Urban Edge Properties Announces Tax Treatment of 2023 Dividend Distributions

January 16 2024 - 6:00AM

Business Wire

Urban Edge Properties (NYSE: UE) announced today the tax

treatment of the 2023 dividend distributions on shares of its

common stock.

The federal income tax characteristics of the 2023 distributions

paid with respect to Urban Edge Properties common stock (CUSIP

#91704F104 and traded under ticker symbol UE) are as follows:

Distribution Type – Per

share

Record Date

Payment Date

Distribution Amount per

share

Ordinary Taxable

Income(1)

Long Term Capital

Gains(2)(3)

Return of Capital

3/15/2023

3/31/2023

$0.16

$0.14

$0.02

$0.00

6/15/2023

6/30/2023

$0.16

$0.14

$0.02

$0.00

9/15/2023

9/29/2023

$0.16

$0.14

$0.02

$0.00

12/15/2023

12/29/2023

$0.16

$0.14

$0.02

$0.00

2023 Totals

$0.64

$0.56

$0.08

$0.00

(1)

The 2023 Taxable Ordinary Dividends are treated as "qualified

REIT dividends" for purposes of Internal Revenue Code section

199A.

(2)

Of the $0.08 reported as long-term capital gains, the amount

that is an unrecaptured 1250 gain is $0.01.

(3)

The long-term capital gains are entirely related to Section 1231

gains and are accordingly excluded from the REIT’s disclosure of

its one-year and three-year amounts required by Treasury Regulation

§1.1061-6(c).

Shareholders are advised to consult their tax advisor about the

specific tax treatment of Urban Edge’s 2023 dividends.

ABOUT URBAN EDGE PROPERTIES

Urban Edge Properties is a NYSE listed real estate investment

trust focused on owning, managing, acquiring, developing, and

redeveloping retail real estate in urban communities, primarily in

the Washington, D.C. to Boston corridor. Urban Edge owns 76

properties totaling 17.1 million square feet of gross leasable

area.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240116170872/en/

Mark Langer, EVP and Chief Financial Officer

Urban Edge Properties (NYSE:UE)

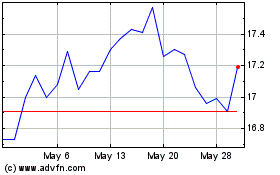

Historical Stock Chart

From Jan 2025 to Feb 2025

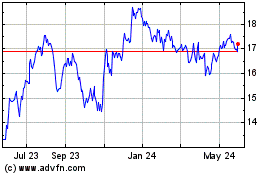

Urban Edge Properties (NYSE:UE)

Historical Stock Chart

From Feb 2024 to Feb 2025