0000092230FALSE00000922302024-07-222024-07-220000092230us-gaap:CommonStockMember2024-07-222024-07-220000092230tfc:SeriesIPreferredStockMember2024-07-222024-07-220000092230tfc:SeriesJPreferredStockMember2024-07-222024-07-220000092230tfc:SeriesOPreferredStockMember2024-07-222024-07-220000092230tfc:SeriesRPreferredStockMember2024-07-222024-07-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

Form 8-K

Current Report

_____________________________________________

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

July 22, 2024

Date of Report (Date of earliest event reported)

Truist Financial Corporation

(Exact name of registrant as specified in its charter)

_____________________________________________ | | | | | | | | |

| North Carolina | 1-10853 | 56-0939887 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

214 North Tryon Street | |

Charlotte, | North Carolina | 28202 |

(Address of principal executive offices) | (Zip Code) |

(336) 733-2000

(Registrant’s telephone number, including area code)

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered | | | | |

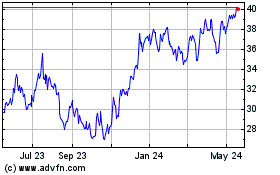

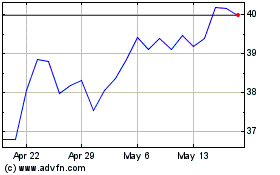

| Common Stock, $5 par value | | TFC | | New York Stock Exchange | | | | |

| Depositary Shares each representing 1/4,000th interest in a share of Series I Perpetual Preferred Stock | | TFC.PI | | New York Stock Exchange | | | | |

| 5.853% Fixed-to-Floating Rate Normal Preferred Purchase Securities each representing 1/100th interest in a share of Series J Perpetual Preferred Stock | | TFC.PJ | | New York Stock Exchange | | | | |

| Depositary Shares each representing 1/1,000th interest in a share of Series O Non-Cumulative Perpetual Preferred Stock | | TFC.PO | | New York Stock Exchange | | | | |

| Depositary Shares each representing 1/1,000th interest in a share of Series R Non-Cumulative Perpetual Preferred Stock | | TFC.PR | | New York Stock Exchange | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.02 Results of Operations and Financial Condition.

On July 22, 2024, Truist Financial Corporation (“Truist”) issued a press release announcing its reporting of second quarter 2024 results and posted on its website its second quarter 2024 Earnings Release, Quarterly Performance Summary, and Earnings Release Presentation. The materials contain forward-looking statements regarding Truist and include cautionary language identifying important factors that could cause actual results to differ materially from those anticipated. The Earnings Release, Quarterly Performance Summary, and Earnings Release Presentation are furnished as Exhibits 99.1, 99.2, and 99.3, respectively. Consequently, they are not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. Such materials may only be incorporated by reference into another filing under the Exchange Act or Securities Act of 1933 if such subsequent filing specifically references this Form 8-K. All information in the Earnings Release, Quarterly Performance Summary, and Earnings Release Presentation speaks as of the date thereof, and Truist does not assume any obligation to update such information in the future.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| | |

| Exhibit No. | | Description of Exhibit |

| | Earnings Release issued July 22, 2024. |

| | Quarterly Performance Summary issued July 22, 2024. |

| | Earnings Release Presentation issued July 22, 2024. |

| | |

| | |

| | |

| | |

| | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| TRUIST FINANCIAL CORPORATION |

| | (Registrant) |

| | |

| By: | /s/ Cynthia B. Powell |

| | Cynthia B. Powell |

| | Executive Vice President and Corporate Controller |

| | (Principal Accounting Officer) |

Date: July 22, 2024

`

| | | | | | | | | | | |

| | News Release |

| | | |

Truist reports second quarter 2024 results |

|

Net income available to common shareholders of $826 million, or $0.62 per share, or $1.2 billion, or $0.91 per share on an adjusted basis(1) | CET1 ratio(3) was 11.6%, significantly strengthened by the sale of TIH | Truist executed a strategic balance sheet repositioning and announced planned share repurchases |

2Q24 Key Financial Data | 2Q24 Performance Highlights(4) |

| | | | | | | | | | | | | | | | | |

| |

| | | | | | | |

| (Dollars in billions, except per share data) | 2Q24 | 1Q24 | 2Q23 | | | | | | |

| Summary Income Statement | |

| Net interest income - TE | $ | 3.58 | | $ | 3.43 | | $ | 3.66 | | | | | | | |

| Noninterest income | (5.21) | | 1.45 | | 1.38 | | | | | | | |

| Total revenue - TE | (1.63) | | 4.87 | | 5.04 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Noninterest expense | 3.09 | | 2.95 | | 3.05 | | | | | | | |

| Net income (loss) from continuing operations | (3.91) | | 1.13 | | 1.17 | | | | | | | |

| Net income from discontinued operations | 4.83 | | 0.07 | | 0.18 | | | | | | | |

| Net income (loss) | 0.92 | | 1.20 | | 1.35 | | | | | | | |

| Net income (loss) available to common shareholders | 0.83 | | 1.09 | | 1.23 | | | | | | | |

Adjusted net income available to common shareholders(1) | 1.24 | | 1.22 | | 1.23 | | | | | | | |

PPNR - unadjusted(1)(2) | (4.73) | | 1.92 | | 1.99 | | | | | | | |

PPNR - adjusted(1)(2) | 2.21 | | 2.13 | | 2.14 | | | | | | | |

| Key Metrics | |

| | | | | | | | | |

| | | | | | | | | |

| Diluted EPS | $ | 0.62 | | $ | 0.81 | | $ | 0.92 | | | | | | | |

Adjusted diluted EPS(1) | 0.91 | | 0.90 | | 0.92 | | | | | | | |

| BVPS | 42.71 | | 38.97 | | 42.68 | | | | | | | |

TBVPS(1) | 28.91 | | 21.64 | | 20.44 | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | | |

| ROCE | 6.1 | % | 8.4 | % | 8.6 | % | | | | | | |

ROTCE(1) | 10.4 | | 16.3 | | 19.4 | | | | | | | |

Efficiency ratio - GAAP(2) | NM | 61.3 | | 61.1 | | | | | | | |

Efficiency ratio - adjusted(1)(2) | 56.0 | | 56.2 | | 57.5 | | | | | | | |

Fee income ratio - GAAP(2) | NM | 30.0 | | 27.7 | | | | | | | |

Fee income ratio - adjusted(1)(2) | 28.7 | | 29.7 | | 27.4 | | | | | | | |

NIM - TE(2) | 3.03 | | 2.89 | | 2.90 | | | | | | | |

| NCO ratio | 0.58 | | 0.64 | | 0.54 | | | | | | | |

| ALLL ratio | 1.57 | | 1.56 | | 1.43 | | | | | | | |

CET1 ratio(3) | 11.6 | | 10.1 | | 9.6 | | | | | | | |

| | | | | | | | | |

| Average Balances | |

| Assets | $ | 527 | | $ | 531 | | $ | 566 | | | | | | | |

| Securities | 121 | | 131 | | 138 | | | | | | | |

| Loans and leases | 308 | | 309 | | 328 | | | | | | | |

| Deposits | 388 | | 389 | | 400 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Amounts may not foot due to rounding.

(1)Represents a non-GAAP measure. A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP measure is included in the appendix to Truist’s Second Quarter 2024 Earnings Presentation.

(2)This metric is calculated based on continuing operations.

(3)Current quarter capital ratios are preliminary.

(4)Comparisons noted in this section summarize changes from second quarter of 2024 compared to first quarter of 2024 on a continuing operations basis, unless otherwise noted.

•Net income available to common shareholders was $826 million, or $0.62 per diluted share, and includes:

◦A gain on the sale of TIH of $6.9 billion ($4.8 billion after-tax), or $3.60 per share (discontinued operations)

◦Securities losses of $6.7 billion ($5.1 billion after-tax), or $3.80 per share, from the strategic balance sheet repositioning of a portion of the available-for-sale investment securities portfolio

◦A charitable contribution to the Truist Foundation of $150 million ($115 million after-tax), or $0.09 per share

◦Restructuring charges of $96 million ($73 million after-tax), or $0.05 per share, for continuing and discontinued operations, or $33 million ($26 million after-tax), or $0.02 per share, for continuing operations primarily due to severance and facilities optimization

•Total revenues were down $6.5 billion due primarily to securities losses. Adjusted revenues(1) were up 3.0% due to higher net interest income.

◦Net interest income increased 4.5% due to the balance sheet repositioning and higher rates on earning assets; net interest margin was up 14 basis points

◦Excluding securities losses, noninterest income was flat due to lower investment banking and trading income that was largely offset by higher mortgage banking income and other income

•Noninterest expense was up 4.8%. Adjusted noninterest expense(1) was up 2.6%, reflecting seasonally higher personnel expense and higher professional fees and outside processing expense

•Average loans and leases HFI decreased 0.7% due to declines in the commercial and industrial, residential mortgage, and indirect auto portfolios

•Average deposits decreased 0.3% due to declines in non-interest bearing and time deposits

•Asset quality remains solid

◦Nonperforming assets were stable

◦Loans 90 days or more past due were down two basis points

◦ALLL ratio increased one basis point

◦Net charge-off ratio of 58 basis points, down six basis points

•Capital levels significantly strengthened from the sale of TIH

◦Announced up to $5 billion in share repurchase authorization through 2026 with buybacks expected to commence in 3Q24

◦CET1 ratio(3) was 11.6%

•Liquidity levels remain strong with consolidated LCR of 110%

“In the second quarter, we continued to see solid momentum in our core banking businesses as evidenced by strong year-over-year growth in investment banking and trading revenue and continued expense discipline. Client deposits are stabilizing, and asset quality metrics remain within our expectations. While loan demand does remain muted, we are encouraged by an improvement in our dialogue with clients and our expanded capacity to support their needs.

