0001487952FALSE☐☐☐☐☐00014879522024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

| | | | | |

Date of Report (Date of Earliest Event Reported): | November 5, 2024 |

Vishay Precision Group, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 1-34679 | 27-0986328 |

| (State or Other Jurisdiction of | (Commission File Number) | (I.R.S. Employer Identification |

| Incorporation or Organization) | | Number) |

| | | | | |

| 3 Great Valley Parkway, Suite 150 | |

Malvern, PA | 19355 |

| (Address of Principal Executive Offices) | (Zip Code) |

(484) 321-5300

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act |

| | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.10 par value | VPG | New York Stock Exchange |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

Item 2.02 Results of Operations and Financial Conditions.

Vishay Precision Group, Inc. (the "Company") issued a press release on November 5, 2024 announcing results for the third quarter of fiscal 2024. The Company will hold a conference call at 9:00 a.m. Eastern time on November 5, 2024 to discuss its results for the third quarter of fiscal 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K and shall not be deemed to be “filed” for any purpose.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Vishay Precision Group, Inc. |

| |

| |

Date: November 5, 2024 | By: | /s/ William M. Clancy |

| | Name: William M. Clancy |

| | Title: Executive Vice President and Chief |

| | Financial Officer |

Exhibit 99.1

For Immediate Release

VPG Reports Fiscal 2024 Third Quarter Results

MALVERN, Pa. (November 5, 2024) - Vishay Precision Group, Inc. (NYSE: VPG), a leader in precision measurement and sensing technologies, today announced its results for its fiscal 2024 third quarter ended September 28, 2024.

Third Fiscal Quarter Highlights (comparisons are to the comparable period a year ago):

•Revenues of $75.7 million decreased 11.8%.

•Gross profit margin was 40.0%, as compared to 41.9%.

•Adjusted gross profit margin* was 40.0%, as compared to 42.1%.

•Operating margin was 5.1%, as compared to 9.6%.

•Adjusted operating margin* was 5.2%, as compared to 11.2%.

•Diluted net loss per share of $(0.10) compared to $0.46.

•Adjusted diluted net earnings per share* of $0.19 compared to $0.47.

•EBITDA* was $5.1 million with an EBITDA margin* of 6.7%.

•Adjusted EBITDA* was $8.1 million with an adjusted EBITDA margin* of 10.7%.

Ziv Shoshani, Chief Executive Officer of VPG, commented, "Total revenue in the third quarter was fairly stable sequentially, as trends across our markets remained mixed. Some of our cyclical markets such as steel and consumer were soft, while orders in test and measurement and avionics, military & space were higher. Total orders of $68.6 million declined 6.7% sequentially and resulted in a book-to-bill of 0.91."

Mr. Shoshani said: "We continue to focus on our long-term strategies for organic growth, as well as to look for additional opportunities to add high-quality businesses to our platform like our recent acquisition of Nokra. As we continue to streamline our operations mainly in the Sensors and Weighing Solutions segments, we believe our operating model and our solid balance sheet positions us to achieve significant operating returns and cash flow as revenues recover."

Third Fiscal Quarter and Nine Month Financial Trends:

The Company's third fiscal quarter 2024 net loss attributable to VPG stockholders was $(1.4) million, or $(0.10) per diluted share, compared to $6.3 million, or $0.46 per diluted share, in the third fiscal quarter of 2023. Included in the third quarter 2024 pre-tax earnings was a loss of $2.9 million related to unrealized foreign currency effects.

In the nine fiscal months ended September 28, 2024, net earnings attributable to VPG stockholders were $9.1 million, or $0.68 per diluted share, compared to $21.5 million, or $1.57 per diluted share, in the nine fiscal months ended September 30, 2023.

The third fiscal quarter 2024 adjusted net earnings* were $2.5 million, or $0.19 per adjusted diluted net earnings per share*, compared to $6.4 million, or $0.47 per adjusted diluted net earnings per share* in the third fiscal quarter of 2023.

In the nine fiscal months ended September 28, 2024, adjusted net earnings* were $12.3 million, or $0.92 per adjusted diluted net earnings per share*, compared to $21.4 million, or $1.57 per adjusted diluted net earnings per share* in the nine fiscal months ended September 30, 2023.

