UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement Pursuant to Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

H&E EQUIPMENT SERVICES, INC.

(Name of Subject Company (Issuer))

UR MERGER SUB VII CORPORATION

a wholly owned subsidiary of

UNITED RENTALS (NORTH AMERICA), INC.

a wholly owned subsidiary of

UNITED RENTALS, INC.

(Names of Filing Persons (Offerors))

Common Stock, par value $0.01

(Title of Class of Securities)

404030108

(CUSIP Number of Class of Securities)

Joli Gross

UR Merger Sub VII Corporation

100 First Stamford Place, Suite 700

Stamford, CT 06902

Telephone: (203) 622-3131

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Francis J. Aquila

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004

Telephone: (212) 558-4000

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☒

third-party tender offer subject to Rule 14d-1.

☐

issuer tender offer subject to Rule 13e-4.

☐

going-private transaction subject to Rule 13e-3.

☐

amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer. ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

Items 1 through 9; Item 11.

This Tender Offer Statement on Schedule TO (this “Schedule TO”) relates to the offer by UR Merger Sub VII Corporation, a Delaware corporation (“Merger Sub”) and a wholly owned subsidiary of United Rentals (North America), Inc., a Delaware corporation (“URNA”) and a wholly owned subsidiary of United Rentals, Inc., a Delaware corporation (“URI”), to purchase all of the outstanding shares of common stock, par value $0.01 per share (the “Shares”), of H&E Equipment Services, Inc., a Delaware corporation (the “Company”), at a price per Share of $92.00 net to the holder thereof in cash, without interest, less any applicable withholding of taxes, upon the terms and subject to the conditions set forth in the offer to purchase, dated January 28, 2025 (the “Offer to Purchase”), and in the related Letter of Transmittal (the “Letter of Transmittal”), copies of which are attached hereto as Exhibits (a)(1)(A) and (a)(1)(B), respectively, which, together with any amendments or supplements thereto, collectively constitute the “Offer”.

All information contained in the Offer to Purchase and the accompanying Letter of Transmittal, including all schedules thereto, is hereby incorporated herein by reference in response to Items 1 through 9 and Item 11 in this Schedule TO.

Item 10. Financial Statements.

Not applicable.

Item 12. Exhibits.

See Exhibit Index.

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: January 28, 2025

UR MERGER SUB VII CORPORATION

By:

/s/ Joli Gross

Name:

Joli Gross

Title:

Secretary

UNITED RENTALS (NORTH AMERICA), INC.

By:

/s/ Joli Gross

Name:

Joli Gross

Title:

Senior Vice President, Chief Legal & Sustainability Officer, Corporate Secretary

UNITED RENTALS, INC.

By:

/s/ Joli Gross

Name:

Joli Gross

Title:

Senior Vice President, Chief Legal & Sustainability Officer, Corporate Secretary

EXHIBIT INDEX

| |

Index No.

|

|

|

|

|

| |

(a)(1)(A)

|

|

|

Offer to Purchase dated January 28, 2025.*

|

|

| |

(a)(1)(B)

|

|

|

Form of Letter of Transmittal.*

|

|

| |

(a)(1)(C)

|

|

|

Form of Notice of Guaranteed Delivery.*

|

|

| |

(a)(1)(D)

|

|

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.*

|

|

| |

(a)(1)(E)

|

|

|

Form of Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.*

|

|

| |

(a)(1)(F)

|

|

|

Summary Advertisement as published in The New York Times on January 28, 2025.* |

|

| |

(a)(5)(A)

|

|

|

Joint press release, dated January 14, 2025 (incorporated by reference to Exhibit 99.1 of the Current Report on Form 8-K filed by United Rentals, Inc. on January 14, 2025).

|

|

| |

(a)(5)(B)

|

|

|

Investor Presentation, dated January 14, 2025 (incorporated by reference to Exhibit 99.2 of the Current Report on Form 8-K filed by United Rentals, Inc. on January 14, 2025).

|

|

| |

(a)(5)(C)

|

|

|

Welcome Letter/FAQ to H&E Equipment Services, Inc. employees, dated January 14, 2025 (incorporated by reference to Exhibit 99.1 of the Tender Offer Statement on Schedule TO-C filed by United Rentals, Inc. on January 15, 2025).

|

|

| |

(a)(5)(D)

|

|

|

Press release, dated January 28, 2025.*

|

|

| |

(b)

|

|

|

Commitment Letter, dated January 13, 2025, by and among Morgan Stanley Senior Funding, Inc., Wells Fargo Securities, LLC, Wells Fargo Bank, National Association, United Rentals, Inc. and United Rentals (North America), Inc.*

|

|

| |

(d)(1)

|

|

|

Agreement and Plan of Merger, dated January 13, 2025, by and among H&E Equipment Services, Inc., United Rentals, Inc. and UR Merger Sub VII Corporation (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by United Rentals, Inc. on January 14, 2025).

|

|

| |

(d)(2)

|

|

|

Confidentiality Agreement, dated November 14, 2024, by and between H&E Equipment Services, Inc. and United Rentals, Inc.*

|

|

| |

(d)(3)

|

|

|

First Amendment to Confidentiality Agreement, dated January 13, 2025, by and between H&E Equipment Services, Inc. and United Rentals, Inc.*

|

|

| |

(d)(4)

|

|

|

Clean Team Confidentiality Agreement, dated December 20, 2024, by and between H&E Equipment Services, Inc. and United Rentals, Inc.*

|

|

| |

(g)

|

|

|

Not applicable.

|

|

| |

(h)

|

|

|

Not applicable.

|

|

| |

107

|

|

|

Filing Fee Table.*

|

|

*

filed herewith

Exhibit (a)(1)(A)

Offer to Purchase for Cash

All Outstanding Shares of Common Stock

of

H&E EQUIPMENT SERVICES, INC.

at

$92.00 Net Per Share

by

UR MERGER SUB VII CORPORATION

a wholly owned subsidiary of

UNITED RENTALS (NORTH AMERICA), INC.,

a wholly owned subsidiary of

UNITED RENTALS, INC.

| |

|

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT ONE MINUTE AFTER 11:59 P.M., EASTERN TIME, ON FEBRUARY 25, 2025, UNLESS THE OFFER IS EXTENDED.

|

|

|

The Offer (as defined below) is being made pursuant to the Agreement and Plan of Merger, dated as of January 13, 2025 (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Merger Agreement”), by and among H&E Equipment Services, Inc., a Delaware corporation (“H&E”), United Rentals Inc., a Delaware corporation (“URI”), and UR Merger Sub VII Corporation, a Delaware corporation (“Merger Sub”) and a wholly owned subsidiary of United Rentals (North America), Inc., a Delaware corporation and wholly owned subsidiary of URI (“URNA”). Merger Sub is offering to purchase any and all of the shares of common stock, par value $0.01 per share (the “Shares”), of H&E that are outstanding at a price of $92.00 per Share, net to the holder thereof in cash (the “Offer Price”), without interest, less any applicable withholding of taxes, upon the terms and subject to the conditions set forth in this offer to purchase (this “Offer to Purchase”) and the related letter of transmittal (the “Letter of Transmittal”), which, together with any amendments or supplements hereto and thereto, collectively constitute the “Offer.”

