Filed Pursuant to Rule 424(b)(7)

File No. 333-280720

PROSPECTUS SUPPLEMENT

(To Prospectus dated July 8, 2024)

Telecom Argentina S.A.

198,085,167 Class B Shares of Common Stock

in the form of American Depositary Shares

Offered by the Selling Shareholder

This prospectus supplement

relates to the proposed resale or other disposition of up to an aggregate of 198,085,167 class B shares of Telecom Argentina common stock,

nominal value P$1.00 per share (the “common stock”) underlying American Depositary Shares (“ADSs”), by the selling

shareholder identified in this prospectus supplement. We are not selling any shares of our common stock under this prospectus supplement

and will not receive any proceeds from the sale of the common stock by the selling shareholder.

The selling shareholder may

offer and sell or otherwise dispose of the common stock described in this prospectus supplement from time to time through public or private

transactions at prevailing market prices, at prices related to prevailing market prices, or at privately negotiated prices. The common

stock offered by this prospectus supplement may be offered by the selling shareholder directly to purchasers or to or through brokers

or dealers or other agents. The selling shareholder will bear all costs, commissions and discounts, if any, attributable to the sales

of common stock. We will bear costs, expenses and fees in connection with the registration of the shares. See “Plan of Distribution”

beginning on page S-34 for more information about how the selling shareholder may sell or dispose of their shares of common stock.

No common stock may be sold without delivery of this prospectus supplement and the accompanying prospectus describing the method and terms

of the offering of such common stock.

Our Class B Shares have

been authorized for public offering in Argentina by the Argentina Nacional Securities Commission (Comisión Nacional de Valores)

(the “CNV”) and are listed in Bolsas y Mercados Argentina (“ByMA”) and trade in MERVAL. Our ADRs are not registered

with the CNV or listed in ByMA. The CNV has not approved or disapproved of the Class B Shares offered hereby, including in the form

of ADSs.

This prospectus has not been,

and will not be, filed with the CNV and therefore, the CNV has not determined if this prospectus is truthful or complete.

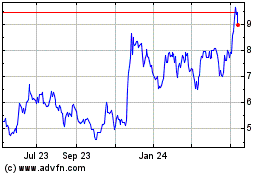

ADSs representing rights to

our Class B Shares are currently listed on the New York Stock Exchange, or the “NYSE,” under the symbol “TEO.”

The last reported sale price of our ADSs on the NYSE on July 5, 2024 was $6.89 per ADS.

Investing in our common

stock involves risks that are described in the “Risk Factors” section beginning on page S-15 of this prospectus supplement

and in our reports filed with the U.S. Securities and Exchange Commission (the “SEC”) that are incorporated by reference in

this prospectus supplement and that you should consider before you make an investment in our common stock offered in this prospectus supplement

and the accompanying prospectus.

Neither the SEC nor any

state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus

supplement. Any representation to the contrary is a criminal offense.

THIS

PROSPECTUS SUPPLEMENT IS SOLELY OUR RESPONSIBILITY AND HAS NOT BEEN REVIEWED OR AUTHORIZED BY THE ARGENTINE COMISIÓN NACIONAL

DE VALORES (THE NATIONAL SECURITIES COMMISSION, OR “CNV”). THE TERMS AND CONDITIONS OF ANY OFFER OF SECURITIES

WILL BE NOTIFIED TO THE CNV FOR INFORMATIONAL PURPOSES ONLY AND SUCH NOTICE DOES NOT CONSTITUTE A CERTIFICATION AS TO THE INVESTMENT

VALUE OF THE SECURITIES OR OUR SOLVENCY. THIS PROSPECTUS SUPPLEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF

AN OFFER TO BUY SECURITIES IN ANY JURISDICTION TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE THE OFFER OR SOLICITATION IN SUCH

JURISDICTION, NOR DOES THIS PROSPECTUS SUPPLEMENT CONSTITUTE AN INVITATION TO SUBSCRIBE FOR OR PURCHASE ANY SECURITIES. IN

MAKING AN INVESTMENT DECISION, ALL INVESTORS, INCLUDING ANY ARGENTINE CITIZEN WHO MAY ACQUIRE SECURITIES FROM TIME TO

TIME, MUST RELY ON THEIR OWN EXAMINATION OF US.

The date of this

prospectus supplement is July 8, 2024.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of

two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part, the accompanying

prospectus, gives more general information, some of which may not apply to this offering. Generally, when we refer to the “prospectus,”

we are referring to both parts combined. If the information in this prospectus supplement differs from the information in the accompanying

prospectus, the information in this prospectus supplement supersedes the information in the accompanying prospectus.

This prospectus supplement

and the accompanying prospectus are part of a registration statement on Form F-3 that we filed with the Securities and Exchange Commission

(the “SEC”), using an automatic shelf registration process. This prospectus supplement contains specific information about

us and the terms of this offering. To the extent that any statement made in this prospectus supplement is inconsistent with statements

made in the prospectus, the statements made in the prospectus will be deemed modified or superseded by those made in this prospectus supplement.

Before you purchase shares of our common stock, you should read in their entirety both this prospectus and any accompanying prospectus

supplement, together with the additional information described under the sections entitled “Where You Can Find More Information”

and “Incorporation of Certain Documents by Reference” before deciding to invest in any of the securities being offered.

Any statement made in this

prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified

or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus supplement or in any other subsequently

filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statements so modified

or superseded will be deemed not to constitute a part of this prospectus except as so modified or superseded.

You should rely only on the

information contained in or incorporated by reference in this prospectus, in any accompanying prospectus supplement or in any free writing

prospectus filed by us with the SEC. Neither we nor the sales agents have authorized anyone to provide you with different information.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

We are not making an offer of shares of our common stock in any state or jurisdiction where the offer or sale is not permitted. You should

not assume that the information contained in this prospectus or the information we previously filed with the SEC and incorporated by reference

herein is accurate as of any date other than its respective date. Our business, financial condition and results of operations and prospects

may have changed since those dates.

In this prospectus supplement,

unless otherwise specified or the context otherwise requires, we use the terms the “Company,” “Telecom,” “we,”

“us,” and “our “ to refer to Telecom Argentina S.A. and its consolidated subsidiaries and affiliates. References

to “Telecom Argentina” refer only to Telecom Argentina S.A. on an unconsolidated basis, except where the context may require

otherwise. The term “you” refers to a prospective investor.

FORWARD-LOOKING STATEMENTS

Some of the information contained

or incorporated by reference in this prospectus supplement are forward-looking statements that are based on current views, expectations,

estimates and projections of our management and information currently available to the Company. These forward-looking statements include,

without limitation, those regarding our future financial position and results of operations, our strategy, plans, objectives, goals and

targets, future developments in the markets in which we participate or are seeking to participate, or anticipated regulatory changes in

the markets in which we operate or intend to operate. In some cases, forward-looking statements can be identified by terminology such

as “anticipate”, “believe”, “continue”, “could”, “estimates”, “expect”,

“intend”, “may”, “plan”, “potential”, “project”, “predict”, “should”

or “will”, or the negative of such terms, or other comparable terminology.

