As

filed with the Securities and Exchange Commission on July 8, 2024

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TELECOM ARGENTINA S.A.

(Exact Name of Registrant as Specified in

Its Charter)

| Republic of Argentina |

4813 |

Not applicable |

(State or Other Jurisdiction of

Incorporation or Organization) |

(Primary Standard Industrial

Classification Code Number) |

(I.R.S. Employer

Identification Number) |

General Hornos 690

(C1272ACK) - Buenos Aires

Argentina

Tel.: 54-11-4968-4000

(Address and telephone number of registrant’s

principal executive offices)

CT Corporation System

28 Liberty Street

New York, New York 10005

(Name, address, and telephone number of agent

for service)

Copies to:

Adam J. Brenneman, Esq.

Cleary Gottlieb Steen & Hamilton LLP

One Liberty Plaza

New York, New York 10006

(212) 225-2000

Approximate

date of commencement of proposed sale to the public: From time to time after this registration

statement becomes effective.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. x

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration

statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company

¨

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of

the Securities Act. ¨

| † |

The term “new or revised financial accounting

standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification

after April 5, 2012. |

PROSPECTUS

Telecom Argentina

S.A.

Debt Securities

Class B

Common Shares

American Depositary

Shares Representing Such Shares

We

may from time to time, in one or more offerings, offer and sell Telecom Argentina S.A.’s (i) debt securities, which may be

senior, subordinated or junior subordinated and convertible or non-convertible (collectively, the “debt securities”), or

(ii) class B ordinary shares, nominal value P$1.00 per share or (“class B shares”), which may be represented by American

Depositary Shares, (or “ADSs” and together with the class B shares, the “equity securities”). We refer collectively

to the equity securities and the debt securities as the “securities.”

In

addition, from time to time, the selling shareholders to be named in an applicable prospectus supplement (the “selling shareholders”)

may offer and sell the equity securities held by them. The selling shareholders may sell the equity securities through public or private

transactions at prevailing market prices or at privately negotiated prices. We will not receive any proceeds from the sale of the equity

securities by the selling shareholders.

The

securities may be offered and sold in the same offering or in separate offerings, to or through underwriters, dealers, and agents, or

directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of the securities, their compensation

and any options to purchase additional securities granted to them will be described in the applicable prospectus supplement. For a more

complete description of the plan of distribution of the securities, see the section entitled “Plan of Distribution” beginning

on page 28 of this prospectus.

This

prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered.

The specific manner in which they may be offered will be described in a supplement to this prospectus and, if applicable, in the information

incorporated by reference in this prospectus and related free writing prospectuses at the time of the offering. You should read this

prospectus, each applicable prospectus supplement, the information incorporated by reference herein and therein, and any related free

writing prospectuses carefully before you make your investment decision. This prospectus may not be used for the offering of securities

unless it is accompanied by a prospectus supplement.

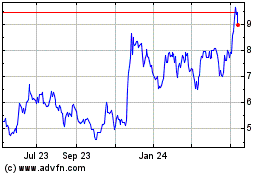

Our

ADSs are listed on the New York Stock Exchange under the symbol “TEO.” Each ADS represents the right to receive five class

B shares. Our class B shares are listed on the Argentine Stock Exchanges and Markets (Bolsas

y Mercados Argentinos S.A., or the “BYMA”) under the symbol “TECO2.” On July 5, 2024, the last reported

sale price of our class B shares on the SSE was P$1932.20 per common share, which is equivalent

to U.S.$10.52 per ADS, based on an exchange rate of P$918

to U.S.$1 as of July 5, 2024.

Investing

in our securities involves a high degree of risk. You should carefully review the risks and uncertainties described under the heading

“Risk Factors” on page 11 of this prospectus, and any risk factors included in any accompanying prospectus supplement

and in our reports filed with the U.S. Securities and Exchange Commission (the “SEC”) that are incorporated by reference

in this prospectus, before you invest in our securities.

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of

this prospectus. Any representation to the contrary is a criminal offense.

Debt

securities issued from time to time by the Company pursuant hereto may qualify as negotiable obligations under, and in such case, shall

be issued pursuant to, and in compliance with all the requirements of, and shall therefore be entitled to the benefits set forth and

subject to the procedural requirements established in, the Argentine Negotiable Obligations Law No. 23,576, as amended and supplemented

(the “Negotiable Obligations Law”), Law No. 26,831, as amended and supplemented (the “Argentine Capital Markets

Law”), the General Resolution No. 622, as amended and supplemented (the “CNV Rules”), issued by the Argentina

National Securities Commission (Comisión Nacional de Valores, or the “CNV”)

and any other applicable laws and regulations of the Republic of Argentina (“Argentina”).

Our

existing class B shares have been authorized for public offering in Argentina by the CNV. The CNV has not approved or disapproved of

the securities offered hereby, including in the form of ADSs.

This

prospectus has not been, and will not be, filed with the CNV and therefore, the CNV has not determined if this prospectus is truthful

or complete.

Offers

of the securities to the public in Argentina shall be made by a prospectus and (if applicable, a prospectus supplement) in the Spanish

language in accordance with CNV regulations and shall be authorized by the CNV pursuant to applicable Argentine laws and regulations.

Prospectus dated

July 8, 2024

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS

This prospectus

is part of an automatic “shelf” registration statement that we filed with the SEC, as a “well-known seasoned issuer”

as defined in Rule 405 under the U.S. Securities Act of 1933, as amended, or the “Securities Act.” By using a shelf

registration statement, we and/or the selling shareholders may sell any combination of the securities described in this prospectus at

any time and from time to time in one or more offerings. This prospectus only provides you with a general description of the securities

we may offer. Each time we or any of the selling shareholders sell securities, we will provide a prospectus supplement that will contain

specific information about the terms of that offering, including the specific amounts, prices and terms of the securities offered. The

prospectus supplement may also add, update or change information contained in this prospectus. You should carefully read this prospectus

and any accompanying prospectus supplement or other offering materials, together with the additional information described under the

headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

In the event the

information set forth in a prospectus supplement differs in any way from information set forth in this prospectus, you should rely on

the information set forth in the prospectus supplement. Neither we nor the selling shareholders have authorized anyone to provide any

information other than that contained or incorporated by reference in this prospectus, any prospectus supplement or any free writing

prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the selling shareholders take responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you.

You should not assume

that the information in this prospectus, any prospectus supplement or any other offering materials is accurate as of any date other than

the date of the document or that the information we have filed or will file with the SEC that is incorporated by reference in this prospectus

is accurate as of any date other than the filing date of the applicable document. Our business, financial condition, results of operations

and prospects may have changed since then.