Segment Performance:

The Sensors segment revenue of $28.2 million in the third fiscal quarter of 2024 decreased 13.3% from $32.5 million in the third fiscal quarter of 2023. Sequentially, revenue decreased 2.3% compared to $28.9 million in the second fiscal quarter of 2024. The year-over-year decrease in revenues was primarily attributable to lower sales of precision resistors in the Test and Measurement and Avionics, Military and Space ("AMS") markets. Sequentially, the decrease primarily reflected lower sales of advanced sensors in

the Other markets, mainly for consumer applications, which was partially offset by higher sales of precision resistors in the AMS and Test and Measurement end markets.

Gross profit margin for the Sensors segment was 31.0% for the third fiscal quarter of 2024. Gross profit margin decreased compared to 35.9% in the third fiscal quarter of 2023 and 38.3% in the second fiscal quarter of 2024. The year-over-year decrease in gross profit margin was primarily due to lower volume. Sequentially, the lower gross profit margin was primarily due to lower volume and temporary operational and labor inefficiencies.

The Weighing Solutions segment revenue of $25.2 million in the third fiscal quarter of 2024 decreased 13.1% compared to $29.0 million in the third fiscal quarter of 2023 and was 8.3% lower than $27.4 million in the second fiscal quarter of 2024. The year-over-year decrease in revenues was mainly attributable to lower sales in our Transportation and Industrial Weighing markets, as well as in our Other markets primarily for precision agriculture and medical applications. Sequentially, the decrease in revenues was primarily attributable to lower sales in the Industrial Weighing, Transportation, and Other markets.

Gross profit margin for the Weighing Solutions segment was 35.1% for the third fiscal quarter of 2024, which decreased compared to 38.7% in the third fiscal quarter of 2023 and 37.6% in the second fiscal quarter of 2024. The year-over-year and sequential decrease in gross profit margin were primarily due to lower volume and unfavorable product mix.

The Measurement Systems segment revenue of $22.4 million in the third fiscal quarter of 2024 decreased 8.2% year-over-year from $24.4 million in the third fiscal quarter of 2023 and was 6.2% higher than $21.0 million in the second fiscal quarter of 2024. The year-over-year decrease was primarily attributable to decreased revenue in the Steel, Transportation, and in our Other markets. Sequentially, the increase in revenue was primarily due to higher sales of Diversified Technical Systems Inc. ("DTS") products in the AMS and Transportation markets.

Gross profit margin for the Measurement Systems segment was 56.8%, compared to 53.6% (or 54.5% reflecting an adjustment to exclude $214 thousand of purchase accounting adjustment related to the DTS and Dynamic System Inc. ("DSI") acquisitions), in the third fiscal quarter of 2023, and 52.4% in the second fiscal quarter of 2024. The year-over-year increase in adjusted gross profit margin* was due to favorable product mix which offset the impact from lower volume. The sequentially higher adjusted gross profit margin* reflected higher volume and favorable product mix.

Near-Term Outlook

“Given our backlog and the current market conditions, we expect net revenues to be in the range of $70 million to $78 million for the fourth fiscal quarter of 2024, at constant third fiscal quarter 2024 foreign currency exchange rates,” concluded Mr. Shoshani.

*Use of Non-GAAP Financial Information:

We define “adjusted gross profit margin" as gross profit margin before purchase accounting adjustments related to the DTS and DSI acquisition. We define "adjusted operating margin" as operating margin before purchase accounting adjustment related to the DTS and DSI acquisitions, and restructuring costs and severance costs. We define "adjusted net earnings” and "adjusted diluted net earnings per share" as net earnings attributable to VPG stockholders before purchase accounting adjustment related to the DTS and DSI acquisitions, restructuring costs and severance costs, foreign currency exchange gains and losses, and associated tax effects. We define "EBITDA" as earnings before interest, taxes, depreciation, and amortization. We define "Adjusted EBITDA" as earnings before interest, taxes, depreciation, and amortization before purchase accounting adjustment related to the DTS and DSI acquisitions, restructuring costs and severance costs, and foreign currency exchange gains and losses.

Management believes that these non-GAAP measures are useful to investors because each presents what management views as our core operating results for the relevant period. The adjustments to the applicable

GAAP measures relate to occurrences or events that are outside of our core operations, and management believes that the use of these non-GAAP measures provides a consistent basis to evaluate our operating profitability and performance trends across comparable periods. These reconciling items are indicated on the accompanying reconciliation schedules and are more fully described in VPG’s financial statements presented in our Annual Report on Form 10-K and its Quarterly Reports on Forms 10-Q.