By their nature, forward-looking

statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the

future. These statements reflect the current views of our management with respect to future events. We caution the reader that forward-looking

statements are not guarantees of future performance and are based on numerous assumptions and that our actual results of operations, including

our financial condition and liquidity, may differ materially from (and be more negative than) those made in, or suggested by, the forward-looking

statements contained in this prospectus supplement. In addition, even if our results of operations, including our financial condition

and liquidity and developments in the industry in which we operate, are consistent with the forward-looking statements contained in this

prospectus supplement, those results or developments may not be indicative of results or developments in subsequent periods. Important

factors that could cause these differences include, but are not limited to:

| · | factors described under the heading “Risk Factors” below or in reports we file from time to

time with the SEC or in other documents that we publicly disseminate, including, in particular, in the TEO 2023 20-F (as defined below); |

| · | failure to satisfy the conditions contained in this prospectus supplement; |

| · | our ability to service our debt and fund our working capital requirements; |

| · | our ability to successfully implement our business strategy and to achieve synergies; |

| · | our expectations for our future performance, revenues, income, earnings per share, capital expenditures,

dividends, liquidity and capital structure; |

| · | the changing dynamics and growth in the telecommunications, cable and cybersecurity markets in Argentina,

Paraguay, Uruguay, Chile and the United States; |

| · | uncertainties relating to political and economic conditions in Argentina, Paraguay, Uruguay, Chile and

the United States, including the policies of the new administration in Argentina; |

| · | inflation and the devaluation of the Argentine Peso, the Paraguayan Guaraní, the Uruguayan Peso

and the Chilean Peso and the exchange rate risks in Argentina, Paraguay, Uruguay and Chile; |

| · | restrictions on the ability to exchange Argentine Pesos, Paraguayan Guaraníes, Uruguayan Pesos

or Chilean Pesos into foreign currencies and transfer funds abroad; |

| · | changes in interest rates; |

| · | our outlook for new and enhanced technologies; |

| · | the effects of operating in a competitive environment; |

| · | the outcome of certain legal proceedings; |

| · | regulatory and legal developments; |

| · | our ability to introduce new products and services that enable business growth; |

| · | the creditworthiness of our actual or potential customers; |

| · | nationalization, expropriation and/or increased government intervention in companies; |

| · | the impact of legal or regulatory matters, changes in the interpretation of current or future regulations

or reform and changes in the legal or regulatory environment in which we operate, including regulatory developments such as sanctions

regimes in other jurisdictions (e.g., the United States) which impact our suppliers; |

| · | the effects of increased competition; |

| · | reliance on content produced by third parties; |

| · | increasing cost of our supplies; |

| · | inability to finance on reasonable terms capital expenditures required to remain competitive; |

| · | fluctuations, whether seasonal or in response to adverse macro-economic developments, in the demand for

advertising; |

| · | our capacity to compete and develop our business in the future; |

| · | the impact of increased national or international restrictions on the transfer or use of telecommunications

technology; |

| · | the impact of additional currency and exchange measures on our ability to access the international capital

markets and our ability to repay our dollar-denominated indebtedness; |

| · | the impact of political developments on demand for securities of Argentine companies; and |

| · | the outbreak of military hostilities, including an escalation of Russia’s invasion of Ukraine and

the armed conflict between Israel and Hamas, and the potential destabilizing effect of such conflicts. |

Many of these factors are

macroeconomic and regulatory in nature and therefore beyond the control of the Company’s management. Should one or more of these

factors or situations materialize, or underlying assumptions prove incorrect, actual results may vary materially from those described

herein as anticipated, believed, estimated, expected, intended, planned or projected.

In light of these risks, uncertainties

and assumptions, the forward-looking events described in this prospectus supplement may not occur. These forward-looking statements speak

only as of the date of this prospectus supplement and we undertake no obligation to update or revise any forward-looking statement, whether

as a result of new information or future events or developments. Additional factors affecting our business emerge from time to time and

it is not possible for us to predict all of these factors, nor can we assess the impact of all such factors on our business or the extent

to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statement. Although we believe that the plans, intentions and expectations reflected in or suggested by such forward-looking statements

are reasonable, we cannot assure you that those plans, intentions or expectations will be achieved. In addition, you should not interpret

statements regarding past trends or activities as assurances that those trends or activities will continue in the future. All written,

oral and electronic forward-looking statements attributable to us or to the persons acting on our behalf are expressly qualified in their

entirety by this cautionary statement. For additional information on factors that could cause our actual results to differ from expectations

reflected in forward-looking statements, please see “Risk Factors” in this prospectus supplement and in documents incorporated

by reference in this prospectus supplement and the accompanying prospectus.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Unless otherwise stated, references

to the financial results of “Telecom” are to the consolidated financial results of Telecom Argentina and its consolidated

subsidiaries. Telecom is primarily engaged in the provision of fixed and mobile telecommunications services, data services, Internet

services and cable television services.

The information provided in

this prospectus that relates to Argentina and its economy is based upon publicly available information, and we do not make any representation

or warranty with respect to such information. Argentina, and any governmental agency or political subdivision thereof, does not in any

way guarantee, and their credit does not otherwise back, our obligations in respect of the notes.

The financial information incorporated by reference

herein for Telecom Argentina S.A. is prepared and presented in accordance with International Financial Reporting Standards as issued by

the International Accounting Standards Board (“IFRS Accounting Standards”).

Our audited consolidated financial

statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021 and the notes thereto (the

“Annual Financial Statements”), have been prepared in accordance with IFRS Accounting Standards and have been audited by Price

Waterhouse & Co. S.R.L. (a member firm of the PricewaterhouseCoopers network) an independent registered public accounting firm

(“PwC”) and are included in Item 18 of the TEO 2023 20-F (as defined below), incorporated by reference in this prospectus.

The Q1 2024 Unaudited Financial

Statements have been prepared in accordance with IAS 34 “Interim Financial Reporting” and they should be read in conjunction

with the Annual Financial Statements. The accounting principles used in the preparation of the Q1 2024 Unaudited Financial Statements

are consistent with those used in the preparation of the Annual Financial Statements. Our Q1 2024 Unaudited Financial Statements do not

include all the information and disclosures required in the Annual Financial Statements and should be read in conjunction with them. Our

historical results for the three months ended March 31, 2024 are not necessarily indicative of results to be expected for the year

ended December 31, 2024, or any future period.

Argentina has been

considered a high-inflation economy for accounting purposes according to the IAS 29 “Financial reporting in hyperinflationary

economies” since July 1, 2018. Therefore, the Annual Financial Statements and the Q1 2024 Unaudited Financial Statements

are presented on the basis of constant Argentine Pesos as of December 31, 2023 (as described in the TEO 2023 20-F) and

March 31, 2024 (as described in the Q1 2024 Disclosure), respectively (“current currency”). We have not recast our

Annual Financial Statements to measure them in terms of constant Argentine Pesos as of March 31, 2024, the most recent

financial period incorporated by reference herein. Therefore, the Annual Financial Statements and the Q1 2024 Unaudited Financial

Statements are not directly comparable. The change in the consumer price index in Argentina between December 31, 2023 and

March 31, 2024 was 51.6%. See Note 1.d) to our Annual Financial Statements. For more on the annual financial information based

on the current currency as of March 31, 2024, see the TEO Q1 2024 6-K (as defined below).

Telecom Argentina and its

subsidiaries maintain their accounting records and prepare their financial statements in Argentine Pesos, which is their functional currency,

except for Televisión Dirigida S.A, Núcleo S.A.E. and its subsidiaries in Paraguay, which use Guaraníes as their

functional currency, Telecom Argentina USA Inc., Opalker S.A. and its subsidiary, which use U.S. dollars as their functional currency

and Adesol S.A. and its subsidiaries incorporated under the laws of Uruguay, which use Uruguayan Pesos as their functional currency. Our

Annual Financial Statements and Q1 2024 Unaudited Financial Statements include the results of these subsidiaries converted into Argentine

Pesos. Assets and liabilities are converted at period-end exchange rates and income and expenses accounts at average exchange rates for

each period presented.