Pursuant to the Merger Agreement, as soon as practicable following the time we accept, for the first time, for payment Shares validly tendered and not properly withdrawn pursuant to the Offer (the “Offer Acceptance Time”) and subject to the satisfaction or waiver of the remaining conditions set forth in the Merger Agreement, Merger Sub will be merged with and into H&E (the “Merger”) without a meeting of the stockholders of H&E in accordance with Section 251(h) of the General Corporation Law of the State of Delaware (the “DGCL”), with H&E continuing as the surviving corporation (the “Surviving Corporation”) in the Merger and becoming a wholly owned subsidiary of URI. At the effective time of the Merger (the “Effective Time”), each Share then outstanding (other than Shares that are held by any stockholders or beneficial owners who properly demand appraisal in connection with the Merger as described in Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights”) will be converted into the right to receive the Offer Price, net to the holder thereof in cash, without interest, less any applicable withholding of taxes, except for Shares then owned by URI, Merger Sub, or H&E and its subsidiaries, which Shares will be cancelled and will cease to exist, and no consideration will be delivered in exchange therefor. Under no circumstances will interest be paid with respect to the purchase of Shares pursuant to the Offer, regardless of any extension of the Offer or any delay in making payment for Shares.

| |

|

THE BOARD OF DIRECTORS OF H&E RECOMMENDS THAT YOU TENDER ALL OF YOUR SHARES PURSUANT TO THE OFFER.

|

|

|

The board of directors of H&E (the “H&E Board”) has unanimously: (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are fair to and in the best interests of H&E and its stockholders, and declared it advisable to enter into the Merger Agreement with URI and Merger Sub, (ii) approved the execution, delivery and performance of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Offer and the Merger, in accordance with the DGCL, (iii) resolved that, subject to the terms of the Merger Agreement, the Merger shall be

effected under Section 251(h) of the DGCL and (iv) resolved to recommend that H&E’s stockholders accept the Offer and tender their Shares to Merger Sub pursuant to the Offer, in each case, upon the terms and subject to the conditions of the Merger Agreement.

The Offer is not subject to any financing condition. The Offer is conditioned upon: (i) the number of Shares validly tendered (and not properly withdrawn) prior to one minute after 11:59 p.m., Eastern Time, on Tuesday, February 25, 2025 (the “Expiration Date,” unless Merger Sub extends the Offer pursuant to and in accordance with the terms of the Merger Agreement, in which event “Expiration Date” will mean the latest time and date at which the Offer, as so extended by us, will expire) (excluding Shares tendered pursuant to guaranteed delivery procedures that were not received prior to the Expiration Date) together with the Shares then owned by Merger Sub, representing at least one Share more than 50% of the then outstanding Shares; (ii) the accuracy of H&E’s representations and warranties contained in the Merger Agreement (subject to customary materiality qualifiers), (iii) H&E’s performance of its obligations under the Merger Agreement in all material respects, (iv) the absence of a Company Material Adverse Effect (as defined below) that has occurred after the date of the Merger Agreement and is continuing, (v) the absence of any legal or regulatory restraint that prevents the consummation of the Offer or the Merger and the expiration of any waiting periods applicable to the Offer and the Merger under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), (vi) the absence of a termination of the Merger Agreement in accordance with its terms, (vii) the commencement and completion of the Marketing Period (as defined below); and (viii) other customary conditions as described in this Offer to Purchase. See Section 15 — “Conditions to the Offer.” After the Offer Acceptance Time and subject to the satisfaction or waiver of the remaining conditions set forth in the Merger Agreement, URI, Merger Sub and H&E will cause the Merger to become effective without a meeting of the stockholders of H&E in accordance with Section 251(h) of the DGCL.

A summary of the principal terms of the Offer appears on pages i through viii of this Offer to Purchase. You should read this entire Offer to Purchase and the Letter of Transmittal carefully before deciding whether to tender your Shares pursuant to the Offer.

January 28, 2025

IMPORTANT

If you desire to tender all or any portion of your Shares to Merger Sub pursuant to the Offer, you should, prior to the Expiration Date, (i) complete and execute the Letter of Transmittal that is enclosed with this Offer to Purchase in accordance with the instructions contained therein, and mail or deliver the Letter of Transmittal together with the certificates representing your Shares and any other required documents, to Equiniti Trust Company, LLC, in its capacity as depositary for the Offer (the “Depositary”), (ii) tender your Shares by book-entry transfer by following the procedures described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Book-Entry Transfer” or (iii) if applicable, request that your broker, dealer, commercial bank, trust company or other nominee effect the transaction for you. If you hold Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you must contact such nominee in order to tender your Shares to Merger Sub pursuant to the Offer.

If you desire to tender your Shares pursuant to the Offer and the certificates representing your Shares are not immediately available, or you cannot comply in a timely manner with the procedures for tendering your Shares by book-entry transfer or you cannot deliver all required documents to the Depositary prior to the Expiration Date, you may tender your Shares to Merger Sub pursuant to the Offer by following the procedures for guaranteed delivery described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Guaranteed Delivery.”

The Letter of Transmittal, the certificates for the Shares (if not held in book-entry form) and any other required documents must reach the Depositary before the expiration of the Offer (currently scheduled for one minute after 11:59 p.m., Eastern Time, on Tuesday, February 25, 2025), unless extended).

*****

Questions and requests for assistance may be directed to Innisfree M&A Incorporated, the information agent for the Offer (the “Information Agent”), at the address and telephone number set forth below. In addition, requests for additional copies of this Offer to Purchase, the Letter of Transmittal, the notice of guaranteed delivery and other tender offer materials may be directed to the Information Agent. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance. Additionally, copies of this Offer to Purchase, the related Letter of Transmittal and any other material related to the Offer may be obtained at the website maintained by the Securities and Exchange Commission at www.sec.gov.

This Offer to Purchase and the Letter of Transmittal contain important information, and you should read both carefully and in their entirety before making a decision with respect to the Offer.

The Information Agent for the Offer is:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders Call Toll Free: (877) 687-1875

Banks and Brokers Call Collect: (212) 750-5833

Table of Contents

| |

|

|

Page

|

|

|

|

|

|

|

|

i |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

51 |

|

|

|

|

|

|

|

|

52 |

|

|

|

|

|

|

|

|

52 |

|

|

|

|

|

|

|

|

53 |

|

|

|

|

|

|

|

|

53 |

|

|

|

|

|

|

|

|

56 |

|

|

|

|

|

|

|

|

56 |

|

|

|

|

|

|

|

|

A-1

|

|

|

SUMMARY TERM SHEET

| |

Securities Sought:

|

|

|

Any and all of the outstanding shares of common stock, par value $0.01 per share (the “Shares”), of H&E Equipment Services, Inc. (“H&E”).

|

|

| |

Price Offered Per Share:

|

|

|

$92.00 per Share, net to the holder thereof in cash (the “Offer Price”), without interest, less any applicable withholding of taxes.

|

|

| |

Scheduled Expiration Date:

|

|

|

One minute after 11:59 p.m., Eastern Time, on Tuesday, February 25, 2025, unless the Offer (as defined below) is extended.

|

|

| |

Purchaser:

|

|

|

UR Merger Sub VII Corporation, a Delaware corporation (“Merger Sub”) and a wholly owned subsidiary of United Rentals (North America), Inc., a Delaware corporation (“URNA”). URNA is a wholly owned subsidiary of United Rentals, Inc., a Delaware corporation (“URI”).

|

|

| |

H&E Board Recommendation:

|

|

|

The board of directors of H&E (the “H&E Board”) has unanimously: (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are fair to and in the best interests of H&E and its stockholders, and declared it advisable to enter into the Merger Agreement with URI and Merger Sub, (ii) approved the execution, delivery and performance of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Offer and the Merger, in accordance with the DGCL, (iii) resolved that, subject to the terms of the Merger Agreement, the Merger shall be effected under Section 251(h) of the DGCL and (iv) resolved to recommend that H&E’s stockholders accept the Offer and tender their Shares to Merger Sub pursuant to the Offer, in each case, upon the terms and subject to the conditions of the Merger Agreement.

|

|

The following are some questions that you, as a stockholder of H&E, may have and answers to those questions. This summary term sheet highlights selected information from this offer to purchase (this “Offer to Purchase”) and may not contain all of the information that is important to you and is qualified in its entirety by the more detailed descriptions and explanations contained in this Offer to Purchase and the related letter of transmittal (the “Letter of Transmittal”), which, together with any amendments or supplements hereto and thereto, collectively constitute the “Offer.” To better understand the Offer and for a complete description of the terms of the Offer, you should read this Offer to Purchase, the Letter of Transmittal and the other documents to which we refer you carefully and in their entirety. Questions or requests for assistance may be directed to Innisfree M&A Incorporated, our information agent (the “Information Agent”), at the address and telephone numbers set forth for the Information Agent on the back cover of this Offer to Purchase. Unless otherwise indicated in this Offer to Purchase or the context otherwise requires, all references in this Offer to Purchase to “we,” “our” or “us” refer to Merger Sub.