We successfully completed the divestiture of our remaining stake in Truist Insurance Holdings, which along with organic capital generation increased our CET1 capital ratio to 11.6% and our tangible book value per share by 34%. We utilized a portion of the capital created from the sale of TIH to reposition our balance sheet, which is expected to replace TIH’s earnings contribution, creates additional liquidity and improves our interest rate risk profile.

In addition, our Board authorized the repurchase of up to $5 billion of shares of our common stock through the end of 2026 with repurchases expected to begin during the third quarter. Moreover, the most recent Federal Reserve stress test highlighted our ability to weather a variety of stressed economic scenarios.

I am confident in the capabilities of our talented teammates to take Truist to the next level as our strengthened capital position offers us the opportunity to grow our core banking franchise, while also prudently returning capital to our shareholders through our strong dividend and recently announced share repurchase program.”

— Bill Rogers, Truist Chairman & CEO

` | | | | | | | | |

| Contact: | | |

| Investors: | Brad Milsaps | 770.352.5347 | investors@truist.com |

| Media: | Hannah Joyce | 781.650.0403 | media@truist.com |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Income, Net Interest Margin, and Average Balances |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 2Q24 | | 1Q24 | | | | | | 2Q23 | | | | | | Link | | Like | | |

Interest income(1) | $ | 6,404 | | | $ | 6,237 | | | | | | | $ | 6,229 | | | | | | | $ | 167 | | | 2.7 | % | | $ | 175 | | | 2.8 | % | | | | |

| Interest expense | 2,824 | | | 2,812 | | | | | | | 2,572 | | | | | | | 12 | | | 0.4 | | | 252 | | | 9.8 | | | | |

Net interest income(1) | $ | 3,580 | | | $ | 3,425 | | | | | | | $ | 3,657 | | | | | | | $ | 155 | | | 4.5 | | | $ | (77) | | | (2.1) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest margin(1) | 3.03 | % | | 2.89 | % | | | | | | 2.90 | % | | | | | | 14 bps | | | | 13 bps | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Average Balances(2) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total earning assets | $ | 473,666 | | | $ | 476,111 | | | | | | | $ | 505,712 | | | | | | | $ | (2,445) | | | (0.5) | % | | $ | (32,046) | | | (6.3) | % | | | | |

| Total interest-bearing liabilities | 343,145 | | | 347,121 | | | | | | | 363,754 | | | | | | | (3,976) | | | (1.1) | | | (20,609) | | | (5.7) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Yields / Rates(1) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total earning assets | 5.42 | % | | 5.26 | % | | | | | | 4.94 | % | | | | | | 16 bps | | | | 48 bps | | | | | | |

| Total interest-bearing liabilities | 3.31 | | | 3.26 | | | | | | | 2.84 | | | | | | | 5 bps | | | | 47 bps | | | | | | |

(1)Amounts are on a taxable-equivalent basis utilizing the federal income tax rate of 21% for the periods presented. Interest income includes certain fees, deferred costs, and dividends.

(2)Excludes basis adjustments for fair value hedges.

Taxable-equivalent net interest income for the second quarter of 2024 was up $155 million, or 4.5%, compared to the first quarter of 2024 primarily due to the impacts of the proceeds from the sale of TIH and balance sheet repositioning. The net interest margin was 3.03%, up 14 basis points.

•Average earning assets decreased $2.4 billion, or 0.5%, primarily due to declines in average securities of $10.0 billion, or 7.6%, and total loans of $1.8 billion, or 0.6%, partially offset by growth in other earning assets of $8.7 billion, or 28%. The change in average securities and other earning assets (increase in balances held at the Federal Reserve) was driven by the balance sheet repositioning.

•The yield on the average total loan portfolio was 6.44%, up six basis points and the yield on the average securities portfolio was 2.77%, up 31 basis points primarily due to investment in higher yielding, shorter duration securities as part of the balance sheet repositioning.

•Average deposits decreased $1.0 billion, or 0.3%, and average long-term debt decreased $4.0 billion, or 9.8%.

•The average cost of total deposits was 2.09%, up six basis points and the average cost of short-term borrowings was 5.58%, down four basis points compared to the prior quarter. The average cost of long-term debt was 4.87%, up 13 basis points.

Taxable-equivalent net interest income for the second quarter of 2024 was down $77 million, or 2.1%, compared to the second quarter of 2023 primarily due to higher funding costs and lower earning assets, partially offset by the balance sheet repositioning. Net interest margin was 3.03%, up 13 basis points.

•Average earning assets decreased $32.0 billion, or 6.3%, primarily due to declines in average total loans of $20.7 billion, or 6.3%, and a decrease in average securities of $17.1 billion, or 12%, partially offset by growth in other earning assets of $4.6 billion, or 13%.

•The yield on the average total loan portfolio was 6.44%, up 37 basis points and the yield on the average securities portfolio was 2.77%, up 60 basis points, primarily reflecting higher market interest rates.

•Average deposits decreased $11.8 billion, or 2.9%, average short-term borrowings increased $2.0 billion, or 8.4%, and average long-term debt decreased $26.9 billion, or 42%.

•The average cost of total deposits was 2.09%, up 56 basis points. The average cost of short-term borrowings was 5.58%, up 39 basis points. The average cost of long-term debt was 4.87%, up 25 basis points. The increase in rates on deposits and other funding sources was largely attributable to the higher rate environment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Income |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 2Q24 | | 1Q24 | | | | | | 2Q23 | | | | | | Link | | Like | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Wealth management income | $ | 361 | | | $ | 356 | | | | | | | $ | 330 | | | | | | | $ | 5 | | | 1.4 | % | | $ | 31 | | | 9.4 | % | | | | |

| Investment banking and trading income | 286 | | | 323 | | | | | | | 211 | | | | | | | (37) | | | (11.5) | | | 75 | | | 35.5 | | | | | |

| Service charges on deposits | 232 | | | 225 | | | | | | | 240 | | | | | | | 7 | | | 3.1 | | | (8) | | | (3.3) | | | | | |

| Card and payment related fees | 230 | | | 224 | | | | | | | 236 | | | | | | | 6 | | | 2.7 | | | (6) | | | (2.5) | | | | | |

| Mortgage banking income | 112 | | | 97 | | | | | | | 99 | | | | | | | 15 | | | 15.5 | | | 13 | | | 13.1 | | | | | |

| Lending related fees | 89 | | | 96 | | | | | | | 86 | | | | | | | (7) | | | (7.3) | | | 3 | | | 3.5 | | | | | |

| Operating lease income | 50 | | | 59 | | | | | | | 64 | | | | | | | (9) | | | (15.3) | | | (14) | | | (21.9) | | | | | |

| Securities gains (losses) | (6,650) | | | — | | | | | | | — | | | | | | | (6,650) | | | NM | | (6,650) | | | NM | | | | |

| Other income | 78 | | | 66 | | | | | | | 114 | | | | | | | 12 | | | 18.2 | | | (36) | | | (31.6) | | | | | |

| Total noninterest income | $ | (5,212) | | | $ | 1,446 | | | | | | | $ | 1,380 | | | | | | | $ | (6,658) | | | NM | | $ | (6,592) | | | (477.7) | | | | | |

Noninterest income was down $6.7 billion compared to the first quarter of 2024 primarily due to $6.7 billion of securities losses resulting from the balance sheet repositioning, lower investment banking and trading income, partially offset by higher mortgage banking income and other income. Excluding securities losses, noninterest income was $1.4 billion, flat compared to the first quarter of 2024.

•Investment banking and trading income decreased due to lower merger and acquisition fees, equity originations, and trading income, partially offset by higher loan syndications.

•Mortgage banking income increased due to valuation adjustments of the commercial mortgage servicing rights in the current quarter.

•Other income increased primarily due to higher income from certain investments.

Noninterest income was down $6.6 billion compared to the second quarter of 2023 primarily due to $6.7 billion of securities losses resulting from the balance sheet repositioning and lower other income, partially offset by higher investment banking and trading income and wealth management income. Excluding securities losses, noninterest income was up $58 million compared to the second quarter of 2023.

•Investment banking and trading income increased due to higher bond origination fees and loan syndications, partially offset by lower trading income.

•Wealth management income increased due to higher assets under management.