Certain financial information

contained in this prospectus has been presented in U.S. dollars. This prospectus contains translations of various Argentine Peso amounts

into U.S. dollars at specified rates solely for convenience of the reader. You should not construe these translations as representations

by us that the Argentine Peso amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rates

indicated. Except as otherwise specified, all references to “U.S.$,” “U.S. dollars” or “dollars” are

to United States dollars, references to “EUR,” “euro” or “€” are to the lawful currency of the

member states of the European Union and references to “P$,” “Argentine Pesos,” “$” or “Pesos”

are to Argentine Pesos. Unless otherwise indicated, we have translated the Argentine Peso amounts using a rate of P$808.45 = U.S.$1.00

and of P$858,00= U.S.$1.00, the U.S. dollar ask rate published by the Banco de la Nación Argentina (Argentine National Bank) on

December 31, 2023 and on March 31, 2024, as applicable. On July 4, 2024, the exchange rate was P$916.00= U.S.$1.00. As

a result of fluctuations in the Argentine Peso/U.S. dollar exchange rate, the exchange rate at such date may not be indicative of current

or future exchange rates. Consequently, these translations should not be construed as a representation that the Peso amounts represent,

or have been or could be converted into, U.S. dollars at that or any other rate. See “Item 5— Operating and Financial Review

and Prospects— Factors Affecting Results of Operations — Effects of Fluctuations in Exchange Rates between the Argentine Peso

and the U.S. dollar and other major foreign currencies” in the TEO 2023 20-F.

Rounding

Certain figures included in this prospectus, and

in the financial information incorporated by reference herein, have been rounded for ease of presentation. Percentage figures included

in this prospectus have in some cases been calculated on the basis of such figures prior to rounding. For this reason, certain percentage

amounts in this prospectus may vary from those obtained by performing the same calculations using the figures in the Annual Financial

Statements or the Q1 2024 Unaudited Financial Statements, as applicable. Certain other amounts that appear in this prospectus may not

sum due to rounding.

Third-Party Information

The information set forth in this prospectus, and

the documents incorporated by reference herein, with respect to the market environment, market developments, growth rates, trends and

competition in the markets and segments in which we operate are based on information published by the Argentine federal and local governments

through the Instituto Nacional de Estadísiticas y Censos (the National Statistics and Census Institute, or “INDEC”),

the BCRA, the Dirección General de Estadística y Censos de la Ciudad de Buenos Aires (General Directorate of Statistics

and Census of the City of Buenos Aires) and the Dirección Provincial de Estadística y Censos de la Provincia de San Luis

(Provincial Directorate of Statistics and Census of the Province of San Luis.)

Market studies are frequently based on information

and assumptions that may not be exact or appropriate, and their methodology is by nature forward looking and speculative. This prospectus

and the documents incorporated by reference herein also contain estimates made by us based on third-party market data, which in turn is

based on published market data or figures from publicly available sources.

Although we have no reason to believe any of this

information or these sources are inaccurate in any material respect, neither we nor the initial purchasers have verified the figures,

market data or other information on which third parties have based their studies nor have such third parties verified the external sources

on which such estimates are based. Therefore, we neither guarantee nor assume responsibility for the accuracy of the information from

third-party studies presented in this prospectus or for the accuracy of the information on which such third-party estimates are based.

This prospectus, and the documents incorporated

by reference herein, also contains estimates of market data and information derived therefrom which cannot be gathered from publications

by market research institutions or any other independent sources. Such information is based on our internal estimates. In

many cases there is no publicly available information on such market data, for example from industry associations, public authorities

or other organizations and institutions. We believe that these internal estimates of market data and information derived therefrom

are helpful in order to give investors a better understanding of the industry in which we operate as well as our position within this

industry. Although we believe that our internal market observations are reliable, such estimates are not reviewed or verified by

any external sources. In addition, such estimates reflect various assumptions made by us that may or may not prove accurate, as well as

the exercise of a substantial degree of judgment by management as to the scope and presentation of such information. No representations

or warranties can be made concerning the accuracy of our estimates of market data and the information presented therefrom. These may deviate

from market data estimates made by our competitors or future statistics provided by market research institutes or other independent sources.

We cannot assure you that our market data estimates or the assumptions are accurate or correctly reflect the state and development of,

or our position in, the industry.

Non-GAAP Financial Measures

In addition to our financial information that has

been prepared and presented in accordance with IFRS, this prospectus includes certain “non-GAAP financial measures” (as defined

in Regulation G under the Securities Act). These measures include Adjusted EBITDA.

An important operational performance measure used

by the Company’s Chief Operating Decision Maker (as this term is defined in IFRS Accounting Standards 8) is Adjusted EBITDA. Adjusted

EBITDA is defined as our net (loss) income less income tax, financial results, earnings (losses) from associates and joint ventures, and

depreciation, amortization and impairment of fixed assets. We believe Adjusted EBITDA facilitates company-to-company operating performance

comparisons by backing out potential differences caused by variations such as capital structures, taxation and the useful lives and book

depreciation and amortization of property, plant and equipment (“PP&E”) and intangible assets, which may vary for different

companies for reasons unrelated to operating performance. Although Adjusted EBITDA is not a measure defined in accordance with IFRS Accounting

Standards (a non-GAAP measure), our management believes that this measure facilitates operating performance comparisons from period to

period and provides useful information to investors, financial analysts and the public in their evaluation of our operating performance.

Adjusted EBITDA does not have a standardized meaning and, accordingly, our definition of Adjusted EBITDA may not be comparable to Adjusted

EBITDA as used by other companies.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We are “incorporating

by reference” information into this prospectus supplement, which means that we are disclosing important information to you without

actually including the specific information in this prospectus supplement by referring you to other documents filed separately with the

SEC. The information incorporated by reference is an important part of this prospectus supplement. We incorporate by reference into this

prospectus supplement the following documents:

| · | our report on Form 6-K, furnished to the SEC on July 8, 2024, containing: (i) our unaudited

condensed consolidated financial statements as of March 31, 2024 and for the three-month period ended March 31, 2024 (the “Q1

2024 Unaudited Financial Statements”), (ii); our operating and financial review and prospects as of March 31, 2024 (the “Q1

2024 MD&A” and, together with the Q1 2024 Unaudited Financial Statements, the “Q1 2024 Disclosure”) and (iii) capsule

financial information illustrating the effects of inflation from December 31, 2023 to March 31, 2024 (the “TEO Q1 2024

6-K”); and |

| · | each subsequent report on Form 6-K that is designated in such report as being incorporated into this

prospectus supplement or the accompanying prospectus after the date of this prospectus supplement and prior to the closing of this offering. |

Any statement contained in

the TEO 2023 20-F, the Q1 2024 Disclosure and any other document incorporated by reference into this prospectus supplement, shall be considered

to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement

or the other reports incorporated by reference herein modifies or supersedes such statement. Any statement that is modified or superseded

shall not, except as so modified or superseded, constitute a part of this prospectus supplement. Certain of the information we incorporate

by reference into this prospectus supplement may contain references to a website. However, the contents of any such website are not incorporated

by reference into this prospectus supplement.

Except as specifically incorporated

by reference above, none of our current or future reports filed or furnished with or to the SEC are incorporated by reference herein.

You may request a copy of

the documents incorporated by reference herein, other than exhibits, and our estatutos sociales (bylaws), at no cost, by writing

or telephoning us at the following:

Telecom Argentina S.A.