Who is offering to buy my Shares?

We are UR Merger Sub VII Corporation, a Delaware corporation, or “Merger Sub,” formed for the purpose of making the Offer and merging with and into H&E. We are a wholly owned subsidiary of United Rentals (North America), Inc., a Delaware corporation, or “URNA.” URNA is a wholly owned subsidiary of United Rentals, Inc., a Delaware corporation, or “URI.” We are making this Offer pursuant to the Agreement and Plan of Merger, dated as of January 13, 2025 (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Merger Agreement”), by and among URI, Merger Sub and H&E. See the “Introduction” and Section 8 — “Certain Information Concerning Merger Sub, URNA and URI.”

How many Shares are you offering to purchase in the Offer?

We are making the Offer to purchase any and all of the outstanding Shares on the terms and subject to the conditions set forth in this Offer to Purchase and the Letter of Transmittal. See the “Introduction” and Section 1 — “Terms of the Offer.”

Why are you making the Offer?

We are making the Offer pursuant to the Merger Agreement in order to acquire control of, and ultimately following the Merger, the entire equity interest in, H&E, while allowing H&E’s stockholders an opportunity to receive the Offer Price promptly after the Offer Acceptance Time (as defined below) (and in any event within three business days) by tendering their Shares pursuant to the Offer. If the Offer is consummated, subject to the satisfaction or waiver of the remaining conditions set forth in the Merger Agreement, we, URI and H&E will consummate the Merger as soon as practicable thereafter without any action by the stockholders of H&E in accordance with Section 251(h) of the General Corporation Law of the State of Delaware (the “DGCL”). At the effective time of the Merger (the “Effective Time”), H&E will become a wholly owned subsidiary of URI. See Section 12 — “Purpose of the Offer; Plans for H&E.”

How much are you offering to pay and what is the form of payment? Will I have to pay any fees or commissions?

We are offering to pay $92.00 per Share, net to the holder thereof in cash, without interest, less any applicable withholding of taxes. If you are the record owner of your Shares and you tender your Shares to us in the Offer, you will not have to pay brokerage fees, commissions or similar expenses. If you own your Shares through a broker, dealer, commercial bank, trust company or other nominee and such nominee tenders your Shares on your behalf, such nominee may charge you a fee for doing so. You should consult with your broker, dealer, commercial bank, trust company or other nominee to determine whether any charges will apply. See the “Introduction,” Section 1 — “Terms of the Offer” and Section 2 — “Acceptance for Payment and Payment for Shares.”

What does the H&E Board recommend?

The H&E Board has unanimously: (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are fair to and in the best interests of H&E and its stockholders, and declared it advisable to enter into the Merger Agreement with URI and Merger Sub, (ii) approved the execution, delivery and performance of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Offer and the Merger, in accordance with the DGCL, (iii) resolved that, subject to the terms of the Merger Agreement, the Merger shall be effected under Section 251(h) of the DGCL and (iv) resolved to recommend that H&E’s stockholders accept the Offer and tender their Shares to Merger Sub pursuant to the Offer, in each case, upon the terms and subject to the conditions of the Merger Agreement.

See the “Introduction” and Section 12 — “Purpose of the Offer; Plans for H&E” and H&E’s Solicitation/Recommendation Statement on Schedule 14D-9 (the “Schedule 14D-9”) that is being filed with the Securities and Exchange Commission (the “SEC”) and, together with this Offer to Purchase, the Letter of Transmittal and other related materials, mailed to H&E’s stockholders in connection with the Offer.

What are the most significant conditions to the Offer?

The Offer is conditioned upon, among other things:

•

the number of Shares validly tendered (and not properly withdrawn) prior to the expiration of the Offer (excluding Shares tendered pursuant to guaranteed delivery procedures that were not received prior to the Expiration Date), together with the Shares then owned by Merger Sub, representing at least one Share more than 50% of the then outstanding Shares (the “Minimum Condition”);

•

the accuracy of H&E’s representations and warranties contained in the Merger Agreement (subject to customary materiality qualifiers);

•

H&E’s performance of its obligations under the Merger Agreement in all material respects;

•

the absence of a Company Material Adverse Effect (as defined below) that has occurred after the date of the Merger Agreement and that is continuing;

•

the absence of any legal or regulatory restraint that prevents the consummation of the Offer or the Merger and the expiration of any waiting periods applicable to the Offer and the Merger under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “Regulatory Approval Condition”);

•

the absence of a termination of the Merger Agreement in accordance with its terms (the “Termination Condition”);

•

the commencement and completion of the Marketing Period (as defined below); and

•

other customary conditions described in this Offer to Purchase as set forth in Section 15 — “Conditions to the Offer.”

We and URI may waive any condition, in whole or in part, other than the Minimum Condition, at any time and from time to time, without H&E’s consent. See Section 15 — “Conditions to the Offer.”

Is the Offer subject to any financing condition?

No. The Offer is not subject to any financing condition.

Do you have the financial resources to pay for all Shares?

Yes. The total amount of funds required by us to purchase all Shares pursuant to the Offer and to pay related fees and expenses is approximately $4.9 billion, including the repayment of $1.4 billion of H&E’s net debt. URI will provide or cause to be provided to us sufficient funds to pay all fees and expenses contemplated by the Merger Agreement, including to purchase all Shares validly tendered in the Offer, and will provide funding for our acquisition of the remaining Shares in the Merger.

We expect to fund such amount with a combination of newly issued debt and/or borrowings and drawings using existing capacity under our ABL facility. In addition, we have agreed to the terms of a commitment letter that have been executed by Morgan Stanley Senior Funding, Inc. (“Morgan Stanley”), Wells Fargo Securities, LLC (“WFS”) and Wells Fargo Bank, National Association (together with WFS, “Wells Fargo” and together with Morgan Stanley and any other initial lenders, the “Initial Lenders”) for a senior unsecured bridge facility in an aggregate principal amount of up to $3,800.0 million (the “Bridge Facility”). Based upon newly issued debt and/or borrowings and existing capacity under our ABL facility (or amounts available under the Bridge Facility if such financing transactions are not completed), we will have sufficient funds to pay the Offer Price for all Shares in the Offer.

The Bridge Facility arranged for us in connection with the Offer is subject to limited conditions.

See Section 9 — “Source and Amount of Funds.”

Is your financial condition relevant to my decision to tender pursuant to the Offer?

No. We do not think that our financial condition is relevant to your decision whether to tender Shares and accept the Offer because:

•

the consummation of the Offer is not subject to any financing condition;

•

the Offer is being made for all Shares solely for cash;

•

if the Offer is consummated, we will acquire all remaining Shares in the Merger for the same cash price as was paid in the Offer (i.e., the Offer Price); and

•

we will have sufficient funds available to purchase all Shares validly tendered and not properly withdrawn pursuant to the Offer and to provide funding for the Merger, and the Bridge Facility arranged for us in connection with the Offer provides for a “certain funds” commitment.

