Initial Statement of Beneficial Ownership (3)

January 05 2022 - 3:08PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Wijnand Hansbart |

2. Date of Event Requiring Statement (MM/DD/YYYY)

1/1/2022

|

3. Issuer Name and Ticker or Trading Symbol

TEMPUR SEALY INTERNATIONAL, INC. [TPX]

|

|

(Last)

(First)

(Middle)

C/O TEMPUR SEALY INTERNATIONAL, INC., 1000 TEMPUR WAY |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

EVP, INTERNATIONAL / |

|

(Street)

LEXINGTON, KY 40511

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Units | (1) | (1) | Common Stock | 2120.0 | $0.0 | D | |

| Restricted Stock Units | (2) | (2) | Common Stock | 23688.0 | $0.0 | D | |

| Performance Restricted Stock Units | (3) | (3) | Common Stock | 42072.0 | $0.0 | D | |

| Restricted Stock Units | (4) | (4) | Common Stock | 5256.0 | $0.0 | D | |

| Restricted Stock Units | (5) | (5) | Common Stock | 16062.0 | $0.0 | D | |

| Explanation of Responses: |

| (1) | On January 5, 2018, the reporting person was granted 8,488 restricted stock units (RSUs). Pursuant to the award agreement, two installments of 2,124 RSUs and one installment of 2,120 RSUs vested and were distributed to the reporting person on January 5, 2019, 2020 and 2021, respectively. The remaining installment of 2,120 RSUs vest on January 5, 2022. The RSUs have been adjusted to reflect the 4-for-1 stock split, which occurred on November 24, 2020. |

| (2) | On January 4, 2019, the reporting person was granted 47,384 restricted stock units (RSUs). Pursuant to the award agreement, two equal installments of 11,848 RSUs vested and were distributed to the reporting person on January 4, 2020 and 2021, respectively. The remaining two equal installments of 11,844 RSUs vest on January 4, 2022 and 2023, respectively. The RSUs have been adjusted to reflect the 4-for-1 stock split, which occurred on November 24, 2020. |

| (3) | On February 4, 2021, the Compensation Committee of the Board of Directors determined that the maximum performance condition for the performance restricted stock units (PRSUs) granted on January 3, 2020 was achieved. The PRSUs vest in approximately three equal installments on January 3, 2022, 2023 and 2024 and have been adjusted to reflect the 4-for-1 stock split, which occurred on November 24, 2020. |

| (4) | On January 3, 2020, the reporting person was granted 7,012 restricted stock units (RSUs). Pursuant to the award agreement, one installment of 1,756 RSUs vested and were distributed to the reporting person on January 3, 2021. The remaining three installments of 1,752 RSUs each vest on January 3, 2022, 2023 and 2024, respectively. The RSUs have been adjusted to reflect the 4-for-1 stock split, which occurred on November 24, 2020. |

| (5) | On January 4, 2021, the reporting person was granted 16,062 restricted stock units, vesting in approximately four equal annual installments beginning on the first anniversary of the grant date. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Wijnand Hansbart

C/O TEMPUR SEALY INTERNATIONAL, INC.

1000 TEMPUR WAY

LEXINGTON, KY 40511 |

|

| EVP, INTERNATIONAL |

|

Signatures

|

| /s/ Bhaskar Rao, Attorney-in-Fact | | 1/5/2022 |

| **Signature of Reporting Person | Date |

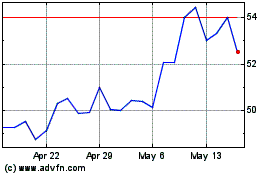

Tempur Sealy (NYSE:TPX)

Historical Stock Chart

From Jun 2024 to Jul 2024

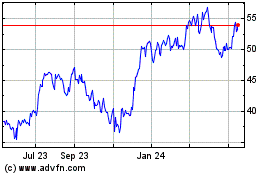

Tempur Sealy (NYSE:TPX)

Historical Stock Chart

From Jul 2023 to Jul 2024