Investor Relations

General Hornos 690

(C1272ACK) Buenos Aires

Argentina

Tel: +54 11 4968 4000

Fax: +54 11 4968 3616

WHERE YOU CAN FIND MORE INFORMATION

Information that we file with

or furnish to the SEC after the date of this prospectus supplement, and that is incorporated by reference herein, will automatically update

and supersede the information in this prospectus supplement. You should review the SEC filings and reports that we incorporate by reference

to determine if any of the statements in this prospectus supplement, the accompanying prospectus or in any documents previously incorporated

by reference have been modified or superseded.

Documents incorporated by

reference in this prospectus supplement are available without charge. Each person to whom this prospectus supplement and the accompanying

prospectus are delivered may obtain documents incorporated by reference herein by requesting them either in writing or orally, by telephone

or by e-mail from us at the following address:

Telecom Argentina S.A.

Investor Relations

General Hornos 690

(C1272ACK) Buenos Aires

Argentina

Tel: +54 11 4968 4000

Fax: +54 11 4968 3616

We are subject to the information

requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), applicable to a foreign private issuer,

and accordingly file or furnish reports, including annual reports on Form 20-F, reports on Form 6-K, and other information with

the SEC. Any filings we make electronically will be available to the public over the Internet at the SEC’s web site at http://www.sec.gov.

The information on this website, which might be accessible through a hyperlink resulting from this URL, is not and shall not be deemed

to be incorporated into this prospectus supplement.

SUMMARY

This summary highlights

key information described in greater detail elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying

prospectus. This summary is not complete and does not contain all of the information you should consider before making an investment decision.

You should read carefully the entire prospectus supplement and the accompanying prospectus, including “Risk Factors” and the

documents incorporated by reference herein, which are described under “Incorporation of Certain Documents by Reference” and

“Where You Can Find More Information.”

The Company

We are one of the largest

private-sector companies in Argentina in terms of revenues, net income, capital expenditures and number of employees. In terms of subscribers,

we are one of the largest telecommunications, cable television and data transmission service providers in Argentina and one of the largest

cable television services providers across Latin America. Additionally, we are an important Multiple Systems Operator (“MSO,”

a company that owns multiple cable systems in different locations under the control and management of a single, common organization) in

Argentina in terms of subscribers.

We offer our customers “quadruple

play” services, combining mobile telephony services, cable television services, Internet services and fixed telephony services.

We also provide fintech services (such as services related to the use of electronic means of payment, transfers and/or electronic use

of money), other telephone-related services such as international long-distance and wholesale services, data transmission and IT solutions

outsourcing and we install, operate and develop cable television and data transmission services. We provide our services in Argentina

(mobile, cable television, Internet, fixed and data services, among others), Paraguay (mobile, Internet, satellite TV services,

among others), Uruguay (cable television services), Chile (cybersecurity) and the United States (fixed wholesale services).

As of December 31, 2023,

(i) our mobile telephony business had approximately 21,004 thousand subscribers in Argentina and approximately 2,316 thousand subscribers

in Paraguay, (ii) our Internet business reached approximately 4,074 thousand accesses, (iii) our cable television business had

approximately 3,369 thousand subscribers, (iv) we had approximately 2,887 thousand fixed telephony lines in service and (v) our

digital wallet service, Personal Pay, already had more than 2 million users.

In 2023, our revenues

amounted to P$2,059,101 million, our net loss amounted to P$249,687 million, our Adjusted EBITDA (see the purpose of use of Adjusted

EBITDA and reconciliation of net income to Adjusted EBITDA for the year ended December 31, 2023 in “Item 5—Operating and

Financial Review and Prospects—(A) Consolidated Results of Operations—Adjusted EBITDA” in the TEO 2023 20-F)

amounted to P$579,396 million and we had total assets of P$5,477,603 million, all stated in current pesos as of December 31, 2023. For the first three months of 2024, our revenues amounted to P$683,916 million, our

net income amounted to P$675,032 million, our Adjusted EBITDA (see reconciliation of net income to Adjusted EBITDA for the three months

ended March 31, 2024 in the TEO Q1 2024 6-K) amounted to P$207,134 million and we had total assets of P$8,143,553 million, all stated

in current pesos as of March 31, 2024. Amounts stated in current pesos as of March 31, 2024 are not comparable to amounts stated in current

pesos as of December 31, 2023. See “Item 2. Telecom's activities for the three-month period ended March 31, 2024 and 2023”

in the TEO 1Q 2024 6-K. Adjusted EBITDA is defined as our net (loss) income less income tax, financial results, earnings (losses) from

associates and joint ventures, and depreciation, amortization and impairment of fixed assets. We believe that the presentation of the

measure “adjusted EBITDA” provides investors and financial analysts with appropriate information that is relevant to understanding

our past and present performance as well as our projections of future performance. Moreover, adjusted EBITDA is one of the key performance

measures used by our management for monitoring our profitability and financial position, at consolidated levels.

Recent Developments

Reliable and Intelligent Telecommunications Services (STeFI,

for its Spanish acronym)

On October 3, 2023,

ENACOM notified us of our prequalification to participate in the 5G spectrum Auction bidding process. On October 24, 2023, we

were awarded Lot 2 (3,400-3,500 MHz Band) for having submitted the highest bid, equivalent to U.S.$350 million. As a result, we

expect to work on the establishment of the use of 5G technology in Argentina. For more information, see “Item

4—Regulatory Authorities and Framework—SPECTRUM 5G” in the TEO 2023 20-F.

Argentine Digital Law

Through Decree No. 302/24

published in the Official Gazette on April 9, 2024, the PEN repealed Decree No. 690/20, which had modified LAD and declared

ICT services as well as access to telecommunications networks for and between licensees as essential public services empowering ENACOM

to ensure accessibility and imposed tariff regulations on such services. As of April 2024, Decree No. 302/24 declared that only

basic telephone service shall qualify as a public service and established the liberalization of the prices of ICT services, providing

that ICT services licensees shall set their prices, which shall be fair and reasonable, cover operating costs and aim at efficient provision

and a reasonable operating margin.

Prior to the enactment of

Decree No. 302/24, upon issue of Decree No. 690/20, we had initiated legal proceedings challenging the constitutionality of

Decree No. 690/20 and ENACOM Resolutions No. 1466/20 and 1467/20 issued in connection therewith. In this context, we obtained

a precautionary measure suspending the application of the aforementioned ENACOM regulations and Decree No. 690/20. In addition, on

June 19, 2024, we were notified of the decision of the Second Chamber of the Federal Court of Appeals on Administrative Litigation

Matters, which (i) dismissed the arguments of the PEN and ENACOM´s appeals against the ruling of Federal Administrative Court

No. 8 dated November 17, 2023 and (ii) upheld the first instance judgment which declared the Decree 690/20 and ENACOM Resolutions

N° 1466/2020 and 1467/2020 issued in connection therewith null. In addition, on June 25, 2024, through Decree 13/2024, the ENACOM

eliminated the regulations limiting Internet, mobile phone and cable TV rate increases.

Consolidation of Personal Envíos

S.A. into Micro Fintech Holding LLC

In May 2024, Núcleo

S.A. distributed to its shareholders, as a dividend in kind, the 7,760 shares of Personal Envíos S.A. held by it, which represent

a 97% stake in Personal Envíos S.A. As a consequence of such distribution, the Company received 5,240 shares of Personal Envíos

S.A.

Subsequently, in May 2024,

we made a contribution in kind to Micro Fintech Holding LLC consisting of the shares of Personal Envíos S.A. received from Núcleo

S.A. as described above along with 160 shares of Personal Envíos S.A. that the Company already owned. As a result of such transaction,

Micro Fintech Holding LLC currently owns 5,400 shares of Personal Envíos S.A., representing a 67.5% of the issued and outstanding

capital stock of Personal Envíos S.A.