•Other income decreased due to lower income from certain equity investments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest Expense |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 2Q24 | | 1Q24 | | | | | | 2Q23 | | | | | | Link | | Like | | |

| Personnel expense | $ | 1,661 | | | $ | 1,630 | | | | | | | $ | 1,705 | | | | | | | $ | 31 | | | 1.9 | % | | $ | (44) | | | (2.6) | % | | | | |

| Professional fees and outside processing | 308 | | | 278 | | | | | | | 311 | | | | | | | 30 | | | 10.8 | | | (3) | | | (1.0) | | | | | |

| Software expense | 218 | | | 224 | | | | | | | 223 | | | | | | | (6) | | | (2.7) | | | (5) | | | (2.2) | | | | | |

| Net occupancy expense | 160 | | | 160 | | | | | | | 166 | | | | | | | — | | | — | | | (6) | | | (3.6) | | | | | |

| Amortization of intangibles | 89 | | | 88 | | | | | | | 99 | | | | | | | 1 | | | 1.1 | | | (10) | | | (10.1) | | | | | |

| Equipment expense | 89 | | | 88 | | | | | | | 87 | | | | | | | 1 | | | 1.1 | | | 2 | | | 2.3 | | | | | |

| Marketing and customer development | 63 | | | 56 | | | | | | | 69 | | | | | | | 7 | | | 12.5 | | | (6) | | | (8.7) | | | | | |

| Operating lease depreciation | 34 | | | 40 | | | | | | | 44 | | | | | | | (6) | | | (15.0) | | | (10) | | | (22.7) | | | | | |

| Regulatory costs | 85 | | | 152 | | | | | | | 73 | | | | | | | (67) | | | (44.1) | | 12 | | | 16.4 | | | | |

| Restructuring charges | 33 | | | 51 | | | | | | | 48 | | | | | | | (18) | | | (35.3) | | | (15) | | | (31.3) | | | | | |

| Goodwill impairment | — | | | — | | | | | | | — | | | | | | | — | | | — | | — | | | — | | | | |

| Other expense | 354 | | | 186 | | | | | | | 221 | | | | | | | 168 | | | 90.3 | | | 133 | | | 60.2 | | | | | |

| Total noninterest expense | $ | 3,094 | | | $ | 2,953 | | | | | | | $ | 3,046 | | | | | | | $ | 141 | | | 4.8 | | | $ | 48 | | | 1.6 | | | | | |

Noninterest expense was up $141 million, or 4.8%, compared to the first quarter of 2024 due to a $150 million charitable contribution to the Truist Foundation (other expense), an increase in personnel expense and professional fees and outside processing expense, partially offset by a $62 million decline in the FDIC special assessment (regulatory costs) compared to the first quarter of 2024 and lower restructuring charges. Restructuring charges for both quarters include severance charges as well as costs associated with continued facilities optimization initiatives. Adjusted noninterest expense, which excludes the charitable contribution, the FDIC special assessment, restructuring charges, and the amortization of intangibles, increased $70 million, or 2.6%, compared to the prior quarter.

•Personnel expense increased due to seasonally higher equity-based compensation due to retirement-eligible teammates and higher medical claims, partially offset by seasonally lower payroll taxes and lower headcount.

•Professional fees and outside processing expense increased primarily due to higher investments in technology.

Noninterest expense was up $48 million, or 1.6%, compared to the second quarter of 2023 due to a $150 million charitable contribution to the Truist Foundation (other expense) and the FDIC special assessment adjustment in the second quarter of 2024 of $13 million (regulatory costs), partially offset by lower personnel expense. Adjusted noninterest expense, which excludes the charitable contribution, the FDIC special assessment adjustment, restructuring charges, the amortization of intangibles, and a small loss on the early extinguishment of debt in 2023, decreased $86 million, or 3.0%, compared to the earlier quarter.

•Personnel expense decreased due to lower headcount across most lines of business, partially offset by higher incentives and higher medical claims.

•Other expense increased due to the aforementioned charitable contribution, partially offset by lower pension expenses.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Provision for Income Taxes | | | | |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 2Q24 | | 1Q24 | | | | | | 2Q23 | | | | | | Link | | Like | | |

| Provision (benefit) for income taxes | $ | (1,324) | | | $ | 232 | | | | | | | $ | 230 | | | | | | | $ | (1,556) | | | NM | | $ | (1,554) | | | NM | | | | |

| Effective tax rate | 25.3 | % | | 17.0 | % | | | | | | 16.4 | % | | | | | | NM | | | | NM | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The higher effective tax rate in the current quarter compared to the first quarter of 2024 and second quarter of 2023 is due to a tax benefit on the pre-tax loss, which is driven by the discrete impact of the balance sheet repositioning of securities.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average Loans and Leases |

| (Dollars in millions) | 2Q24 | | 1Q24 | | | | | | | | Change | | % Change |

| | | | | | | | | | | | | |

| Commercial: | | | | | | | | | | | | | |

| Commercial and industrial | $ | 157,043 | | | $ | 158,385 | | | | | | | | | $ | (1,342) | | | (0.8) | % |

| CRE | 21,969 | | | 22,400 | | | | | | | | | (431) | | | (1.9) | |

| Commercial construction | 7,645 | | | 7,134 | | | | | | | | | 511 | | | 7.2 | |

| | | | | | | | | | | | | |

| Total commercial | 186,657 | | | 187,919 | | | | | | | | | (1,262) | | | (0.7) | |

| Consumer: | | | | | | | | | | | | | |

| Residential mortgage | 54,490 | | | 55,070 | | | | | | | | | (580) | | | (1.1) | |

| Home equity | 9,805 | | | 9,930 | | | | | | | | | (125) | | | (1.3) | |

| Indirect auto | 22,016 | | | 22,374 | | | | | | | | | (358) | | | (1.6) | |

| Other consumer | 28,326 | | | 28,285 | | | | | | | | | 41 | | | 0.1 | |

| | | | | | | | | | | | | |

| Total consumer | 114,637 | | | 115,659 | | | | | | | | | (1,022) | | | (0.9) | |

| Credit card | 4,905 | | | 4,923 | | | | | | | | | (18) | | | (0.4) | |

| | | | | | | | | | | | | |

| Total loans and leases held for investment | $ | 306,199 | | | $ | 308,501 | | | | | | | | | $ | (2,302) | | | (0.7) | |

Average loans held for investment decreased $2.3 billion, or 0.7%, compared to the prior quarter.

•Average commercial loans decreased 0.7% due to a decline in the commercial and industrial portfolio.

•Average consumer loans decreased 0.9% due to declines in the residential mortgage and indirect auto portfolios.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Deposits |

| (Dollars in millions) | 2Q24 | | 1Q24 | | | | | | | | Change | | % Change |

| | | | | | | | | | | | | |

| Noninterest-bearing deposits | $ | 107,634 | | | $ | 108,888 | | | | | | | | | $ | (1,254) | | | (1.2) | % |

| Interest checking | 103,894 | | | 103,537 | | | | | | | | | 357 | | | 0.3 | |

| Money market and savings | 135,264 | | | 134,696 | | | | | | | | | 568 | | | 0.4 | |

| Time deposits | 41,250 | | | 41,937 | | | | | | | | | (687) | | | (1.6) | |

| | | | | | | | | | | | | |

| Total deposits | $ | 388,042 | | | $ | 389,058 | | | | | | | | | $ | (1,016) | | | (0.3) | |

Average deposits for the second quarter of 2024 were $388.0 billion, a decrease of $1.0 billion, or 0.3%, compared to the prior quarter.

Average noninterest-bearing deposits decreased 1.2% compared to the prior quarter and represented 27.7% of total deposits for the second quarter of 2024 compared to 28.0% for the first quarter of 2024. Average time deposits decreased 1.6%. Average money market and savings accounts and interest checking increased 0.4% and 0.3%, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital Ratios |

| 2Q24 | | 1Q24 | | 4Q23 | | 3Q23 | | 2Q23 |

| Risk-based: | (preliminary) | | | | | | | | |

| CET1 | 11.6 | % | | 10.1 | % | | 10.1 | % | | 9.9 | % | | 9.6 | % |

| Tier 1 | 13.2 | | | 11.7 | | | 11.6 | | | 11.4 | | | 11.1 | |

| Total | 15.4 | | | 13.9 | | | 13.7 | | | 13.5 | | | 13.2 | |

| Leverage | 10.5 | | | 9.5 | | | 9.3 | | | 9.2 | | | 8.8 | |

| Supplementary leverage | 8.9 | | | 8.0 | | | 7.9 | | | 7.8 | | | 7.5 | |

Capital ratios significantly strengthened compared to the regulatory requirements for well capitalized banks. Truist’s CET1 ratio was 11.6% as of June 30, 2024, up 150 basis points compared to March 31, 2024 due to the sale of TIH and organic capital generation, partially offset by the balance sheet repositioning. Truist did not repurchase any shares in the second quarter of 2024. Truist's board of directors has authorized a $5 billion share repurchase program through 2026 as part of the Company's overall capital distribution strategy, with share repurchases expected to begin during the third quarter of 2024. Truist declared common dividends of $0.52 per share during the second quarter of 2024 and plans to maintain its current quarterly common stock dividend, subject to approval by its board of directors.

Truist completed the 2024 CCAR process and received a preliminary SCB requirement of 2.8% for the period October 1, 2024 to September 30, 2025, down 10 basis points from the SCB requirement for the period October 1, 2023 to September 30, 2024. The Federal Reserve will provide Truist with its final SCB requirement by August 31, 2024.