Conference Call and Webcast:

A conference call will be held on Tuesday, November 5, 2024 at 9:00 a.m. ET (8:00 a.m. CT). To access the conference call, interested parties may call 1-833-470-1428 or internationally +1-404-975-4839 and use passcode 148407, or log on to the investor relations page of the VPG website at ir.vpgsensors.com. A replay will be available approximately one hour after the completion of the call by calling toll-free 1-866-813-9403 or internationally 1-929-458-6194 and by using passcode 378501. The replay will also be available on the “Events” page of investor relations section of the VPG website at ir.vpgsensors.com.

About VPG:

Vishay Precision Group, Inc. (VPG) is a leader in precision measurement and sensing technologies. Our sensors, weighing solutions and measurement systems optimize and enhance our customers’ product performance across a broad array of markets to make our world safer, smarter, and more productive. To learn more, visit VPG at www.vpgsensors.com and follow us on LinkedIn.

Forward-Looking Statements:

From time to time, information provided by us, including, but not limited to, statements in this report, or other statements made by or on our behalf, may contain or constitute "forward-looking" information within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve a number of risks, uncertainties, and contingencies, many of which are beyond our control, which may cause actual results, performance, or achievements to differ materially from those anticipated.

Such statements are based on current expectations only, and are subject to certain risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, expected, estimated, or projected. Among the factors that could cause actual results to materially differ include: general business and economic conditions; impact of inflation; potential issues respecting the United States federal government debt ceiling; global labor and supply chain challenges; difficulties or delays in identifying, negotiating and completing acquisitions and integrating acquired companies; the inability to realize anticipated synergies and expansion possibilities; difficulties in new product development; changes in competition and technology in the markets that we serve and the mix of our products required to address these changes; changes in foreign currency exchange rates; political, economic, and health (including pandemics) instabilities; instability caused by military hostilities in the countries in which we operate (including Israel); difficulties in implementing our cost reduction strategies, such as underutilization of production facilities, labor unrest or legal challenges to our lay-off or termination plans, operation of redundant facilities due to difficulties in transferring production to achieve efficiencies; compliance issues under applicable laws, such as export control laws, including the outcome of our voluntary self-disclosure of export control non-compliance; significant developments from the recent and potential changes in tariffs and trade regulation; our efforts and efforts by governmental authorities to mitigate the COVID-19 pandemic, such as travel bans, shelter-in-place orders and business closures and the related impact on resource allocations, manufacturing and supply chains; our status as a “critical”, “essential” or “life-sustaining” business in light of COVID-19 business closure laws, orders and guidance being challenged by a governmental body or other applicable authority; our ability to execute our new corporate strategy and business continuity, operational and budget plans; and other factors affecting our operations, markets, products, services, and prices that are set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. We caution you not to place undue reliance on forward-looking statements, which speak only as of the date of this report or as of the dates otherwise indicated in such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Contact:

Steve Cantor

Vishay Precision Group, Inc.

781-222-3516

info@vpgsensors.com

| | | | | | | | | | | |

| VISHAY PRECISION GROUP, INC. | | | |

| Consolidated Condensed Statements of Operations | | | |

| (Unaudited - In thousands, except per share amounts) | | | |

| | | |

| Fiscal quarter ended |

| September 28, 2024 | | September 30, 2023 |

| Net revenues | $ | 75,727 | | | $ | 85,854 | |

| Costs of products sold | 45,467 | | | 49,919 | |

| Gross profit | 30,260 | | | 35,935 | |

| Gross profit margin | 40.0 | % | | 41.9 | % |

| | | |

| Selling, general and administrative expenses | 26,337 | | | 26,558 | |

| | | |

| | | |

| | | |

| Restructuring costs | 82 | | | 1,153 | |

| Operating income | 3,841 | | | 8,224 | |

| Operating margin | 5.1 | % | | 9.6 | % |

| | | |

| Other (expense) income : | | | |

| Interest expense | (648) | | | (1,119) | |

| Other | (2,646) | | | 1,671 | |

| Other (expense) income | (3,294) | | | 552 | |

| | | |

| Income before taxes | 546 | | | 8,776 | |

| | | |

| Income tax expense | 1,874 | | | 2,419 | |

| | | |

| Net (loss) earnings | (1,328) | | | 6,357 | |

| Less: net earnings attributable to noncontrolling interests | 23 | | | 77 | |

| Net (loss) earnings attributable to VPG stockholders | $ | (1,351) | | | $ | 6,280 | |