Acquisition of Naperville Investments LLC

On May 20, 2024,

Televisión Dirigida S.A., our subsidiary, has exercised the call option to purchase a 51% stake in Naperville Investments,

LLC, a limited liability company organized under the laws of Delaware, who owns a 76.63% stake in Manda S.A., a satellite services

supplier operating in Argentina, Paraguay and Uruguay, as well as the call option to acquire a 0.0074% direct stake in Manda S.A.

from minority shareholders. In consideration for the acquisition of the shares of Naperville Investments LLC, in addition to the call

option premium of U.S.$3.8 million, which had already been paid, we agreed to pay U.S.$12.6 million.

Recent issuances

On June 6, 2024, the

Company issued Series 20 notes under the Program, at a fixed rate of 5%, maturing on June 6, 2026 for a nominal value of U.S.$59,728,670 and subsequently, on June 11, 2024, we issued additional Series 20 notes, for a nominal value of U.S.$21,568,635,

which added to those originally issued results in a total of U.S.$81,297,305 outstanding as of the date hereof.

Concurrent Transactions

Notes Offering

On the date of this prospectus

supplement, we announced an offering of a new series of notes (the “Notes,” and such offering the “Notes Offering”)

to be issued by the Company in reliance on an exemption from the registration requirements of the U.S. Securities Act of 1933, as amended

(the “Securities Act”). The Notes Offering will be made in compliance with all the requirements of, and will be subject to

the procedural requirements established in, the Argentine Negotiable Obligations Law No. 23,576, as amended and supplemented (the

“Negotiable Obligations Law”), Law No. 26,831, as amended and supplemented (the “Argentine Capital Markets Law”),

the General Resolution No. 622, as amended and supplemented, issued by the CNV, and any other applicable laws and regulations of

Argentina.

The Notes have not been registered

under the Securities Act, or with the securities regulatory authority of any state or other jurisdiction in the United States. The Notes

may not be offered or sold within the United States or to U.S. persons, except to qualified institutional buyers in reliance on the exemption

from registration as defined in Rule 144A under the Securities Act and in reliance on exemptions from registration under the Securities

Act, and to non U.S. persons in offshore transactions in reliance on Regulation S under the Securities Act. This prospectus supplement

is not deemed to be an offer to sell or a solicitation of an offer to buy any securities of the Company in the offering of the Notes or

any other transaction.

BBVA Securities Inc., BCP Securities, Inc., Deutsche Bank Securities Inc., J.P. Morgan Securities LLC, Latin Securities S.A., Agente de

Valores, Santander US Capital Markets LLC and UBS Securities LLC are acting as initial purchasers in the offering of the Notes.

No assurances can be made

that we will consummate the Notes offering, or if it is consummated, what the terms of the Notes will be.

Tender Offer

Concurrent with the

commencement of the offering of the Notes, we launched a cash tender offer (the “Tender Offer”) for up to U.S.$100

million aggregate principial amount of our 8.500% Notes due 2025 (the “Target Notes”) upon the terms and subject to the

conditions set forth in the Offer to Purchase dated July 8, 2024 (as it may be amended or supplemented from time to time). We

intend to use of the net proceeds from the sale of the Notes, in compliance with the requirements of Section 36 of the

Argentine Negotiable Obligations Law (i) to pay all or a portion of the consideration for the Tender Offer and accrued and

unpaid interest on the Target Notes validly tendered and accepted by us on or before the applicable expiration date, (ii) to

pay fees and expenses incurred in connection with the Tender Offer (iii) to pay or prepay in whole or in part (a) the 2019 IDB

Invest Loan Agreement to the extent such prepayment is permitted in accordance with the terms thereof and is not in conflict with

applicable laws and regulations (including, without limitation, the BCRA regulations); (b) the 2016

IFC Loan Agreement; (c) the 2017 IDB Loan Invest Agreement; and/or (d) certain loans under the 2019 IFC Loan Agreement; and (iv) the

remainder, if any, for general corporate purposes.

The offering of the Notes

is not conditioned on the successful consummation of the Tender Offer or any level of participation in the Tender Offer. However, the

Tender Offer is conditioned on achieving a minimum issuance size in the offering of the Notes. The Tender Offer is not being made pursuant

to this prospectus supplement. The Tender Offer is being made solely on the terms and subject to the conditions set out in a separate

offer document.

The initial

purchasers are acting as dealer managers in the Tender Offer.

Exchange Offer

Upon the pricing of the

offering of the Notes, we may launch an offer to exchange (the “Exchange Offer”) our outstanding 8.000% Notes due 2026

for additional notes of the same series of Notes offered in the Notes Offering (the “Additional Exchange Notes”).

Whether any such Additional Exchange Notes will be fungible for U.S. federal income tax purposes with the Notes will depend on a

number of factors, and no assurance can be given that any such Additional Exchange Notes will be fungible for such purposes with the

Notes. If any such Additional Exchange Notes are fungible for such purposes with the Notes, the Additional Exchange Notes will

constitute a single series with, and be assigned the same CUSIP and ISIN numbers, and have the same terms and conditions as, the

Notes offered. If, however, any such Additional Exchange Notes are not fungible for U.S. federal income tax purposes with the Notes,

the applicable Additional Exchange Notes will be assigned separate CUSIP and ISIN numbers from the Notes.

The offering of the Notes

is not conditioned on the successful consummation of the Exchange Offer. However, the consummation of the Exchange Offer is expected to

be contingent on the successful consummation of the offering of the Notes. The Exchange Offer is not being made pursuant to this prospectus

supplement. The Exchange Offer is expected to be made solely on the terms and subject to the conditions set out in a separate offer document.

The initial purchasers are

expected to act as dealer managers in the Exchange Offer.

No assurances can be made

that we will launch the Exchange Offer. If we launch the Exchange Offer, we cannot predict whether holders of our outstanding debt will

participate in any such Exchange Offer or whether the Exchange Offer will be successfully consummated.

Corporate Contact Information

Our principal executive offices are located at

General Hornos 690, C1272ACK, Buenos Aires, Argentina, and our telephone number is 54-11-4968-4000.

The

offering

| Issuer |

Telecom Argentina S.A., a corporation organized under Argentine law. |

| Shares of common stock offered to the public by the Selling Shareholder |

198,085,167 |

| Manner of Offering |

Sales of shares of our common stock under this prospectus supplement, if any, will be made by the selling shareholder in open market transactions, privately negotiated transactions, block transactions or by any other method or payment permitted by law. Please read “Plan of Distribution” in this prospectus supplement. |

| Use of Proceeds |

We will not receive any of the proceeds from the sale of shares of our common stock being offered by the selling shareholder. |

| NYSE Symbol |

TEO |

| Risk Factors |

An investment in our common stock involves risks. You should carefully consider each of the factors described or referred to under “Risk Factors” beginning on page S-15 of this prospectus supplement, page 14 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement and accompanying prospectus before you make an investment in our common stock. |

RISK FACTORS

An investment in our securities

involves a significant degree of risk. You should carefully consider those risks and the risks described below, as well as the other information

included or incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision.

Risks Relating to Argentina

Devaluation of the

Argentine Peso and foreign exchange restrictions may adversely affect our results of operations, our capital expenditures and our ability

to service our liabilities and pay dividends.

Since we generate a substantial

portion of our revenues in Argentine Pesos (the functional currency of Telecom), any devaluation may negatively affect the U.S. dollar

value of our earnings while increasing, in Peso terms, our expenses and capital expenditures denominated in foreign currency. The Argentine

Peso has been subject to significant devaluation against the U.S. dollar in the past and may be subject to fluctuations in the future.

