Americas Gold and Silver Corporation (“the Company”)

(TSX: USA, NYSE American: USAS) is pleased to provide an

update on its ongoing work programs at the Galena Complex

(“Galena”) following the closing of the Galena consolidation and

recapitalization transaction (the “Transaction”) closed on December

19, 2024 (see associated press release dated December 19,

2024).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250224871832/en/

Figures 1, 2, 3 & 4: New Equipment

Ordered (Image credit: Americas Gold and Silver Corporation)

Significant progress has been made in identifying opportunities

and initiating action as part of the Company’s technical review and

optimization work to ensure that the Galena Complex reaches its

full production potential, underscoring the Company's ongoing

commitment to operational efficiency, safety, production growth,

and maximizing value from existing assets. This progress includes

initial work on the #3 shaft, a trade off study currently underway

at the mine and the ordering of new mining equipment to boost

productivity underground. The Company is also pleased to release

new drilling results that continue to demonstrate the geologic

prospectivity of the deposit and identify new veins that could be

brought into production with further drilling. Lastly, as a result

of an initial review of byproduct metallurgical performance, the

Company has also initiated further test work to evaluate the

potential to maximize recoveries of copper and antimony.

Key Highlights:

- #3 Shaft Hoist Upgrades Underway – The Company has

identified hoisting capacity as the primary bottleneck at the

Galena Complex. A multi-step upgrade plan for the #3 Hoist includes

increasing motor size, modifying the motor base, brake and control

system improvements, and installing a down-rope shaft communication

system. Completion is expected in Q4 2025.

- New Equipment Acquisition – To improve safety,

efficiency, and productivity, the Company has ordered five new

pieces of underground equipment, including one 4yd LHD, two 2yd

LHDs, and two 20-ton haul trucks. Initial deliveries are expected

in Q1 2025, with commissioning in Q2 2025.

- Metallurgical Sampling in Progress – A metallurgical

test program has been initiated to optimize concentrate sales by

assessing by-product recovery and payability. 1,000 drill hole

pulps from past Ag-Cu vein intersections have been shipped for

multi-element analysis, and flotation testing is underway at SGS

Laboratories in Lakefield, Canada to maximize recoveries of silver,

copper, antimony, and gold.

- Discovery of the 049 Vein – A new high-grade

silver-copper vein was intercepted while targeting the 072 vein.

Notable results include up to 1,731 opt Ag (53,839 g/t) and 16.3%

Cu over 0.15m true width. Three additional drill holes are in

progress to further define the resource and integrate it into

near-term production plans.

- 368 Vein Infill Drilling Program – Recent infill

drilling in the 360 Complex has confirmed the continuity of

economic mineralization and identified the shifting of higher

grades shift into a parallel shear structure. The results support

continued mining in this zone, with new development and resource

conversion ongoing.

Paul Huet, CEO of Americas Gold and Silver, commented: “The

first two months of review and optimization work undertaken at the

Galena Complex have been remarkably productive. I have been very

impressed by the energized workforce and the tremendous potential

of our primary silver asset. In my 35 years of mining, I have been

fortunate to lead several operational improvement projects, and I

am encouraged by both the opportunities and the commitments I have

seen from the team at Galena during our first 60 days as part of

the new Americas team.

Our review of the primary #3 hoisting shaft has yielded some

strong near-term and longer-term upgrade projects. We have also

ordered five new pieces of equipment, with initial deliveries this

quarter. On the exploration front, the Galena Complex continues to

demonstrate its exceptional exploration potential under the new

leadership team. The discovery of the 049 Vein, along with the

discovery of the new 181 & 182 Veins and the 368 Vein,

reaffirms our confidence in the long-term sustainability of this

asset. Finally, our review of metallurgical opportunities

identified during our due diligence has led to immediate action

with new sampling programs underway to optimize our concentrate by

product potential by capturing previously untapped metal value.

As we move forward with these exciting programs, we remain

committed to improving the productivity of the operation through a

safety-focused approach. We look forward to sharing further

progress on all of our initiatives in the coming months.”

Operational Revitalization through Technical Review and

Optimization Projects

The Company is investing significantly both in terms of capital

projects and equipment as well as management focus and operational

team excellence with the aim to potentially return the Galena

Complex back to historical production levels through growth and

operational efficiency improvements.

Major projects already underway include:

- Upgrades to #3 Hoist and Shaft

- Acquisition of five new pieces of underground mobile

equipment

- Comprehensive mine-wide trade off studies

- Metallurgical sampling program to identify by-product revenue

optimization opportunities

Upgrades to #3 Hoist

Hoisting capacity has been identified as the primary bottleneck

to increasing future production at the Galena Complex. Following

technical review, the Company has developed a multi-step plan to

begin improving productivity at the #3 Hoist, which is the primary

production hoist. The project aims to boost total hoisting capacity

significantly beyond the current 700tpd of total material hoisting.