| | | |

| Basic (loss) earnings per share attributable to VPG stockholders | $ | (0.10) | | | $ | 0.46 | |

| Diluted (loss) earnings per share attributable to VPG stockholders | $ | (0.10) | | | $ | 0.46 | |

| | | |

| Weighted average shares outstanding - basic | 13,254 | | | 13,600 | |

| Weighted average shares outstanding - diluted | 13,254 | | | 13,686 | |

| | | | | | | | | | | |

| VISHAY PRECISION GROUP, INC. | | | |

| Consolidated Condensed Statements of Operations | | | |

| (Unaudited - In thousands, except per share amounts) | | | |

| | | |

| Nine fiscal months ended |

| September 28, 2024 | | September 30, 2023 |

| Net revenues | $ | 233,869 | | | $ | 265,520 | |

| Costs of products sold | 136,108 | | | 153,674 | |

| Gross profit | 97,761 | | | 111,846 | |

| Gross profit margin | 41.8 | % | | 42.1 | % |

| | | |

| Selling, general and administrative expenses | 80,232 | | | 80,472 | |

| | | |

| | | |

| | | |

| Restructuring costs | 864 | | | 1,431 | |

| Operating income | 16,665 | | | 29,943 | |

| Operating margin | 7.1 | % | | 11.3 | % |

| | | |

| Other (expense) income : | | | |

| Interest expense | (1,925) | | | (3,195) | |

| Other | 915 | | | 2,965 | |

| Other (expense) income | (1,010) | | | (230) | |

| | | |

| Income before taxes | 15,654 | | | 29,713 | |

| | | |

| Income tax expense | 6,508 | | | 8,023 | |

| | | |

| Net earnings | 9,146 | | | 21,690 | |

| Less: net earnings attributable to noncontrolling interests | 3 | | | 210 | |

| Net earnings attributable to VPG stockholders | $ | 9,143 | | | $ | 21,480 | |

| | | |

| Basic earnings per share attributable to VPG stockholders | $ | 0.68 | | | $ | 1.58 | |

| Diluted earnings per share attributable to VPG stockholders | $ | 0.68 | | | $ | 1.57 | |

| | | |

| Weighted average shares outstanding - basic | 13,367 | | | 13,596 | |

| Weighted average shares outstanding - diluted | 13,405 | | | 13,670 | |

| | | | | | | | | | | |

| VISHAY PRECISION GROUP, INC. | | | |

| Consolidated Condensed Balance Sheets | | | |

| (In thousands) | | | |

| September 28, 2024 | | December 31, 2023 |

| (Unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 81,077 | | | $ | 83,965 | |