The value of the Peso compared to other foreign currencies is dependent, among other factors, on the level of international reserves maintained

by the BCRA, which have also shown significant fluctuations in recent years. The Argentine macroeconomic environment, in which we operate,

has been affected by the continued devaluation of the Peso, which in turn has and could continue to have a direct impact on our financial

and economic position.

The value of the Peso has

fluctuated significantly over time. In 2023, the Argentine Peso continued to depreciate against the U.S. dollar and other major foreign

currencies. According to Banco de la Nación Argentina, the Peso/dollar exchange rate stood at P$808.45 per U.S.$1.00 as of December 29,

2023, evidencing an appreciation of the U.S. dollar against the Argentine Peso of approximately 356.3% from its value of P$177.16 per

dollar at December 30, 2022 (compared to 72.5% and 22.1% in the years ended December 31, 2022 and 2021, respectively). Until

November 2023, the average exchange rate, stood at P$295.29 per U.S. dollar. However, with the assumption of the new administration,

the U.S. dollar appreciated 118% against the Argentine Peso, bringing the exchange rate to P$800 per dollar on December 13, 2023.

The BCRA subsequently announced the transition to a new macroeconomic stability regime establishing a 2% monthly sliding path of the official

exchange rate. Additionally, the “Relevamiento de Expectativas de Mercado” (“REM”), published by the BCRA

on July 4, 2024, estimated an inflation of 138.1% for 2024. Monthly inflation for the months of January, February, March, April and

May 2024 was 20.6%, 13.2%, 11%, 8.8% and 4.4% respectively, while the accumulated figure for the first five months of the year reached

71.9%. In turn, the Organisation for Economic Cooperation and Development (“OECD”) stated that inflation in 2024 is estimated

to be 250.6%.

As a result of the Argentine

Peso’s increased volatility, the Argentine government and the BCRA implemented several measures to stabilize its value. The continued

devaluation of the Argentine Peso during the past years has had and continues to have a negative impact on the payment of foreign currency

denominated debts by local private sector debtors to unrelated foreign entities, and has also led to an increase in inflation, which in

turn has a direct impact on real wages. The devaluation has also negatively impacted businesses whose success is dependent on domestic

market demand, and adversely affected the Argentine government’s ability to honor its foreign debt commitments.

Higher restrictions to access

the official FX Markets were imposed starting 2020, with a view to reducing the loss of international reserves generated by a greater

demand of U.S. dollars by individuals and companies. These restrictions have resulted in the creation of multiple reference exchange rates,

such as the “blue chip swap” rate (contado con liquidación), MEP dollar (Mercado Electrónico de Pagos),

and soybean dollar (dólar soja), among others. Some of these exchange rates are only available to certain markets participants,

or in the activities in which the currency is held. In addition, dealing with certain of these reference rates might directly affect the

access of the Company to the FX Market. The requirements to access these different exchange rates, as well as the actual exchange rate

of each option, vary significantly from one another. Pursuant to Communication “A” 7106 (as amended and supplemented from

time to time), the BCRA established certain requirements to access the local exchange market for purposes of repayment of cross-border

financial debts, in particular, for the payment of principal outstanding amounts in loans and securities having amortization payments

scheduled between October 15, 2020 and December 31, 2021 for principal amounts exceeding U.S.$2,000,000 by the non-financial

private sector and financial entities. Particularly, the payment of principal amounts pertaining to loans and securities subject to the

regulation should be part of a refinancing plan that must be previously filed with the BCRA, which must provide that (i) only 40%

of the principal amount owed and payable shall be paid through the local foreign exchange market on or prior to March 31, 2021; and

(ii) the remaining 60% must be refinanced so the average life of the debt is increased for a minimum of two years. Pursuant to Communication

“A” 7621, the BCRA requirements set forth by Communication “A” 7106 are also applicable to amortization payments

of principal outstanding amounts in loans and securities scheduled until December 31, 2023. As of the date of this prospectus supplement,

this regime has not been renewed. It is not possible to guarantee that the period covered by Communication “A” 7621 will not

be reinstated in the future by the BCRA or that other regulations with similar effects will be issued that would require the Company to

refinance its obligations, which in turn could have a negative impact on the Company, and in particular, in the Company’s ability

to meet its debt obligations. See “Item 10—Foreign Investment and Exchange Controls—External financial indebtedness”

in the TEO 2023 20-F.

In October 2022, the

former administration issued the General Resolution No. 5271/2022 creating the Argentine System of Imports (SIRA) and the Argentine

System of Imports and Foreign Payments of Services (SIRASE), an import licensing and approval system created to preserve hard currency

reserves within the BCRA. All products and services were under the scope of the SIRA regime, which required Argentine importers to submit

a SIRA or SIRASE request for all imports before shipping products or contracting services from abroad. The implementation of this system

ultimately generated major import approval delays and barriers to foreign exchange availability for Argentine companies during 2023 and,

because of the inability for companies to access the FX Market, this was the only time in recent years when many Argentine companies had

to extend or renegotiate their commercial debts with foreign suppliers.

Due to this situation, we

have been unable to access the FX Market to cancel most of our obligations in foreign currency for imports of goods and services which

are crucial for our operations, while additionally generating the accumulation of commercial debt. This additional commercial debt, in

the case it is past-due, is being treated as financial debt when considering the calculation of the financial ratios of the Company, in

accordance with the definitions incorporated in some of our debt contracts.

Milei’s administration

has announced that it plans to implement policies aimed at modifying Argentina’s macroeconomic conditions, such as reducing the

fiscal deficit, reforming the National State, privatizing public companies and rationalizing the current spending of the national administration.

These measures and any future measures may generate volatility in economic and financial conditions. To address the issue of increasing

commercial debts, under the Milei administration, the BCRA has been offering U.S. dollar-denominated securities (BOPREAL, standing for

Bond for the Reconstruction of a Free Argentina in Spanish), which can only be subscribed by importers with overdue debts for goods with

customs registration and/or services actually rendered until December 12, 2023. As an alternative, BOPREALs may be used for an easier

access to foreign currency, whether through the collection of interest or principal upon maturity, or through the sale of the bonds in

the secondary market in exchange for dollars paid abroad. Importers of goods and services may not repay debts incurred prior to December 12,

2023 by any other means, with the exception of dollars held abroad, without jeopardizing access to the official exchange market. Pursuant

to current BCRA rules, importers will not be entitled to access the FX Market for 90 days if they have conducted exchange transactions

involving the sale/purchase of securities governed by local law (other than BOPREALs) settled in dollars abroad or for 180 days if they

have conducted exchange transactions involving the sale or purchase of securities governed by foreign law settled in dollars abroad.

In this regard, between January and

May 2024, the BCRA completed the Series 1, 2 and 3 BOPREAL auctions issuing their maximum amounts of U.S.$5,000 million, U.S.$2,000

million and U.S.$3,000 million, respectively. Series 3 of BOPREAL was also qualified for subscription by those who have debt related

to payment of dividends (BCRA Communication “A” 7999), and comply with certain conditions.

Given the options currently

provided by the BCRA, we are managing the stock of commercial debt that was accumulated due to the aforementioned restrictions. We participated

in the auctions of BOPREAL 1 and 2 Series during January and February 2024. As of the date that the BOPREALs are received,

they are measured at fair value and included as current investments. The bonds would allow us to agree on a settlement of the existing

commercial debt with our main vendors, which we are negotiating with each counterparty on a one-by-one basis.

In addition, on December 26,

2023 the new administration passed the General Joint Resolution 5466/2023, which established a new Statistical System for Imports (SEDI)

and derogated the previous regime established by the General Resolution No. 5271/2022.

