Earnings Call to be held 7:30 am CT on

Thursday, November 7, 2024

Texas Pacific Land Corporation (NYSE: TPL) (the “Company” or

“TPL”) today announced its financial and operating results for the

third quarter of 2024.

Third Quarter 2024 Highlights

- Acquired mineral interests across approximately 4,106 net

royalty acres located in the northern Delaware Basin for a purchase

price of $120.3 million, net of post-close adjustments, in an

all-cash transaction

- Acquired approximately 4,120 surface acres and other

surface-related assets located in the core of the Midland Basin for

a purchase price of $45.0 million, in an all-cash transaction

- Royalty production of 28.3 thousand barrels of oil equivalent

(“Boe”) per day

- As of September 30, 2024, TPL’s royalty acreage had an

estimated 6.9 net well permits, 11.8 net drilled but uncompleted

wells, 3.4 net completed wells, and 79.2 net producing wells. Net

producing wells added during the quarter had an average lateral

length of approximately 7,659 ft.

- Consolidated net income of $106.6 million, or $4.63 per share

(diluted)

- Adjusted EBITDA(1) of $144.1 million

- Free cash flow (1) of $106.9 million

- Special cash dividend of $10.00 per share was paid on July 15,

2024

- Quarterly cash dividend of $1.17 per share was paid on

September 17, 2024

Nine Months Ended September 30, 2024 Highlights

- The Company announced the development of a new energy-efficient

method of produced water desalination and treatment. The Company

has successfully conducted a technology pilot and is progressing

towards the construction of a larger test facility with an initial

capacity of 10,000 barrels of produced water per day.

- Three-for-one stock split effected March 26, 2024

- Royalty production of 26.0 thousand Boe per day

- Consolidated net income of $335.6 million, or $14.58 per share

(diluted)

- Adjusted EBITDA(1) of $449.4 million

- Free cash flow (1) of $337.3 million

- $310.6 million of total cash dividends paid through September

30, 2024 (composed of a $10.00 per share special dividend and $1.17

per share in regular quarterly cash dividends)

- $22.7 million of common stock repurchases

(1) Reconciliations of Non-GAAP measures are provided in the

tables below.

“Our strong results this quarter showcase the benefit of a

strategy predicated on robust active management on our legacy

assets combined with opportunistic growth,” said Tyler Glover,

Chief Executive Officer of the Company. “Record royalty production

during the quarter was driven by our outstanding legacy royalty

position, and we anticipate that our recently announced

acquisitions will also meaningfully enhance our royalty production

going forward. In addition, we continue to execute on new

opportunities leveraging our surface and water assets, with prior

acquisitions of strategic surface acreage and pore-space easements

facilitating numerous new commercial agreements with high-quality

operator customers. The 37% increase to the regular dividend

announced today is largely supported by our recent acquisitions,

which we expect to provide a substantial uplift to our near-term

financial results and to strengthen our long-term growth

outlook.”

Financial Results for the Third Quarter of 2024 -

Sequential

The Company reported net income of $106.6 million for the third

quarter of 2024 compared to net income of $114.6 million for the

second quarter of 2024.

Total revenues for the third quarter of 2024 were $173.6 million

compared to $172.3 million for the second quarter of 2024. The

increase in revenues was primarily due to a $4.6 million increase

in oil and gas royalty revenue and a $2.4 million increase in

produced water royalties, partially offset by a $4.4 million

decrease in water sales compared to the second quarter of 2024. The

decrease in water sales was principally due to a decrease of 9.0%

in water sales volumes for the third quarter of 2024 compared to

the second quarter of 2024. The Company’s share of production was

28.3 thousand Boe per day for the third quarter of 2024 versus 24.9

thousand Boe per day for the second quarter of 2024, and the

average realized price was $38.04 per Boe in the third quarter of

2024 compared to $41.44 per Boe in the second quarter of 2024.

TPL's revenue streams are directly impacted by commodity prices and

development and operating decisions made by its customers.

Total operating expenses were $46.2 million for the third

quarter of 2024 compared to $39.1 million for the second quarter of

2024. The change in operating expenses was principally related to

an increase in legal and professional fees during the third quarter

of 2024, partially offset by a decrease in water service-related

expenses over the same period.