Truist’s average consolidated LCR was 110% for the three months ended June 30, 2024, compared to the regulatory minimum of 100%.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Asset Quality | |

| (Dollars in millions) | 2Q24 | | 1Q24 | | 4Q23 | | 3Q23 | | 2Q23 | |

| Total nonperforming assets | $ | 1,476 | | | $ | 1,476 | | | $ | 1,488 | | | $ | 1,584 | | | $ | 1,583 | | |

| | | | | | | | | | |

| Total loans 90 days past due and still accruing | 489 | | | 538 | | | 534 | | | 574 | | | 662 | | |

| Total loans 30-89 days past due and still accruing | 1,791 | | | 1,716 | | | 1,971 | | | 1,636 | | | 1,550 | | |

Nonperforming loans and leases as a percentage of loans and leases held for investment | 0.46 | % | | 0.45 | % | | 0.44 | % | | 0.46 | % | | 0.47 | % | |

| | | | | | | | | | |

| | | | | | | | | | |

| Loans 30-89 days past due and still accruing as a percentage of loans and leases | 0.59 | | | 0.56 | | | 0.63 | | | 0.52 | | | 0.48 | | |

| Loans 90 days or more past due and still accruing as a percentage of loans and leases | 0.16 | | | 0.18 | | | 0.17 | | | 0.18 | | | 0.21 | | |

| Loans 90 days or more past due and still accruing as a percentage of loans and leases, excluding government guaranteed | 0.04 | | | 0.04 | | | 0.04 | | | 0.04 | | | 0.04 | | |

Allowance for loan and lease losses as a percentage of loans and leases held for investment | 1.57 | | | 1.56 | | | 1.54 | | | 1.49 | | | 1.43 | | |

Ratio of allowance for loan and lease losses to net charge-offs | 2.7x | | 2.4x | | 2.7x | | 2.9x | | 2.6x | |

Ratio of allowance for loan and lease losses to nonperforming loans and leases held for investment | 3.4x | | 3.4x | | 3.5x | | 3.2x | | 3.0x | |

Applicable ratios are annualized.

Nonperforming assets totaled $1.5 billion at June 30, 2024, flat compared to March 31, 2024, as declines in the commercial and industrial and commercial construction portfolio were offset by an increase in the CRE portfolio. Nonperforming loans and leases held for investment were 0.46% of loans and leases held for investment at June 30, 2024, up one basis point compared to March 31, 2024.

Loans 90 days or more past due and still accruing totaled $489 million at June 30, 2024, down two basis points as a percentage of loans and leases compared with the prior quarter. Excluding government guaranteed loans, the ratio of loans 90 days or more past due and still accruing as a percentage of loans and leases was 0.04% at June 30, 2024, unchanged from March 31, 2024.

Loans 30-89 days past due and still accruing of $1.8 billion at June 30, 2024 were up $75 million, or three basis points as a percentage of loans and leases, compared to the prior quarter due to increases in the residential mortgage and indirect auto portfolios, partially offset by a decline in the commercial and industrial portfolio.

The allowance for credit losses was $5.1 billion and includes $4.8 billion for the allowance for loan and lease losses and $302 million for the reserve for unfunded commitments. The ALLL ratio was 1.57%, up one basis point compared with March 31, 2024. The ALLL covered nonperforming loans and leases held for investment 3.4X, flat compared to March 31, 2024. At June 30, 2024, the ALLL was 2.7X annualized net charge-offs, compared to 2.4X at March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Provision for Credit Losses |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 2Q24 | | 1Q24 | | | | | | 2Q23 | | | | | | Link | | Like | | |

| Provision for credit losses | $ | 451 | | | $ | 500 | | | | | | | $ | 538 | | | | | | | $ | (49) | | | (9.8) | % | | $ | (87) | | | (16.2) | % | | | | |

| Net charge-offs | 442 | | | 490 | | | | | | | 440 | | | | | | | (48) | | | (9.8) | | | 2 | | | 0.5 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net charge-offs as a percentage of average loans and leases | 0.58 | % | | 0.64 | % | | | | | | 0.54 | % | | | | | | (6) bps | | | | 4 bps | | | | | | |

Applicable ratios are annualized.

The provision for credit losses was $451 million compared to $500 million for the first quarter of 2024.

•The decrease in the current quarter provision expense primarily reflects stable credit performance and solid economic conditions.

•The net charge-off ratio for the current quarter was down compared to the first quarter of 2024 primarily driven by lower net charge-offs in the other consumer and indirect auto portfolios.

The provision for credit losses was $451 million compared to $538 million for the second quarter of 2023.

•The decrease in the current quarter provision expense primarily reflects a lower allowance build.

•The net charge-off ratio was up compared to the second quarter of 2023 primarily driven by higher net charge-offs in the CRE, other consumer, indirect auto, and credit card portfolios, partially offset by lower net charge-offs in the commercial and industrial portfolio. Additionally, the second quarter of 2023 included $98 million of charge-offs related to the sale of the student loan portfolio.

| | |

Earnings Presentation and Quarterly Performance Summary |

Investors can access the live second quarter 2024 earnings call at 8 a.m. ET today by webcast or dial-in as follows:

Webcast: app.webinar.net/zVb4RPwq23Q

Dial-in: 1-877-883-0383, passcode 0130732

Additional details: The news release and presentation materials will be available at ir.truist.com under “Events & Presentations.” A replay of the call will be available on the website for 30 days.

The presentation, including an appendix reconciling non-GAAP disclosures, and Truist’s Second Quarter 2024 Quarterly Performance Summary, which contains detailed financial schedules, are available at https://ir.truist.com/earnings.

Truist Financial Corporation is a purpose-driven financial services company committed to inspiring and building better lives and communities. As a leading U.S. commercial bank, Truist has leading market share in many of the high-growth markets across the country. Truist offers a wide range of products and services through our wholesale and consumer businesses, including consumer and small business banking, commercial banking, corporate and investment banking, wealth management, payments, and specialized lending businesses. Headquartered in Charlotte, North Carolina, Truist is a top-10 commercial bank with total assets of $520 billion as of June 30, 2024. Truist Bank, Member FDIC. Learn more at Truist.com.

#-#-#

| | | | | |

| Glossary of Defined Terms |

| Term | Definition |

ACL | Allowance for credit losses |

ALLL | Allowance for loan and lease losses |

| BVPS | Book value (common equity) per share |

| |

| CEO | Chief Executive Officer |

CET1 | Common equity tier 1 |

| CRE | Commercial real estate |

| |

| FDIC | Federal Deposit Insurance Corporation |

| FHLB | Federal Home Loan Bank |

| GAAP | Accounting principles generally accepted in the United States of America |

| HFI | Held for investment |

| LCR | Liquidity Coverage Ratio |

| Like | Compared to second quarter of 2023 |

| Link | Compared to first quarter of 2024 |

NCO | Net charge-offs |

| NIM | Net interest margin, computed on a TE basis |

| NM | Not meaningful |

| PPNR | Pre-provision net revenue |

| ROCE | Return on average common equity |

ROTCE | Return on average tangible common equity |

| |

| |

TBVPS | Tangible book value per common share |

| TE | Taxable-equivalent |

| TIH | Truist Insurance Holdings |

| | |

| Non-GAAP Financial Information |

This news release contains financial information and performance measures determined by methods other than in accordance with GAAP. Truist’s management uses these “non-GAAP” measures in their analysis of Truist’s performance and the efficiency of its operations. Management believes these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods and demonstrate the effects of significant items in the current period. The Corporation believes a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Below is a listing of the types of non-GAAP measures used in this news release:

•Adjusted net income available to common shareholders and adjusted diluted EPS - Adjusted net income available to common shareholders and diluted earnings per share are non-GAAP in that these measures exclude selected items, net of tax. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges.

•Adjusted efficiency ratio, adjusted fee income ratio, and related measures - The adjusted efficiency ratio is non-GAAP in that it excludes securities gains and losses, amortization of intangible assets, restructuring charges, and other selected items. Adjusted revenue and adjusted noninterest expense are related measures used to calculate the adjusted efficiency ratio. Additionally, the adjusted fee income ratio is non-GAAP in that it excludes securities gains and losses and other selected items, and is calculated using adjusted revenue and adjusted noninterest income. Adjusted revenue and adjusted noninterest income exclude securities gains and losses and other selected items. Adjusted noninterest expense excludes amortization of intangible assets, restructuring charges, and other selected items. Truist’s management calculated these measures based on the Company’s continuing operations. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges.

•PPNR - Pre-provision net revenue is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the provision for credit losses and provision for income taxes. Adjusted pre-provision net revenue is a non-GAAP measure that additionally excludes securities gains (losses), restructuring charges, amortization of intangible assets, and other selected items. Truist’s management calculated these measures based on the Company’s continuing operations. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods.

•Tangible Common Equity and Related Measures - Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization and impairment charges. These measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. Truist’s management uses these measures to assess profitability, returns relative to balance sheet risk, and shareholder value.

A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP measure is included in the appendix to Truist’s Second Quarter 2024 Earnings Presentation, which is available at https://ir.truist.com/earnings.

| | |

| Forward Looking Statements |

From time to time we have made, and in the future will make, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results.