See Section 9 — “Source and Amount of Funds” and Section 11 — “The Merger Agreement; Other Agreements.”

What percentage of Shares do you or your controlled affiliates currently own?

None of Merger Sub, URNA or URI or any of their respective controlled affiliates currently own any Shares.

How long do I have to decide whether to tender pursuant to the Offer?

You will be able to tender your Shares pursuant to the Offer until one minute after 11:59 p.m., Eastern Time, on Tuesday, February 25, 2025 (the “Expiration Date,” unless Merger Sub extends the Offer pursuant to and in accordance with the terms of the Merger Agreement, in which event “Expiration Date” will mean the latest time and date at which the Offer, as so extended by us, will expire). Further, if you cannot deliver everything that is required in order to make a valid tender in accordance with the terms of the Offer by the Expiration Date, you may be able to use a guaranteed delivery procedure by which a broker, a bank or any other fiduciary that is an Eligible Institution (as defined in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Signature Guarantees”) may guarantee that the missing items will be received by Equiniti Trust Company, LLC, our depositary for the Offer (the “Depositary”), within one NASDAQ Global Select Market (“NASDAQ”) trading day. Please give your broker, dealer, commercial bank, trust company or other nominee instructions in sufficient time to permit such nominee to tender your Shares by the Expiration Date. See Section 1 — “Terms of the Offer” and Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

Can the Offer be extended and, if so, under what circumstances can or will the Offer be extended?

Yes, the Offer can be extended. In some cases, we are required to extend the Offer beyond the initial Expiration Date, but in no event will we be required to extend the Offer beyond the earlier to occur of (x) the valid termination of the Merger Agreement in accordance with its terms and (y) one business day prior to the Termination Date (as defined below) (such earlier occurrence, the “Extension Deadline”).

Pursuant to the Merger Agreement, we are required to extend the Offer:

•

for additional periods of up to 10 business days per extension if, as of the scheduled Expiration Date, any Offer Condition (as defined below) is not satisfied (unless such condition is waivable by Merger Sub or URI and has been waived), to permit such Offer Condition to be satisfied;

•

from time to time for any period required by applicable law, any interpretation or position of the SEC, the staff thereof or the New York Stock Exchange (“NYSE”) applicable to the Offer; and

•

until the later of the No-Shop Period Start Date (as defined below) or the date when any Excluded Parties (as defined below) cease to be Excluded Parties (and if any such date is not a business day, the first business day thereafter).

The Merger Agreement provides that we are not required to extend the Offer beyond the Extension Deadline. The “Termination Date” means May 13, 2025, subject to potential extensions for an additional 30 days if certain regulatory conditions remain outstanding as of the Termination Date, and to the date that is five business days following the then-scheduled end date of the Marketing Period (as defined below) in the event that the Marketing Period has commenced but has not been completed as of the Termination Date, as summarized below in Section 11 — “The Merger Agreement; Other Agreements — The Merger Agreement — Termination of the Merger Agreement.” If we extend the Offer, such extension will extend the time that you will have to tender your Shares. See Section 1 — “Terms of the Offer.”

How will I be notified if the time period during which I can tender my Shares pursuant to the Offer is extended?

If we extend the Offer, we will inform the Depositary of that fact and will make a public announcement of the extension no later than 9:00 a.m., Eastern Time, on the next business day after the previously scheduled Expiration Date. See Section 1 — “Terms of the Offer.”

How do I tender my Shares pursuant to the Offer?

To tender your Shares pursuant to the Offer, you must deliver the certificates representing your Shares, together with a properly completed and duly executed Letter of Transmittal, together with any required

signature guarantees (or, in the case of a book-entry transfer of Shares, either such Letter of Transmittal or an Agent’s Message (as defined in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Valid Tender of Shares”) in lieu of such Letter of Transmittal), and any other documents required by the Letter of Transmittal, to the Depositary prior to the Expiration Date. If your Shares are held in street name (i.e., through a broker, dealer, commercial bank, trust company or other nominee), your Shares can be tendered by such nominee through The Depository Trust Company (“DTC”). You should contact the institution that holds your Shares for more details.

If you are unable to deliver any required document or instrument to the Depositary prior to the Expiration Date, you may gain some extra time by having a broker, a bank or any other fiduciary that is an eligible guarantor institution guarantee that the missing items will be received by the Depositary by using the enclosed notice of guaranteed delivery (the “Notice of Guaranteed Delivery”). For the tender to be valid, however, the Depositary must receive the Notice of Guaranteed Delivery prior to the Expiration Date and must then receive the missing items within one NASDAQ trading day after the date of execution of such Notice of Guaranteed Delivery. See Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Guaranteed Delivery.”

Have any stockholders already agreed to tender their Shares in the Offer?

No. We have not entered into any agreements with any of H&E’s stockholders with respect to their tender of Shares into the Offer. H&E has been advised, however, that all of its directors and executive officers currently intend to tender, or cause to be tendered pursuant to the Offer, all of their transferrable Shares held of record and beneficially owned by such persons immediately prior to the expiration of the Offer. The foregoing does not include any Shares over which, or with respect to which, any such executive officer or director acts in a fiduciary capacity or is subject to the instructions of a third party with respect to such tender or is a Company equity award held by such executive officer or director.

Until what time may I withdraw previously tendered Shares?

Except as otherwise provided in Section 4 — “Withdrawal Rights,” tenders of Shares made pursuant to the Offer are irrevocable. Shares tendered pursuant to the Offer may be withdrawn at any time prior to the Expiration Date. Thereafter, tenders of Shares are irrevocable, except that they may also be withdrawn after 60 days from the commencement of the Offer, unless such Shares have already been accepted for payment by us pursuant to the Offer. If you tendered your Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct such nominee to arrange for the withdrawal of your Shares. See Section 4 — “Withdrawal Rights.”

How do I properly withdraw previously tendered Shares?

To properly withdraw any of your previously tendered Shares, you must deliver a written notice of withdrawal with the required information (as specified in this Offer to Purchase and in the Letter of Transmittal) to the Depositary while you still have the right to withdraw Shares. If you tendered your Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct such nominee to arrange for the proper withdrawal of your Shares. See Section 4 — “Withdrawal Rights.”

Upon the successful consummation of the Offer, will Shares continue to be publicly traded?

No. Following the consummation of the Offer, we, URI and H&E expect to consummate the Merger as soon as practicable in accordance with Section 251(h) of the DGCL. Following the Merger, the Shares will no longer be publicly traded and the Surviving Corporation will be a wholly owned subsidiary of URI. Following the consummation of the Merger (the “Closing”), we intend to cause H&E to be delisted from NASDAQ and deregistered under the Securities Exchange Act of 1934, as amended, and the regulations thereunder (the “Exchange Act”). See Section 13 — “Certain Effects of the Offer.”

Will the Offer be followed by the Merger if all of the Shares are not tendered in the Offer?

Yes. If at least such number of Shares as satisfies the Minimum Condition are validly tendered and accepted for payment by us in the Offer, and the other conditions to the Merger are satisfied or waived (see

Section 11 — “The Merger Agreement; Other Agreements — The Merger Agreement — Merger Closing Conditions”), then, in accordance with the terms of the Merger Agreement, we will complete the Merger without a vote of H&E’s stockholders pursuant to Section 251(h) of the DGCL. See Section 1 — “Terms of the Offer.”

If you do not consummate the Offer, will you nevertheless consummate the Merger?

No. None of us, URI or H&E are under any obligation to pursue or consummate the Merger if the Offer has not been first consummated.

Will there be a subsequent offering period?

