UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

July 31, 2024

(Commission File Number: 001-15128)

United Microelectronics Corporation

(Translation of registrant’s name into English)

No. 3 Li-Hsin 2nd Road

Hsinchu Science Park

Hsinchu, Taiwan, R.O.C.

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

United Microelectronics Corporation |

|

|

|

By: |

Chitung Liu |

Name: |

Chitung Liu |

Title: |

CFO |

Date: July 31, 2024

EXHIBIT INDEX

www.umc.com

www.umc.com

Exhibit

Exhibit Description

99.1 Announcement on 2024/07/23: Announcement of the Company’s Board Meeting Date of Q2, 2024 Consolidated Financial Report

99.2 Announcement on 2024/07/31: Announcement of board meeting approved the consolidated financial statements for the second quarter of 2024

99.3 Announcement on 2024/07/31: The board meeting approved capital budget execution

99.4 Announcement on 2024/07/31: The Board of Directors Approved the Cancellation of Restricted Shares to Employees Stock Awards

99.5 Announcement on 2024/07/31: UMC announced its operating results for the second quarter of 2024

Exhibit 99.1

Announcement of the Company’s Board Meeting Date of Q2, 2024 Consolidated Financial Report

1. Date of a notice of the board of directors meeting is issued: 2024/07/23

2. Expected date of the board of directors meeting is convened: 2024/07/31

3. Expected year and quarter of the financial reports or the annual self-assessed financial information submitted to the board of directors or approved by the board of directors:

Q2, 2024 Consolidated Financial Report

4. Any other matters that need to be specified: None

Exhibit 99.2

Announcement of board meeting approved the consolidated financial statements for the second quarter of 2024

1. Date of submission to the board of directors or approval by the board of directors: 2024/07/31

2. Date of approval by the audit committee: 2024/07/31

3. Start and end dates of financial reports or annual self-assessed financial information of the reporting period (XXXX/XX/XX~XXXX/XX/XX): 2024/01/01~2024/06/30

4. Operating revenue accumulated from 1/1 to end of the period (thousand NTD): 111,431,389

5. Gross profit (loss) from operations accumulated from 1/1 to end of the period (thousand NTD): 36,882,654

6. Net operating income (loss) accumulated from 1/1 to end of the period (thousand NTD): 25,555,933

7. Profit (loss) before tax accumulated from 1/1 to end of the period (thousand NTD): 29,141,211

8. Profit (loss) accumulated from 1/1 to end of the period (thousand NTD): 24,204,809

9. Profit (loss) during the period attributable to owners of parent accumulated from 1/1 to end of the period (thousand NTD): 24,242,305

10. Basic earnings (loss) per share accumulated from 1/1 to end of the period (NTD): 1.95

11. Total assets end of the period (thousand NTD): 586,961,945

12. Total liabilities end of the period (thousand NTD): 230,870,264

13. Equity attributable to owners of parent end of the period (thousand NTD): 355,779,378

14. Any other matters that need to be specified: NA

Exhibit 99.3

The board meeting approved capital budget execution

1. Date of the resolution of the board of directors or shareholders meeting: 2024/07/31

2. Content of the investment plan: capital budget execution

3. Projected monetary amount of the investment: NT$ 2,654 million

4. Projected date of the investment: by capital budget plan

5. Source of capital funds: working capital

6. Specific purpose: capacity deployment

7. Any other matters that need to be specified: none

Exhibit 99.4

The Board of Directors Approved the Cancellation of Restricted Shares to Employees Stock Awards

1. Date of the board of directors’ resolution: 2024/07/31

2. Reason for capital reduction: The Restricted shares to employees will be returned to the Company and cancelled due to non-fulfillment of the vesting conditions.

3. Amount of capital reduction: NT$1,225,230

4. Cancelled shares: 122,523 shares

5. Capital reduction percentage: 0.001%

6. Share capital after capital reduction: NT$125,284,663,840

7. Scheduled date of the shareholders’ meeting: N/A

8. Estimated no. of listed common shares after issuance of new shares upon capital reduction: N/A

9. Estimated ratio of listed common shares after issuance of new shares upon capital reduction to outstanding common shares: N/A

10. Please explain any countermeasures for lower circulation in shareholding if the aforesaid estimated no. of listed common shares upon capital reduction does not reach 60 million and the percentage does not reach 25%: N/A

