Teleflex Incorporated (NYSE:TFX), a leading global provider of

medical technologies, today announced it has entered into a

definitive agreement to acquire substantially all of the Vascular

Intervention business of BIOTRONIK SE & Co. KG for an estimated

cash payment on closing of approximately €760 million, less certain

adjustments as provided in the purchase agreement including certain

working capital not transferring and other customary adjustments.

The acquisition is subject to customary closing conditions,

including receipt of certain regulatory approvals, and is expected

to be completed by the end of the third quarter of 2025.

The acquisition reflects Teleflex’s commitment to investing in

the estimated $10 billion interventional cardiology and peripheral

vascular market served by the Company’s portfolio post close.1,2

The acquired business will expand the Teleflex Interventional

portfolio to include a broad suite of vascular intervention devices

such as drug-coated balloons, drug-eluting stents, covered stents,

balloon and self-expanding bare metal stents, and balloon

catheters. In 2023, approximately 75% of the acquired revenues were

generated by coronary interventions while the remaining

approximately 25% were associated with peripheral interventional

procedures.3

“We are excited to announce the acquisition of BIOTRONIK’s

Vascular Intervention business, which we anticipate will

significantly enhance our global presence in the cath lab, expand

our suite of innovative technologies, and improve patient care”

said Liam Kelly, Chairman, President and Chief Executive Officer of

Teleflex. “We believe the acquisition will allow us to position

this advanced coronary portfolio alongside our existing

Interventional business and establish our global footprint in the

fast-growing peripheral intervention market. In particular, the

acquired coronary products will be highly complementary to our

well-established complex percutaneous coronary intervention (PCI)

platform and expand and enhance the legacy Interventional

salesforce and offerings by combining existing Teleflex access

products with the Vascular Intervention therapeutic devices. The

acquired business is rooted in robust research and development,

clinical expertise, and global manufacturing capabilities, which we

believe will further bolster Teleflex’s innovation pipeline, and

position the company to participate in the emerging potential for

resorbable scaffold technologies. We believe the acquired business

will be a meaningful contributor to our growth in the coming years,

diversify our geographic revenue mix with 50% of the acquired

revenues generated in EMEA3, and provide additional scale for

investment into innovation.”

The acquired Vascular Intervention business consists of a

comprehensive and differentiated portfolio for coronary and

peripheral interventions performed in the cath lab and

interventional radiology suites. In coronary vascular

interventions, key products include the Pantera™ Lux™ Drug-Coated

Balloon Catheter, the novel PK Papyrus™ Covered Coronary Stent for

acute coronary artery perforations, and the Orsiro™ Mission Drug

Eluting Stent, an ultrathin drug-eluting stent with differentiated

clinical features. For peripheral interventions, the portfolio

includes the Passeo™-18 Lux™ Peripheral Drug-Coated Balloon

Catheter, Dynetic™-35 Balloon-Expandable Cobalt Chromium Stent, and

the Pulsar™-18 T3 Self-Expanding 4F Stent.

The acquisition of the Vascular Intervention business will also

allow Teleflex the opportunity to invest in and expand the clinical

trial program for BIOTRONIK’s Freesolve™, a sirolimus-eluting

Resorbable Metallic Scaffold (RMS) technology, including possible

pursuit of the U.S. market. Freesolve™, which received its CE Mark

in February 2024, is indicated in CE-mark accepting countries for

de novo coronary artery lesions. The combination of temporary

scaffolding with drug delivery is anticipated to address the

current trend in interventional coronary and endovascular

procedures toward leaving behind less permanent hardware. As

demonstrated in the BIOMAG-I study, Freesolve™ RMS demonstrated

resorption after 12 months, a target lesion failure rate comparable

to contemporary drug-eluting stents, and no definite or probable

scaffold thrombosis.4,5 The European pivotal BIOMAG-II study is now

enrolling.

Teleflex’s established peer-to-peer education, patient outreach,

and clinical platform for its existing Interventional business will

be further leveraged by the acquired portfolio of coronary vascular

and peripheral vascular intervention devices.

As the interventional cardiology and peripheral intervention

markets grow on a global basis, Teleflex anticipates that this

acquisition will enhance its offerings to cardiac and peripheral

care specialists, while significantly advancing its corporate

growth objectives.

Vascular Intervention Acquisition Financial

OutlookThe acquired BIOTRONIK products delivered a

constant currency revenue CAGR of 5.4% from 2022 to 2024. The

acquired products are expected to generate approximately €91

million in revenues in the fourth quarter of 2025. Beginning in

2026, the BIOTRONIK acquisition is expected to deliver constant

currency revenue growth of 6% or better.

Excluding non-recurring purchase accounting items and other

acquisition and integration related costs, the transaction is

expected to be approximately $0.10 accretive to the Company’s

adjusted earnings per share in the first year of ownership from the

date of close, and to be increasingly accretive, thereafter.

Teleflex plans to initially finance the acquisition through a

new term loan and revolving borrowings under its existing senior

credit facility and cash on hand.

Additionally, the Company entered into foreign exchange

derivative contracts to economically hedge against the foreign

currency exposure associated with the cash consideration needed to

complete the acquisition.

Company To Host Conference Call The Company

will host a conference call to discuss its fourth quarter financial

results and provide an operational update inclusive of the

transaction at 8:00 a.m. ET on Thursday, February 27, 2025. To

participate in the conference call, please utilize this link to

pre-register and receive the dial-in information. The call can also

be accessed through a live audio webcast on the company’s website,

teleflex.com.