Any further depreciation

of the Argentine Peso or our inability to acquire foreign currency could have a material adverse effect on our financial condition and

results of operations. We cannot predict whether and to what extent the value of the Peso could depreciate against the U.S. dollar and

the way in which any such fluctuations could affect our business. Furthermore, no assurance can be given that, in the future, no additional

currency or foreign exchange restrictions or controls will be imposed. Existing and future measures may negatively affect Argentina’s

international competitiveness, discouraging foreign investments and lending by foreign investors or increasing foreign capital outflow

which could have an adverse effect on economic activity in Argentina, and which in turn could adversely affect our business and results

of operations. We cannot predict how these conditions will affect the consumption of services provided by Telecom or our ability to meet

our liabilities denominated in currencies other than the Argentine Peso. Any restrictions on transferring funds abroad imposed by the

government could undermine our ability to pay dividends on our ADSs or make payments (of principal or interest) under our outstanding

indebtedness in U.S. dollars as well as to comply with any other obligation denominated in foreign currency. See “Item 10—Additional

Information—Foreign Investment and Exchange Controls in Argentina” in the TEO 2023 20-F.

The success of these measures

is subject to uncertainty and any further depreciation of the Argentine Peso or our inability to acquire foreign currency could have a

material adverse effect on our financial condition and results of operations. We cannot predict the effectiveness of these measures. We

cannot predict whether, and to what extent, the value of the Argentine Peso may depreciate or appreciate against the U.S. dollar or other

foreign currencies, and how these uncertainties will affect demand for the fixed and mobile telephony services, Internet services

and cable television services we provide. Furthermore, no assurance can be given that, in the future, no additional currency or foreign

exchange restrictions or controls will be imposed. Existing and future measures may negatively affect Argentina’s international

competitiveness, discouraging foreign investments and lending by foreign investors or increasing foreign capital outflow which could have

an adverse effect on economic activity in Argentina, and which in turn could adversely affect our business and results of operations.

We cannot predict how these conditions will affect the consumption of services provided by Telecom or our ability to meet our liabilities

denominated in currencies other than the Argentine Peso. Any restrictions on transferring funds abroad imposed by the government could

undermine our ability to pay dividends on our ADSs or make payments (of principal or interest) under our outstanding indebtedness in U.S.

dollars as well as to comply with any other obligation denominated in foreign currency. See “Item 10—Additional Information—Foreign

Investment and Exchange Controls in Argentina” in the TEO 2023 20-F.

Depreciation of the Argentine

Peso against major foreign currencies may also have an adverse impact on our capital expenditure program and increase the Argentine Peso

amount of our trade payables and borrowings denominated in foreign currencies. As of March 31, 2024, P$2,151,567 million of our liabilities

net were denominated in foreign currencies. Telecom seeks to manage the risk of devaluation of the Argentine Peso, by entering from time

to time into certain DFI agreements and futures contracts in order to hedge some of its exposure to foreign currency fluctuations. However,

Telecom remains highly exposed to risks associated with the fluctuation of the Argentine Peso. In addition, the devaluation of the Argentine

Peso and foreign exchange restrictions may affect compliance with our covenants. See “Item 3—Key Information—Risk Factors—Restrictive

covenants in Telecom’s outstanding indebtedness may restrict its ability to pursue its business strategies” in the TEO 2023

20-F.

Economic and political developments in Argentina, and future

policies of the Argentine government may affect the economy as well as the operations of the telecommunications industry, including Telecom

Argentina.

The Argentine government

has historically exercised significant influence over the economy, and telecommunications companies in particular have operated in a highly

regulated environment. The Argentine government may promulgate numerous, far-reaching regulations affecting the economy and telecommunications

companies in particular.

In August 2020, Decree

No. 690/20 declared ICT services as an essential public service and imposed tariff regulations on such services. As of April 2024,

this decree has been replaced by Decree No. 302/24, which qualified mobile telephone services in all its modalities as public services

and established the liberalization of the prices of ICT services. For further information about Decree No. 690/20, Decree No. 302/24,

its related regulation and the related legal proceedings, see “Item 4 —Regulatory Authorities and Framework— Decree

No. 302/24” and “Item 3—Risks Relating to Telecom and its operations— The regulation of prices may adversely

affect Telecom Argentina’s revenues” in the TEO 2023 20-F.

In October 2022, the

Argentine government signed a new agreement with the Paris Club, which is an amendment to the 2014 Paris Club Agreement. This new agreement

recognizes a principal amount of U.S.$ 1.971 billion, to be repaid in thirteen semiannual payments, starting in December 2022, and

with final maturity in September 2028. As part of the agreement, the interest rate applicable to the first three payments was reduced

from 9% to 3.9%, with subsequent gradual increases to 4.5%. The payment profile involves semiannual payments for an average of U.S.$ 170

million (principal and interest included). In April 2023, the former Minister of Economy, Sergio Massa, signed agreements with the

Netherlands, Germany, Canada, Israel, Finland, Denmark and Austria as part of the negotiations between the Argentine government and

the group of creditors part of the Paris Club, to complete the repayment of the obligations in 2028. As of December 31, 2023, Argentina

had made an interest payment to the Paris Club of U.S.$190 billion, and to other organizations such as the World Bank and the Development

Bank of Latin America and the Caribbean, among others, for U.S.$ 38 billion as part of the payments committed to in the international

agreements.

During the first quarter

of 2022, the Argentine government reached a new agreement with the IMF in order to renegotiate the principal maturities of the U.S.$44.1

billion disbursed between 2018 and 2019 under a SBA, originally planned for the years 2021, 2022 and 2023. On January 28, 2022, the

IMF and the Argentine authorities reached an understanding on key policies as part of their ongoing discussions on an IMF-supported program.

On March 4, 2022, the Argentine government reached a staff-level agreement with the IMF and a bill was sent to the Argentine Congress.

On March 11, 2022, the lower house of the Argentine Congress passed and sent to the Senate the bill that supports the agreement between

Argentina and the IMF under the extended fund facility arrangement. Finally, on March 17, 2022, this agreement was approved by Argentine

Congress.

By the end of 2022, the IMF

approved the third quarter target review and released the disbursement of U.S.$4.4 billion, which helped increase the BCRA’s international

reserves from U.S.$39.262 billion to U.S.$43.263 billion. However, the IMF warned about the “exceptionally high” risks of

the economic plan and the fragility of political support, and stressed the need to implement further reforms in the economy. Thus, in

2022, the 2.5% primary fiscal deficit target was met. Contrary to what was projected, the primary fiscal deficit in 2023 was 2.9%, one

point above what was established with the international lending institution and, according to the IMF fiscal monitor, the deficit is projected

to be 3.7% in 2024, 1.9% in 2025 and 0.5% in 2026.

In addition, at the beginning

of 2023, Argentina agreed with the IMF to disburse U.S.$5.2 billion and agreed on a substantial modification in the BCRA’s reserves

target for 2023 as a consequence of the severe drought in the country and the costs of the war in Ukraine. This outlay was the result

of the fulfillment of the targets agreed upon with the IMF for the last quarter of 2022, which were linked to the fiscal deficit, monetary

issuance and BCRA reserves.

As of December 31, 2023,

the IMF staff and the Argentine authorities reached a staff-level agreement on the first to the sixth reviews, under the extended fund

facility arrangement.