The four primary components to this capital improvement are:

- Increasing motor size: The Company owns two 2,250HP

motors that are currently being refurbished by a supplier in nearby

Spokane, WA which will upgrade the current 1,750HP motor.

- Upgrade the existing motor base for the new motors: A

modest amount of construction work is required to modify the

pedestal which holds the current motor.

- Complete brake and Lilly upgrades: to allow for faster

ascent and decent and improved operational control to optimize skip

loading and hoisting cycle times.

- Installing a down rope shaft communication system with load

link: Modernizing the #3 Hoist by providing real time skip

loading weights and improved hoisting controls with short interval

control data collection for continual improvements to hoist safety

and productivity.

The #3 hoist upgrades are expected to be complete during Q4

2025.

Equipment Acquisition & Trade Off Studies

The Company moved quickly in Q4 2024 to buy equipment and

improve the existing mobile equipment fleet to provide immediate

improvements to safety, efficiency, and productivity. This included

securing five new pieces of equipment, further modernizing

underground operations. Delivery of the equipment is expected

during Q1 2025, with the equipment being rebuilt and commissioned

underground in Q2 2025. The initial equipment purchase

includes:

- One 4yd LHD

- Two 2yd LHDs

- Two 20t Trucks

Comprehensive Mine Wide Trade Off Studies

The Company has begun a series of technical planning exercises

and mine-wide trade off studies to comprehensively align the needs

of mine production to the infrastructure and equipment required to

unlock the improvements. These studies will utilize internal

expertise as well as external consultants over the next several

months and are expected to guide the Company on priority production

areas, new infrastructure and upgrades to existing infrastructure.

Further updates on the findings will be provided in the coming

months.

Metallurgical Optimization

The Galena Complex continuously achieves excellent silver and

lead recoveries; however, one of the early opportunities identified

through a comprehensive audit of historical concentrate production

is the opportunity to optimize concentrate sales by enhancing

by-product recovery and payability. A historical analysis of

shipped flotation concentrates from Galena since the year 2000

indicates significant payable by-products were present in past

production. Since 2015, only a Pb/Ag concentrate has been sold,

with no revenue realized for copper, antimony, or gold content. In

order to better understand this opportunity, a metallurgical test

program has been initiated to assess the potential of optimizing

recoveries of all payable metals. The program involves:

- 1,000 drill hole pulps from past Ag-Cu vein intersections have

been shipped for multi-element analysis.

- Flotation testing is underway at the industry leading SGS

Laboratory in Lakefield, Canada, focused on:

- Maximizing recoveries of silver, copper, antimony, and

gold.

- Evaluating the viability of differential flotation to generate

separate Pb/Ag and Cu/Ag concentrates.

Results from the metallurgical study will be used to guide

future mill process improvements providing potential revenue

enhancements.

Operational Excellence

The management team and the board strongly believe in the full

potential of the Galena Complex and are dedicated to unlocking its

existing potential. This commitment has been evident since the

closing of the Transaction with the continuous presence of the

executive team on site and the addition of a number of new hires to

both the corporate and management team on site providing real-time

training support to mine leadership and operations. These early

actions are necessary to create a step change in performance at the

operation. The team has successfully improved data collection and

reporting which has led to a number of modifications to existing

procedures to improve task execution and efficiency. The new

focused approach has generated several quick wins and has begun to

build a culture of operational team excellence on site where all

employees participate in idea generation and execution of new

processes. The results and responses to date have been

positive.

Exploration Update

Recent drilling campaigns have identified three new potentially

economic veins as well as completing a successful infill program to

de-risk near term production. The strong exploration results are

reflective of the high exploration potential and geologic endowment

at the Galena Complex, leading to the discovery of the 049, 181 and

182 veins. The 368 vein has also been successfully infill drilled

ahead of production.