Financial Results for the Third Quarter of 2024 - Year Over

Year

Total revenues for the nine months ended September 30, 2024 were

$520.0 million compared to $464.9 million for the same period of

2023. All revenue streams, except land sales and easements and

other surface-related income, increased for the nine months ended

September 30, 2024 with the $28.2 million increase in water sales

being the biggest contributor. The growth in water sales was

principally due to an increase of 27.6% in water sales volumes for

the nine months ended September 30, 2024 compared to the same

period of 2023. Additionally, oil and gas royalty revenue increased

$17.7 million primarily due to higher production volumes for the

nine months ended September 30, 2024 compared to the same period of

2023. Oil and gas royalty revenue for the nine months ended

September 30, 2023 included an $8.7 million settlement with an

operator with respect to unpaid oil and gas royalties for older

production periods. Excluding the impact of the $8.7 million

settlement on oil and gas royalty revenues for the nine months

ended September 30, 2023, oil and gas royalty revenue for the nine

months ended September 30, 2024 increased $26.4 million over the

same period of 2023. The Company’s share of production was 26.0

thousand Boe per day for the nine months ended September 30, 2024

versus 22.6 thousand Boe per day for the same period of 2023. The

average realized price was $40.60 per Boe for the nine months ended

September 30, 2024 versus $42.49 per Boe for the same period of

2023. TPL’s revenue streams are directly impacted by commodity

prices and development and operating decisions made by its

customers.

Total operating expenses were $123.4 million for the nine months

ended September 30, 2024 compared to $112.7 million for the same

period of 2023. The change in operating expenses was principally

related to an increase in water service-related expenses due to the

27.6% increase in water sales volumes for the nine months ended

September 30, 2024 compared to the same period of 2023.

Quarterly Dividend Declared

On November 4, 2024, the Company's Board of Directors declared a

quarterly cash dividend of $1.60 per share, payable on December 16,

2024 to stockholders of record at the close of business on December

2, 2024.

Conference Call and Webcast Information

The Company will hold a conference call on Thursday, November 7,

2024 at 7:30 a.m. Central Time to discuss third quarter results. A

live webcast of the conference call will be available on the

Investors section of the Company’s website at www.TexasPacific.com.

To listen to the live broadcast, go to the site at least 15 minutes

prior to the scheduled start time in order to register and install

any necessary audio software.

The conference call can also be accessed by dialing

1-877-407-4018 or 1-201-689-8471. The telephone replay can be

accessed by dialing 1-844-512-2921 or 1-412-317-6671 and providing

the conference ID# 13745174. The telephone replay will be available

starting shortly after the call through November 21, 2024.

About Texas Pacific Land Corporation

Texas Pacific Land Corporation is one of the largest landowners

in the State of Texas with approximately 873,000 acres of land,

with the majority of its ownership concentrated in the Permian

Basin. The Company is not an oil and gas producer, but its surface

and royalty ownership provide revenue opportunities throughout the

life cycle of a well. These revenue opportunities include fixed fee

payments for use of our land, revenue for sales of materials

(caliche) used in the construction of infrastructure, providing

sourced water and/or treated produced water, revenue from our oil

and gas royalty interests, and revenues related to saltwater

disposal on our land. The Company also generates revenue from

pipeline, power line and utility easements, commercial leases and

temporary permits related to a variety of land uses including

midstream infrastructure projects and hydrocarbon processing

facilities.

Visit TPL at www.TexasPacific.com.

Cautionary Statement Regarding Forward-Looking

Statements

This news release may contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that are based on TPL’s beliefs, as well as assumptions

made by, and information currently available to, TPL, and therefore

involve risks and uncertainties that are difficult to predict.

Generally, future or conditional verbs such as “will,” “would,”

“should,” “could,” or “may” and the words “believe,” “anticipate,”

“continue,” “intend,” “expect” and similar expressions identify

forward-looking statements. Forward-looking statements include, but

are not limited to, references to strategies, plans, objectives,

expectations, intentions, assumptions, future operations and

prospects and other statements that are not historical facts. You

should not place undue reliance on forward-looking statements.

Although TPL believes that plans, intentions and expectations

reflected in or suggested by any forward-looking statements made

herein are reasonable, TPL may be unable to achieve such plans,

intentions or expectations and actual results, and performance or

achievements may vary materially and adversely from those envisaged

in this news release due to a number of factors including, but not

limited to: the initiation or outcome of potential litigation; and

any changes in general economic and/or industry specific

conditions. These risks, as well as other risks associated with TPL

are also more fully discussed in our Annual Report on Form 10-K and

our Quarterly Reports on Form 10-Q. You can access TPL’s filings

with the Securities and Exchange Commission (“SEC”) through the

SEC's website at www.sec.gov and TPL strongly encourages you to do

so. Except as required by applicable law, TPL undertakes no

obligation to update any forward-looking statements or other

statements herein for revisions or changes after this communication

is made.