We further note

that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This

prospectus is not an offer to sell and it is not a solicitation of an offer to buy securities in any jurisdiction in which the offer,

sale or exchange is not permitted. The distribution of this prospectus and the offer or sale of the securities offered hereby in certain

jurisdictions is restricted by law. This prospectus may not be used for, or in connection with, and does not constitute, any offer to,

or solicitation by, anyone in any jurisdiction or under any circumstance in which such offer or solicitation is not authorized or is

unlawful. Recipients must not distribute this prospectus into jurisdictions where such distribution would be unlawful.

Unless

the context otherwise requires, references to the “Company,” “Telecom,”

“we,” “us,” and “our “ are to Telecom Argentina S.A. and its consolidated subsidiaries and affiliates.

The term “Telecom Argentina” refers to Telecom Argentina S.A., excluding its subsidiaries.

We are responsible

for the information contained in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference

herein and therein. We have not authorized any person to give you any other information, and we take no responsibility for any other

information that others may give you. This document may only be used where it is legal to sell these securities. You should rely only

on the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement. You should

not assume that the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement

is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects

may have changed since those dates. We are not making an offer of these securities in any state or jurisdiction where the offer is not

permitted.

Where

You Can Find More Information

We

have filed with the SEC a registration statement (including amendments and exhibits to the registration statement) on Form F-3 under

the Securities Act with respect to the securities offered in this prospectus. This prospectus, which constitutes a part of the registration

statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith.

For further information with respect to us and our securities, reference is made to the registration statement and the exhibits and schedules

filed therewith. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as

an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference

to the full text of such contract or other document filed as an exhibit to the registration statement.

We

are currently subject to the information reporting requirements of the U.S. Securities Exchange Act of 1934, as amended, or the “Exchange

Act,” applicable to foreign private issuers. Accordingly, we are required to file reports and other information with the SEC, including

annual reports on Form 20-F and periodic reports on Form 6-K. Those reports may be inspected without charge at the locations

described above. As a foreign private issuer, we are exempt from the rules under the Exchange Act related to the furnishing and

content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit

recovery provisions contained in Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act to file

periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered

thereunder.

The

SEC maintains a website that contains reports, proxy and information statements and other information regarding registrants that file

electronically with the SEC. The address is https://www.sec.gov. We currently make available to the public our annual and interim reports,

as well as certain information regarding our corporate governance and other matters on our website https://www.telecom.com.ar/web. The

reference to our website address does not constitute incorporation by reference of the information contained on or available through

our website, and you should not consider it to be a part of this prospectus.

Incorporation

of Certain Information By Reference

The

SEC allows us to incorporate by reference information into this document. This means that we can disclose important information to you

by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part

of this document, except for any information superseded by information that is included directly in this prospectus or incorporated by

reference subsequent to the date of this prospectus. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this prospectus.

We

incorporate by reference into this prospectus the following documents or information that we have filed with the SEC:

| ● | our

report on Form 6-K, furnished to the SEC on April 25, 2024, whereby we announced

the composition of our Board of Directors, Supervisory Committee and Audit Committee and

the Independent Auditors (SEC File/Film No. 001-13464/ 24874886); |

| ● | our

report on Form 6-K, furnished to the SEC on July 8, 2024, containing: (i) our

unaudited condensed consolidated financial statements as of March 31, 2024 and for the

three-month period ended March 31, 2024 (the “Q1 2024 Unaudited Financial Statements”),

(ii); our operating and financial review and prospects as of March 31, 2024 (the “Q1

2024 MD&A” and, together with the Q1 2024 Unaudited Financial Statements, the “Q1

2024 Disclosure”) and (iii) capsule financial information illustrating the effects

of inflation from December 31, 2023 to March 31, 2024 (the “TEO Q1 2024 6-K”)

(SEC File/Film No. 001-13464/ 241103965); |

| ● | the

description of our class B shares and ADSs contained in Exhibit 2.2 to the TEO 2023

20-F (included as Exhibit 2.6 of our Annual Report on Form 20-F for the year ended

December 31, 2019, as filed with the SEC on March 18, 2020 (SEC File/Film No. 001-13464/20725248),

and incorporated by referenced in the TEO 2023 20-F); |

the

description of our ADSs set forth in our Registration Statement on Form F-6, filed with the SEC on April 30, 2021 (SEC File/Film

No. 333-255672/21878733);

| ● | Any

future filings on Form 20-F made with the SEC after the date of this prospectus and

prior to the termination of the offering of the securities offered by this prospectus, and

any future reports on Form 6-K furnished to the SEC during that period that are identified

in those forms as being incorporated by reference into this prospectus. |

We

will provide without charge to each person to whom a prospectus is delivered, upon written or oral request of such person, a copy of

any or all documents that are incorporated into this prospectus by reference, other than exhibits to such documents, unless such exhibits

are specifically incorporated by reference into the documents that this prospectus incorporates. You may also request a copy of such

information, at no cost, by writing to us at lfrialubago@teco.com.ar and tlpellicori@teco.com.ar, https://inversores.telecom.com.ar/ar/es/contacto.html

or at General Hornos 690, (1727) Buenos Aires, Argentina or by telephoning us at 54-11-4968-4000.

The

SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers that

file electronically with the SEC at http://www.sec.gov.

Forward-Looking

Statements

This

registration statement on Form F-3 contains certain forward-looking statements and information

relating to the Company that are based on current views, expectations, estimates and projections of our management and information currently

available to the Company. These forward-looking statements include, without limitation, those regarding our future financial position

and results of operations, our strategy, plans, objectives, goals and targets, future developments in the markets in which we participate

or are seeking to participate, or anticipated regulatory changes in the markets in which we operate or intend to operate. In some cases,

forward-looking statements can be identified by terminology such as “anticipate”, “believe”, “continue”,

“could”, “estimates”, “expect”, “intend”, “may”, “plan”, “potential”,

“project”, “predict”, “should” or “will”, or the negative of such terms, or other comparable

terminology.

By

their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. These statements reflect the current views of our management with respect to future events. We caution

the reader that forward-looking statements are not guarantees of future performance and are based on numerous assumptions and that our

actual results of operations, including our financial condition and liquidity, may differ materially from (and be more negative than)

those made in, or suggested by, the forward-looking statements contained in this prospectus. In addition, even if our results of operations,

including our financial condition and liquidity and developments in the industry in which we operate, are consistent with the forward-looking

statements contained in this registration statement, those results or developments may not be indicative of results or developments in

subsequent periods. Important factors that could cause these differences include, but are not limited to:

| ● | the

factors described in the “Risk Factors” section in this prospectus, any prospectus

supplement, the TEO 2023 20-F and any other documents

incorporated by reference herein; |

| ● | failure

to satisfy the conditions contained in this prospectus or any prospectus supplement; |

| ● | our

ability to service our debt and fund our working capital requirements; |

| ● | our

ability to successfully implement our business strategy and to achieve synergies; |

| ● | our

expectations for our future performance, revenues, income, earnings per share, capital expenditures,

dividends, liquidity and capital structure; |

| ● | the

changing dynamics and growth in the telecommunications, cable and cybersecurity markets in

