Aims to Install an Independent Slate and

Legendary CEO Committed to Abandoning the Blocked Nippon Deal,

Collecting the $565 Million Breakup Fee and Making U.S. Steel Great

Again in the Public Market

Believes the Board’s Decision to Pursue a

Risky Sale to Nippon – an Overseas Bidder Paying Just $1 Per Share

More Than the Top Domestic Bidder – Has Led to a Dead End

Contends the Board and CEO David Burritt,

Who Collectively Stood to Receive $100+ Million if the Sale

Proceeded, Prioritized Deal Advocacy at the Expense of Financial

Health and Operational Performance

Expresses Concern About the Board and Mr.

Burritt Continuing to Devote Immense Resources to Litigation

Despite Legal Headwinds, Labor Resistance and Bipartisan

Policymaker Opposition

Slate’s Foremost

Priority is Pursuing a Public Market Turnaround of U.S. Steel – Not

Trying to Solicit Alternative Bids and Sell the

Company

Ancora Holdings Group, LLC (collectively with its affiliates,

“Ancora” or “we”), a diversified investment firm that oversees

approximately $10 billion in assets, today issued the below open

letter to the Board of Directors (the “Board”) of United States

Steel Corporation (NYSE: X) (“U.S. Steel” or the “Company”)

regarding a variety of issues, including the Company’s recently

blocked sale to Nippon Steel Corporation (“Nippon”).

To receive important updates, visit

www.MakeUSSteelGreatAgain.com.

***

January 27, 2025

United States Steel Corporation 600 Grant Street Pittsburgh, PA

15219 Attn: The Board

Dear Members of the Board,

Ancora is a growing shareholder of U.S. Steel. As an investment

firm with deep roots in the Midwest, we have an affinity for the

industrial and logistics companies that collectively form the

backbone of America’s economy. We are proud to be investors in

companies such as Berry Global Group, Inc., Norfolk Southern

Corporation, RB Global, Inc. and now U.S. Steel. Owning these types

of businesses enables us to pursue strong risk-adjusted returns

while helping support American competitiveness, job creation and

wage growth.

Although we understand why the Board explored strategic

alternatives in 2023, its ultimate decision to ignore national

security and pursue a risky sale to Nippon – an overseas bidder

that came in just $1 per share higher than a competing domestic

bidder – has led to a dead end. There appears to be no legal basis

and no precedent for U.S. Steel’s costly litigation over the

Presidential Executive Order blocking the transaction. Moreover,

President Donald Trump is a vocal opponent of the deal and

long-term proponent of strengthening America’s domestic

manufacturing base. He also has long-held skepticism about foreign

direct investment from Japan based on his own business dealings

dating back to the 1980s. We see no reason to believe that

President Trump, a high-conviction businessman who was elected by

middle-class and working-class voters, is going to contradict his

self-described “America First” agenda and disregard the opposition

of the United Steelworkers.

The Board’s choice to double down on its extremely poor decision

to pursue a sale to Nippon has also kept U.S. Steel in a corroded

state. Chief Executive Officer David Burritt, who stood to rake in

more than $70 million himself if the sale had been consummated, has

been allowed to misallocate capital, issue unreliable and

overoptimistic forecasts, and repeatedly miss financial targets. It

seems the Board failed to keep Mr. Burritt’s attention on

efficiency, execution and risk management as steel prices remained

depressed over the past year. Rather than finally acknowledge the

Company’s perilous trajectory and try to course correct, the Board

remains steadfastly committed to an underperforming leader who

apparently lacks the ability and vision to bring U.S. Steel back

from a busted transaction.

In light of these alarming decisions and the unjustifiable

deference to Mr. Burritt, who has made clear through outlandish

rhetoric that he is self-interested and unfit for leadership,

Ancora has nominated nine highly qualified, independent candidates

for election to the Board at U.S. Steel’s 2025 Annual Meeting of

Stockholders. Our slate includes individuals with corporate

governance experience, finance expertise, industrials and

manufacturing backgrounds, public policy acumen and other

qualifications critical to turning around a standalone U.S. Steel.

The slate’s plan includes installing Alan Kestenbaum, a steel

industry legend who delivered total shareholder returns of more

than 450% at Stelco Holdings Inc., as a replacement for Mr.

Burritt. We expect the investment community will agree that any

steel company would be fortunate to have Mr. Kestenbaum assume such

a role.

Our slate and Mr. Kestenbaum look forward to ultimately

releasing their full plan for enhancing U.S. Steel’s corporate

governance, cost structure, labor relations, margins, operations

and long-term viability as a force within the American economy.

With the tailwind of President Trump’s agenda, including steel

tariffs, our nominees are confident they will shift the Company’s

strategy from hoping to be saved to implementing a multi-year plan

that targets meaningful share price appreciation.