No. Pursuant to Section 251(h) of the DGCL and due to the obligations of URI, us and H&E under the Merger Agreement, we expect the Merger to occur as soon as practicable following the Offer Acceptance Time without a subsequent offering period. See Section 1 — “Terms of the Offer.”

If I object to the price being offered, will I have appraisal rights?

Appraisal rights are not available to the holders or beneficial owners of Shares in connection with the Offer. However, if the Merger is consummated, the holders and beneficial owners of Shares immediately prior to the Effective Time who (i) did not tender their Shares in the Offer, (ii) follow the procedures set forth in Section 262 of the DGCL and (iii) do not thereafter withdraw their demand for appraisal of such Shares or otherwise lose their appraisal rights, in each case in accordance with the DGCL, will be entitled to have their Shares appraised by the Delaware Court of Chancery and receive payment of the “fair value” of such Shares, exclusive of any element of value arising from the accomplishment or expectation of the Merger, together with a fair rate of interest, as determined by such court. The “fair value” could be higher or lower than, or the same as, the Offer Price or the consideration payable in the Merger (which is equivalent in amount to the Offer Price). See Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights.” Concurrently with the commencement of the Offer, H&E is distributing the Schedule 14D-9, which contains important information regarding how a holder or beneficial owner of Shares may exercise its appraisal rights.

If I decide not to tender my Shares pursuant to the Offer, how will the Offer affect my Shares?

Subject to the satisfaction of the remaining conditions set forth in the Merger Agreement, Merger Sub, URI and H&E will consummate the Merger as soon as practicable following the Offer Acceptance Time. If the Merger is consummated, then stockholders who did not tender their Shares pursuant to the Offer will receive $92.00 per Share, net to the holder thereof in cash, without interest (the “Per Share Price”), the same amount of cash per Share that they would have received had they tendered their Shares pursuant to the Offer (i.e., the Offer Price), less any applicable withholding of taxes and subject to any appraisal rights properly exercised by such stockholders in accordance with the DGCL. Therefore, if the Merger takes place, the only differences to you between tendering your Shares pursuant to the Offer and not tendering your Shares pursuant to the Offer would be that, if you tender your Shares, you may be paid earlier and no appraisal rights will be available. No interest will be paid for Shares acquired in the Merger. Because the Merger will be governed by Section 251(h) of the DGCL, no stockholder vote will be required to consummate the Merger.

Furthermore, following the Offer, it is possible that the Shares may no longer constitute “margin securities” for the purposes of the margin regulations of the Federal Reserve Board, in which event the Shares would be ineligible as collateral for margin loans made by brokers. See Section 13 — “Certain Effects of the Offer.”

See Section 11 — “The Merger Agreement; Other Agreements” and Section 13 — “Certain Effects of the Offer.”

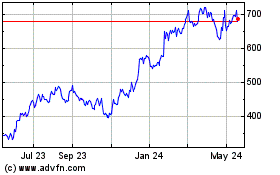

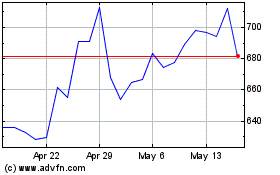

What is the market value of my Shares as of a recent date and the “premium” I am receiving?

The Offer Price of $92.00 per Share represents an approximate:

•

109.4% premium over the closing price per Share of $43.94 reported on NASDAQ on January 13, 2025, the last full trading day before we announced the execution of the Merger Agreement and the Offer; and

•

70.0% premium over the volume weighted-average price of the Shares of $54.12 for the 60-day period ending on January 13, 2025.

On January 27, 2025, the last trading day before we commenced the Offer, the closing price per Share reported on NASDAQ was $88.33 per Share.

We encourage you to obtain a recent quotation for Shares in deciding whether to tender your Shares. See Section 6 — “Price Range of Shares; Dividends.”

If I tender my Shares, when and how will I get paid?

If the conditions to the Offer as set forth in Section 15 — “Conditions to the Offer” are satisfied or waived and we consummate the Offer and accept your Shares for payment, you will be entitled to promptly (but no later than within three business days following the Offer Acceptance Time) receive an amount equal to the number of Shares you tendered pursuant to the Offer multiplied by the Offer Price, net to you in cash, without interest, less any applicable withholding of taxes. We will pay for your validly tendered and not properly withdrawn Shares by depositing the aggregate Offer Price therefor with the Depositary, which will act as your agent for the purpose of receiving payments from us and transmitting such payments to you. In all cases, payment for tendered Shares will be made only after timely receipt by the Depositary of (i) certificates representing such Shares or a confirmation of a book-entry transfer of such Shares as described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Book-Entry Transfer,” (ii) a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees or, in the case of a book-entry transfer of Shares, either such Letter of Transmittal or an Agent’s Message (as defined in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Valid Tender of Shares”) in lieu of such Letter of Transmittal, and (iii) any other required documents for such Shares. See Section 1 — “Terms of the Offer” and Section 2 — “Acceptance for Payment and Payment for Shares.”

What will happen to my equity awards in the Offer?

The Offer is being made only for outstanding Shares and is not being made for any equity awards of H&E that have not vested and/or settled into Shares prior to the Expiration Date.

At the Effective Time, each H&E restricted stock unit award whose vesting is conditioned in full or in part based on achievement of performance goals or metrics (each, an “H&E PSU”), and certain awards of restricted stock of H&E (an “H&E Single-Trigger RSA”) specified in the Merger Agreement that are, in each case, outstanding as of immediately prior to the Effective Time will be fully vested, cancelled and automatically converted, without any required action on the part of the holder thereof, into the right to receive an amount in cash equal to the product of (A) the aggregate number of Shares subject to such H&E Single-Trigger RSA or H&E PSU, as applicable, immediately prior to the Effective Time (together, in the case of H&E PSUs, with any accrued and unpaid dividends or dividend equivalents corresponding to such H&E PSU), with any performance conditions deemed to be earned based on “target” performance for any performance periods that have not ended prior to the Effective Time and “actual” performance for any performance periods that have ended prior to the Effective Time), multiplied by (B) the Offer Price, less any applicable withholding taxes.

At the Effective Time, each H&E restricted stock award (an “H&E RSA”) that is unvested as of immediately prior to the Effective Time and is not an H&E Single-Trigger RSA described above will be cancelled and be substituted with an award of restricted stock units of URI granted under the URI 2019 Long-Term Incentive Plan in respect of a number of shares of common stock, $0.01 par value, of URI (each, a “URI RSU”) equal to (rounded down to the nearest whole number) (A) the number of Shares subject to such H&E RSA immediately prior to the Effective Time multiplied by (B) (x) the Per Share Price divided by (y) the volume weighted average of the closing sale prices per share of the common stock, $0.01 par value, of URI on the New York Stock Exchange on each of the five full consecutive trading days ending on and including the third business day prior to the date on which the closing of the Merger occurs. Except as specifically provided in the Merger Agreement, following the Effective Time, each URI RSU will vest according to the same vesting schedule and will have forfeiture conditions no less favorable to the holder

of such URI RSU than the forfeiture conditions that were applicable to the corresponding H&E RSA immediately prior to the Effective Time.

See Section 11 — “The Merger Agreement; Other Agreements — The Merger Agreement — Treatment of H&E Equity Awards.”

What are the U.S. federal income tax consequences of the Offer and the Merger?

