CEO. “We are executing on a

disciplined strategy to grow copper production by advancing our

portfolio of lower capital intensity, high-returning projects in

stable jurisdictions.”

Price and members of the executive leadership team will provide

details on the company’s performance and strategy for energy

transition metals growth, including:

- Near-term growth supported by one of the strongest balance

sheets in the sector, enabling the company to fund growth while

continuing to return cash to shareholders:

- $2.3 billion of debt reduction year-to-date 2024, and current

net cash position of $1.8 billion.

- $5.3 billion returned to shareholders since 2019, including

more than $0.9 billion in share buybacks so far in 2024, with a

further $2.3 billion of authorized buybacks ongoing.

- Planned investment in the range of US$3.2 to US$3.9 billion

over 4 years to develop four key near-term copper projects is

expected to increase copper production to about 800 kilotonnes per

annum (ktpa):

- Quebrada Blanca (QB) optimization and debottlenecking

(Teck 60% owner, Chile) – extremely low capital cost

option to potentially increase QB production by a further 15-25%

(US$100-200 million estimated attributable capital cost).

- Highland Valley Copper Mine Life Extension (Teck 100%

owner, Canada) – low complexity brownfield project

extending the life of Canada’s largest copper mine to mid-2040s.

Estimated life-of-mine copper production of 137 ktpa post-2024

(US$1.3-1.4 billion estimated attributable capital).

- Zafranal Project (Teck 80% owner, Peru) – long

life, competitive capital cost and low-complexity copper-gold

project, SEIA approval received and positioned for sanction

decision in H2 2025. Estimated copper production of 126 ktpa over

the first five years with substantial additional gold value

(US$1.5-1.8 billion estimated attributable capital).

- San Nicolás Project (Teck 50% owner, Mexico) –

low capital cost, low-complexity copper-zinc project in

well-established mining jurisdiction in partnership with a leading

Canadian mining company. Estimated production of 63 ktpa copper and

147 ktpa zinc over the first five years. Feasibility study and

execution strategy progressing with potential sanction decision in

H2 2025 (Teck estimated funding requirement US$0.3-0.5

billion).

- This growth pathway builds on significant copper growth

achieved to-date, with copper production increasing from 297

kilotonnes (kt) in 2023 to a potential 420-455 kt in 2024 and

510-590 kt in 2025.

“We are focused on disciplined allocation of capital that

balances value-accretive growth with continued cash returns to

shareholders, all while maintaining a strong balance sheet through

market cycles,” said Price.

The Teck 2024 Strategy Day takes place Tuesday, November 5,

2024, from 4:00 p.m. to 8:00 p.m. Eastern / 1:00 p.m. to 5:00 p.m.

Pacific time. Presentations will be available on www.teck.com.

A webcast to view the event will be held as follows:

|

Date: |

|

Tuesday,

November 5, 2024 |

|

Time: |

|

1:00 p.m. PT / 4:00 p.m. ET |

|

Listen-Only Webcast: |

|

here |

| |

|

|

An archive of the webcast will be available at teck.com within

24 hours.

CAUTIONARY STATEMENT ON FORWARD-LOOKING

STATEMENTSThis news release contains certain

forward-looking information and forward-looking statements as

defined in applicable securities laws (collectively referred to as

forward-looking statements). These statements relate to future

events or our future performance. All statements other than

statements of historical fact are forward-looking statements. The

use of any of the words “anticipate”, “plan”, “continue”,

“estimate”, “expect”, “may”, “will”, “project”, “predict”,

“potential”, “should”, “believe” and similar expressions is

intended to identify forward-looking statements. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. These

statements speak only as of the date of this news release.

These forward-looking statements include, but are not limited

to, statements concerning: our focus and strategy and priorities,

including being a pure-play energy transition metals company; all

guidance included in this news release, including future production

and capital expenditure guidance; all statements and expectations

regarding QB, including optimization and debottlenecking targets;

all expectations relating to our projects and mine life extensions

and the development thereof, including expectations related to

benefits and payback periods, the submission, receipt and timing of

regulatory approvals, timing for completion of prefeasibility,

feasibility studies and sanctioning, costs and timing related to

construction and commissioning and expectations relating to

production levels, capital and operating costs.

Actual results and developments are likely to differ, and may

differ materially, from those expressed or implied by the

forward-looking statements contained in this presentation. Such

statements are based on a number of assumptions that may prove to

be incorrect, including, but not limited to, assumptions regarding:

general business and economic conditions; commodity and power

prices; the supply and demand for, and the level and volatility of

prices of, copper, zinc and our other metals and minerals as well

as inputs required for our operations; the timing of receipt of

permits and other regulatory and governmental approvals for our

development projects and operations, including mine extensions; our

costs of production, and our production and productivity levels, as

well as those of our competitors; availability of water and power

resources for our projects and operations; credit market conditions

and conditions in financial markets generally; our ability to

procure equipment and operating supplies and services in sufficient

quantities on a timely basis; the availability of qualified

employees and contractors for our operations and our projects and

our ability to attract and retain such employees; the satisfactory

negotiation of collective agreements with unionized employees; the

impact of changes in Canadian-U.S. dollar exchange rates, Canadian

dollar-Chilean Peso exchange rates and other foreign exchange rates

on our costs and results; the accuracy of our mineral reserve and

resource estimates (including with respect to size, grade and

recoverability) and the geological, operational and price

assumptions on which these are based; tax benefits and tax rates;