Argentina, Paraguay, Uruguay, Chile and the United States; |

| ● | uncertainties

relating to political and economic conditions in Argentina, Paraguay, Uruguay, Chile and

the United States, including the policies of the new administration in Argentina; |

| ● | inflation

and the devaluation of the Argentine Peso, the Paraguayan Guaraní, the Uruguayan Peso

and the Chilean Peso and the exchange rate risks in Argentina, Paraguay, Uruguay and Chile; |

| ● | restrictions

on the ability to exchange Argentine Pesos, Paraguayan Guaraníes, Uruguayan Pesos

or Chilean Pesos into foreign currencies and transfer funds abroad; |

| ● | changes

in interest rates; |

| ● | our

outlook for new and enhanced technologies; |

| ● | the

effects of operating in a competitive environment; |

| ● | the

outcome of certain legal proceedings; |

| ● | regulatory

and legal developments; |

| ● | our

ability to introduce new products and services that enable business growth; |

| ● | the

creditworthiness of our actual or potential customers; |

| ● | nationalization,

expropriation and/or increased government intervention in companies; |

| ● | the

impact of legal or regulatory matters, changes in the interpretation of current or future

regulations or reform and changes in the legal or regulatory environment in which we operate,

including regulatory developments such as sanctions regimes in other jurisdictions (e.g.,

the United States) which impact our suppliers; |

| ● | the

effects of increased competition; |

| ● | reliance

on content produced by third parties; |

| ● | increasing

cost of our supplies; |

| ● | inability

to finance on reasonable terms capital expenditures required to remain competitive; |

| ● | fluctuations,

whether seasonal or in response to adverse macro-economic developments, in the demand for

advertising; |

| ● | our

capacity to compete and develop our business in the future; |

| ● | the

impact of increased national or international restrictions on the transfer or use of telecommunications

technology; |

| ● | the

impact of additional currency and exchange measures on our ability to access the international

capital markets and our ability to repay our dollar-denominated indebtedness; |

| ● | the

impact of political developments on demand for securities of Argentine companies; and |

| ● | the

outbreak of military hostilities, including an escalation of Russia's invasion of Ukraine

and the armed conflict between Israel and Hamas, and the potential destabilizing effect of

such conflicts. |

Many

of these factors are macroeconomic and regulatory in nature and therefore beyond the control of the Company’s management. Should

one or more of these factors or situations materialize, or underlying assumptions prove incorrect, actual results may vary materially

from those described herein as anticipated, believed, estimated, expected, intended, planned or projected.

In

light of these risks, uncertainties and assumptions, the forward-looking events described in this registration statement may not occur.

These forward-looking statements speak only as of the date of this registration statement and we undertake no obligation to update or

revise any forward-looking statement, whether as a result of new information or future events or developments. Additional factors affecting

our business emerge from time to time and it is not possible for us to predict all of these factors, nor can we assess the impact of

all such factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statement. Although we believe that the plans, intentions and expectations reflected in or

suggested by such forward-looking statements are reasonable, we cannot assure you that those plans, intentions or expectations will be

achieved. In addition, you should not interpret statements regarding past trends or activities as assurances that those trends or activities

will continue in the future. All written, oral and electronic forward-looking statements attributable to us or to the persons acting

on our behalf are expressly qualified in their entirety by this cautionary statement.

Presentation

of Financial and Other Information

Unless

otherwise stated, references to the financial results of “Telecom” are to the consolidated financial results of Telecom Argentina

and its consolidated subsidiaries. Telecom is primarily engaged in the provision of fixed and mobile telecommunications services, data

services, Internet services and cable television services.

The

information provided in this prospectus that relates to Argentina and its economy is based upon publicly available information, and we

do not make any representation or warranty with respect to such information. Argentina, and any governmental agency or political subdivision

thereof, does not in any way guarantee, and their credit does not otherwise back, our obligations in respect of the notes.

The financial information

incorporated by reference herein for Telecom Argentina S.A. is prepared and presented in accordance with International Financial Reporting

Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”).

Our

audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022

and 2021 and the notes thereto (the “Annual Financial Statements”), have been prepared in accordance with IFRS Accounting

Standards and have been audited by Price Waterhouse & Co. S.R.L. (a member firm of the PricewaterhouseCoopers network) an independent

registered public accounting firm (“PwC”) and are included in Item 18 of the TEO 2023 20-F, incorporated by reference in

this prospectus.

The

Q1 2024 Unaudited Financial Statements have been prepared in accordance with IAS 34 “Interim Financial Reporting” and they

should be read in conjunction with the Annual Financial Statements. The accounting principles used in the preparation of the Q1 2024

Unaudited Financial Statements are consistent with those used in the preparation of the Annual Financial Statements. Our Q1 2024 Unaudited

Financial Statements do not include all the information and disclosures required in the Annual Financial Statements and should be read

in conjunction with them. Our historical results for the three months ended March 31, 2024 are not necessarily indicative of results

to be expected for the year ended December 31, 2024, or any future period.

Argentina

has been considered a high-inflation economy for accounting purposes according to the IAS 29 “Financial reporting in hyperinflationary

economies” since July 1, 2018. Therefore, the Annual Financial Statements and the Q1 2024 Unaudited Financial Statements are

presented on the basis of constant Argentine Pesos as of December 31, 2023 (as described in the TEO 2023 20-F) and March 31,

2024 (as described in the Q1 2024 Disclosure), respectively (“current currency”). We have not recast our Annual Financial

Statements to measure them in terms of constant Argentine Pesos as of March 31, 2024, the most recent financial period included

herein. Therefore, the Annual Financial Statements and the Q1 2024 Unaudited Financial Statements are not directly comparable. The change

in the consumer price index in Argentina between December 31, 2023 and March 31, 2024 was 51.62%. See the TEO 2023 20-F and

Note 1.d) to our Annual Financial Statements. For more on the annual financial

information based on the current currency as of March 31, 2024, see the TEO Q1 2024 6-K.

Telecom

Argentina and its subsidiaries maintain their accounting records and prepare their financial statements in Argentine Pesos, which is

their functional currency, except for Televisión Dirigida S.A, Núcleo S.A.E. and its subsidiaries in Paraguay, which use

Guaraníes as their functional currency, Telecom Argentina USA Inc., Opalker S.A. and its subsidiary, which use U.S. dollars as

their functional currency and Adesol S.A. and its subsidiaries incorporated under the laws of Uruguay, which use Uruguayan Pesos as their

functional currency. Our Annual Financial Statements and Q1 2024 Unaudited Financial Statements include the results of these subsidiaries

converted into Argentine Pesos. Assets and liabilities are converted at period-end exchange rates and income and expenses accounts at

average exchange rates for each period presented.