The receipt of cash by you in exchange for your Shares pursuant to the Offer or the Merger will be a taxable transaction for U.S. federal income tax purposes if you are a United States Holder (as defined in Section 5 — “Certain Material U.S. Federal Income Tax Consequences of the Offer and the Merger — United States Holders”). In general, you will recognize gain or loss equal to the difference between your adjusted tax basis in Shares that you tender pursuant to the Offer or exchange in the Merger and the amount of cash you receive for such Shares. If you are a United States Holder and you hold your Shares as a capital asset, the gain or loss that you recognize will be a capital gain or loss and will be treated as a long-term capital gain or loss if you have held such Shares for more than one year. If you are a Non-United States Holder (as defined in Section 5 — “Certain Material U.S. Federal Income Tax Consequences of the Offer and the Merger — Non-United States Holders”), then except as described below in Section 5 — “Certain Material U.S. Federal Income Tax Consequences of the Offer and the Merger — Non-United States Holders,” you will generally not be subject to U.S. federal income tax on any gain recognized on Shares you tender pursuant to the Offer or exchange in the Merger. You should consult your tax advisor about the particular tax consequences to you of tendering your Shares pursuant to the Offer, exchanging your Shares in the Merger or exercising appraisal rights. See Section 5 — “Certain Material U.S. Federal Income Tax Consequences of the Offer and the Merger” for a discussion of certain material U.S. federal income tax consequences of tendering Shares pursuant to the Offer or exchanging Shares in the Merger.

To whom should I talk if I have additional questions about the Offer?

You may call Innisfree M&A Incorporated, the Information Agent, by telephone at (877) 687-1875 (stockholders toll free) or (212) 750-5833 (banks and brokers).

To the Holders of Shares of H&E:

INTRODUCTION

The Offer is being made pursuant to the Merger Agreement by and among URI, H&E and us. We are offering to purchase any and all of the outstanding Shares at the Offer Price, without interest, less any applicable withholding of taxes, upon the terms and subject to the conditions set forth in the Offer.

The Offer and the withdrawal rights will expire at the Expiration Date, unless the Offer is extended or the Merger Agreement has been earlier terminated in accordance with its terms. Under no circumstances will interest be paid with respect to the purchase of Shares pursuant to the Offer, regardless of any extension of the Offer or any delay in making payment for Shares.

If you are a record owner of Shares and you tender such Shares directly to the Depositary in accordance with the terms of this Offer, we will not charge you brokerage fees, commissions or, except as set forth in Instruction 6 of the Letter of Transmittal, stock transfer taxes on the sale of Shares pursuant to the Offer. However, if you do not complete and sign the Internal Revenue Service (“IRS”) Form W-9 that is enclosed with the Letter of Transmittal or other applicable form, you may be subject to backup withholding at the applicable statutory rate on the gross proceeds payable to you. See Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Backup Withholding.” Stockholders with Shares held in street name by a broker, dealer, bank, trust company or other nominee should consult with such nominee to determine if they will be charged any service fees or commissions. We will pay all charges and expenses of the Depositary and the Information Agent incurred in connection with the Offer. See Section 18 — “Fees and Expenses.”

Subject to the provisions of the Merger Agreement, as soon as practicable following the Offer Acceptance Time, we, URI and H&E will cause the Merger to be consummated by filing with the Secretary of State of the State of Delaware a certificate of merger (the “Certificate of Merger”), in accordance with the relevant provisions of the DGCL. The Merger will become effective upon the filing of the Certificate of Merger or at such later time as URI, Merger Sub and H&E agree in writing and specify in the Certificate of Merger, at which time Merger Sub will merge with and into H&E, with H&E continuing as the Surviving Corporation and a wholly owned subsidiary of URI. At the Effective Time, each Share then outstanding (other than Shares that are held by any stockholders who properly demand appraisal in connection with the Merger as described in Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights”) will be converted into the right to receive the Offer Price, without interest, less any applicable withholding of taxes, except for Shares then owned by URI, Merger Sub or H&E, which Shares will be cancelled and will cease to exist, and no consideration will be delivered in exchange therefor.

Section 11 — “The Merger Agreement; Other Agreements” more fully describes the Merger Agreement. Certain material U.S. federal income tax consequences of the sale of Shares pursuant to the Offer and the exchange of Shares pursuant to the Merger are described in Section 5 — “Certain Material U.S. Federal Income Tax Consequences of the Offer and the Merger.”

The H&E Board has unanimously: (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are fair to and in the best interests of H&E and its stockholders, and declared it advisable to enter into the Merger Agreement with URI and Merger Sub, (ii) approved the execution, delivery and performance of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Offer and the Merger, in accordance with the DGCL, (iii) resolved that, subject to the terms of the Merger Agreement, the Merger shall be effected under Section 251(h) of the DGCL and (iv) resolved to recommend that H&E’s stockholders accept the Offer and tender their Shares to Merger Sub pursuant to the Offer, in each case, upon the terms and subject to the conditions of the Merger Agreement.

A more complete description of the H&E Board’s reasons for authorizing and approving the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, is set forth in the Schedule 14D-9 that is being filed with the SEC and, together with this Offer to Purchase, the Letter of Transmittal and other related materials, mailed to H&E’s stockholders in connection with the Offer. Stockholders should carefully read the information set forth in the Schedule 14D-9 in its entirety.

The Offer is not subject to any financing condition.

The Offer is conditioned upon, among other things, the satisfaction of the Minimum Condition and the satisfaction or waiver by us and URI of the Regulatory Approval Condition and the other customary conditions described in Section 15 — “Conditions to the Offer.”

According to H&E, as of January 13, 2025 there were (a) 36,604,864 Shares issued and outstanding, (b) no shares of preferred stock of H&E were issued and outstanding, and (c) 4,481,494 Shares were issued and held by H&E in its treasury, (d) 276,320 Shares were subject to H&E RSAs, (e) 220,581 and 441,162 Shares were subject to issuance pursuant to H&E PSUs (assuming each of target and maximum achievement of all performance goals, respectively), (f) an aggregate amount of $0 in respect of accrued but unpaid dividends or dividend equivalents in respect of outstanding H&E RSAs and $606,598 and $1,213,196 in respect of accrued but unpaid dividends or dividend equivalents in respect of outstanding H&E PSUs (assuming each of target and maximum achievement of all performance goals, respectively); and (g) 2,228,894 Shares were reserved for future issuance pursuant to the Amended and Restated 2016 Stock-Based Incentive Compensation Plan and 2016 Stock-Based Incentive Compensation Plan, in each case, (the “H&E Equity Plans”). Based upon the foregoing and assuming that (i) no other Shares were or are issued after January 13, 2025 and (ii) no H&E Equity Plans terminated or expired after January 13, 2025 and no equity-based awards have been granted or expired after January 13, 2025, the Minimum Condition would be satisfied if approximately 18,302,433 Shares are validly tendered and not properly withdrawn prior to the Expiration Date. The actual number and percentage of outstanding Shares that are required to be tendered to satisfy the Minimum Condition will depend on the actual number of Shares outstanding at the Expiration Date.

The Merger will be governed by Section 251(h) of the DGCL. Accordingly, subject to the satisfaction or waiver of the remaining conditions set forth in the Merger Agreement, URI, we and H&E will cause the Merger to become effective as soon as practicable following the Offer Acceptance Time without a meeting of stockholders of H&E in accordance with Section 251(h) of the DGCL. See Section 11 — “The Merger Agreement; Other Agreements — The Merger Agreement — Application of Section 251(h) of the DGCL.” At the Effective Time, our directors immediately prior to the Effective Time will be the only directors of the Surviving Corporation.

Appraisal rights are not available to the holders or beneficial owners of Shares in connection with the Offer. However, if the Merger is consummated, the holders and beneficial owners of Shares immediately prior to the Effective Time who (i) did not tender their Shares in the Offer, (ii) follow the procedures set forth in Section 262 of the DGCL and (iii) do not thereafter withdraw their demand for appraisal of such Shares or otherwise lose their appraisal rights, in each case in accordance with the DGCL, will be entitled to have their Shares appraised by the Delaware Court of Chancery and receive payment of the “fair value” of such Shares, exclusive of any element of value arising from the accomplishment or expectation of the Merger, together with a fair rate of interest, as determined by such court. The “fair value” could be higher or lower than, or the same as, the Offer Price or the consideration payable in the Merger (which is equivalent in amount to the Offer Price). See Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights.”