This news release, including any information incorporated by reference herein, contains forward-looking statements. We also may make forward-looking statements in other documents that are filed or furnished with the SEC. In addition, we may make forward-looking statements orally or in writing to investors, analysts, members of the media, and others. All forward- looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, and results may differ materially from those set forth in any forward-looking statement. While no list of assumptions, risks, and uncertainties could be complete, some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements include:

•evolving political, business, economic, and market conditions at local, regional, national, and international levels;

•monetary, fiscal, and trade laws or policies, including as a result of actions by governmental agencies, central banks, or supranational authorities;

•the legal, regulatory, and supervisory environment, including changes in financial-services legislation, regulation, policies, or government officials or other personnel;

•our ability to address heightened scrutiny and expectations from supervisory or other governmental authorities and to timely and credibly remediate related concerns or deficiencies;

•judicial, regulatory, and administrative inquiries, examinations, investigations, proceedings, disputes, or rulings that create uncertainty for or are adverse to us or the financial-services industry;

•the outcomes of judicial, regulatory, and administrative inquiries, examinations, investigations, proceedings, or disputes to which we are or may be subject and our ability to absorb and address any damages or other remedies that are sought or awarded and any collateral consequences;

•evolving accounting standards and policies;

•the adequacy of our corporate governance, risk-management framework, compliance programs, and internal controls over financial reporting, including our ability to control lapses or deficiencies in financial reporting, to make appropriate estimates, or to effectively mitigate or manage operational risk;

•any instability or breakdown in the financial system, including as a result of the actual or perceived soundness of another financial institution or another participant in the financial system;

•disruptions and shifts in investor sentiment or behavior in the securities, capital, or other financial markets, including financial or systemic shocks and volatility or changes in market liquidity, interest or currency rates, or valuations;

•our ability to cost-effectively fund our businesses and operations, including by accessing long- and short-term funding and liquidity and by retaining and growing client deposits;

•changes in any of our credit ratings;

•our ability to manage any unexpected outflows of uninsured deposits and avoid selling investment securities or other assets at an unfavorable time or at a loss;

•negative market perceptions of our investment portfolio or its value;

•adverse publicity or other reputational harm to us, our service providers, or our senior officers;

•business and consumer sentiment, preferences, or behavior, including spending, borrowing, or saving by businesses or households;

•our ability to execute on strategic and operational plans, including simplifying our businesses, achieving cost-savings targets and lowering expense growth, accelerating franchise momentum, and improving our capital position;

•changes in our corporate and business strategies, the composition of our assets, or the way in which we fund those assets;

•our ability to successfully make and integrate acquisitions and to effect divestitures, including the ability to successfully deploy the proceeds from the sale of TIH and perform our obligations under the transition services arrangements supporting TIH in a cost-effective and efficient manner;

•our ability to develop, maintain, and market our products or services or to absorb unanticipated costs or liabilities associated with those products or services;

•our ability to innovate, to anticipate the needs of current or future clients, to successfully compete, to increase or hold market share in changing competitive environments, or to deal with pricing or other competitive pressures;

•our ability to maintain secure and functional financial, accounting, technology, data processing, or other operating systems or infrastructure, including those that safeguard personal and other sensitive information;

•our ability to appropriately underwrite loans that we originate or purchase and to otherwise manage credit risk, including in connection with commercial and consumer mortgage loans;

•our ability to satisfactorily and profitably perform loan servicing and similar obligations;

•the credit, liquidity, or other financial condition of our clients, counterparties, service providers, or competitors;

•our ability to effectively deal with economic, business, or market slowdowns or disruptions;

•the efficacy of our methods or models in assessing business strategies or opportunities or in valuing, measuring, estimating, monitoring, or managing positions or risk;

•our ability to keep pace with changes in technology that affect us or our clients, counterparties, service providers, or competitors or to maintain rights or interests in associated intellectual property;

•our ability to attract, hire, and retain key teammates and to engage in adequate succession planning;

•the performance and availability of third-party service providers on whom we rely in delivering products and services to our clients and otherwise in conducting our business and operations;

•our ability to detect, prevent, mitigate, and otherwise manage the risk of fraud or misconduct by internal or external parties; our ability to manage and mitigate physical-security and cybersecurity risks, including denial-of-service attacks, hacking, phishing, social-engineering attacks, malware intrusion, data-corruption attempts, system breaches, identity theft, ransomware attacks, environmental conditions, and intentional acts of destruction;

•natural or other disasters, calamities, and conflicts, including terrorist events, cyber-warfare, and pandemics;

•widespread outages of operational, communication, and other systems;

•our ability to maintain appropriate ESG practices, oversight, and disclosures;

•policies and other actions of governments to manage and mitigate climate and related environmental risks, and the effects of climate change or the transition to a lower-carbon economy on our business, operations, and reputation; and

•other assumptions, risks, or uncertainties described in the Risk Factors (Item 1A), Management’s Discussion and Analysis of Financial Condition and Results of Operations (Item 7), or the Notes to the Consolidated Financial Statements (Item 8) in our Annual Report on Form 10-K or described in any of the Company’s subsequent quarterly or current reports.

Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, or Current Report on Form 8-K.

Quarterly Performance Summary

Truist Financial Corporation

Second Quarter 2024

| | | | | | | | |

| Table of Contents | |

| Quarterly Performance Summary | |

| Truist Financial Corporation | |

| | |

| | | |

| | | |

| | | |

| | | Page |

| Financial Highlights | |

| |

| Consolidated Statements of Income | |

| |

| Consolidated Ending Balance Sheets | |

| |

| |

| Average Balances and Rates - Quarters | |

| Average Balances and Rates - Year-To-Date | |

| Credit Quality | |

| |

| Segment Financial Performance | |

| Capital Information | |

| Selected Mortgage Banking Information & Additional Information | |

| Selected Items | |

| |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Year-to-Date | | |

| (Dollars in millions, except per share data, shares in thousands) | June 30 | | March 31 | | Dec. 31 | | Sept. 30 | | June 30 | | June 30 | | June 30 | | |

| 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | 2024 | | 2023 | | |

| Summary Income Statement | | | | | | | | | | | | | | | |

| Interest income - taxable equivalent | $ | 6,404 | | | $ | 6,237 | | | $ | 6,324 | | | $ | 6,284 | | | $ | 6,229 | | | $ | 12,641 | | | $ | 12,064 | | | |

| Interest expense | 2,824 | | | 2,812 | | | 2,747 | | | 2,692 | | | 2,572 | | | 5,636 | | | 4,489 | | | |

| Net interest income - taxable equivalent | 3,580 | | | 3,425 | | | 3,577 | | | 3,592 | | | 3,657 | | | 7,005 | | | 7,575 | | | |

| Less: Taxable-equivalent adjustment | 53 | | | 53 | | | 58 | | | 57 | | | 54 | | | 106 | | | 105 | | | |

| Net interest income | 3,527 | | | 3,372 | | | 3,519 | | | 3,535 | | | 3,603 | | | 6,899 | | | 7,470 | | | |

| Provision for credit losses | 451 | | | 500 | | | 572 | | | 497 | | | 538 | | | 951 | | | 1,040 | | | |

| Net interest income after provision for credit losses | 3,076 | | | 2,872 | | | 2,947 | | | 3,038 | | | 3,065 | | | 5,948 | | | 6,430 | | | |

| Noninterest income | (5,212) | | | 1,446 | | | 1,363 | | | 1,334 | | | 1,380 | | | (3,766) | | | 2,801 | | | |

| Noninterest expense | 3,094 | | | 2,953 | | | 9,557 | | | 3,060 | | | 3,046 | | | 6,047 | | | 6,061 | | | |

| Income (loss) before income taxes | (5,230) | | | 1,365 | | | (5,247) | | | 1,312 | | | 1,399 | | | (3,865) | | | 3,170 | | | |

| Provision (benefit) for income taxes | (1,324) | | | 232 | | | (56) | | | 203 | | | 230 | | | (1,092) | | | 591 | | | |

Net income (loss) from continuing operations(1) | (3,906) | | | 1,133 | | | (5,191) | | | 1,109 | | | 1,169 | | | (2,773) | | | 2,579 | | | |

Net income (loss) from discontinued operations(1) | 4,828 | | | 67 | | | 101 | | | 74 | | | 176 | | | 4,895 | | | 281 | | | |

| Net income (loss) | 922 | | | 1,200 | | | (5,090) | | | 1,183 | | | 1,345 | | | 2,122 | | | 2,860 | | | |

| | | | | | | | | | | | | | | |

Noncontrolling interests from discontinued operations(1) | 19 | | | 3 | | | — | | | 6 | | | 36 | | | 22 | | | 38 | | | |

| | | | | | | | | | | | | | | |

| Preferred stock dividends and other | 77 | | | 106 | | | 77 | | | 106 | | | 75 | | | 183 | | | 178 | | | |

| Net income (loss) available to common shareholders | 826 | | | 1,091 | | | (5,167) | | | 1,071 | | | 1,234 | | | 1,917 | | | 2,644 | | | |

Net income available to common shareholders - adjusted(2) | 1,235 | | | 1,216 | | | 1,094 | | | 1,071 | | | 1,234 | | | 2,451 | | | 2,644 | | | |

| Additional Income Statement Information | | | | | | | | | | | | | | | |

| Revenue - taxable equivalent | (1,632) | | | 4,871 | | | 4,940 | | | 4,926 | | | 5,037 | | | 3,239 | | | 10,376 | | | |

Pre-provision net revenue - unadjusted(2) | (4,726) | | | 1,918 | | | (4,617) | | | 1,866 | | | 1,991 | | | (2,808) | | | 4,315 | | | |

Pre-provision net revenue - adjusted(2) | 2,209 | | | 2,132 | | | 2,221 | | | 2,025 | | | 2,142 | | | 4,341 | | | 4,622 | | | |

| Key Metrics | | | | | | | | | | | | | | | |

| Earnings: | | | | | | | | | | | | | | | |

Earnings per share-basic from continuing operations(1)(3) | $ | (2.98) | | | $ | 0.77 | | | $ | (3.95) | | | $ | 0.75 | | | $ | 0.82 | | | $ | (2.21) | | | $ | 1.80 | | | |

| | | | | | | | | | | | | | | |

| Earnings per share-basic | 0.62 | | | 0.82 | | | (3.87) | | | 0.80 | | | 0.93 | | | $ | 1.43 | | | $ | 1.99 | | | |