Certain

financial information contained, or incorporated by reference, in this prospectus has been presented in U.S. dollars. This prospectus

contains translations of various Argentine Peso amounts into U.S. dollars at specified rates solely for convenience of the reader. You

should not construe these translations as representations by us that the Argentine Peso amounts actually represent these U.S. dollar

amounts or could be converted into U.S. dollars at the rates indicated. Except as otherwise specified, all references to “U.S.$,”

“U.S. dollars” or “dollars” are to United States dollars, references to “EUR,” “euro”

or “€” are to the lawful currency of the member states of the European Union and references to “P$,” “Argentine

Pesos,” “$” or “Pesos” are to Argentine Pesos. Unless otherwise indicated, we have translated the Argentine

Peso amounts using a rate of P$788,25 = U.S.$1.00 and of P$858,00= U.S.$1.00, the U.S. dollar ask rate published by the Banco de la Nación

Argentina (Argentine National Bank) on December 31, 2023 and on March 31, 2024, as applicable. On July 4, 2024, the exchange

rate was P$916.00= U.S.$1.00. As a result of fluctuations in the Argentine Peso/U.S. dollar exchange rate, the exchange rate at such

date may not be indicative of current or future exchange rates. Consequently, these translations should not be construed as a representation

that the Peso amounts represent, or have been or could be converted into, U.S. dollars at that or any other rate. See “Item 5—

Operating and Financial Review and Prospects— Factors Affecting Results of Operations — Effects of Fluctuations in Exchange

Rates between the Argentine Peso and the U.S. dollar and other major foreign currencies” in the TEO 2023 20-F.

Rounding

Certain figures

included in this prospectus, and in the financial information incorporated by reference herein, have been rounded for ease of presentation.

Percentage figures included in this prospectus have in some cases been calculated on the basis of such figures prior to rounding. For

this reason, certain percentage amounts in this prospectus may vary from those obtained by performing the same calculations using the

figures in the Annual Financial Statements or the Q1 2024 Unaudited Financial Statements, as applicable. Certain other amounts that appear

in this prospectus may not sum due to rounding.

Third-Party

Information

The information

set forth in this prospectus, and the documents incorporated by reference herein, with respect to the market environment, market developments,

growth rates, trends and competition in the markets and segments in which we operate are based on information published by the Argentine

federal and local governments through the Instituto Nacional de Estadísiticas y Censos (the National Statistics and Census Institute,

or “INDEC”), the BCRA, the Dirección General de Estadística y Censos de la Ciudad de Buenos Aires (General

Directorate of Statistics and Census of the City of Buenos Aires) and the Dirección Provincial de Estadística y Censos

de la Provincia de San Luis (Provincial Directorate of Statistics and Census of the Province of San Luis.)

Market studies are

frequently based on information and assumptions that may not be exact or appropriate, and their methodology is by nature forward looking

and speculative. This prospectus and the documents incorporated by reference herein also contain estimates made by us based on third-party

market data, which in turn is based on published market data or figures from publicly available sources.

Although we have

no reason to believe any of this information or these sources are inaccurate in any material respect, neither we nor the initial purchasers

have verified the figures, market data or other information on which third parties have based their studies nor have such third parties

verified the external sources on which such estimates are based. Therefore, we neither guarantee nor assume responsibility for the accuracy

of the information from third-party studies presented in this prospectus or for the accuracy of the information on which such third-party

estimates are based.

This prospectus,

and the documents incorporated by reference herein, also contains estimates of market data and information derived therefrom which cannot

be gathered from publications by market research institutions or any other independent sources. Such information is based on our

internal estimates. In many cases there is no publicly available information on such market data, for example from industry associations,

public authorities or other organizations and institutions. We believe that these internal estimates of market data and information

derived therefrom are helpful in order to give investors a better understanding of the industry in which we operate as well as our position

within this industry. Although we believe that our internal market observations are reliable, such estimates are not reviewed or

verified by any external sources. In addition, such estimates reflect various assumptions made by us that may or may not prove accurate,

as well as the exercise of a substantial degree of judgment by management as to the scope and presentation of such information. No representations

or warranties can be made concerning the accuracy of our estimates of market data and the information presented therefrom. These may

deviate from market data estimates made by our competitors or future statistics provided by market research institutes or other independent

sources. We cannot assure you that our market data estimates or the assumptions are accurate or correctly reflect the state and development

of, or our position in, the industry.

Non-GAAP Financial

Measures

In addition to our

financial information that has been prepared and presented in accordance with IFRS, this prospectus includes certain “non-GAAP

financial measures” (as defined in Regulation G under the Securities Act). These measures include Adjusted EBITDA.

An important operational

performance measure used by the Company’s Chief Operating Decision Maker (as this term is defined in IFRS Accounting Standards

8) is Adjusted EBITDA. Adjusted EBITDA is defined as our net (loss) income less income tax, financial results, earnings (losses) from

associates and joint ventures, and depreciation, amortization and impairment of fixed assets. We believe Adjusted EBITDA facilitates

company-to-company operating performance comparisons by backing out potential differences caused by variations such as capital structures,

taxation and the useful lives and book depreciation and amortization of property, plant and equipment (“PP&E”) and intangible

assets, which may vary for different companies for reasons unrelated to operating performance. Although Adjusted EBITDA is not a measure

defined in accordance with IFRS Accounting Standards (a non-GAAP measure), our management believes that this measure facilitates operating

performance comparisons from period to period and provides useful information to investors, financial analysts and the public in their

evaluation of our operating performance. Adjusted EBITDA does not have a standardized meaning and, accordingly, our definition of Adjusted

EBITDA may not be comparable to Adjusted EBITDA as used by other companies.

The

Company

Overview

We

are one of the largest private-sector companies in Argentina in terms of revenues, net income, capital expenditures and number of employees.

In terms of customers, we are one of the largest telecommunications, cable television and data transmission

service providers in Argentina and one of the largest cable television services providers across Latin America. Additionally, we are

an important Multiple Systems Operator (“MSO”, a company that owns multiple cable systems in different locations under the

control and management of a single, common organization) in Argentina in terms of customers.

We

offer our customers “quadruple play” services, combining mobile telephony services, cable television services, Internet

services and fixed telephony services. We also provide Fintech Services, other telephone-related services such as international long-distance

and wholesale services, data transmission and IT solutions outsourcing and we install, operate and

develop cable television and data transmission services. We provide our services in Argentina (mobile, cable television, Internet,

fixed and data services, among others), Paraguay (mobile, Internet, satellite TV services, among others), Uruguay (cable television

services), the United States (fixed wholesale services) and Chile (cybersecurity services and products).