This Offer to Purchase and the Letter of Transmittal contain important information that should be read carefully before any decision is made with respect to the Offer.

THE TENDER OFFER

1.

Terms of the Offer.

Upon the terms and subject to the conditions to the Offer (including, if the Offer is extended or amended, the terms and conditions of such extension or amendment), Merger Sub will (and URI will cause Merger Sub to) promptly, and in no event later than 9:00 a.m., Eastern Time one business day after the Expiration Date, irrevocably accept for payment all Shares validly tendered (and not properly withdrawn) pursuant to the Offer (the time of such acceptance, the “Offer Acceptance Time”) and as promptly as practicable after the Offer Acceptance Time (and in any event within three business days) pay for all such Shares.

The Offer is not subject to any financing condition. The Offer is conditioned upon the satisfaction of the Minimum Condition, the satisfaction or waiver by us or URI of the Regulatory Approval Condition and the other customary conditions described in Section 15 — “Conditions to the Offer.”

We expressly reserve the right to (i) increase the amount of cash constituting the Offer Price, (ii) waive any condition (to the extent permitted under applicable laws) described in Section 15 — “Conditions to the Offer” (each, an “Offer Condition”) and (iii) make any other changes to the terms and conditions of the Offer not inconsistent with the terms of the Merger Agreement; provided, however, that, notwithstanding anything to the contrary contained in the Merger Agreement, without the prior written consent of H&E, URI and Merger Sub will not, (A) decrease the Offer Price (except as expressly permitted by the Merger Agreement), (B) change the form of consideration payable in the Offer (other than increasing the cash consideration payable in the Offer), (C) decrease the maximum number of Shares sought to be purchased in the Offer, (D) impose any conditions or requirements to the Offer other than the Offer Conditions, (E) amend, modify or waive the Minimum Condition, Termination Condition or Regulatory Approval Condition, (F) amend, modify or supplement any of the Offer Conditions in a manner that adversely affects, or would reasonably be expected to adversely affect, any holder of Shares in its capacity as such, (G) except as otherwise required or expressly permitted by the Merger Agreement, withdraw or terminate the Offer or accelerate, extend or otherwise change the Expiration Date, or (H) provide for any “subsequent offering period” (or any extension thereof) within the meaning of Rule 14d-11 under the Exchange Act.

There will not be a subsequent offering period for the Offer. Pursuant to the Merger Agreement, subject to the satisfaction or waiver of the remaining conditions set forth in the Merger Agreement, we, URI and H&E will take all necessary action to cause the Merger to become effective as soon as practicable following the Offer Acceptance Time. Because the Merger will be governed by Section 251(h) of the DGCL, no stockholder vote will be required to consummate the Merger. We do not expect there to be a significant period of time between the consummation of the Offer and the Closing.

The Merger Agreement separately provides that we are required to extend the Offer beyond the initial Expiration Date (a) for additional periods of up to 10 business days per extension if, as of the scheduled Expiration Date, any Offer Condition (as defined below) is not satisfied (unless such condition is waivable by Merger Sub or URI and has been waived), to permit such Offer Condition to be satisfied; (b) from time to time for any period required by applicable law, any interpretation or position of the SEC, the staff thereof or the NYSE applicable to the Offer; and (c) until the later of the No-Shop Period Start Date (as defined below) or the date when any Excluded Parties (as defined below) cease to be Excluded Parties (and if any such date is not a business day, the first business day thereafter). The Merger Agreement provides that we are not required or, without the prior consent of H&E, permitted, to extend the Offer beyond the Extension Deadline, as summarized below in Section 11 — “The Merger Agreement; Other Agreements — The Merger Agreement — Termination of the Merger Agreement.” For purposes of the Offer, as provided under the Exchange Act, a “business day” means each day that is not a Saturday, Sunday or other day on which the Federal Reserve Bank of New York is closed.

If we extend the Offer, are delayed in our acceptance for payment of Shares, are delayed in payment after the Offer Acceptance Time or are unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to our rights under the Offer, the Depositary may retain tendered Shares on our behalf, and such Shares may not be withdrawn except to the extent that tendering stockholders are entitled to withdrawal rights as described in this Offer to Purchase under Section 4 — “Withdrawal Rights.”

However, our ability to delay the payment for Shares that we have accepted for payment is limited by Rule 14e-1(c) under the Exchange Act, which requires us to promptly pay the consideration offered or return the securities deposited by or on behalf of stockholders promptly after the termination or withdrawal of the Offer.

If we make a material change in the terms of the Offer or the information concerning the Offer or if we waive a material condition of the Offer, we will disseminate additional tender offer materials and extend the Offer if and to the extent required by Rules 14d-4(d)(1), 14d-6(c) and 14e-1 under the Exchange Act and the interpretations thereunder. The minimum period during which an offer must remain open following material changes in the terms of an offer or information concerning an offer, other than a change in price or a change in percentage of securities sought, will depend upon the facts and circumstances, including the relative materiality of the terms or information changes and the appropriate manner of dissemination. In a published release, the SEC has stated that, in its view, an offer should remain open for a minimum of five business days from the date the material change is first published, sent or given to stockholders, and that if material changes are made with respect to information that approaches the significance of price and the percentage of securities sought, a minimum period of 10 business days may be required to allow for adequate dissemination to stockholders and investor response. In accordance with the foregoing view of the SEC and applicable law, if, prior to the Expiration Date, and subject to the limitations of the Merger Agreement, we change the number of Shares being sought or the consideration offered pursuant to the Offer, and if the Offer is scheduled to expire at any time earlier than the 10th business day from the date that notice of such change is first published, sent or given to stockholders, the Offer will be extended at least until the expiration of such 10th business day.

If, prior to the Expiration Date, we increase the consideration being paid for Shares, such increased consideration will be paid to all stockholders whose Shares are purchased in the Offer, whether or not such Shares were tendered before the announcement of such increase in consideration.

Any extension, delay, termination, waiver or amendment of the Offer will be followed as promptly as practicable by public announcement thereof, such announcement in the case of an extension to be made no later than 9:00 a.m., Eastern Time, on the next business day after the previously scheduled Expiration Date. Subject to applicable law (including Rules 14d-4(d), 14d-6(c) and 14e-1 under the Exchange Act, which require that material changes be promptly disseminated to stockholders in a manner reasonably designed to inform them of such changes) and without limiting the manner in which we may choose to make any public announcement, we will have no obligation to publish, advertise or otherwise communicate any such public announcement other than by issuing a press release to a national news service.

This Offer to Purchase and the Letter of Transmittal will be mailed to record holders of Shares whose names appear on H&E’s stockholder list and will be furnished, for subsequent transmittal to beneficial owners of Shares, to brokers, dealers, commercial banks, trust companies and other nominees whose names, or the names of whose nominees, appear on the stockholder list or, if applicable, who are listed as participants in a clearing agency’s security position listing.

2.

Acceptance for Payment and Payment for Shares.

Upon the terms and subject to the conditions of the Offer (including, if the Offer is extended or amended, the terms and conditions of any such extension or amendment), Merger Sub will (and URI will cause Merger Sub to) promptly, and in no event later than 9:00 a.m., Eastern Time, one business day after the Expiration Date, irrevocably accept for payment all Shares validly tendered (and not properly withdrawn) pursuant to the Offer and as promptly as practicable after the Offer Acceptance Time (and in any event within three business days) pay for all such Shares.