| Accounts receivable, net | 52,821 | | | 56,438 | |

| Inventories: | | | |

| Raw materials | 34,027 | | | 33,973 | |

| Work in process | 28,275 | | | 26,594 | |

| Finished goods | 26,000 | | | 27,572 | |

| Inventories, net | 88,302 | | | 88,139 | |

| | | |

| | | |

| Prepaid expenses and other current assets | 20,137 | | | 14,520 | |

| | | |

| Total current assets | 242,337 | | | 243,062 | |

| | | |

| Property and equipment: | | | |

| Land | 4,186 | | | 4,154 | |

| Buildings and improvements | 73,759 | | | 72,952 | |

| Machinery and equipment | 133,281 | | | 131,738 | |

| Software | 10,198 | | | 9,619 | |

| Construction in progress | 10,761 | | | 11,379 | |

| Accumulated depreciation | (145,391) | | | (139,206) | |

| Property and equipment, net | 86,794 | | | 90,636 | |

| | | |

| Goodwill | 45,610 | | | 45,734 | |

| Intangible assets, net | 41,807 | | | 44,634 | |

| Operating lease right-of-use assets | 25,239 | | | 26,953 | |

| Other assets | 20,739 | | | 20,547 | |

| Total assets | $ | 462,526 | | | $ | 471,566 | |

| | | | | | | | | | | |

| VISHAY PRECISION GROUP, INC. | | | |

| Consolidated Condensed Balance Sheets | | | |

| (In thousands) | | | |

| September 28, 2024 | | December 31, 2023 |

| (Unaudited) | | |

| Liabilities and equity | | | |

| Current liabilities: | | | |

| Trade accounts payable | $ | 9,986 | | | $ | 11,698 | |

| Payroll and related expenses | 17,819 | | | 18,971 | |

| Other accrued expenses | 21,989 | | | 22,427 | |

| Income taxes | 1,150 | | | 4,524 | |

| Current portion of operating lease liabilities | 4,053 | | | 4,004 | |

| | | |

| Total current liabilities | 54,997 | | | 61,624 | |

| | | |

| Long-term debt | 31,383 | | | 31,856 | |

| Deferred income taxes | 3,645 | | | 3,490 | |

| Operating lease liabilities | 20,645 | | | 22,625 | |

| Other liabilities | 14,145 | | | 14,770 | |

| Accrued pension and other postretirement costs | 7,054 | | | 7,276 | |

| Total liabilities | 131,869 | | | 141,641 | |

| | | |

| | | |

| | | |

| Equity: | | | |

| Common stock | 1,336 | | | 1,330 | |

| Class B convertible common stock | 103 | | | 103 | |

| Treasury stock | (25,335) | | | (17,460) | |

| Capital in excess of par value | 202,872 | | | 202,672 | |

| Retained earnings | 191,209 | | | 182,066 | |

| Accumulated other comprehensive loss | (39,564) | | | (38,869) | |

| Total Vishay Precision Group, Inc. stockholders' equity | 330,621 | | | 329,842 | |

| Noncontrolling interests | 36 | | | 83 | |

| Total equity | 330,657 | | | 329,925 | |

| Total liabilities and equity | $ | 462,526 | | | $ | 471,566 | |

| | | | | | | | | | | |

| VISHAY PRECISION GROUP, INC. | | | |

| Consolidated Condensed Statements of Cash Flows | | | |

(Unaudited - In thousands) | | | |

| | | |

| Nine Fiscal Months Ended |

| September 28, 2024 | | September 30, 2023 |

| Operating activities | | | |

| Net earnings | $ | 9,146 | | | $ | 21,690 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| | | |

| Depreciation and amortization | 11,771 | | | 11,559 | |

| | | |

| Loss (gain) on sale of property and equipment | (154) | | | 38 | |

| | | |

| Share-based compensation expense | 1,060 | | | 1,885 | |

| Inventory write-offs for obsolescence | 1,722 | | | 1,567 | |

| Deferred income taxes | 512 | | | 691 | |

| Foreign currency impacts and other items | (1,213) | | | (2,755) | |

| Net changes in operating assets and liabilities: | | | |

| Accounts receivable | 3,340 | | | 1,604 | |

| Inventories | (1,816) | | | (7,811) | |

| Prepaid expenses and other current assets | (5,576) | | | 1,990 | |

| Trade accounts payable | (743) | | | (1,151) | |

| Other current liabilities | (3,921) | | | (1,082) | |

| Other non current assets and liabilities, net | (767) | | | (170) | |

| Accrued pension and other postretirement costs, net | (322) | | | (945) | |

| Net cash provided by operating activities | 13,039 | | | 27,110 | |

| | | |

| Investing activities | | | |

| Capital expenditures | (6,965) | | | (9,848) | |

| Proceeds from sale of property and equipment | 647 | | | 50 | |

| | | |

| | | |

| Net cash used in investing activities | (6,318) | | | (10,798) | |

| | | |

| Financing activities | | | |

| | | |

| | | |

| | | |

| | | |

| Payments on revolving facility | — | | | (7,000) | |

| Debt issuance costs | (569) | | | — | |

| Purchase of treasury stock | (7,815) | | | (1,196) | |

| | | |

| Distributions to noncontrolling interests | (50) | | | (138) | |

| Payments of employee taxes on certain share-based arrangements | (860) | | | (825) | |

| Net cash used in financing activities | (9,294) | | | (9,159) | |

| Effect of exchange rate changes on cash and cash equivalents | (315) | | | (1,083) | |