Earnings per share-diluted from continuing operations(1)(3) | (2.98) | | | 0.76 | | | (3.95) | | | 0.75 | | | 0.82 | | | (2.21) | | | 1.79 | | | |

| | | | | | | | | | | | | | | |

| Earnings per share-diluted | 0.62 | | | 0.81 | | | (3.87) | | | 0.80 | | | 0.92 | | | 1.43 | | | 1.98 | | | |

Earnings per share-adjusted diluted(2) | 0.91 | | | 0.90 | | | 0.81 | | | 0.80 | | | 0.92 | | | 1.82 | | | 1.98 | | | |

| Cash dividends declared per share | 0.52 | | | 0.52 | | | 0.52 | | | 0.52 | | | 0.52 | | | 1.04 | | | 1.04 | | | |

| Common shareholders’ equity per share | 42.71 | | | 38.97 | | | 39.31 | | | 41.37 | | | 42.68 | | | | | | | |

Tangible common shareholders’ equity per share(2) | 28.91 | | | 21.64 | | | 21.83 | | | 19.25 | | | 20.44 | | | | | | | |

| End of period shares outstanding | 1,338,223 | | | 1,338,096 | | | 1,333,743 | | | 1,333,668 | | | 1,331,976 | | | | | | | |

| Weighted average shares outstanding-basic | 1,338,149 | | | 1,335,091 | | | 1,333,703 | | | 1,333,522 | | | 1,331,953 | | | 1,336,620 | | | 1,330,286 | | | |

| Weighted average shares outstanding-diluted | 1,338,149 | | | 1,346,904 | | | 1,333,703 | | | 1,340,574 | | | 1,337,307 | | | 1,336,620 | | | 1,338,346 | | | |

| Return on average assets | 0.70 | % | | 0.91 | % | | (3.74) | % | | 0.86 | % | | 0.95 | % | | 0.81 | % | | 1.02 | % | | |

| Return on average common shareholders’ equity | 6.1 | | | 8.4 | | | (36.6) | | | 7.5 | | | 8.6 | | | 7.2 | | | 9.5 | | | |

Return on average tangible common shareholders’ equity(2) | 10.4 | | | 16.3 | | | 15.0 | | | 17.3 | | | 19.4 | | | 12.5 | | | 21.6 | | | |

Net interest margin - taxable equivalent(3) | 3.03 | | | 2.89 | | | 2.96 | | | 2.93 | | | 2.90 | | | 2.96 | | | 3.03 | | | |

Efficiency ratio-GAAP(3) | NM | | 61.3 | | | 195.8 | | | 62.9 | | | 61.1 | | | NM | | 59.0 | | | |

Efficiency ratio-adjusted(2)(3) | 56.0 | | | 56.2 | | | 55.0 | | | 58.9 | | | 57.5 | | | 56.1 | | | 55.4 | | | |

Fee income ratio-GAAP(3) | NM | | 30.0 | | | 27.9 | | | 27.4 | | | 27.7 | | | NM | | 27.3 | | | |

Fee income ratio-adjusted(2)(3) | 28.7 | | | 29.7 | | | 27.6 | | | 27.1 | | | 27.4 | | | 29.2 | | | 27.0 | | | |

| Credit Quality | | | | | | | | | | | | | | | |

| Nonperforming loans and leases as a percentage of LHFI | 0.46 | % | | 0.45 | % | | 0.44 | % | | 0.46 | % | | 0.47 | % | | 0.28 | % | | 0.29 | % | | |

| Net charge-offs as a percentage of average LHFI | 0.58 | | | 0.64 | | | 0.57 | | | 0.51 | | | 0.54 | | | 0.61 | % | | 0.46 | % | | |

| Allowance for loan and lease losses as a percentage of LHFI | 1.57 | | | 1.56 | | | 1.54 | | | 1.49 | | | 1.43 | | | | | | | |

| Ratio of allowance for loan and lease losses to nonperforming LHFI | 3.4x | | 3.4x | | 3.5x | | 3.2x | | 3.0x | | | | | | |

| Average Balances | | | | | | | | | | | | | | | |

| Assets | $ | 526,894 | | | $ | 531,002 | | | $ | 539,656 | | | $ | 547,704 | | | $ | 565,822 | | | $ | 528,948 | | | $ | 562,741 | | | |

Securities(4) | 121,318 | | | 131,273 | | | 133,390 | | | 135,527 | | | 138,393 | | | 126,295 | | | 139,466 | | | |

| Loans and leases | 307,583 | | | 309,426 | | | 313,832 | | | 319,881 | | | 328,258 | | | 308,505 | | | 327,905 | | | |

| Deposits | 388,042 | | | 389,058 | | | 395,333 | | | 401,038 | | | 399,826 | | | 388,550 | | | 404,118 | | | |

| Common shareholders’ equity | 54,863 | | | 52,167 | | | 56,061 | | | 56,472 | | | 57,302 | | | 53,515 | | | 56,346 | | | |

| Total shareholders’ equity | 61,677 | | | 59,011 | | | 62,896 | | | 63,312 | | | 64,101 | | | 60,344 | | | 63,095 | | | |

| Period-End Balances | | | | | | | | | | | | | | | |

| Assets | $ | 519,853 | | | $ | 534,959 | | | $ | 535,349 | | | $ | 542,707 | | | $ | 554,549 | | | | | | | |

Securities(4) | 108,416 | | | 119,419 | | | 121,473 | | | 120,059 | | | 124,923 | | | | | | | |

| Loans and leases | 307,149 | | | 308,477 | | | 313,341 | | | 317,112 | | | 324,015 | | | | | | | |

| Deposits | 385,411 | | | 394,265 | | | 395,865 | | | 400,024 | | | 406,043 | | | | | | | |

| Common shareholders’ equity | 57,154 | | | 52,148 | | | 52,428 | | | 55,167 | | | 56,853 | | | | | | | |

| Total shareholders’ equity | 63,827 | | | 59,053 | | | 59,253 | | | 62,007 | | | 63,681 | | | | | | | |

| Capital and Liquidity Ratios | (preliminary) | | | | | | | | | | | | | | |

| Common equity tier 1 | 11.6 | % | | 10.1 | % | | 10.1 | % | | 9.9 | % | | 9.6 | % | | | | | | |

| Tier 1 | 13.2 | | | 11.7 | | | 11.6 | | | 11.4 | | | 11.1 | | | | | | | |

| Total | 15.4 | | | 13.9 | | | 13.7 | | | 13.5 | | | 13.2 | | | | | | | |

| Leverage | 10.5 | | | 9.5 | | | 9.3 | | | 9.2 | | | 8.8 | | | | | | | |

| Supplementary leverage | 8.9 | | | 8.0 | | | 7.9 | | | 7.8 | | | 7.5 | | | | | | | |

| Liquidity coverage ratio | 110 | | | 115 | | | 112 | | | 110 | | | 112 | | | | | | | |

| | | | | | | | | | | | | | | |

| | |

|

| | |

| | |

| | | | | | |

Applicable ratios are annualized.

(1)On February 20, 2024, the Company entered into an agreement to sell the remaining 80% stake of the common equity in TIH to an investor group, representing substantially all of the Company’s IH segment. The sale represents a material strategic shift for the Company and as a result, the Company recast results for all periods presented under the discontinued operations basis of presentation. On May 6, 2024, the Company completed the sale resulting in an after-tax gain of $4.8 billion.

(2)Represents a non-GAAP measure. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are included in the appendix to Truist’s Second Quarter 2024 Earnings Presentation.

(3)This metric is calculated based on continuing operations.

(4)Includes AFS and HTM securities. Average balances reflect AFS and HTM securities at amortized cost. Period-end balances reflect AFS securities at fair value and HTM securities at amortized cost.

Consolidated Statements of Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Year-to-Date |

| June 30 | | March 31 | | Dec. 31 | | Sept. 30 | | June 30 | | June 30 | | June 30 |

| (Dollars in millions, except per share data, shares in thousands) | 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | 2024 | | 2023 |

| Interest Income | | | | | | | | | | | | | |

| Interest and fees on loans and leases | $ | 4,879 | | | $ | 4,865 | | | $ | 4,971 | | | $ | 4,976 | | | $ | 4,915 | | | $ | 9,744 | | | $ | 9,571 | |

| Interest on securities | 838 | | | 805 | | | 802 | | | 763 | | | 749 | | | 1,643 | | | 1,501 | |

| Interest on other earning assets | 634 | | | 514 | | | 493 | | | 488 | | | 511 | | | 1,148 | | | 887 | |

| Total interest income | 6,351 | | | 6,184 | | | 6,266 | | | 6,227 | | | 6,175 | | | 12,535 | | | 11,959 | |

| Interest Expense | | | | | | | | | | | | | |

| Interest on deposits | 2,016 | | | 1,964 | | | 1,917 | | | 1,858 | | | 1,527 | | | 3,980 | | | 2,652 | |

| Interest on long-term debt | 446 | | | 482 | | | 476 | | | 491 | | | 734 | | | 928 | | | 1,248 | |

| Interest on other borrowings | 362 | | | 366 | | | 354 | | | 343 | | | 311 | | | 728 | | | 589 | |

| Total interest expense | 2,824 | | | 2,812 | | | 2,747 | | | 2,692 | | | 2,572 | | | 5,636 | | | 4,489 | |

| Net Interest Income | 3,527 | | | 3,372 | | | 3,519 | | | 3,535 | | | 3,603 | | | 6,899 | | | 7,470 | |