In

2023, our revenues amounted to P$2,059,101 million, our net loss amounted to P$249,687 million, our Adjusted EBITDA (see the purpose

of use of Adjusted EBITDA and reconciliation of net income to Adjusted EBITDA for the year ended December 31, 2023 in “Item

5—Operating and Financial Review and Prospects—(A) Consolidated Results of Operations—Adjusted EBITDA” in

the TEO 2023 20-F) amounted to P$579,396 million and we had total assets of P$5,477,603, million all stated in current pesos as of December 31,

2023. For the first three months of 2024, our revenues amounted to P$683,916 million, our net income amounted to P$675,032 million, our

Adjusted EBITDA (see reconciliation of net income to Adjusted EBITDA for the three months ended March 31, 2024 in the TEO

Q1 2024 6-K) amounted to P$207,134 million and we had total assets of P$8,143,553 million, all stated in current pesos as of March 31,

2024. Amounts stated in current pesos as of March 31, 2024 are not comparable to amounts stated in current pesos as of December 31,

2023. See “Item 2. Telecom’s activities for the three-month period ended March 31, 2024 and 2023” in the TEO 1Q

2024 6-K. Adjusted EBITDA is defined as our net (loss) income less income tax, financial results, earnings (losses) from associates and

joint ventures, and depreciation, amortization and impairment of fixed assets. We believe that the presentation of the measure “adjusted

EBITDA” provides investors and financial analysts with appropriate information that is relevant to understanding our past and present

performance as well as our projections of future performance. Moreover, adjusted EBITDA is one of the key performance measures used by

our management for monitoring our profitability and financial position, at consolidated levels.

As of March 31,

2024, our subsidiaries were Núcleo, PEM, Cable Imagen, Televisión Dirigida, Adesol, AVC Continente Audiovisual, Inter

Radios, Telecom Argentina USA Inc., Personal Smarthome, Micro Sistemas, Opalker, NYSSA, and Micro Fintech Holding, among others.

Corporate Information

Telecom

Argentina was created by Decree No. 60/90 of the executive branch of the Argentine government (Poder Ejecutivo Nacional)

dated January 5, 1990, and incorporated as “Sociedad Licenciataria Norte S.A.” on April 23, 1990. In November 1990,

its legal name was changed to “Telecom Argentina STET-France Telecom S.A.” and on February 18, 2004, it was changed

to “Telecom Argentina S.A.” Telecom Argentina is organized as a corporation (sociedad anónima)

under Argentine law. The duration of Telecom Argentina is 99 years from the date of registration with the IGJ (July 13, 1990). Telecom

Argentina conducts business under the commercial name “Telecom”. Telecom Argentina’s object and purpose is to provide,

directly or through third parties, or in association with third parties, Information and Communication Technology services (“ICT

Services”), whether these ICT services are fixed, mobile, wired, wireless, national or international, with or without its own infrastructure,

and to provide Audiovisual Communication Services.

Our

telephone number is 54-11-4968-4000, and our principal executive offices are located in Gral. Hornos

690, (C1272ACK) Buenos Aires, Argentina. Our internet address is https://www.telecom.com.ar/web. The information contained on, or that

can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus. We have included

our website address as an inactive textual reference only. Our agent for service of process in the United States is CT Corporation System,

and its address is 28 Liberty Street, New York, New York 10005.

Risk

Factors

Investing

in our securities involves a significant degree of risk. Before you decide to buy any securities, you should read and carefully consider

the risks and uncertainties discussed in the section “Risk Factors” in Item 3 of the TEO 2023 20-F incorporated by reference

herein, any current reports on Form 6-K subsequently furnished to the SEC and incorporated by reference herein, as well as any risks

described in any applicable prospectus supplement and any related free writing prospectus or in other documents that are incorporated

by reference therein.

Additional

risks not currently known to us or that we currently deem immaterial may also have a material adverse effect on us. You should carefully

consider the aforementioned risks together with the other information in this registration statement and incorporated by reference herein

before deciding to invest in our securities. If any of those risks actually occur, our business, financial condition, results of operations,

cash flow and prospects could be materially and adversely affected. As a result, the trading price of our securities could decline, and

you could lose all or part of your investment.

CAPITALIZATION

AND INDEBTEDNESS

Our capitalization

and indebtedness will be set forth in a prospectus supplement to this prospectus or in a report on Form 6-K subsequently furnished

to the SEC and specifically incorporated herein by reference.

Use

of Proceeds

We intend to use

the net proceeds from the sale of any securities offered by us as set forth in the applicable prospectus supplement.

We will not receive

any proceeds from the sale of equity securities to be offered by any of the selling shareholders pursuant to this prospectus and the

applicable prospectus supplement.

Selling

Shareholders

This prospectus

also relates to the possible sale, from time to time, by the selling shareholders to be named in an applicable prospectus supplement,

of their equity securities that were issued and outstanding prior to the original date of filing of the registration statement of which

this prospectus forms a part.

The selling shareholders

to be named in the applicable prospectus supplement may, from time to time, offer and sell such securities pursuant to this prospectus

and any applicable prospectus supplement.

An applicable prospectus

supplement will set forth the name of each selling shareholder selling in connection with such an offering, their description and relationship

to us, the amount of our securities owned by each selling shareholder prior to the offering, the amount of our securities that may be

offered by each selling shareholder, and the amount and the percentage, if any, of our securities to be owned by each selling shareholder

after completion of the offering.

Unless disclosed

otherwise in the applicable prospectus supplement, we may pay certain fees and the expenses incurred in effecting the registration of

the securities covered by this prospectus, including, without limitation, registration and filing fees, and fees and expenses of our

counsel, and the selling shareholders will pay any underwriting or broker discounts and commissions incurred by the selling shareholders

in selling their securities, as well as their own fees and expenses, including those of the selling shareholders’ counsel.

The

selling shareholders shall not sell any of our securities pursuant to this prospectus until we have identified such selling shareholder

and the securities that may be offered for resale by such selling shareholder in a subsequent prospectus supplement. However, the selling

shareholders may sell or transfer all or a portion of their securities pursuant to any available exemption from the registration requirements

of the Securities Act.

DESCRIPTION

OF SECURITIES

This prospectus

contains summary descriptions of the debt securities and the equity securities that we or the selling shareholders may offer and sell

from time to time. These summary descriptions are not meant to be complete descriptions of each security. The particular terms of any

security will be described in the applicable prospectus supplement.

DESCRIPTION

OF DEBT SECURITIES

We may offer secured

or unsecured debt securities, which may be senior, subordinated or junior subordinated, and which may be convertible or non-convertible.

We may issue debt securities in one or more series.

Any debt securities

that we issue will be governed by a document called an indenture and may qualify as negotiable obligations under, and in such case, shall

be issued pursuant to, and in compliance with all the requirements of, and shall therefore be entitled to the benefits set forth and

subject to the procedural requirements established in, the Argentine Negotiable Obligations Law, the Argentine Capital Markets Law and

the CNV Rules, and any other applicable laws and regulations of Argentina. The form of senior indenture and the form of subordinated

indenture are each filed as an exhibit to the registration statement of which this prospectus forms a part. The indenture is a contract

entered into between us and a trustee. The trustee has two main roles:

| ● | first,

the trustee can enforce your rights against us if we default, although there are some limitations

on the extent to which the trustee acts on your behalf that are described in the indenture;

and |

| ● | second,

the trustee performs administrative duties for us, such as sending interest payments to you,

transferring your debt securities to a new buyer if you sell and sending notices to you. |

Together or separately,

we may issue as many distinct series of debt securities under the applicable indenture as are authorized by the corporate bodies that

are required under applicable law and our corporate organizational documents to authorize the issuance of debt securities. Specific issuances

of debt securities will also be governed by a supplemental indenture, an officer’s certificate or a document evidencing the authorization

of any such corporate body, as will be described in an applicable prospectus supplement. Offers of the securities to the public in Argentina

shall be made by a prospectus and (if applicable, a prospectus supplement) in the Spanish language in accordance with CNV Rules authorized

by the CNV pursuant to applicable Argentine laws and regulations.