| (Decrease) Increase in cash and cash equivalents | (2,888) | | | 6,070 | |

| | | |

| Cash and cash equivalents at beginning of period | 83,965 | | | 88,562 | |

| Cash and cash equivalents at end of period | $ | 81,077 | | | $ | 94,632 | |

| | | |

| Supplemental disclosure of investing transactions: | | | |

| Capital expenditures accrued but not yet paid | $ | 1,354 | | | $ | 1,204 | |

| Supplemental disclosure of financing transactions: | | | |

| Excise tax on net share repurchases accrued but not yet paid | 60 | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| VISHAY PRECISION GROUP, INC. | | | | | | | | | | |

| Reconciliation of Consolidated Adjusted Gross Profit, Operating Income, Net Earnings Attributable to VPG Stockholders and Diluted Earnings Per Share | | |

| (Unaudited - In thousands) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Gross Profit | | Operating Income | | Net (Loss) Earnings Attributable to VPG Stockholders | | Diluted Earnings Per share |

| Three months ended | September 28, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 |

| As reported - GAAP | $ | 30,260 | | | $ | 35,935 | | | $ | 3,841 | | | $ | 8,224 | | | $ | (1,351) | | | $ | 6,280 | | | $ | (0.10) | | | $ | 0.46 | |

| As reported - GAAP Margins | 40.0 | % | | 41.9 | % | | 5.1 | % | | 9.6 | % | | | | | | | | |

| Acquisition purchase accounting adjustments | — | | | 214 | | | — | | | 214 | | | — | | | 214 | | | — | | | 0.02 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Restructuring costs | — | | | — | | | 82 | | | 1,153 | | | 82 | | | 1,153 | | | 0.01 | | | 0.08 | |

| | | | | | | | | | | | | | | |

| Foreign currency exchange gain (loss) | — | | | — | | | — | | | — | | | 2,912 | | | (1,283) | | | 0.22 | | | (0.09) | |

| Less: Tax effect of reconciling items and discrete tax items | — | | | — | | | — | | | — | | | (839) | | | (77) | | | (0.06) | | | — | |

| As Adjusted - Non GAAP | $ | 30,260 | | | $ | 36,149 | | | $ | 3,923 | | | $ | 9,591 | | | $ | 2,482 | | | $ | 6,441 | | | $ | 0.19 | | | $ | 0.47 | |

| As Adjusted - Non GAAP Margins | 40.0 | % | | 42.1 | % | | 5.2 | % | | 11.2 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| VISHAY PRECISION GROUP, INC. | | | | | | | | | | |

| Reconciliation of Consolidated Adjusted Gross Profit, Operating Income, Net Earnings Attributable to VPG Stockholders and Diluted Earnings Per Share | | |

| (Unaudited - In thousands) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Gross Profit | | Operating Income | | Net Earnings Attributable to VPG Stockholders | | Diluted Earnings Per share |

| Nine fiscal months ended | September 28, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 |

| As reported - GAAP | $ | 97,761 | | | $ | 111,846 | | | $ | 16,665 | | | $ | 29,943 | | | $ | 9,143 | | | $ | 21,480 | | | $ | 0.68 | | | $ | 1.57 | |

| As reported - GAAP Margins | 41.8 | % | | 42.1 | % | | 7.1 | % | | 11.3 | % | | | | | | | | |

| Acquisition purchase accounting adjustments | — | | | 304 | | | — | | | 304 | | | — | | | 304 | | | — | | | 0.02 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Restructuring costs | — | | | — | | | 864 | | | 1,431 | | | 864 | | | 1,431 | | | 0.06 | | | 0.11 | |

| Severance cost | — | | | — | | | 347 | | | — | | | 347 | | | — | | | 0.03 | | | — | |

| Foreign currency exchange gain (loss) | — | | | — | | | — | | | — | | | 34 | | | (2,139) | | | — | | | (0.16) | |

| Less: Tax effect of reconciling items and discrete tax items | — | | | — | | | — | | | — | | | (1,913) | | | (357) | | | (0.14) | | | (0.03) | |

| As Adjusted - Non GAAP | $ | 97,761 | | | $ | 112,150 | | | $ | 17,876 | | | $ | 31,678 | | | $ | 12,301 | | | $ | 21,433 | | | $ | 0.92 | | | $ | 1.57 | |