| Provision for credit losses | 451 | | | 500 | | | 572 | | | 497 | | | 538 | | | 951 | | | 1,040 | |

| Net Interest Income After Provision for Credit Losses | 3,076 | | | 2,872 | | | 2,947 | | | 3,038 | | | 3,065 | | | 5,948 | | | 6,430 | |

| Noninterest Income | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Wealth management income | 361 | | | 356 | | | 346 | | | 343 | | | 330 | | | 717 | | | 669 | |

| Investment banking and trading income | 286 | | | 323 | | | 165 | | | 185 | | | 211 | | | 609 | | | 472 | |

| Service charges on deposits | 232 | | | 225 | | | 229 | | | 154 | | | 240 | | | 457 | | | 490 | |

| Card and payment related fees | 230 | | | 224 | | | 232 | | | 238 | | | 236 | | | 454 | | | 466 | |

| Mortgage banking income | 112 | | | 97 | | | 94 | | | 102 | | | 99 | | | 209 | | | 241 | |

| Lending related fees | 89 | | | 96 | | | 153 | | | 102 | | | 86 | | | 185 | | | 192 | |

| Operating lease income | 50 | | | 59 | | | 60 | | | 63 | | | 64 | | | 109 | | | 131 | |

| Securities gains (losses) | (6,650) | | | — | | | — | | | — | | | — | | | (6,650) | | | — | |

| Other income | 78 | | | 66 | | | 84 | | | 147 | | | 114 | | | 144 | | | 140 | |

| Total noninterest income | (5,212) | | | 1,446 | | | 1,363 | | | 1,334 | | | 1,380 | | | (3,766) | | | 2,801 | |

| Noninterest Expense | | | | | | | | | | | | | |

| Personnel expense | 1,661 | | | 1,630 | | | 1,474 | | | 1,669 | | | 1,705 | | | 3,291 | | | 3,373 | |

| Professional fees and outside processing | 308 | | | 278 | | | 305 | | | 289 | | | 311 | | | 586 | | | 598 | |

| Software expense | 218 | | | 224 | | | 223 | | | 222 | | | 223 | | | 442 | | | 423 | |

| Net occupancy expense | 160 | | | 160 | | | 159 | | | 164 | | | 166 | | | 320 | | | 335 | |

| Amortization of intangibles | 89 | | | 88 | | | 98 | | | 98 | | | 99 | | | 177 | | | 199 | |

| Equipment expense | 89 | | | 88 | | | 103 | | | 89 | | | 87 | | | 177 | | | 189 | |

| Marketing and customer development | 63 | | | 56 | | | 53 | | | 70 | | | 69 | | | 119 | | | 137 | |

| Operating lease depreciation | 34 | | | 40 | | | 42 | | | 43 | | | 44 | | | 74 | | | 90 | |

| Regulatory costs | 85 | | | 152 | | | 599 | | | 77 | | | 73 | | | 237 | | | 148 | |

| Restructuring charges | 33 | | | 51 | | | 155 | | | 61 | | | 48 | | | 84 | | | 104 | |

| Goodwill impairment | — | | | — | | | 6,078 | | | — | | | — | | | — | | | — | |

| Other expense | 354 | | | 186 | | | 268 | | | 278 | | | 221 | | | 540 | | | 465 | |

| Total noninterest expense | 3,094 | | | 2,953 | | | 9,557 | | | 3,060 | | | 3,046 | | | 6,047 | | | 6,061 | |

| Earnings | | | | | | | | | | | | | |

| Income (loss) before income taxes | (5,230) | | | 1,365 | | | (5,247) | | | 1,312 | | | 1,399 | | | (3,865) | | | 3,170 | |

| Provision (benefit) for income taxes | (1,324) | | | 232 | | | (56) | | | 203 | | | 230 | | | (1,092) | | | 591 | |

Net income (loss) from continuing operations(1) | (3,906) | | | 1,133 | | | (5,191) | | | 1,109 | | | 1,169 | | | (2,773) | | | 2,579 | |

Net income from discontinued operations(1) | 4,828 | | | 67 | | | 101 | | | 74 | | | 176 | | | 4,895 | | | 281 | |

| Net income (loss) | 922 | | | 1,200 | | | (5,090) | | | 1,183 | | | 1,345 | | | 2,122 | | | 2,860 | |

| | | | | | | | | | | | | |

Noncontrolling interests from discontinuing operations(1) | 19 | | | 3 | | | — | | | 6 | | | 36 | | | 22 | | | 38 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Preferred stock dividends and other | 77 | | | 106 | | | 77 | | | 106 | | | 75 | | | 183 | | | 178 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income (loss) available to common shareholders | $ | 826 | | | $ | 1,091 | | | $ | (5,167) | | | $ | 1,071 | | | $ | 1,234 | | | $ | 1,917 | | | $ | 2,644 | |

| | | | | | | | | | | | | |

| Earnings Per Common Share | | | | | | | | | | | | | |

Basic earnings from continuing operations(1) | $ | (2.98) | | | $ | 0.77 | | | $ | (3.95) | | | $ | 0.75 | | | $ | 0.82 | | | $ | (2.21) | | | $ | 1.80 | |

| | | | | | | | | | | | | |

| Basic earnings | 0.62 | | | 0.82 | | | (3.87) | | | 0.80 | | | 0.93 | | | $ | 1.43 | | | 1.99 | |

Diluted earnings from continuing operations(1) | (2.98) | | | 0.76 | | | (3.95) | | | 0.75 | | | 0.82 | | | (2.21) | | | 1.79 | |

| | | | | | | | | | | | | |

| Diluted earnings | 0.62 | | | 0.81 | | | (3.87) | | | 0.80 | | | 0.92 | | | 1.43 | | | 1.98 | |

| Weighted Average Shares Outstanding | | | | | | | | | | | | | |

| Basic | 1,338,149 | | | 1,335,091 | | | 1,333,703 | | | 1,333,522 | | | 1,331,953 | | | 1,336,620 | | | 1,330,286 | |

| Diluted | 1,338,149 | | | 1,346,904 | | | 1,333,703 | | | 1,340,574 | | | 1,337,307 | | | 1,336,620 | | | 1,338,346 | |

| | | | | | | | | | | | | |

|

(1)On February 20, 2024, the Company entered into an agreement to sell the remaining 80% stake of the common equity in TIH to an investor group, representing substantially all of the Company’s IH segment. The sale represents a material strategic shift for the Company and as a result, the Company recast results for all periods presented under the discontinued operations basis of presentation. On May 6, 2024, the Company completed the sale resulting in an after-tax gain of $4.8 billion.

Consolidated Ending Balance Sheets - Five Quarter Trend

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30 | | March 31 | | Dec. 31 | | Sept. 30 | | June 30 | |

| (Dollars in millions) | 2024 | | 2024 | | 2023 | | 2023 | | 2023 | |

| Assets | | | | | | | | | | |

| Cash and due from banks | $ | 5,204 | | | $ | 5,040 | | | $ | 5,000 | | | $ | 5,090 | | | $ | 4,733 | | |

| Interest-bearing deposits with banks | 35,675 | | | 29,510 | | | 25,230 | | | 24,305 | | | 24,934 | | |

| Securities borrowed or purchased under resale agreements | 2,338 | | | 2,091 | | | 2,378 | | | 2,018 | | | 2,315 | | |

| Trading assets at fair value | 5,558 | | | 5,268 | | | 4,332 | | | 4,384 | | | 4,097 | | |

| Securities available for sale at fair value | 55,969 | | | 66,050 | | | 67,366 | | | 65,117 | | | 68,965 | | |

| Securities held to maturity at amortized cost | 52,447 | | | 53,369 | | | 54,107 | | | 54,942 | | | 55,958 | | |

| Loans and leases: | | | | | | | | | | |

| Commercial: | | | | | | | | | | |

| Commercial and industrial | 156,400 | | | 157,669 | | | 160,788 | | | 162,330 | | | 167,153 | | |

| CRE | 21,730 | | | 22,142 | | | 22,570 | | | 22,736 | | | 22,825 | | |

| Commercial construction | 7,787 | | | 7,472 | | | 6,683 | | | 6,343 | | | 5,943 | | |

| | | | | | | | | | |

| Consumer: | | | | | | | | | | |

| Residential mortgage | 54,344 | | | 54,886 | | | 55,492 | | | 56,013 | | | 56,476 | | |

| Home equity | 9,772 | | | 9,825 | | | 10,053 | | | 10,160 | | | 10,348 | | |

| Indirect auto | 21,994 | | | 22,145 | | | 22,727 | | | 24,084 | | | 25,759 | | |

| Other consumer | 28,677 | | | 28,096 | | | 28,647 | | | 29,105 | | | 28,755 | | |

| | | | | | | | | | |

| Credit card | 4,988 | | | 4,989 | | | 5,101 | | | 4,928 | | | 4,833 | | |

| | | | | | | | | | |

| Total loans and leases held for investment | 305,692 | | | 307,224 | | | 312,061 | | | 315,699 | | | 322,092 | | |

| Loans held for sale | 1,457 | | | 1,253 | | | 1,280 | | | 1,413 | | | 1,923 | | |

| Total loans and leases | 307,149 | | | 308,477 | | | 313,341 | | | 317,112 | | | 324,015 | | |

| Allowance for loan and lease losses | (4,808) | | | (4,803) | | | (4,798) | | | (4,693) | | | (4,606) | | |

| Premises and equipment | 3,244 | | | 3,274 | | | 3,298 | | | 3,319 | | | 3,379 | | |

| Goodwill | 17,157 | | | 17,157 | | | 17,156 | | | 23,234 | | | 23,235 | | |

| Core deposit and other intangible assets | 1,729 | | | 1,816 | | | 1,909 | | | 2,011 | | | 2,111 | | |

| Loan servicing rights at fair value | 3,410 | | | 3,417 | | | 3,378 | | | 3,537 | | | 3,497 | | |

| Other assets | 34,781 | | | 36,521 | | | 34,997 | | | 34,858 | | | 33,864 | | |

