United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of

March 2025

Vale S.A.

Praia de Botafogo nº 186, offices 1101, 1701 and

1801, Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

(Check One) Form 20-F x

Form 40-F o

|

Press Release |

|

Vale announces pricing of cash tender offers

for notes due 2034, 2039 and 2036

Rio de Janeiro, March 7, 2025 – Vale

Overseas Limited (“Vale Overseas” or the “Offeror”), a wholly owned subsidiary of Vale S.A. (“Vale”),

further to the press release issued on February 24, 2025, announces the Total Consideration (as defined below) payable in connection with

the previously announced offers to purchase for cash (the “Offers”) up to a maximum aggregate principal amount of Notes (as

defined below) validly tendered in the Offers not to exceed US$450,000,000, excluding any premium and any accrued and unpaid interest,

of the outstanding notes issued by Vale Overseas of the series of notes as set forth in the table below (the “Notes”), validly

tendered and accepted for purchase. The Offers are being made upon the terms and subject to the conditions set forth in the offer to purchase

dated February 24, 2025 (the “Offer to Purchase”).

|

Title of

Security |

CUSIP /

ISIN Nos |

Principal

Amount Outstanding |

Acceptance

Priority Level |

Reference

U.S. Treasury Security(1) |

Fixed Spread(2) |

Repurchase

Yield(3) |

Total Consideration

(4)(5) |

| 8.250% Guaranteed Notes due 2034 |

91911TAE3 / US91911TAE38 |

US$438,337,000 |

1 |

4.625% due February 15, 2035 |

+121 bps |

5.473% |

US$1,192.59 |

| 6.875% Guaranteed Notes due 2039 |

91911TAK9 / US91911TAK97 |

US$1,061,600,000 |

2 |

4.625% due February 15, 2035 |

+148 bps |

5.743% |

US$1,111.06 |

| 6.875% Guaranteed Notes due 2036 |

91911TAH6 / US91911TAH68 |

US$916,425,000 |

3 |

4.625% due February 15, 2035 |

+141 bps |

5.673% |

US$1,101.60 |

| (1) | The Dealer Managers (as defined below) quoted the bid-side price of the Reference U.S. Treasury Security

set forth in the table above from Bloomberg Bond Trader FIT1. |

| (2) | Inclusive of an early tender payment of US$50.00 per US$1,000 principal amount of Notes validly

tendered on or prior to the Early Tender Date (as defined below) and accepted for purchase (the “Early Tender

Payment”). |

| (3) | The “Repurchase Yield” is equal to the Reference Yield (as defined in the Offer to Purchase)

plus the Fixed Spread. |

| (4) | Per US$1,000 principal amount. |

| (5) | The Total Consideration for Notes validly tendered on or prior to the Early Tender Date (as defined below)

and accepted for purchase is inclusive of the Early Tender Payment and calculated using the applicable Fixed Spread for the applicable

series of Notes to the yield of the Reference U.S. Treasury Security for that series as of 11:00 a.m., New York City time, on March 7,

2025. All holders of Notes accepted for purchase will also receive accrued and unpaid interest on Notes validly tendered and accepted

for purchase from and including the applicable last interest payment date up to, but not including, the applicable settlement date. |

Holders that validly tender and do not validly

withdraw their Notes in the Offers at or prior to 5:00 p.m., New York City time, on March 7, 2025 (the “Early Tender Date”),

and whose Notes are accepted for purchase will be entitled to receive the total consideration as set forth in the table above per US$1,000

principal amount of Notes validly tendered and not validly withdrawn and accepted for purchase (the “Total Consideration”),

which includes the Early Tender Payment of US$50.00 per US$1,000 principal amount of Notes accepted for purchase. In addition, holders

whose Notes have been accepted for purchase pursuant to the Offers will also receive accrued and unpaid interest (“Accrued Interest”)

on their accepted Notes from the last interest payment date to, but not including, the Early Settlement Date (as defined below).

The applicable Total Consideration payable

per US$1,000 principal amount of Notes tendered and accepted for purchase pursuant to the Offers was determined by the Dealer Managers

in the manner described in the Offer to Purchase by reference to the applicable fixed spread for each series of Notes (as set forth in

the table above) plus the applicable yield-to-maturity based on the bid-side price of the applicable Reference U.S. Treasury Security

for that series of Notes (as set forth in the table above) at 11:00 a.m., New York City time, on March 7, 2025.