The following description

briefly sets forth certain general terms and provisions of the debt securities. The particular terms of the debt securities offered by

any prospectus supplement and the extent, if any, to which these general provisions may apply to the debt securities will be described

in the applicable prospectus supplement. The terms of the debt securities will include those set forth in the indenture and any related

securities documents and terms made a part of the indenture by the U.S. Trust Indenture Act of 1939, as amended. You should read the

summary below, the applicable prospectus supplement and the provisions of the indenture and any related security documents, if any, in

their entirety before investing in our debt securities. Capitalized terms used in the summary have the meanings specified in the applicable

indenture.

The prospectus supplement

relating to any series of debt securities that we may offer will contain the specific terms of the debt securities. These terms may include

the following:

| ● | the

title and aggregate principal amount of the series of debt securities; |

| ● | the

guarantors of each series, if any, and the extent of the guarantees (including provisions

relating to seniority, subordination, security and release of the guarantees), if any; |

| ● | whether

the debt securities will be senior, subordinated or junior subordinated, and any applicable

subordination provisions for any subordinated debt securities; |

| ● | any

restriction or condition on the transferability of the debt securities; |

| ● | whether

the debt securities are secured and the terms of such security; |

| ● | the

purchase price, denomination and any limit upon the aggregate principal amount of the series

of debt securities; |

| ● | the date or dates

on which the principal of and premium, if any, on the series of debt securities is payable

or the method of determination thereof; |

| ● | the

interest rate(s) at which the series of debt securities will bear interest or the method

for determining the interest rate(s), the date or dates from which such interest will accrue

or the method for determining that date or those dates, the dates on which interest will

be payable and the regular record date, if any, for the interest payable on any interest

payment date; |

| o | the

place or places where the principal, any premium and any interest on the series of debt securities

will be payable; |

| ● | the

place or places where the series of debt securities may be exchanged or transferred; |

| ● | any

redemption or early repayment provision; |

| ● | our

obligation or right to redeem, purchase, or repay the series of debt securities under a sinking

fund, amortization or analogous provision; |

| ● | authorized

denominations; |

| ● | the

form or forms of the debt securities of the series including such legends as may be required

by applicable law; |

| ● | the

currency, currencies or currency units in which the purchase price for, the principal of

and any premium and any interest on, the series of debt securities will be payable; |

| ● | the

time period within which, the manner in which and the terms and conditions upon which the

purchaser of the debt securities can select the payment currency; |

| ● | the

portion of the principal amount that will be payable upon declaration of acceleration in

connection with the occurrence of an event of default or the method by which such portion

will be determined; |

| ● | any

covenants applicable to the series of debt securities being issued, any defaults and events

of default applicable to the series of debt securities being issued, and whether those additional

or modified events of default or covenants are subject to covenant defeasance; |

| ● | provisions,

if any, granting special rights to holders upon the occurrence of specified events; |

| ● | whether

provisions relating to covenant defeasance and legal defeasance apply to that series of debt

securities; |

| ● | provisions

relating to satisfaction and discharge of the indenture; |

| ● | provisions

relating to the modification of the indenture both with and without the consent of holders

of debt securities issued under the indenture; |

| ● | the

identity of the registrar and any paying agent; |

| ● | whether

such debt securities will be issued in whole or in part in the form of one or more global

securities, the identity of the depositary for global securities, the form of any legends

borne by the global securities and the terms upon which beneficial interests in a global

security may be exchanged in whole or in part for beneficial interests in individual definitive

securities; |

| ● | the

date as of which any global security of any series shall be dated if other than the original

issuance of the first security of the series to be issued; |

| ● | whether

the series of debt securities are convertible or exchangeable into other securities, including

in the form of attached or separately trading warrants to acquire securities; and |

| ● | any

other terms of the debt securities (which terms shall not be inconsistent with the provisions

of the U.S. Trust Indenture Act of 1939, as amended, but may modify, amend, supplement or

delete any of the terms of the indenture with respect to such series of debt securities). |

General

We may sell the debt securities, including original

issue discount securities, at par or at a substantial discount below their stated principal amount. Unless we inform you otherwise in

a prospectus supplement, we may issue additional debt securities of a particular series without the consent of the holders of the debt

securities of such series outstanding at the time of issuance. Any such additional debt securities, together with all other outstanding

debt securities of that series, will constitute a single series of securities under the indenture. In addition, we will describe in the

applicable prospectus supplement any material U.S. federal income tax considerations and any other special considerations for any debt

securities we sell which are denominated in a currency or currency unit other than U.S. dollars.

Unless we inform you otherwise in a prospectus

supplement, debt securities will be issued in fully registered form without coupons and in denominations of U.S.$150,000

and multiples of U.S.$1,000 in excess thereof. Subject to the limitations provided in the indenture and in the applicable prospectus

supplement, debt securities that are issued in registered form may be transferred or exchanged at the corporate office of the trustee

or the principal corporate trust office of the trustee, without the payment of any service charge, other than any tax or other governmental

charge payable in connection therewith.

Global Securities

Unless we inform you otherwise in the applicable

prospectus supplement, the debt securities of a series may be issued in whole or in part in the form of one or more global securities

that will be deposited with, or on behalf of, a depositary identified in the applicable prospectus supplement or free writing prospectus,

as the case may be. Global securities will be issued in registered form and in either temporary or definitive form. Unless and until

it is exchanged in whole or in part for the individual debt securities, a global security may not be transferred except as a whole by

the depositary for such global security to a nominee of such depositary or by a nominee of such depositary to such depositary or another

nominee of such depositary or by such depositary or any such nominee to a successor of such depositary or a nominee of such successor.

The specific terms of the depositary arrangement with respect to any debt securities of a series and the rights of and limitations upon

owners of beneficial interests in a global security will be described in the applicable prospectus supplement or free writing prospectus,

as the case may be.

Debt securities that constitute

negotiable obligations (“obligaciones negociables”) under the Negotiable Obligations Law will be entitled to the benefits

set forth therein and subject to the procedural requirements thereof. Under the terms of Article 29 of the Negotiable Obligations

Law, debt securities constituting negotiable obligations grant their holders access to summary judgment judicial proceedings. In accordance

with the Argentine Capital Markets Law, certificates in respect of the debt securities represented by any global note in favor of any

beneficial owner subject to certain limitations set out in the indenture should enable beneficial owners to institute suit before any

competent court in Argentina, including summary judgment proceedings, to obtain any overdue amount under the notes.