11. The record date for capital reduction: 2024/07/31

12. Any other matters that need to be specified: None

Exhibit 99.5

UMC announced its operating results for the second quarter of 2024

1. Date of occurrence of the event: 2024/07/31

2. Company name: UNITED MICROELECTRONICS CORPORATION

3. Relationship to the Company (please enter “head office” or “subsidiaries”): head office

4. Reciprocal shareholding ratios: N/A

5. Cause of occurrence:

UMC Reports Second Quarter 2024 Results

Gross margin reached 35.2% as operating income increased 19.1% QoQ

Earnings per share in 1H was NT$1.95

Second Quarter 2024 Overview:

‧Revenue: NT$56.80 billion (US$1.75 billion)

‧Gross margin: 35.2%; Operating margin: 24.5%

‧Revenue from 22/28nm: 33%

‧Capacity utilization rate: 68%

‧Net income attributable to shareholders of the parent: NT$13.79 billion (US$425 million)

‧Earnings per share: NT$1.11; earnings per ADS: US$0.171

Taipei, Taiwan, ROC – July 31, 2024 – United Microelectronics Corporation (NYSE: UMC; TWSE: 2303) (“UMC” or “The Company”), a leading global semiconductor foundry, today announced its consolidated operating results for the second quarter of 2024.

Second quarter consolidated revenue was NT$56.80 billion, increasing 4.0% from NT$54.63 billion in 1Q24. Compared to a year ago, 2Q24 revenue increased 0.9%. Consolidated gross margin for 2Q24 was 35.2%. Net income attributable to the shareholders of the parent was NT$13.79 billion, with earnings per ordinary share of NT$1.11.

Jason Wang, co-president of UMC, said, “In the second quarter, wafer shipments increased 2.6% QoQ and fab utilization rate improved to 68% as we saw notable demand momentum in the consumer segment. Contribution from our 22/28nm business rose sequentially on healthy demand for WiFi and digital TV applications. Together with a favorable exchange rate and improved product mix, second-quarter gross margin was better than what was previously guided. During the quarter, we announced technology updates including a 3D IC solution to stack RFSOI wafers, which is the first of its kind in the industry, and a 22nm embedded high voltage platform, currently the most advanced display driver foundry solution in the market. They reflect UMC’s commitment to building on our leadership across a number of specialty technologies that are crucial for the development of AI, 5G, and automotive.”

Co-president Wang commented, “Looking to the third quarter, we expect to see end market dynamics improve further, particularly in the communication and computing segments, which will drive higher fab utilization. Our 22/28nm business remains a promising growth driver, with a number of tape-outs taking place in the second half for applications including display drivers, connectivity and networking. At the same time, we do expect to face some margin pressure going into the second half due to a pickup in depreciation expense related to capacity expansions as well as higher utility rates. Despite these cost challenges, we believe we will continue to demonstrate our resilience as we did during the recent market downturn, and deliver on our strategy of providing differentiated technology solutions and a diversified manufacturing footprint to help our customers to strengthen their supply chain management.”

Co-president Wang added, “In pursuit of our net-zero by 2050 goal, UMC continues to take concrete steps to drive emissions reduction in our operations and supply chain, and to increase our use of renewable energy. We are on track to achieving our progressive 2025 and 2030 targets. More details on our ESG progress will be made available to stakeholders in our upcoming Sustainability Report.”

Third Quarter 2024 Outlook & Guidance

‧Wafer Shipments: Will increase by mid-single digit %

‧ASP in USD: Will remain firm

‧Gross Profit Margin: Will be in the mid-30% range

‧Capacity Utilization: approximately 70%

‧2024 CAPEX: US$3.3 billion

6. Countermeasures: N/A

7. Any other matters that need to be specified (the information disclosure also meets the requirements of Article 7, subparagraph 9 of the Securities and Exchange Act Enforcement Rules, which brings forth a significant impact on shareholders rights or the price of the securities on public companies.): N/A

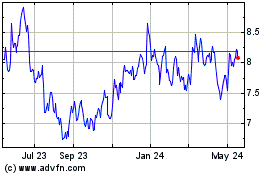

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Jul 2024 to Jul 2024

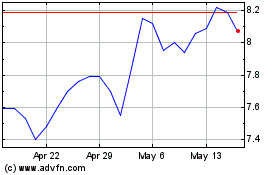

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Jul 2023 to Jul 2024