The Case for Wholesale Change: The Board Has

Doubled Down on its Bad Decision to Pursue a Risky Sale – Even

After the Sale was Blocked by Executive Order

We want to take this opportunity to share a few key facts. First

and foremost, no transaction blocked by Presidential Executive

Order after a review by the Committee on Foreign Investment in the

United States has ever gone through. This means there is no legal

precedent for the litigation brought by U.S. Steel and Nippon

earlier this month.

Although U.S. Steel seems to be holding out hope that it can

convince President Trump to approve the deal, the facts indicate

that this is a pipe dream. President Trump has repeatedly voiced

opposition to the transaction and has long been skeptical of deals

with Japanese businesses.1 In fact, just last month he stated “I am

totally against the once great and powerful U.S. Steel being bought

by a foreign company, in this case Nippon Steel of Japan […] As

President, I will block this deal from happening.”2 Nothing he has

said since former President Joseph Biden’s Executive Order

indicates a change of heart.

In addition to the aforementioned headwinds, the blocked deal

also faced opposition from Vice President J.D. Vance, Secretary of

State Marco Rubio, a bipartisan contingent of high-profile

lawmakers and the United Steelworkers. When they were in the

Senate, Messrs. Vance and Rubio previously co-authored a letter to

then-Secretary of the Treasury Janet Yellen to stress that “[t]he

transaction was not entered into with U.S. national security in

mind.”3 It should be clear as day that U.S. Steel is now fighting a

binding Executive Order, the Trump administration, an array of

senators and representatives, and a multitude of third parties that

do not buy into Mr. Burritt’s self-serving arguments.

The Board should also be aware of what independent and objective

legal experts have to say:

“Unfortunately for Nippon Steel, their

argument is not particularly strong. The president's action in this

case is explicitly excluded from judicial review under U.S.

law.”

- Akira Inoue, partner, Baker &

McKenzie4

“The D.C. Circuit is unlikely to overturn the

blocking order based solely on allegations of pre-determination or

the appearance of a sham process. Substantial evidence of

constitutional violations or procedural defects is normally

required. In addition, there does not appear to be a process for

taking evidence, so the sham argument cannot be developed beyond

what is in the public record.”

- Ken Nunnenkamp, partner, Morgan Lewis5

“Nippon and U.S. Steel face a formidable

uphill battle in challenging CFIUS' referral and the president's

exercise of authority to block the deal on national security

grounds. Congress intended to shield CFIUS' decisions, and the

president's conclusions under the CFIUS regime, from virtually all

judicial review, an approach that is consistent with broad judicial

deference to the executive branch on national security

matters.”

- Mario Mancuso, George W. Hicks Jr. and

Lucille Hague, partners, Kirkland & Ellis6

It borders on delusional to think that the Trump administration

would use precious political capital at the start of its term to

reverse its public position on the transaction, not to mention

undermine its clearly articulated focus on revitalizing American

manufacturing and insourcing.

The Case for Wholesale Change: The Board Has

Allowed a Conflicted, Underperforming CEO to Hinder U.S. Steel’s

Credibility and Undermine the Company’s Future

Ancora has a proven track record of correctly identifying

companies that are held back by conflicted or unfit CEOs. Before we

seek the removal of a CEO, we typically try to work with a board of

directors to address and course correct the executive’s

shortcomings. In this case, however, we see no future with Mr.

Burritt.

In our view, Mr. Burritt exhibited disqualifying behavior on

January 3rd, when he issued a statement that called former

President Biden’s decision “shameful and corrupt.” He continued

what appeared to be a tirade by calling highly respected United

Steelworkers President David McCall a “union boss,” effectively

questioning his integrity.7 We also need to scrutinize the Board’s

oversight of Mr. Burritt in light of his public accusation that the

prior administration made a decision that supports the Chinese

Communist Party. It runs counter to the interests of shareholders,

to which Mr. Burritt owes a fiduciary duty, to make seemingly

unhinged and retaliatory statements about plans “to fight President

Biden’s political corruption.”8 Regardless of political leanings,

this is not how standard public company executives act. Perhaps

this is why Jeh Johnson, former Secretary of the Department of

Homeland Security, abruptly resigned from the Board in recent

weeks.

Since before the sale to Nippon was announced, Mr. Burritt also

appears to have diverted his focus from U.S. Steel’s operations.