Payment of the applicable Total Consideration

and Accrued Interest for the Notes validly tendered and accepted for purchase will be made on March 12, 2025 (the “Early Settlement

Date”). The Offers will expire at 5:00 p.m., New York City time, on March 24, 2025.

Vale has retained BMO Capital Markets Corp.,

BofA Securities, Inc., Credit Agricole Securities (USA) Inc., HSBC Securities (USA) Inc. and J.P. Morgan Securities LLC to serve as dealer

managers (“Dealer Managers”) and D.F. King & Co., Inc. to serve as tender and information agent for the Offers (“D.F.

King”). The Offer to Purchase and any related supplements are available at the D.F. King website at www.dfking.com/vale. The full

details of the Offers, including complete instructions on how to tender Notes, are included in the Offer to Purchase. Holders of Notes

are strongly encouraged to carefully read the Offer to Purchase, including materials incorporated by reference therein, because they will

contain important information. Requests for the Offer to Purchase and any related supplements may also be directed to D.F. King by telephone

at +1 (212) 269-5550 or +1 (800) 714-3310 (US toll free) or in writing at vale@dfking.com. Questions about the Offers may be directed

to BMO Capital Markets Corp. by telephone at +1 (212) 702-1840 (collect) or +1 (833) 418-0762 (US toll free), BofA Securities, Inc. by

telephone at +1 (646) 855-8988 (collect) or +1 (888) 292-0070 (US toll free), Credit Agricole Securities (USA) Inc. by telephone at +1

(212) 261-7802 (collect) or +1 (866) 807-6030 (US toll free), HSBC Securities (USA) Inc. by telephone at +1 (212) 525-5552 (collect) or

+1 (888) HSBC-4LM (US toll free), or J.P. Morgan Securities LLC by telephone at +1 (212) 834-3554 (collect) or +1 (866) 834-4666 (US toll

free).

This news release is for informational

purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any securities. The Offers are being made only

by, and pursuant to the terms of, the Offer to Purchase. The Offers are not being made in any jurisdiction in which the making or acceptance

thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. In any jurisdiction where the laws

require the Offers to be made by a licensed broker or dealer, the Offers will be made by the Dealer Managers on behalf of the Offeror.

None of the Offeror, D.F. King, the Dealer Managers or the trustee with respect to the Notes, nor any of their affiliates, makes any recommendation

as to whether holders should tender or refrain from tendering all or any portion of their Notes in response to the Offers. None of the

Offeror, D.F. King, the Dealer Managers or the trustee with respect to the Notes, nor any of their affiliates, has authorized any person

to give any information or to make any representation in connection with the Offers other than the information and representations contained

in the Offer to Purchase.

Marcelo Feriozzi Bacci

Executive Vice President, Finance and Investor

Relations

For further information, please contact:

Vale.RI@vale.com

Thiago Lofiego: thiago.lofiego@vale.com

Mariana Rocha: mariana.rocha@vale.com

Luciana Oliveti: luciana.oliveti@vale.com

Pedro Terra: pedro.terra@vale.com

Patricia Tinoco: patricia.tinoco@vale.com

This press release may include statements that

present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve

various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include

factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital

markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global

competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those

forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão

de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking Statements” and “Risk

Factors” in Vale’s annual report on Form 20-F.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

VALE S.A.

|

| |

|

| |

|

|

| |

By: |

/s/ Adriana Barbosa Areias |

| |

|

Name: Adriana Barbosa Areias

Title: Attorney-in-fact |

| |

|

|

| |

By: |

/s/ Rodrigo Sebollela Duque Estrada Regis |

| |

|

Name: Rodrigo Sebollela Duque Estrada Regis

Title: Attorney-in-fact |

| |

|

|

| |

|

|

| Date: March 7, 2025 |

|

|

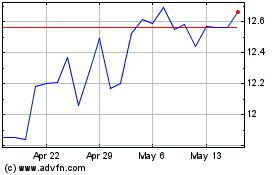

Vale (NYSE:VALE)

Historical Stock Chart

From Feb 2025 to Mar 2025

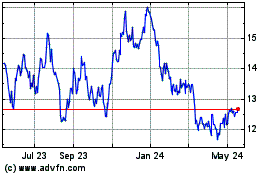

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Mar 2025