An audio replay of the call will be available beginning at 11:00

am Eastern Time on February 27, 2025, either on the Teleflex

website or by telephone. The call can be accessed by dialing 1 800

770 2030 (U.S. and Canada) or 1 609 800 9909 (all other locations).

The conference ID is 69028.

About Teleflex IncorporatedAs a global provider

of medical technologies, Teleflex is driven by our purpose to

improve the health and quality of people’s lives. Through our

vision to become the most trusted partner in healthcare, we offer a

diverse portfolio with solutions in the therapy areas of

anesthesia, emergency medicine, interventional cardiology and

radiology, surgical, vascular access, and urology. We believe that

the potential of great people, purpose driven innovation, and

world-class products can shape the future direction of

healthcare.

Teleflex is the home of Arrow™, Barrigel™, Deknatel™, LMA™,

Pilling™, QuikClot™, Rüsch™, UroLift™ and Weck™ – trusted brands

united by a common sense of purpose.

At Teleflex, we are empowering the future of healthcare. For

more information, please visit teleflex.com.

Not all products may be available in all countries. The

above-referenced drug-coated devices are not available in the

United States and Japan.

References:

- iData Research. (2023). Global Market Report Suite for

Peripheral Vascular Devices: With Impact of

COVID-19 (iDATA_GLPV24_MS).

- iData Research. (2023). Global Market Report Suite for

Interventional Cardiology Devices: With Impact of

COVID-19 (iDATA_GLIC23_MS).

- Based on BIOTRONIK 2023 actual net revenue at constant

currency.

- Seguchi M, Aytekin A, Xhepa E, Haude M, Wlodarczak A, van der

Schaaf RJ, Torzewski J, Ferdinande B, Escaned J, Iglesias JF,

Bennett J, Toth GG, Toelg R, Wiemer M, Olivecrona G, Vermeersch P,

Waksman R, Garcia-Garcia HM, Joner M. Vascular response following

implantation of the third-generation drug-eluting resorbable

coronary magnesium scaffold: an intravascular imaging analysis of

the BIOMAG-I first-in-human study. EuroIntervention. 2024 Sep

16;20(18):e1173-e1183. doi: 10.4244/EIJ-D-24-00055. PMID: 39279514;

PMCID: PMC11384225. The study was sponsored by BIOTRONIK. M.

Seguchi, M. Haude, J.F. Iglesias, J. Bennett, G.G. Toth, M. Wiemer,

G. Olivecrona, R. Waksman, H.M. Garcia-Garcia, and M. Joner are

paid consultants of BIOTRONIK.

- Haude M, Wlodarczak A, van der Schaaf RJ, Torzewski J,

Ferdinande B, Escaned J, Iglesias JF, Bennett J, Toth GG, Joner M,

Toelg R, Wiemer M, Olivecrano G, Vermeersch P, Garcia-Garcia HM,

Waksman R. A new resorbable magnesium scaffold for de novo coronary

lesions (DREAMS 3): one-year results of the BIOMAG-I first-in-human

study. EuroIntervention. 2023 Aug 7;19(5):e414-e422. doi:

10.4244/EIJ-D-23-00326. PMID: 37334655; PMCID: PMC10397670.

Forward-Looking StatementsThis press release

contains forward-looking statements, including, but not limited to,

statements about our proposed acquisition of the Vascular

Intervention business, our and the Vascular Intervention business’s

commercialized and pipeline products, and the Vascular Intervention

business’s technology platform, including, in each case, their

potential benefits, anticipated revenue contribution, anticipated

financing, anticipated accretion and the anticipated timing of

completion of the proposed acquisition. Actual results could differ

materially from those in the forward-looking statements due to,

among other things, the possibility that the acquisition does not

close; unanticipated costs and length of time required to comply

with legal requirements and regulatory approvals applicable to the

transaction; unanticipated difficulties and expenditures in

connection with integration programs; customer and shareholder

reaction to the transaction; risks associated with the financing of

the transaction; disruption from the transaction making it more

difficult to maintain business and operational relationships;

significant transaction costs; unknown liabilities; the risk of

regulatory actions related to the proposed acquisition; changes in

general and international economic conditions, including

fluctuations in foreign currency exchange rates; and other factors

described or incorporated in our filings with the Securities and

Exchange Commission, including our Annual Report on Form 10-K for

the year ended December 31, 2023.

CAUTION: Federal (USA) law restricts these devices for sale or

use by or on the order of a physician.

Teleflex, the Teleflex logo, Arrow, Barrigel, Deknatel, LMA,

Pilling, QuikClot, Titan SGS, Rüsch, UroLift and Weck are

trademarks or registered trademarks of Teleflex Incorporated or its

affiliates in the U.S. and/or other countries. Other names are the

trademarks of their respective owners. Refer to the Instructions

for Use for a complete listing of the indications,

contraindications, warnings, and precautions. Information in this

document is not a substitute for the product Instructions for Use.

Not all products may be available in all countries. Please contact

your local representative.

© 2025 Teleflex Incorporated. All rights reserved.

Contacts:TeleflexLawrence KeuschVice President,

Investor Relations and Strategy Development

investor.relations@teleflex.com610-948-2836

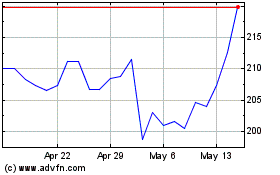

Teleflex (NYSE:TFX)

Historical Stock Chart

From Feb 2025 to Mar 2025

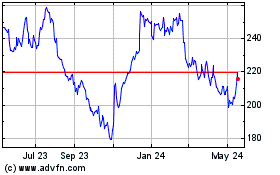

Teleflex (NYSE:TFX)

Historical Stock Chart

From Mar 2024 to Mar 2025