Furthermore, at the beginning

of January 2024, the government reached an agreement with the IMF in which it authorized the payment of U.S.$ 4.7 billion, corresponding

to the seventh review of the program. This money is expected to be used to repay a loan requested from the Andean Development Corporation

for U.S.$ 900 million, which was used to pay December 2023 maturities with the IMF, and to pay the principal maturities of January and

April 2023. The disbursement, which is intended to support policy efforts to restore macroeconomic stability for Argentina and to

meet its balance of payments needs, was approved by the IMF’s Executive Board in April 2023. As a result, the Argentine government

was able to pay maturities of U.S.$ 2.8 billion.

On February 1, 2024,

the IMF Executive Board concluded the seventh review of the arrangement under the IMF’s Extended Fund Facility arrangement for Argentina.

The Executive Board’s decision allows for an immediate disbursement of approximately U.S.$4.7 billion (or SDR 3.5 billion) to support

the major efforts of the new authorities to restore macroeconomic stability in Argentina.

On May 14, 2024, the

eighth review of the program took place, which focused on fiscal compliance during the first quarter of 2024. According to the Ministry

of Economy´s figures, the primary fiscal surplus was four times higher than the figure required by the current program, whereas

the BCRA accumulated more than U.S.$ 2 billion above the agreed amount. In turn, under the 2018 agreement, the BCRA is expected to make

a payment of U.S.$ 1.927 billion and after which only a last principal payment of approximately U.S.$ 640 billion will remain and, from

that moment on, the BCRA will make calendar interest and surcharge payments until September 2026, when the repayment process of the

current Extended Facilities Program is expected to begin. On June 13, 2024, the IMF Executive Board approved the eighth review of

the program and enabled a disbursement of almost U.S.$ 800 million that is programmed to increase the Central Bank’s reserves. The

Argentine government is expected to seek negotiations towards a new program with additional financing, as a way to speed up the exit from

the exchange restriction.

We cannot assure the Argentine

government will be successful in future negotiations with the IMF, which could affect the Argentine government’s ability to implement

reforms and public policies and boost economic growth, or the impact the result of such renegotiations will have in Argentina’s

ability to access international capital markets (and indirectly in our ability to access those markets). Moreover, the long-term impact

of these measures and any future measures taken by the government on the Argentine economy, as a whole and in the telecommunication sector

in particular, remains uncertain. It is possible that such reforms could be disruptive to the economy and adversely affect the Argentine

economy and the telecommunications industry, and consequently, our business, results of operations and financial condition. We are also

unable to predict the measures that the Argentine government may adopt in the future, and how they will impact on the Argentine economy

and our results of operations and financial condition.

In the event of any economic,

social or political crisis, companies operating in Argentina may face the risk of strikes, expropriation, nationalization, mandatory amendment

of existing contracts, and changes in taxation policies including tax increases and retroactive tax claims. In addition, Argentine courts

have sanctioned modifications on rules related to labor matters, requiring companies to assume greater responsibility for the assumption

of costs and risks associated with sub-contracted labor and the calculation of salaries, severance payments and social security contributions.

Since we operate in a context in which the governing law and applicable regulations change frequently, also as a result of changes in

government administrations, it is difficult to predict if and how our activities will be affected by such changes.

Presidential and federal

congressional elections in Argentina were held in October 2023. Since assuming office on December 10, 2023, Javier Milei´s

administration has announced a range of economic and policy reforms, which impact on the future economic and political environment is

uncertain. No assurances can be made as to the policies that may be implemented by the new Argentine administration, or that political

developments in Argentina, will not adversely affect the Argentine economy or our business, financial condition or results of operations.

In addition, we cannot assure that future economic, regulatory, social and political developments in Argentina will not impair our business,

financial condition or results of operations, or cause the market value of our shares to decline.

On December 21, 2023

Javier Milei’s administration issued Decree of Necessity and Urgency No. 70/2023, entitled “Bases para la Reconstrucción

de la Economía Argentina” (Foundations for the reconstruction of the Argentine economy) establishing various initiatives

for the deregulation of the economy and reduction of the size of the public administration and public expenses. Such decree remains mostly

in effect. The decree includes a series of legal, institutional, tax, and criminal reforms affecting various sectors of the economy. Additionally,

the decree declares a public emergency in economic, financial, fiscal, social security, defense, tariff, energy, health and social matters

until December 31, 2025, extendable for two additional years, and delegates numerous legislative powers to the PEN for the duration

of the public emergency.

This decree is subject to

the subsequent legislative control established by section 99, paragraph 3, of the National Constitution and Law 26,122, which provides

that the decree will remain in force until it is rejected by both Chambers of the National Congress. On March 14, 2024, the Senate

rejected the decree, thereby passing to the lower house for its vote. In the event that the lower house also rejects it, the decree will

become ineffective.

The Milei administration

also submitted to Congress a significant number of reforms through the omnibus bill entitled “Bases y Puntos de Partida para

la Libertad de los Argentinos” (Foundations and Starting Points for the Freedom of the Argentine People). After months of negotiation,

on June 28, 2024, the bill finally passed and the Ley Bases was finally approved.

The key points entailed by

this approval are the following:

| · | Emergency: Ley Bases declares public emergency on administrative, economic and energy matters for a one-year period. Also, legislative powers are delegated to the PEN in the terms of Article 76 of the National Constitution. The PEN must

report monthly and in detail to the Congress about the exercise and the results of this delegation; |

| · | State Reform: Regarding the reorganization of the state, the law establishes the bases of legislative

delegations, namely: i) to improve the functioning of the state; ii) to reduce the oversizing of the state structure; and iii) to ensure

effective internal control in the national public administration. Also, regarding the privatization of public companies, the law determined

that the companies “subject to total or partial privatization” are: Energía Argentina S.A.; Intercargo S.A.U.; Agua

y Saneamientos Argentinos S.A.; Belgrano Cargas y Logística S.A.; Railway Operating Society S.E. (SOFSE); and Corredores Viales

S.A. Likewise, reforms and modifications were introduced to laws 19,549 (National Administrative Procedures), 25,164 (Regulation of National

Public Employment), and 24,185 (Collective Labor Agreements). |

| · | Incentive Regime for Large Investments: The creation of the “Régimen de Incentivos para

Grandes Inversiones” which establishes a legal and regulatory framework to promote investment in productive projects in Argentina.

This regime will provide incentives, legal certainty and protection of acquired rights for projects that meet the established requirements.

It is declared that large investments under the RIGI are of national interest and benefit Argentina, the Argentine Provinces, the City

of Buenos Aires and the municipalities. Its objectives are: to encourage “large investments”, promote economic development,

strengthen competitiveness, increase exports and services, generate employment and provide stability to future investments. Throughout

the articles, the deadlines, the subjects authorized to participate, the specific requirements of the RIGI, tax incentives and exchange

incentives are regulated; |

| · | Concessions: The possibility of the government to grant public work concessions to private or public entities

for the construction, conservation or exploitation of public works and for the provision of public services through the collection of

rates, tolls or other remunerations; |

| · | Energy: Various modifications are included to laws 17,319 (Hydrocarbons), 24,076 (Natural Gas) and 26,741

(Fiscal Oil Fields). The National Gas and Electricity Regulatory Entity is created, replacing the Electricity Regulatory Entity (“ENRE”)

and the Gas Regulatory Entity (“ENARGAS”). On the other hand, the PEN is empowered to adapt Laws 15,336 (Electrical

Energy) and 24,065 (Electrical Regulatory Framework). |

| · | Labor modernization: Various modifications are introduced to laws 24,013 (Employment), 20,744 (Employment

Contract Law) and 26,727 (Agrarian Work). Likewise, Law 25,323 (Worker's Compensation) is repealed. Modifications include the extension

of the trial period or the exemption from sanctions and criminal actions for those employers who have not made the corresponding contributions,