FINANCIAL AND OPERATIONAL

RESULTS

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

2024

June 30, 2024

September 30,

2024

September 30,

2023(2)

Company’s share of production

volumes(1):

Oil (MBbls)

1,046

967

3,003

2,642

Natural gas (MMcf)

4,654

3,851

12,312

10,405

NGL (MBbls)

779

661

2,073

1,784

Equivalents (MBoe)

2,600

2,270

7,128

6,160

Equivalents per day (MBoe/d)

28.3

24.9

26.0

22.6

Oil and gas royalty revenue (in

thousands):

Oil royalties

$

75,427

$

74,747

$

222,788

$

193,969

Natural gas royalties

4,201

2,367

13,630

23,210

NGL royalties

14,816

12,699

39,959

32,800

Total oil and gas royalties

$

94,444

$

89,813

$

276,377

$

249,979

Realized prices (1):

Oil ($/Bbl)

$

75.53

$

80.93

$

77.68

$

76.88

Natural gas ($/Mcf)

$

0.98

$

0.66

$

1.20

$

2.41

NGL ($/Bbl)

$

20.57

$

20.78

$

20.84

$

19.88

Equivalents ($/Boe)

$

38.04

$

41.44

$

40.60

$

42.49

______________________________

(1)

Term

Definition

Bbl

One stock tank barrel of 42 U.S. gallons

liquid volume used herein in reference to crude oil, condensate or

NGLs.

MBbls

One thousand barrels of crude oil,

condensate or NGLs.

MBoe

One thousand Boe.

MBoe/d

One thousand Boe per day.

Mcf

One thousand cubic feet of natural

gas.

MMcf

One million cubic feet of natural gas.

NGL

Natural gas liquids. Hydrocarbons found in

natural gas that may be extracted as liquefied petroleum gas and

natural gasoline.

(2)

The metrics and dollars provided for the

nine months ended September 30, 2023 exclude the impact of an $8.7

million settlement with an operator with respect to unpaid oil and

gas royalties.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except share and

per share amounts) (unaudited)

Three Months Ended

Nine Months Ended

September 30,

2024

June 30, 2024

September 30,

2024

September 30,

2023

Revenues:

Oil and gas royalties

$

94,444

$

89,813

$

276,377

$

258,644

Water sales

36,211

40,650

113,987

85,799

Produced water royalties

27,727

25,301

76,034

61,824

Easements and other surface-related

income

14,280

16,570

51,496

51,865

Land sales

901

—

2,145

6,806

Total revenues

173,563

172,334

520,039

464,938

Expenses:

Salaries and related employee expenses

14,030

12,771

39,262

32,688

Water service-related expenses

11,731

14,824

36,767

24,496

General and administrative expenses

4,029

3,673

12,626

10,738

Legal and professional fees

8,316

2,307

14,680

28,471

Ad valorem and other taxes

2,189

1,444

5,990

5,425

Land sales expenses

175

—

425

49

Depreciation, depletion and

amortization

5,762

4,093

13,695

10,881

Total operating expenses

46,232

39,112

123,445

112,748

Operating income

127,331

133,222

396,594

352,190

Other income, net

8,086

13,220

31,249

20,239

Income before income taxes

135,417

146,442

427,843

372,429

Income tax expense

28,823

31,853

92,243

79,894

Net income

$

106,594

$

114,589

$

335,600

$

292,535

Net income per share of common stock

(1)

Basic

$

4.64

$

4.99

$

14.60

$

12.69

Diluted

$

4.63

$

4.98

$

14.58

$

12.68

Weighted average number of shares of

common stock outstanding (1)

Basic

22,979,781

22,987,971

22,990,213

23,054,073

Diluted

23,012,169

23,013,793

23,016,733

23,072,955

__________________________

(1)

All share and share price amounts reflect the three-for-one stock

split effected on March 26, 2024.