and our ongoing relations with our employees and with our business

and joint venture partners. Statements concerning future production

costs or volumes are based on numerous assumptions of management

regarding operating matters and on assumptions that demand for

products develops as anticipated; that customers and other

counterparties perform their contractual obligations; that

operating and capital plans will not be disrupted by issues such as

mechanical failure, unavailability of parts and supplies, labour

disturbances, interruption in transportation or utilities, or

adverse weather conditions; and that there are no material

unanticipated variations in the cost of energy or supplies.

Inherent in forward-looking statements are risks and

uncertainties beyond our ability to predict or control, including,

without limitation: risks that are generally encountered in the

permitting and development of mineral properties such as unusual or

unexpected geological formations; associated with unanticipated

metallurgical difficulties; relating to delays associated with

permit appeals or other regulatory processes, ground control

problems, adverse weather conditions or process upsets and

equipment malfunctions; risks associated with any damage to our

reputation; risks associated with volatility in financial and

commodities markets and global uncertainty; risks associated with

labour disturbances and availability of skilled labour; risks

associated with fluctuations in the market prices of our principal

commodities or of our principal inputs; associated with changes to

the tax and royalty regimes in which we operate; risks posed by

fluctuations in exchange rates and interest rates, as well as

general economic conditions and inflation; risks associated with

climate change, environmental compliance, changes in environmental

legislation and regulation, and changes to our reclamation

obligations; risks created through competition for mining

properties; risks associated with lack of access to capital or to

markets; risks associated with mineral reserve and resource

estimates; risks associated with changes to our credit ratings;

risks associated with our material financing arrangements and our

covenants thereunder; risks associated with procurement of goods

and services for our business, projects and operations; risks

associated with non-performance by contractual counterparties;

risks associated with potential disputes with partners and

co-owners; risks associated with operations in foreign countries;

risks associated with information technology; risks associated with

tax reassessments and legal proceedings; and other risk factors

detailed in our Annual Information Form. Declaration and payment of

dividends and capital allocation are the discretion of the Board,

and our dividend policy and capital allocation framework will be

reviewed regularly and may change. Dividends and share repurchases

can be impacted by share price volatility, negative changes to

commodity prices, availability of funds to purchase shares,

alternative uses for funds and compliance with regulatory

requirements. Certain of our operations and projects are operated

through joint arrangements where we may not have control over all

decisions, which may cause outcomes to differ from current

expectations.

We assume no obligation to update forward-looking statements

except as required under securities laws. Further information

concerning risks, assumptions and uncertainties associated with

these forward-looking statements and our business can be found in

our Annual Information Form for the year ended December 31, 2023

filed under our profile on SEDAR+ (www.sedarplus.ca) and on EDGAR

(www.sec.gov) under cover of Form 40-F, as well as subsequent

filings that can also be found under our profile.

Scientific and technical information in this quarterly report

regarding our material properties was reviewed, approved and

verified by Rodrigo Alves Marinho, P.Geo., an employee of Teck and

a Qualified Person as defined under National Instrument 43-101.

About TeckTeck is a leading Canadian resource

company focused on responsibly providing metals essential to

economic development and the energy transition. Teck has a

portfolio of world-class copper and zinc operations across North

and South America and an industry-leading copper growth pipeline.

We are focused on creating value by advancing responsible growth

and ensuring resilience built on a foundation of stakeholder trust.

Headquartered in Vancouver, Canada, Teck’s shares are listed on the

Toronto Stock Exchange under the symbols TECK.A and TECK.B and the

New York Stock Exchange under the symbol TECK. Learn more about

Teck at www.teck.com or follow @TeckResources.

Investor Contact:Fraser PhillipsSenior Vice

President, Investor Relations and Strategic

Analysis604.699.4621fraser.phillips@teck.comMedia

Contact:Dale SteevesDirector, External

Communications236.987.7405 dale.steeves@teck.com

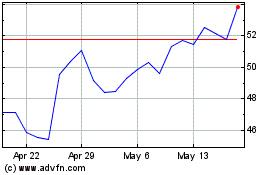

Teck Resources (NYSE:TECK)

Historical Stock Chart

From Oct 2024 to Nov 2024

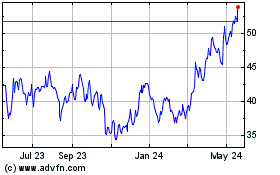

Teck Resources (NYSE:TECK)

Historical Stock Chart

From Nov 2023 to Nov 2024