Governing Law

The

indenture and the debt securities shall be construed in accordance with and governed by the laws of the State of New York. The indenture

and the debt securities shall be construed in accordance with and governed by the laws of the State of New York; provided that,

if applicable, the Negotiable Obligations Law governs the requirements for the debt securities to qualify as obligaciones negociables

thereunder while such law, together with Argentine Law No. 19,550, as amended, the Argentine Capital Markets Law, the CNV Rules and

other applicable Argentine laws and regulations, govern the capacity and corporate authorization of the Issuer to execute and deliver

the debt securities, the authorization of the CNV for the public offering of the debt securities in Argentina and certain matters in

relation to meetings of holders.

We will set forth in the applicable prospectus

supplement a description of the debt securities that may be offered under this prospectus. The debt securities will be issued under an

indenture between us and a trustee to be named in the applicable prospectus supplement. Each such indenture, a form of which will be

filed as an amendment or incorporated by reference to this registration statement, will be executed at the time we issue any debt securities

thereunder.

Description

of EQUITY SECURITIES

Description of Common Stock

The following information describes our common

stock and provisions of our by-laws and of the Argentine Corporation Law. This description is only a summary. You should read and refer

to our by-laws incorporated by reference in the registration statement of which this prospectus is a part and the TEO 2023 20-F.

Our authorized capital stock consists of (i) 683,856,600

class A shares, (ii) 628,058,019 class B shares, (iii) 106,734 class C shares, and (iv) 841,666,658 class D shares, each

class with a par value of P$1.00 per share and the right to one vote per share. As of December 31, 2023 and March 31, 2024,

we had (i) 683,856,600 outstanding class A shares, (ii) 628,058,019 outstanding class B shares, (iii) 106,734 outstanding

class C shares, and (iv) 841,666,658 outstanding class D shares.

Class A shares and class D shares of common

stock are convertible into class B shares of common stock with equal political and economic rights, at a ratio of one to one, at any

time, at the request of the holder of one or more shares of common stock who wishes to convert them into another class, through a notice

addressed to the Board of Directors. For more information on certain veto rights of class A shares and class D shares, see “Item

7. Major Shareholders and Related Party Transactions—Major Shareholders—Telecom Shareholders’ Agreement” in the

TEO 2023 20-F and our by-laws.

All outstanding shares are fully paid in and our

class B shares have been listed on the Buenos Aires Stock Exchange since 1992. All outstanding ADSs representing rights to class B shares

are listed on the New York Stock Exchange. For a further description of our common stock, see “Item 10. Additional Information—Memorandum

and Articles of Association” in the TEO 2023 20-F.

Description of American Depositary Shares

JPMorgan

Chase Bank, N.A. (“JPMorgan”), as depositary, registers and delivers the ADSs pursuant to the deposit agreement, dated as

of May 7, 2021, among Telecom Argentina, JPMorgan, and the registered holders from time to time of the ADSs issued thereunder. Telecom

Argentina has listed on the New York Stock Exchange American Depositary Shares, also referred to as ADSs, representing Telecom Argentina’s

class B shares. The address of the depositary’s principal executive office is 383 Madison Avenue, Floor 11, New York, New York

10179. Each ADS represents rights to five class B shares deposited with the principal Buenos Aires office of Banco Santander Río

S.A., as custodian for the depositary in Argentina. Each ADS will also represent rights to any other securities, cash or other property

which may be held by the depositary. The depositary’s office is located at 383 Madison Avenue, 11th floor, New York,

New York 10179.

You may hold ADSs either (A) directly by

having an American Depositary Receipt (“ADR”), which is a certificate evidencing a specific number of ADSs, registered in

your name or (B) indirectly by holding a security entitlement in ADSs through your broker or other financial institution that is

a direct or indirect participant in The Depositary Trust Company (“DTC.”) If you hold ADSs directly, you are a registered

ADS holder. The obligations of the depositary under the deposit agreement are to ADR holders and this description assumes you are an

ADR holder. All holders of ADSs, however, are bound by the provisions of the deposit agreement even if they hold ADSs indirectly. If

you hold the ADSs indirectly, you must rely on the procedures of your broker or other financial institution to assert the rights of ADR

holders described in this section. You should consult your broker or financial institution to find out what those procedures are.

As

an ADR holder, we will not treat you as one of our shareholders and you will not have shareholder rights. Argentine law governs shareholder

rights. The depositary will be the holder of the class B shares underlying your ADSs. As a holder of ADRs, you will have

ADR holder rights. A deposit agreement among us, the depositary and the holders of ADRs sets out ADR holder rights as well as the rights

and obligations of the depositary. New York law governs the deposit agreement and the ADRs.

The following is a summary of the material provisions

of the deposit agreement. For more complete information, you should read the entire deposit agreement and the form of ADR. Directions

on how to obtain copies of those documents are provided on page 4 of this prospectus.

Dividends and Other Distributions

How will you receive dividends and other distributions on the class

B shares?

The

depositary has agreed to pay to you the cash dividends or other distributions that it or the custodian receives on class B

shares or other deposited securities, after deducting its fees and expenses. You will receive these distributions in proportion to the

number of class B shares your ADSs represent.

| ● | Cash.

The depositary will pay any cash dividend or other cash distribution on the class B

shares in U.S. dollars. The depositary will convert any foreign cash dividend or other cash

distribution we pay on the class B shares into U.S. dollars, if it can do so on a reasonable

basis and can transfer the U.S. dollars to the United States on a reasonable basis, subject

to such distribution being impermissible or impracticable with respect to certain ADR holders.

Before making a distribution, the depositary will deduct any withholding taxes that must

be paid. See “Taxation.” The depositary will also deduct its expenses in (i) converting

any foreign currency to U.S. dollars by sale or in such other manner as the depositary may

determine, (ii) transferring foreign currency or U.S. dollars to the United States by

such means as the depositary may determine and (iii) obtaining any approval or license

of any governmental authority required for such conversion or transfer, which is obtainable

at a reasonable cost and within a reasonable time. If the depositary is distributing the

net proceeds from the sale of a non-cash distribution, it will also deduct its expenses in

making such sale. The depositary will distribute only whole U.S. dollars and cents and any

fractional cents will be withheld without liability for interest and added to future cash

distributions. If the exchange rates fluctuate during a time when the depositary cannot convert

the foreign currency, you may lose some or a significant portion of the value of the distribution. |

| ● | Class B

Shares. The depositary may distribute additional ADSs representing rights to any class B

shares we distribute as a dividend or free distribution. The depositary will only distribute

whole ADSs. It will distribute, in the same way as it does with cash, U.S. dollars available

to it from the net proceeds of sales of class B shares which would give rise to fractional