In all cases, payment for Shares accepted for payment pursuant to the Offer will be made only after timely receipt by the Depositary of:

•

for Shares held as physical certificates, the certificates evidencing such Shares (“Share Certificates”) or, for Shares held in book-entry form, confirmation of a book-entry transfer of such Shares (a “Book-Entry Confirmation”) into the Depositary’s account at DTC, in each case pursuant to the procedures set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares”;

•

a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees, or, in the case of a book-entry transfer of Shares, either such Letter of Transmittal or an Agent’s Message in lieu of such Letter of Transmittal; and

•

any other documents required by the Letter of Transmittal.

Accordingly, tendering stockholders may be paid at different times depending upon when the above referenced items (including Share Certificates or Book-Entry Confirmations with respect to tendered Shares) are actually received by the Depositary.

For purposes of the Offer, we will be deemed to have accepted for payment, and thereby purchased, shares validly tendered and not properly withdrawn, if and when we give oral or written notice to the Depositary of our acceptance for payment of such Shares pursuant to the Offer. Upon the terms and subject to the conditions to the Offer, payment for Shares accepted for payment pursuant to the Offer will be made by deposit of the Offer Price therefor with the Depositary, which will act as agent for tendering stockholders for the purpose of receiving payments from us and transmitting such payments to tendering stockholders of record whose Shares have been accepted for payment. If, for any reason whatsoever, acceptance for payment of any Shares tendered pursuant to the Offer is delayed, or we are unable to accept for payment Shares tendered pursuant to the Offer, then, without prejudice to our rights under the Offer, the Depositary may, nevertheless, on our behalf, retain tendered Shares, and such Shares may not be withdrawn, except to the extent that the tendering stockholders are entitled to withdrawal rights as described in Section 4 — “Withdrawal Rights” and as otherwise required by Rule 14e-1(c) under the Exchange Act.

Under no circumstances will interest with respect to the Shares purchased pursuant to the Offer be paid, regardless of any extension of the Offer or delay in making such payment.

All questions as to the validity, form, eligibility (including time of receipt) and acceptance for payment of any tender of Shares will be determined by us in our sole discretion. We reserve the absolute right to reject any and all tenders determined by us not to be in proper form or the acceptance for payment of which may, in the opinion of our counsel, be unlawful.

Shares tendered by a Notice of Guaranteed Delivery will be excluded for purposes of determining whether the Minimum Condition has been satisfied.

If any tendered Shares are not accepted for payment for any reason pursuant to the terms and conditions of the Offer, or if Share Certificates are submitted evidencing more Shares than are tendered, Share Certificates evidencing unpurchased or untendered Shares will be returned, without expense, to the tendering stockholder (or, in the case of Shares tendered by book-entry transfer into the Depositary’s account at DTC pursuant to the procedure set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares,” such Shares will be credited to an account maintained at DTC), in each case, promptly following the expiration or termination of the Offer.

We reserve the right to transfer or assign in whole or in part from time to time to another wholly owned subsidiary of URI or us the right to purchase all or any Shares tendered pursuant to the Offer, but any such transfer or assignment will not relieve us of our obligations under the Offer and will in no way prejudice your rights to receive payment for Shares validly tendered and not withdrawn pursuant to the Offer.

3.

Procedures for Accepting the Offer and Tendering Shares.

Valid Tender of Shares. No alternative, conditional or contingent tenders will be accepted. In order for an H&E stockholder to validly tender Shares pursuant to the Offer, the stockholder must follow one of the following procedures:

•

for Shares held as physical certificates, the Share Certificates, a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees, and any other documents required by the Letter of Transmittal, must be received by the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase before the Expiration Date;

•

for Shares held in book-entry form, either a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees, or an Agent’s Message in lieu of such

Letter of Transmittal, and any other required documents, must be received by the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase, and such Shares must be delivered according to the book-entry transfer procedures described below under “Book-Entry Transfer” and a Book-Entry Confirmation must be received by the Depositary, in each case before the Expiration Date; or

•

for Shares tendered by a Notice of Guaranteed Delivery, the tendering stockholder must comply with the guaranteed delivery procedures described below under “Guaranteed Delivery” before the Expiration Date.

The term “Agent’s Message” means a message transmitted by DTC to, and received by, the Depositary and forming a part of a Book-Entry Confirmation that states that DTC has received an express acknowledgment from the participant in DTC’s systems tendering the Shares that are the subject of such Book-Entry Confirmation, that such participant has received and agrees to be bound by the terms of the Letter of Transmittal and that we may enforce such agreement against such participant.

Book-Entry Transfer. The Depositary will establish an account with respect to the Shares at DTC for purposes of the Offer within two business days after the date of this Offer to Purchase. Any financial institution that is a participant in DTC’s systems may make a book-entry delivery of Shares by causing DTC to transfer such Shares into the Depositary’s account at DTC in accordance with DTC’s procedures for such transfer. However, although delivery of Shares may be effected through book-entry transfer at DTC, a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees, or, in the case of a book-entry transfer, either such Letter of Transmittal or an Agent’s Message in lieu of such Letter of Transmittal, and any other required documents (for example, in certain circumstances, a completed IRS Form W-9 that is included in the Letter of Transmittal or a completed, applicable IRS Form W-8) must, in any case, be received by the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase prior to the Expiration Date, or the tendering stockholder must comply with the guaranteed delivery procedure described below. Delivery of documents to DTC does not constitute delivery to the Depositary.

Signature Guarantees. No signature guarantee is required on the Letter of Transmittal if:

•

the Letter of Transmittal is signed by each registered holder (which term, for purposes of this Section 3, includes any participant in DTC’s systems whose name appears on a security position listing as the owner of the Shares) of the Shares tendered therewith, unless such registered holder has completed either the box entitled “Special Delivery Instructions” or the box entitled “Special Payment Instructions” on the Letter of Transmittal; or

•

Shares tendered pursuant to such Letter of Transmittal are for the account of a financial institution (including most commercial banks, savings and loan associations and brokerage houses) that is a member of or participant in a recognized “Medallion Program” approved by the Securities Transfer Association Inc., including the Security Transfer Agents Medallion Program (STAMP), the Stock Exchange Medallion Program (SEMP) and the New York Stock Exchange Medallion Signature Program (MSP), or any other “eligible guarantor institution,” as such term is defined in Rule 17Ad-15 under the Exchange Act (each, an “Eligible Institution”).

In all other cases, all signatures on a Letter of Transmittal must be guaranteed by an Eligible Institution. See Instruction 5 of the Letter of Transmittal. If a Share Certificate is registered in the name of a person or persons other than the signatory of the Letter of Transmittal, or if payment is to be made or delivered to, or a Share Certificate not accepted for payment or not tendered is to be issued in the name of or returned to, a person other than the registered holder(s), then the Share Certificate must be endorsed or accompanied by appropriate duly executed stock powers, in either case signed exactly as the name(s) of the registered holder(s) appears on the Share Certificate, with the signature(s) on such Share Certificate or stock powers guaranteed by an Eligible Institution as provided in the Letter of Transmittal. See Instruction 5 of the Letter of Transmittal.

Guaranteed Delivery. If a stockholder desires to tender Shares pursuant to the Offer and the Share Certificates evidencing such stockholder’s Shares are not immediately available or such stockholder cannot deliver the Share Certificates and all other required documents to the Depositary prior to the Expiration Date,

or such stockholder cannot complete the procedure for delivery by book-entry transfer on a timely basis, such Shares may nevertheless be tendered, provided that all of the following conditions are satisfied:

•

such tender is made by or through an Eligible Institution;

•

a properly completed and duly executed Notice of Guaranteed Delivery, in the form made available by us, is received prior to the Expiration Date by the Depositary as provided below; and

•