Valmont Announces Capital Allocation Priorities

February 18 2025 - 5:50AM

Business Wire

New $700 Million Authorization for Share

Repurchases

Increase of Quarterly Dividend to $0.68 per

Share

Valmont® Industries, Inc. (NYSE: VMI), a global leader that

provides products and solutions to support vital infrastructure and

advance agricultural productivity, today announced an update to its

capital allocation priorities aimed at accelerating growth and

increasing shareholder returns.

“Valmont anticipates generating significant cash flow in the

coming years as we execute our strategic growth and margin

expansion initiatives. We are pleased that our Board has approved a

$700 million share repurchase authorization and an increase in our

quarterly dividend,” said Thomas Liguori, Executive Vice President

and Chief Financial Officer. “These decisions underscore our

confidence in Valmont’s long-term strategy and commitment to

shareholder returns.”

The capital allocation priorities are intended to present a

balanced approach to maintaining disciplined investments in organic

and inorganic growth opportunities while delivering meaningful

capital returns to shareholders over the next three to five years.

These priorities are expected to be supported by the Company’s

projected cash flow generation.

Key features include the following:

- Approximately 50% of operating cash flow allocated to

high-return growth opportunities, focused on:

- Capital expenditures for strategic capacity expansion,

primarily in the Infrastructure segment, to maintain and increase

manufacturing output and efficiency while driving innovation to

better serve customers

- Acquisitions that strategically augment the Company’s

competitive position, with a focus on sustainable growth and

premium returns on invested capital (ROIC)

- Approximately 50% of operating cash flows will be allocated to

shareholder returns through the form of share repurchases and

dividends. The Board of Directors has approved the following steps

to enable this goal:

- A new $700 million share repurchase authorization, representing

approximately 10% of the Company’s current market

capitalization

- A 13% increase in the quarterly dividend to $0.68 per share

($2.72 annualized), payable on April 15, 2025, to shareholders of

record on March 28, 2025. The Company anticipates increasing its

dividend annually in the first quarter of each year, at a pace

aligned with expected longer-term earnings growth

- As part of its capital allocation framework, the Company

intends to maintain its Investment Grade credit rating, with a

long-term target for net leverage of 2.5X or less, while capable of

temporarily flexing leverage higher if the opportunity for

exceptionally impactful, larger transactions arises

The Company is authorized to repurchase up to $700 million of

its outstanding common stock from time to time, by means of

open-market purchases through any method or program, including

through Rule 10b5-1 trading plans, or through privately negotiated

transactions. The purchases will be funded from available cash

balances and ongoing cash flows and will be made subject to market

and economic conditions. The Company is not obligated to make any

repurchases and may discontinue the program at any time. The new

authorization, which has no stated expiration date, will be added

to the current authorization, of which approximately $66 million

remained as of December 28, 2024. Valmont currently has

approximately 20.2 million shares outstanding.

The Company’s goal of returning 50% of operating cash flow to

shareholders is subject to various factors, including industry and

market conditions, the price of the Company’s common stock, and

alternative uses of capital. Actual shareholder returns may vary

over time. There can be no guarantee as to the timing of the

declaration and payment of any dividends, or the amount thereof,

which is at the discretion of the Board.

About Valmont Industries, Inc. For nearly 80 years,

Valmont has been a global leader that provides products and

solutions to support vital infrastructure and advance agricultural

productivity. We are committed to customer-focused innovation that

delivers lasting value. Learn more about how we’re Conserving

Resources. Improving Life.® at valmont.com.

Concerning Forward-Looking Statements This release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

are based on assumptions made by management, considering its

experience in the industries where Valmont operates, perceptions of

historical trends, current conditions, expected future

developments, and other relevant factors. It is important to note

that these statements are not guarantees of future performance or

results. They involve risks, uncertainties (some of which are

beyond Valmont’s control), and assumptions. While management

believes these forward-looking statements are based on reasonable

assumptions, numerous factors could cause actual results to differ

materially from those anticipated. These factors include, among

other things, risks described in Valmont’s reports to the

Securities and Exchange Commission (“SEC”), the Company’s actual

cash flows and net income, future economic and market

circumstances, industry conditions, company performance and

financial results, operational efficiencies, availability and price

of raw materials, availability and market acceptance of new

products, product pricing, domestic and international competitive

environments, geopolitical risks, and actions and policy changes by

domestic and foreign governments. The Company cautions that any

forward-looking statements in this release are made as of its

publication date and does not undertake to update these statements,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218834640/en/

Renee Campbell renee.campbell@valmont.com February 18, 2025

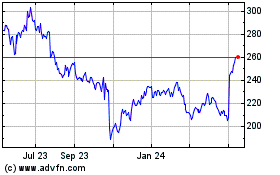

Valmont Industries (NYSE:VMI)

Historical Stock Chart

From Jan 2025 to Feb 2025

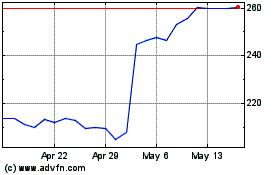

Valmont Industries (NYSE:VMI)

Historical Stock Chart

From Feb 2024 to Feb 2025