Tapestry, Inc. (NYSE: TPR), a house of iconic accessories and

lifestyle brands, today announced that it entered into a definitive

agreement to sell the Stuart Weitzman brand to Caleres (NYSE: CAL),

a market-leading portfolio of consumer-driven footwear brands, for

$105 million in cash, subject to customary adjustments.

“Stuart Weitzman is an iconic global footwear brand, whose teams

have added to the passion, creativity, and craftsmanship of our

organization over the last decade," said Joanne Crevoiserat, Chief

Executive Officer of Tapestry, Inc. "Importantly, as diligent

stewards of our portfolio and disciplined allocators of capital,

this transaction ensures that all our brands are positioned for

long-term success and that we maintain a sharp focus on our largest

value creation opportunities. At Tapestry, this means harnessing

our position of strength to sustain Coach’s leadership and momentum

while reinvigorating Kate Spade to drive durable organic growth and

shareholder value. At the same time, we are pleased that we found

Stuart Weitzman a home in Caleres – an ideal owner to guide its

next chapter of growth.”

Jay Schmidt, president and CEO of Caleres added, “I have long

admired Stuart Weitzman for the brand’s pivotal role in shaping the

footwear industry. As we bring this iconic brand into the Caleres

portfolio, we are committed to preserving its legacy of

craftsmanship, quality and fit while driving it forward. The

acquisition of Stuart Weitzman advances our strategic agenda to

grow our Brand Portfolio segment with more global and

direct-to-consumer reach. Stuart Weitzman will be a lead brand for

Caleres, and with this combination the Brand Portfolio segment will

generate nearly half of our total revenue and will continue to

generate over half of our operating profit. We will leverage our

demonstrated, best-in-class footwear capabilities while pursuing

category and channel growth. We expect to operate the brand

profitably post integration and I look forward to partnering with

both the Tapestry and Stuart Weitzman teams for a seamless and

successful transition.”

The transaction is expected to close in the summer of 2025,

subject to customary closing conditions.

Advisors Morgan Stanley

& Co. LLC is serving as Tapestry, Inc.’s financial advisor and

Latham & Watkins LLP is its legal advisor. BofA Securities is

serving as Caleres’s financial advisor and BCLP (Bryan Cave

Leighton Paisner) is its legal advisor.

About Tapestry, Inc. Our

global house of brands unites the magic of Coach, kate spade new

york and Stuart Weitzman. Each of our brands are unique and

independent, while sharing a commitment to innovation and

authenticity defined by distinctive products and differentiated

customer experiences across channels and geographies. We use our

collective strengths to move our customers and empower our

communities, to make the fashion industry more sustainable, and to

build a company that’s equitable, inclusive, and diverse.

Individually, our brands are iconic. Together, we can stretch

what’s possible. To learn more about Tapestry, please visit

www.tapestry.com. For important news and information regarding

Tapestry, visit the Investor Relations section of our website at

www.tapestry.com/investors. In addition, investors should continue

to review our news releases and filings with the SEC. We use each

of these channels of distribution as primary channels for

publishing key information to our investors, some of which may

contain material and previously non-public information. The

Company’s common stock is traded on the New York Stock Exchange

under the symbol TPR.

About Stuart Weitzman Since

1986, New York City-based global luxury footwear brand Stuart

Weitzman has combined its signature artisanal craftsmanship and

precise engineering to empower women to stand strong. Having

perfected the art of shoemaking for over 35 years, the brand

continues to expand its assortment to feature handbags and men’s

footwear, all the while staying true to its ethos of inspiring

strength and confidence with every step.

About Caleres Caleres is a

market-leading portfolio of global footwear brands that includes

Famous Footwear, Sam Edelman, Allen Edmonds, Naturalizer, Vionic,

and more. Our products are available virtually everywhere - in the

nearly 1,000 retail stores we operate, in hundreds of major

department and specialty stores, on our 15 branded e-commerce

sites, and on many additional third-party retail websites.