Discovery of 049 Vein at 5500 Galena Diamond Drill

Station

A previously undiscovered vein was intercepted while targeting

the 072 vein. The new 049 vein has returned exceptional silver and

copper grades. Geologic modeling identified eight additional

intercepts along the vein structure as outlined in the results

below. Three additional drill holes are in progress to further

define the potential resource and to create mining plans to add

this high-grade area into near term production. New high-grade

silver veins continue to be discovered at Galena, reinforcing the

long-term potential of the operation. The most significant

intercepts through the 049 vein are:

- Hole 52-514: 6,246 g/t (200.8 opt) silver, 1.7%

copper over 0.49 m true width[1]

- Hole 52-550: 7,853 g/t(252.5 opt) silver, 2.3% copper

over 0.27 m true width[1]

- Hole 52-553: 53,839 g/t (1,731.0 opt) silver, 16.3%

copper over 0.15 m true width[1]

The 049 vein was initially encountered in a previously reported

interval on January 23, 2024 in hole 52-507 containing:

- Hole 52-507: 6442.1 g/t (207.2 opt) silver and

1.8% copper over 0.37 m true width[1]

181 & 182 Vein Discovery

Drilling from the 49-132 Loop 5 diamond drill station identified

two new parallel silver-lead (Ag/Pb) veins situated near the 4900

Ramp system, approximately 15 meters (50 feet) northeast of the

drill station. Development access has since crosscut these veins,

and initial mining has commenced. Mining plans have been adjusted

to incorporate this discovery as a new production stope and

development is in progress.

The 181/182 veins were discovered in 2024 and the geology was

immediately identified as having a positive significant impact on

mining and production. The veins are open at depth and above with

both extensional and infill drilling scheduled for later this year.

From the next drill station on 4600L, which is located in an

actively producing mining area. The Company is confident in the

potential to extend the size of these two prospective vein

areas.

368 Vein Infill Drilling Program

The 360 Complex is an active mining area in the eastern portion

of the mine currently accessed from the 4900L. The 360 Complex has

contributed profitable tons over the past several years as the ramp

system has developed up towards the 4600L. An infill program

confirmed the continuation of economic mineralization following the

structure up dip of the 360 Vein, with higher grades appearing to

jump to a parallel vein structure within a broader shear zone which

is currently an active significant production area. Highlighted

drill results include:

- Hole 49-768: 353 g/t (10.3 opt) silver, 9.8% lead

over 2.65 m true width[1]

- Hole 49-764: 302 g/t (8.8 opt) silver, 9.2% lead over

2.04 m true width[1]

Ongoing infill drilling to convert resources also demonstrate

grade increases to the west of the current mining area. Current

forecasted grade and tons represents a significant source of feed

material to support the planned increase in mined and milled tons

as part of the planned revitalization of Galena.

A full table of drill results can be found at:

https://americas-gold.com/site/assets/files/4297/dr20250224.pdf

About Americas Gold and Silver Corporation

Americas Gold and Silver is a growing precious metals mining

company with multiple assets in North America. The Company owns and

operates the Cosalá Operations in Sinaloa, Mexico, and in December

2024, the Company acquired 100% ownership in the Galena Complex

(located in Idaho, USA) in a transaction with Eric Sprott and a

Paul Huet-led management team, further strengthening its position

as a leading silver producer. Eric Sprott is now the largest

shareholder in the company, holding a ~20% interest. Additionally,

the Company owns the San Felipe development project in Sonora,

Mexico. With these strategically positioned assets, Americas Gold

and Silver is striving to become one of the top North American

silver-focused producers with an objective of over 80% of its

revenue generated from silver by the end of 2025.

Technical Information and Qualified Persons

The scientific and technical information relating to the

operation of the Company’s material operating mining properties

contained herein has been reviewed and approved by Chris McCann,

P.Eng., VP Technical Services of the Company. The Company’s current

Annual Information Form and the NI 43-101 Technical Reports for its

other material mineral properties, all of which are available on

SEDAR at www.sedar.com, and EDGAR at www.sec.gov, contain further

details regarding mineral reserve and mineral resource estimates,

classification and reporting parameters, key assumptions and

associated risks for each of the Company’s material mineral

properties, including a breakdown by category.

The diamond drilling program used NQ-size core and BQ-size core.

The Company’s standard QA/QC practices were utilized to ensure the

integrity of the core and sample preparation at the Galena Complex

through delivery of the samples to the assay lab. The drill core

was stored in a secure facility, photographed, logged and sampled

based on lithologic and mineralogical interpretations. Standards of

certified reference materials, field duplicates and blanks were

inserted as samples shipped with the core samples to the lab.

Analytical work was carried out by American Analytical Services

Inc. (“AAS”) located in Osburn, Idaho. AAS is an independent,

ISO-17025 accredited laboratory. Sample preparation includes a

30-gram pulp sample analyzed by atomic absorption spectrometry

(“AA”) techniques to determine silver, copper, and lead, using aqua

regia for pulp digestion. Samples returning values over 514g/t Ag

are re-assayed using fire-assay techniques for silver.

Additionally, samples returning values over 23% Pb are re-assayed

using titration techniques.