| As Adjusted - Non GAAP Margins | 41.8 | % | | 42.2 | % | | 7.6 | % | | 11.9 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| VISHAY PRECISION GROUP, INC. | | | | |

| Reconciliation of Adjusted Gross Profit by segment | | | | |

| (Unaudited - In thousands) | | | | | |

| | | | | |

| Fiscal quarter ended |

| September 28, 2024 | | September 30, 2023 | | June 29, 2024 |

| Sensors | | | | | |

| As reported - GAAP | $ | 8,730 | | | $ | 11,681 | | | $ | 11,066 | |

| As reported - GAAP Margins | 31.0 | % | | 35.9 | % | | 38.3 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| As Adjusted - Non GAAP | $ | 8,730 | | | $ | 11,681 | | | $ | 11,066 | |

| As Adjusted - Non GAAP Margins | 31.0 | % | | 35.9 | % | | 38.3 | % |

| | | | | |

| Weighing Solutions | | | | | |

| As reported - GAAP | $ | 8,840 | | | $ | 11,207 | | | $ | 10,310 | |

| As reported - GAAP Margins | 35.1 | % | | 38.7 | % | | 37.6 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| As Adjusted - Non GAAP | $ | 8,840 | | | $ | 11,207 | | | $ | 10,310 | |

| As Adjusted - Non GAAP Margins | 35.1 | % | | 38.7 | % | | 37.6 | % |

| | | | | |

| Measurement Systems | | | | | |

| As reported - GAAP | $ | 12,690 | | | $ | 13,047 | | | $ | 11,031 | |

| As reported - GAAP Margins | 56.8 | % | | 53.6 | % | | 52.4 | % |

| Acquisition purchase accounting adjustments | — | | | 214 | | | — | |

| | | | | |

| | | | | |

| | | | | |

| As Adjusted - Non GAAP | $ | 12,690 | | | $ | 13,261 | | | $ | 11,031 | |

| As Adjusted - Non GAAP Margins | 56.8 | % | | 54.5 | % | | 52.4 | % |

| | | | | | | | | | | | | | | | | |

| VISHAY PRECISION GROUP, INC. | | | | |

| Reconciliation of Adjusted EBITDA | | | | |

| (Unaudited - In thousands) | | | | | |

| Fiscal quarter ended |

| September 28, 2024 | | September 30, 2023 | | June 29, 2024 |

| Net (loss) earnings attributable to VPG stockholders | $ | (1,351) | | | $ | 6,280 | | | $ | 4,603 | |

| Interest Expense | 648 | | | 1,119 | | | 649 | |

| Income tax expense | 1,874 | | | 2,419 | | | 2,316 | |

| Depreciation | 2,988 | | | 2,954 | | | 2,992 | |

| Amortization | 925 | | | 880 | | | 924 | |

| EBITDA | 5,084 | | | $ | 13,652 | | | $ | 11,484 | |

| EBITDA MARGIN | 6.7 | % | | 15.9 | % | | 14.8 | % |

| | | | | |

| Acquisition purchase accounting adjustments | — | | | 214 | | | — | |

| | | | | |

| Restructuring costs | 82 | | | 1,153 | | | — | |

| | | | | |

| | | | | |

| Foreign currency exchange gain (loss) | 2,912 | | | (1,283) | | | (1,289) | |

| ADJUSTED EBITDA | $ | 8,079 | | | $ | 13,736 | | | $ | 10,195 | |

| ADJUSTED EBITDA MARGIN | 10.7 | % | | 16.0 | % | | 13.2 | % |

Cover

|

Nov. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 05, 2024

|

| Entity Registrant Name |

Vishay Precision Group, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-34679

|

| Entity Tax Identification Number |

27-0986328

|

| Entity Address, Address Line One |

3 Great Valley Parkway, Suite 150

|

| Entity Address, City or Town |

Malvern

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19355

|

| City Area Code |

484

|

| Local Phone Number |

321-5300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.10 par value

|

| Trading Symbol |

VPG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001487952

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

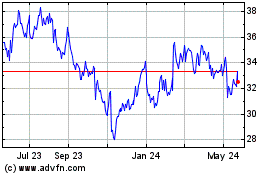

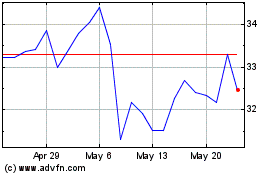

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Nov 2023 to Nov 2024