Assets of discontinued operations(1) | — | | | 7,772 | | | 7,655 | | | 7,473 | | | 8,052 | | |

| Total assets | $ | 519,853 | | | $ | 534,959 | | | $ | 535,349 | | | $ | 542,707 | | | $ | 554,549 | | |

| Liabilities | | | | | | | | | | |

| Deposits: | | | | | | | | | | |

| Noninterest-bearing deposits | $ | 107,310 | | | $ | 110,901 | | | $ | 111,624 | | | $ | 116,674 | | | $ | 121,831 | | |

| Interest checking | 102,654 | | | 108,329 | | | 104,757 | | | 103,288 | | | 106,471 | | |

| Money market and savings | 136,989 | | | 133,176 | | | 135,923 | | | 137,914 | | | 135,514 | | |

| Time deposits | 38,458 | | | 41,859 | | | 43,561 | | | 42,148 | | | 42,227 | | |

| | | | | | | | | | |

| Total deposits | 385,411 | | | 394,265 | | | 395,865 | | | 400,024 | | | 406,043 | | |

| Short-term borrowings | 22,816 | | | 26,329 | | | 24,828 | | | 23,485 | | | 24,456 | | |

| Long-term debt | 34,616 | | | 39,071 | | | 38,918 | | | 41,232 | | | 44,749 | | |

| Other liabilities | 13,183 | | | 13,119 | | | 12,946 | | | 12,962 | | | 11,788 | | |

| Liabilities of discontinued operations | — | | | 3,122 | | | 3,539 | | | 2,997 | | | 3,832 | | |

| Total liabilities | 456,026 | | | 475,906 | | | 476,096 | | | 480,700 | | | 490,868 | | |

| Shareholders’ Equity: | | | | | | | | | | |

| Preferred stock | 6,673 | | | 6,673 | | | 6,673 | | | 6,673 | | | 6,673 | | |

| Common stock | 6,691 | | | 6,690 | | | 6,669 | | | 6,668 | | | 6,660 | | |

| Additional paid-in capital | 36,364 | | | 36,197 | | | 36,177 | | | 36,114 | | | 35,990 | | |

| Retained earnings | 22,603 | | | 22,483 | | | 22,088 | | | 27,944 | | | 27,577 | | |

| Accumulated other comprehensive loss | (8,504) | | | (13,222) | | | (12,506) | | | (15,559) | | | (13,374) | | |

| Noncontrolling interests | — | | | 232 | | | 152 | | | 167 | | | 155 | | |

| Total shareholders’ equity | 63,827 | | | 59,053 | | | 59,253 | | | 62,007 | | | 63,681 | | |

| Total liabilities and shareholders’ equity | $ | 519,853 | | | $ | 534,959 | | | $ | 535,349 | | | $ | 542,707 | | | $ | 554,549 | | |

| |

(1)Includes goodwill and intangible assets of $5.0 billion as of March 31, 2024, $5.0 billion as of December 31, 2023, $5.0 billion as of September 30, 2023, and $5.1 billion as of June 30, 2023.

Average Balances and Rates - Quarters | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 |

| (Dollars in millions) | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) | | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) | | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) | | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) | | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) |

| Assets | | | | | | | | | | | | | | | | | | | |

| AFS and HTM securities at amortized cost: | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury | $ | 11,145 | | $ | 101 | | 3.66 | % | | $ | 9,853 | | $ | 37 | | 1.49 | % | | $ | 10,967 | | $ | 38 | | 1.37 | % | | $ | 10,886 | | $ | 34 | | 1.27 | % | | $ | 11,115 | | $ | 30 | | 1.10 | % |

| U.S. government-sponsored entities (GSE) | 382 | | 3 | | 3.27 | | | 389 | | 3 | | 3.40 | | | 389 | | 2 | | 3.23 | | | 339 | | 3 | | 2.92 | | | 329 | | 3 | | 2.70 | |

| Mortgage-backed securities issued by GSE | 107,901 | | 720 | | 2.67 | | | 116,946 | | 735 | | 2.51 | | | 117,868 | | 736 | | 2.50 | | | 120,078 | | 701 | | 2.33 | | | 122,647 | | 690 | | 2.25 | |

| States and political subdivisions | 420 | | 5 | | 4.14 | | | 421 | | 4 | | 4.15 | | | 421 | | 5 | | 4.16 | | | 423 | | 4 | | 4.12 | | | 425 | | 5 | | 4.18 | |

| Non-agency mortgage-backed | 1,452 | | 10 | | 2.61 | | | 3,645 | | 27 | | 2.98 | | | 3,725 | | 22 | | 2.37 | | | 3,781 | | 22 | | 2.33 | | | 3,852 | | 22 | | 2.32 | |

| Other | 18 | | — | | 5.29 | | | 19 | | — | | 5.35 | | | 20 | | — | | 5.47 | | | 20 | | 1 | | 5.55 | | | 25 | | — | | 5.20 | |

| Total securities | 121,318 | | 839 | | 2.77 | | | 131,273 | | 806 | | 2.46 | | | 133,390 | | 803 | | 2.41 | | | 135,527 | | 765 | | 2.26 | | | 138,393 | | 750 | | 2.17 | |

| Loans and leases: | | | | | | | | | | | | | | | | | | | |

| Commercial: | | | | | | | | | | | | | | | | | | | |

| Commercial and industrial | 157,043 | | 2,550 | | 6.53 | | | 158,385 | | 2,572 | | 6.53 | | | 160,278 | | 2,657 | | 6.58 | | | 164,022 | | 2,686 | | 6.50 | | | 166,588 | | 2,610 | | 6.28 | |

| CRE | 21,969 | | 381 | | 6.93 | | | 22,400 | | 389 | | 6.95 | | | 22,755 | | 400 | | 6.94 | | | 22,812 | | 396 | | 6.85 | | | 22,706 | | 384 | | 6.73 | |

| Commercial construction | 7,645 | | 147 | | 7.85 | | | 7,134 | | 137 | | 7.83 | | | 6,515 | | 127 | | 7.84 | | | 6,194 | | 120 | | 7.83 | | | 5,921 | | 111 | | 7.64 | |

| | | | | | | | | | | | | | | | | | | |

| Consumer: | | | | | | | | | | | | | | | | | | | |

| Residential mortgage | 54,490 | | 525 | | 3.86 | | | 55,070 | | 528 | | 3.84 | | | 55,658 | | 532 | | 3.83 | | | 56,135 | | 532 | | 3.79 | | | 56,320 | | 531 | | 3.77 | |

| Home equity | 9,805 | | 195 | | 8.02 | | | 9,930 | | 196 | | 7.92 | | | 10,104 | | 199 | | 7.80 | | | 10,243 | | 196 | | 7.61 | | | 10,478 | | 190 | | 7.26 | |

| Indirect auto | 22,016 | | 381 | | 6.95 | | | 22,374 | | 372 | | 6.69 | | | 23,368 | | 381 | | 6.46 | | | 24,872 | | 386 | | 6.16 | | | 26,558 | | 398 | | 6.01 | |

| Other consumer | 28,326 | | 581 | | 8.25 | | | 28,285 | | 561 | | 7.98 | | | 28,913 | | 561 | | 7.69 | | | 28,963 | | 542 | | 7.43 | | | 28,189 | | 499 | | 7.10 | |

| Student | — | | — | | — | | | — | | — | | — | | | — | | — | | — | | | — | | 1 | | — | | | 4,766 | | 80 | | 6.76 | |

| Credit card | 4,905 | | 148 | | 12.14 | | | 4,923 | | 146 | | 11.96 | | | 4,996 | | 149 | | 11.84 | | | 4,875 | | 143 | | 11.62 | | | 4,846 | | 137 | | 11.48 | |

| | | | | | | | | | | | | | | | | | | |

| Total loans and leases held for investment | 306,199 | | 4,908 | | 6.44 | | | 308,501 | | 4,901 | | 6.38 | | | 312,587 | | 5,006 | | 6.36 | | | 318,116 | | 5,002 | | 6.25 | | | 326,372 | | 4,940 | | 6.07 | |

| Loans held for sale | 1,384 | | 22 | | 6.56 | | | 925 | | 15 | | 6.38 | | | 1,245 | | 21 | | 6.82 | | | 1,765 | | 28 | | 6.20 | | | 1,886 | | 28 | | 5.94 | |

| Total loans and leases | 307,583 | | 4,930 | | 6.44 | | | 309,426 | | 4,916 | | 6.38 | | | 313,832 | | 5,027 | | 6.36 | | | 319,881 | | 5,030 | | 6.25 | | | 328,258 | | 4,968 | | 6.07 | |

| | | | | | | | | | | | | | | | | | | |

| Interest earning trading assets | 5,515 | | 84 | | 6.11 | | | 4,845 | | 79 | | 6.50 | | | 4,680 | | 80 | | 6.92 | | | 4,380 | | 76 | | 6.91 | | | 4,445 | | 75 | | 6.73 | |