SEGMENT OPERATING

RESULTS

(dollars in thousands)

(unaudited)

Three Months Ended

September 30,

2024

June 30, 2024

Revenues:

Land and resource management:

Oil and gas royalties

$

94,444

54

%

$

89,813

52

%

Easements and other surface-related

income

11,303

7

%

14,219

8

%

Land sales

901

—

%

—

—

%

Total land and resource management

revenue

106,648

61

%

104,032

60

%

Water services and operations:

Water sales

36,211

21

%

40,650

24

%

Produced water royalties

27,727

16

%

25,301

15

%

Easements and other surface-related

income

2,977

2

%

2,351

1

%

Total water services and operations

revenue

66,915

39

%

68,302

40

%

Total consolidated revenues

$

173,563

100

%

$

172,334

100

%

Net income:

Land and resource management

$

71,870

67

%

$

80,129

70

%

Water services and operations

34,724

33

%

34,460

30

%

Total consolidated net income

$

106,594

100

%

$

114,589

100

%

Nine Months Ended

September 30,

2024

September 30,

2023

Revenues:

Land and resource management:

Oil and gas royalties

$

276,377

54

%

$

258,644

56

%

Easements and other surface-related

income

43,643

8

%

49,826

11

%

Land sales

2,145

—

%

6,806

1

%

Total land and resource management

revenue

322,165

62

%

315,276

68

%

Water services and operations:

Water sales

113,987

22

%

85,799

19

%

Produced water royalties

76,034

15

%

61,824

13

%

Easements and other surface-related

income

7,853

1

%

2,039

—

%

Total water services and operations

revenue

197,874

38

%

149,662

32

%

Total consolidated revenues

$

520,039

100

%

$

464,938

100

%

Net income:

Land and resource management

$

232,970

69

%

$

217,860

74

%

Water services and operations

102,630

31

%

74,675

26

%

Total consolidated net income

$

335,600

100

%

$

292,535

100

%

NON-GAAP PERFORMANCE MEASURES AND

DEFINITIONS

In addition to amounts presented in accordance with generally

accepted accounting principles in the United States of America

(“GAAP”), we also present certain supplemental non-GAAP performance

measurements. These measurements are not to be considered more

relevant or accurate than the measurements presented in accordance

with GAAP. In compliance with the requirements of the SEC, our

non-GAAP measurements are reconciled to net income, the most

directly comparable GAAP performance measure. For all non-GAAP

measurements, neither the SEC nor any other regulatory body has

passed judgment on these non-GAAP measurements.

EBITDA, Adjusted EBITDA and Free Cash Flow

EBITDA is a non-GAAP financial measurement of earnings before

interest expense, taxes, depreciation, depletion and amortization.

Its purpose is to highlight earnings without finance, taxes, and

depreciation, depletion and amortization expense, and its use is

limited to specialized analysis. We calculate Adjusted EBITDA as

EBITDA plus employee share-based compensation. Its purpose is to

highlight earnings without non-cash activity such as share-based

compensation and other non-recurring or unusual items, if

applicable. We calculate Free Cash Flow as Adjusted EBITDA less

current income tax expense and capital expenditures. Its purpose is

to provide an additional measure of operating performance. We have

presented EBITDA, Adjusted EBITDA and Free Cash Flow because we

believe that these metrics are useful supplements to net income in

analyzing the Company’s operating performance. Our definitions of

EBITDA, Adjusted EBITDA and Free Cash Flow may differ from

computations of similarly titled measures of other companies.

The following table presents a reconciliation of net income to

EBITDA, Adjusted EBITDA and Free Cash Flow for the three months

ended September 30, 2024 and June 30, 2024 and for the nine months

ended September 30, 2024 and September 30, 2023 (in thousands):

Three Months Ended

Nine Months Ended

September 30,

2024

June 30, 2024

September 30,

2024

September 30,

2023

Net income

$

106,594

$

114,589

$

335,600

$

292,535

Add:

Income tax expense

28,823

31,853

92,243

79,894

Depreciation, depletion and

amortization

5,762

4,093

13,695

10,881

EBITDA

141,179

150,535

441,538

383,310

Add:

Employee share-based compensation

2,935

2,700

7,855

7,217

Adjusted EBITDA

144,114

153,235

449,393

390,527

Less:

Current income tax expense

(27,416

)

(30,766

)

(90,080

)

(80,928

)

Capital expenditures

(9,833

)

(6,499

)

(21,994

)

(10,387

)

Free Cash Flow

$

106,865

$

115,970

$

337,319

$

299,212

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106128184/en/

Investor Relations IR@TexasPacific.com

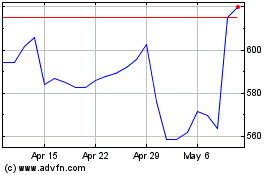

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Feb 2025 to Mar 2025

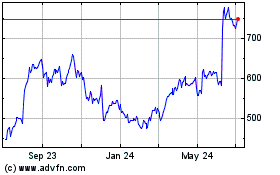

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Mar 2024 to Mar 2025