Duplicate pulp samples were sent out quarterly to ALS Global, an

independent, ISO-17025 accredited laboratory based in Reno, Nevada

to perform an independent check analysis. A conventional AA

technique was used for the analysis of silver, copper and lead at

ALS Global with the same industry standard procedures as those used

by AAS. The assay results listed in this report did not show any

significant contamination during sample preparation or sample bias

of analysis.

All mining terms used herein have the meanings set forth in

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”), as required by Canadian securities

regulatory authorities. These standards differ from the

requirements of the SEC that are applicable to domestic United

States reporting companies. Any mineral reserves and mineral

resources reported by the Company in accordance with NI 43-101 may

not qualify as such under SEC standards. Accordingly, information

contained in this news release may not be comparable to similar

information made public by companies subject to the SEC’s reporting

and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas expectations,

intentions, plans, assumptions and beliefs with respect to, among

other things, estimated and targeted production rates and results

for gold, silver and other metals, the expected prices of gold,

silver and other metals, as well as the related costs, expenses and

capital expenditures; Company’s technical review and optimization

work at the Galena Complex; operational improvements and production

from the Galena Complex, including the expected production levels

and anticipated improvements through production growth and

operational efficiency, and potential additional mineral resources

thereat; the expected timing and completion of the Galena hoist and

shaft improvements, mine-wide trade-off studies and equipment

upgrades and the expected operational and production results

therefrom, including the anticipated improvements to total capacity

and operational efficiency, to the cash costs per silver ounce and

all-in sustaining costs per silver ounce at the Galena Complex

following completion; opportunities relating to the optimization of

concentrate sales by enhancing by-product recovery and payability;

and the timing and results of its metallurgical sampling program to

identify by-product revenue optimization opportunities and the

anticipated improvements therefrom; and the initial results and

expectations arising out of the Company’s exploration and drilling

programs at the Galena Complex. Often, but not always,

forward-looking information can be identified by forward-looking

words such as “anticipate”, “believe”, “expect”, “goal”, “plan”,

“intend”, “potential’, “estimate”, “may”, “assume” ‘ensure” and

“will” or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions,

or statements about future events or performance. Forward-looking

information is based on the opinions and estimates of Americas as

of the date such information is provided and is subject to known

and unknown risks, uncertainties, and other factors that may cause

the actual results, level of activity, performance, or achievements

of Americas to be materially different from those expressed or

implied by such forward-looking information. With respect to the

business of Americas , these risks and uncertainties include risks

relating to widespread epidemics or pandemic outbreak;

interpretations or reinterpretations of geologic information;

unfavorable exploration results; inability to obtain permits

required for future exploration, development or production; general

economic conditions and conditions affecting the industries in

which the Company operates; the uncertainty of regulatory

requirements and approvals; potential litigation; fluctuating

mineral and commodity prices; the ability to obtain necessary

future financing on acceptable terms or at all; the ability to

operate the Company’s projects; and risks associated with the

mining industry such as economic factors (including future

commodity prices, currency fluctuations and energy prices), ground

conditions, illegal blockades and other factors limiting mine

access or regular operations without interruption, failure of

plant, equipment, processes and transportation services to operate

as anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital and construction expenditures, reclamation activities,

labor relations or disruptions, social and political developments,

risks associated with generally elevated inflation and inflationary

pressures, risks related to changing global economic conditions,

and market volatility, risks relating to geopolitical instability,

political unrest, war, and other global conflicts may result in

adverse effects on macroeconomic conditions including volatility in

financial markets, adverse changes in trade policies, inflation,

supply chain disruptions and other risks of the mining industry.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. Readers are cautioned not to place undue reliance on such

information. Additional information regarding the factors that may

cause actual results to differ materially from this forward‐looking

information is available in Americas filings with the Canadian

Securities Administrators on SEDAR and with the SEC. Americas does

not undertake any obligation to update publicly or otherwise revise

any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas does not give any

assurance (1) that Americas will achieve its expectations, or (2)

concerning the result or timing thereof. All subsequent written and

oral forward‐looking information concerning Americas are expressly

qualified in their entirety by the cautionary statements above.

1 Meters represent “True Width” which is calculated for

significant intercepts only and is based on orientation axis of

core across the estimated dip of the vein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224871832/en/

For further information, please contact: Maxim Kouxenko -

Manager, Investor Relations M: +1(647) 888-6458 E:

ir@americas-gold.com W: americas-gold.com

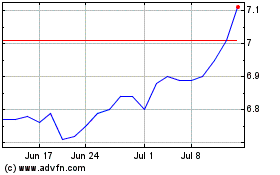

Liberty All Star Equity (NYSE:USA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Liberty All Star Equity (NYSE:USA)

Historical Stock Chart

From Feb 2024 to Feb 2025