Combined, these brands make Caleres a company with both a legacy

and a mission. Our legacy is our more than 140 years of

craftsmanship and our passion for fit, while our mission is to

continue to inspire people to feel great… feet first. Visit

caleres.com to learn more about us.

This Press Release may contain forward-looking statements based

on management’s current expectations. Forward-looking statements

include, but are not limited to, statements regarding the Company’s

capital deployment plans, including anticipated share repurchase

plans, and statements that can be identified by the use of

forward-looking terminology such as “may,” “can,” “if,” “continue,”

“assume,” “should,” “expect,” “confidence,” “goals,” “trends,”

“anticipate,” “intend,” “estimate,” “on track,” “future,” “plan,”

“deliver,” “potential,” “position,” “believe,” “will,” “target,”

“guidance,” “forecast,” “outlook,” “commit,” “leverage,”

“generate,” “enhance,” “innovation,” “drive,” “effort,” “progress,”

“confident,” “uncertain,” “achieve,” “strategic,” “growth,” “we can

stretch what’s possible,” similar expressions, and variations or

negatives of these words. Future results may differ materially from

management’s current expectations, based upon a number of important

factors, including risks and uncertainties such as the effect of

the announcement of the announced transaction to sell the Stuart

Weitzman business on the ability of the Company to retain and hire

key personnel and maintain relationships with customers, suppliers

and others with whom the Company or the Stuart Weitzman business do

business, or on the Company’s or the Stuart Weitzman business’s

operating results and business generally; risks that the

transaction disrupts current plans and operations and the potential

difficulties in employee retention as a result of the transaction;

the outcome of any legal proceedings related to the transaction;

the ability of the parties to consummate the transaction on a

timely basis or at all; the satisfaction of the conditions

precedent to consummation of the Transaction; business disruption

following the Transaction, the impact of economic conditions,

recession and inflationary measures, risks associated with

operating in international markets and our global sourcing

activities, the ability to anticipate consumer preferences and

retain the value of our brands, including our ability to execute on

our e-commerce and digital strategies, the impact of tax and other

legislation, the risks associated with potential changes to

international trade agreements and the imposition of additional

duties on importing our products, the ability to successfully

implement the initiatives under our 2025 growth strategy, the

effect of existing and new competition in the marketplace, the

effect of seasonal and quarterly fluctuations on our sales or

operating results, the risk of cybersecurity threats and privacy or

data security breaches, our ability to satisfy our outstanding debt

obligations or incur additional indebtedness, the risks associated

with climate change and other corporate responsibility issues, our

ability to protect against infringement of our trademarks and other

proprietary rights, and the impact of pending and potential future

legal proceedings, etc. In addition, purchases of shares of the

Company’s common stock will be made subject to market conditions

and at prevailing market prices. Please refer to the Company’s

latest Annual Report on Form 10-K, latest Quarterly Report on Form

10-Q and its other filings with the Securities and Exchange

Commission for a complete list of risks and important factors. The

Company assumes no obligation to revise or update any such

forward-looking statements for any reason, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219518173/en/

Tapestry, Inc. Analysts and Investors: Christina Colone

Global Head of Investor Relations 212/946-7252

ccolone@tapestry.com

Media: Jennifer Leemann Global Head of Communications

212/631-2797 jleemann@tapestry.com

Caleres Analysts and Investors: Liz Dunn SVP Corporate

Development and Strategic Communications ldunn@caleres.com

Media: Kelly Malone VP Corporate Communications

kmalone@caleres.com

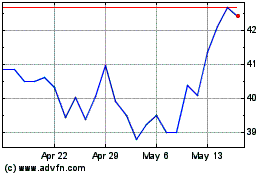

Tapestry (NYSE:TPR)

Historical Stock Chart

From Jan 2025 to Feb 2025

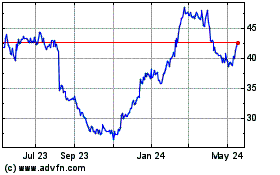

Tapestry (NYSE:TPR)

Historical Stock Chart

From Feb 2024 to Feb 2025