ADSs. If the depositary determines that a distribution of additional ADSs is not practicable

with respect to any ADR holder, it may make any distribution it deems practicable, including

the distribution of foreign currency or securities, or it may retain the class B shares as

deposited securities in which case the outstanding ADSs will also represent rights to the

new class B shares. The depositary may sell a portion of the distributed shares (or

ADSs representing rights to those shares) sufficient to pay its fees and expenses in connection

with that distribution. |

| ● | Rights

to purchase additional class B shares. If we offer holders of our securities any rights

to subscribe for additional class B shares or any other rights, the depositary will make

these rights available to you to the extent that we timely furnish evidence satisfactory

to the depositary that it may lawfully distribute such rights. To the extent we do not furnish

such evidence and sales of the rights are practicable, the depositary may sell the rights

and distribute the proceeds in the same way as it does with cash. If it is not practicable

to sell the rights by reason of the nontransferability of the rights, limited markets therefor,

their short duration or otherwise, the depositary will allow the rights to lapse. In that

case, you will receive no value for them. If the depositary makes rights available to you,

it will exercise the rights in accordance with your instructions and purchase the class B

shares on your behalf. The depositary will then deposit the class B shares and deliver ADSs

to you. It will only exercise rights if you pay the exercise price and any other charges

the deposit agreement requires you to pay. |

| ● | Other

Distributions. The depositary will send to you anything else we distribute on deposited

securities by any means it thinks is equitable and practical, after consulting with us, if

practicable. If the depositary cannot make the distribution in such manner, the depositary

may i) decide to sell what we distributed and distribute the net proceeds, in the same way

as it does with cash, or ii) may decide to hold what we distributed as deposited securities,

in which case the outstanding ADSs will also represent rights to the newly distributed property.

The depositary may sell a portion of the distributed securities or property sufficient to

pay its fees and expenses in connection with that distribution. |

Deposit and Withdrawal

How are ADSs issued?

The

depositary will deliver ADSs if you or your broker deposits class B shares or evidence of rights to receive class B

shares with the custodian. Upon payment of depositary fees and expenses and of any taxes or charges, such as stamp taxes or stock transfer

taxes or fees, and subject to your delivery to the depositary or the custodian of any other documents and/or instruments that may be

required under the deposit agreement, the depositary will register the appropriate number of ADSs in the names you request and will deliver

ADRs evidencing the ADSs to the persons you request. At your request, risk and expense, the depositary may accept deposits for forwarding

to the custodian and deliver ADRs at a place other than its office.

How do ADR Holders cancel an ADS and obtain Class B Shares?

You

may surrender your ADSs at the depositary’s office. Upon payment of depositary fees and expenses and of any taxes or charges, such

as stamp taxes or stock transfer taxes or fees, the depositary will deliver the class B shares and any other deposited securities

underlying the ADSs to i) you, ii) a person you designate through the Caja de Valores, S.A,, iii) institutions you designate that

maintain accounts at the Caja de Valores S.A., iv) by such other means as the depositary may deem practicable, or v) at your request,

risk and expense, at such other place as you may request.

Voting Rights

You

may instruct the depositary to vote the class B shares underlying your ADSs. Upon receipt of notice from us, the depositary

will notify you of the upcoming vote and arrange to deliver our voting materials to you. The materials will describe the matters to be

voted on and explain how you may instruct the depositary to vote the class B shares or other deposited securities underlying your

ADSs as you direct by a specified date. For instructions to be valid, the depositary must receive them on or before the date specified.

The depositary will try, insofar as practicable, subject to the provisions of or governing our class B shares or other deposited

securities, to vote or cause to be voted the class B shares or other deposited securities as you instruct. Otherwise, you will not

be able to exercise your right to vote unless you withdraw the class B shares. However, note that it is possible that you may not

know about the meeting far enough in advance to validly withdraw the class B shares. The depositary will only vote or attempt to

vote in the manner you instruct. We cannot assure you that you will receive the voting materials in time to ensure that you can instruct

the depositary to vote your class B shares. This means that you may not be able to exercise your right to vote and there may be

nothing you can do if your class B shares are not voted as you requested.

Record Dates

The depositary shall, after consultation with

us if practicable, fix a record date (which shall be as near as practicable to any corresponding record date set by us) for the determination

of the ADR holders who will be entitled to receive any distribution on or in respect of deposited securities, to give instructions for

the exercise of any voting rights, to receive any notice or to act in respect of other matters and only such ADR holders will be so entitled.

Fees and Expenses for Holders of ADSs

Persons depositing or withdrawing class B shares or ADR holders

must pay:

| |

For: |

● U.S.$5.00

(or less) per 100 ADSs (or portion of 100 ADSs)

● U.S.$0.05

(or less) per ADS

|

● Issuance

of ADSs, including issuances resulting from a distribution, sale or exercise of class B shares or rights or other property;

and

● Cancellation

of ADSs for the purpose of withdrawal, including if the deposit agreement terminates

● ADSs

held for any cash distribution made, or for any elective cash/stock dividend offered, pursuant to the Deposit Agreement, or a fee

for the distribution or sale of securities, such fee being in an amount equal to the fee for the execution and delivery of ADSs which

would have been charged as a result of the deposit of such securities, but which securities or the net cash proceeds from the sale

thereof are instead distributed by the depositary to holders

|

| ● $U.S.0.05

(or less) per ADS (in the aggregate) per calendar year (or portion thereof) |

● For

services performed by the depositary in administering the ADRs (which fee may be charged on a periodic basis during each calendar

year and shall be assessed against holders as of the record date or record dates set by the depositary during each calendar year

and shall be payable at the sole discretion of the depositary by billing such holders or by deducting such charge from one or more

cash dividends or other cash distributions) |

| ● Registration

or transfer fees |

● Transfer

and registration of shares on any applicable share register to or from the name of the depositary or its agent when you deposit or

withdraw shares |

| ● Expenses

of the depositary and/or any of its agents |

● Stock

transfer or other taxes and other governmental charges

● Cable,

telex and facsimile transmission and delivery charges

● Incurred

in connection with the servicing of class B shares or other deposited securities, the sale of securities (including, without limitation,

deposited securities) the delivery of deposited securities or otherwise in connection with the depositary’s or its custodian’s

compliance with applicable law, rule or regulations (which fees and charges shall be assessed on a proportionate basis against

holders as of the record date or dates set by the depositary and shall be payable at the sole discretion of the depositary by billing

such holders or by deducting such charge from one or more cash dividends or other cash distributions)

● Converting

foreign currency into U.S. Dollars |

The

depositary collects its fees for the issuance and cancellation of ADSs from investors depositing shares or surrender of ADSs for the

purpose of withdrawal or from intermediaries acting for them. The depositary also collects taxes and governmental charges from

the holders of ADSs. The depositary collects fees for making distributions to investors by deducting those fees from the amounts distributed