For example, on the conference call for the Nippon sale

announcement, analysts noted that Big River’s EBITDA per ton was

down roughly 59% and the mini-mill cost per ton was up roughly 23%

following the 2021 Big River acquisition.9 Mr. Burritt’s response

to this was tone deaf: “we feel absolutely wonderful about this Big

River facility. And with Big River 2, it's going to be even more

remarkable.”10

When U.S. Steel reported fourth quarter and full year 2023

earnings only six weeks later, it revealed $12 million of costs

related to Big River, which had the effect of reducing the

mini-mill segment’s EBITDA to just $74 million.11 Unfortunately for

shareholders, the trend of excess costs at Big River has continued

unabated. On September 19, 2024, the Company disclosed that the

mini-mill segment’s adjusted EBITDA would be lower than the

previous quarter, impacted by $40 million of costs from the Big

River 2 mini-mill.12 The Company followed this with a vague

cautionary note on December 19, 2024, stating Big River 2

“ramp-related costs exert pressure on the quarter.”13

In addition to unrelenting Big River cost overruns, U.S. Steel

has consistently missed earnings estimates over the past year and a

half while lagging its peers. Notably, during Mr. Burritt’s tenure,

the Company’s total shareholder returns have underperformed peers

by a staggering 227.7%.

Total Shareholder

Returns*

1-year

5-year

Burritt CEO Tenure

U.S. Steel

-7.7%

-21.3%

13.5%

Peer Median

24.9%

180.6%

241.2%

Relative Performance

-32.2%

-201.9%

-227.7%

Source: FactSet and Bloomberg. Peers

include Commercial Metals Company, Cleveland-Cliffs Inc., Reliance,

Inc., Steel Dynamics, Inc. and Nucor Corporation.

*Total shareholder returns as of market

close August 11, 2023, the last trading day prior to the Company’s

disclosure of initiating a strategic alternatives process. Mr.

Burritt’s election by the Board to assume the CEO role was

announced May 10, 2017.

Key Performance

Metrics**

Revenue Growth

Adjusted EBITDA Growth

CapEx Growth

Free Cash Flow Growth

U.S. Steel

19.7%

-25.6%

336.6%***

-225.7%

Peer Median

38.3%

15.5%

79.2%

55.0%

Relative Performance

-18.6%

-41.1%

257.4%

-280.7%

**Key performance metrics measured from

figures reported by U.S. Steel and peers from Q2 2021 to Q3 2024.

These dates reflect the start of the economic recovery from COVID

and the most recently reported quarter.

***CapEx Growth is based on incurred

expenses and likely does not yet reflect U.S. Steel's $600 million

budget expansion for Big River 2.

U.S. Steel is now in a dire state due to its excessive capital

spending, high debt, soft earnings and nonexistent contingency

plan. While Mr. Burritt may not care due to what seem to be his

jet-setting ways, we believe the city of Pittsburgh and the

Commonwealth of Pennsylvania have been put at economic risk by his

sale aspirations and mismanagement of the Company. There are

consequences associated with having out-of-touch leadership with

weak involvement in local communities. Absent a miracle, Ancora

believes a substantial and urgent reconstitution of the Company’s

leadership is necessary.

An Alternative Path Forward: Our Slate and

Mr. Kestenbaum Want to Make U.S. Steel Great Again in the Public

Market

Ancora has nominated a fit-for-purpose slate with nine highly

qualified individuals, whose complementary skills make them greater

than the sum of their parts. Each is a leader in his or her

respective field and is able to draw on prior public company

experience to help set a viable go-forward strategy. Our nominees

include individuals with experience in corporate governance,

executive leadership, finance, logistics, manufacturing, regulatory

affairs and strategic transactions. They come to the Board free of

the incumbents’ past mistakes, open-minded, and committed to

producing enduring value for shareholders and stakeholders.

Importantly, the slate includes industry heavyweight Alan

Kestenbaum, the former Chairman and CEO of Stelco, as a CEO

candidate for U.S. Steel. If our slate’s campaign is successful,

Mr. Kestenbaum will bring to the role a uniquely close relationship

with the United Steelworkers, expertise in identifying and

operating undervalued assets, and an unrelenting commitment to

delivering the best possible results.

Most notably, Mr. Kestenbaum has a history of turning U.S.

Steel’s failed endeavors into home runs. Look no further than what

he accomplished at Stelco, a company U.S. Steel put into

bankruptcy. Mr. Kestenbaum acquired Stelco for approximately $53

million, only to later sell it for more than $2 billion.14 In the

process, he enriched his shareholders through the success of a

turnaround, whereas U.S. Steel’s investors received virtually

nothing for the asset. Considering the significant underperformance

of U.S. Steel’s operations and Mr. Burritt’s underwhelming results

as a leader, Mr. Kestenbaum represents a massive upgrade on all

fronts.

If elected, our slate and its CEO candidate are committed to the

following:

- Pursuing the $565 million breakup fee that U.S. Steel needs

based on Mr. Burritt’s own statements regarding the prospect of

potential facility closures and layoffs.

- Immediately ending the current Board’s spending spree on Wall

Street advisors, which we estimate to be a nine-figure sum over the

past 18 months.

- Revamping the executive leadership team to be full of operators

residing near facilities and plants.

- Restoring relations with labor union members and leaders,

community organizations and elected officials.

- Releasing a clear standalone strategy so investors have

transparency about priorities for capital allocation, operations

and production, and other commercial initiatives.

- Protecting Mon Valley Works and other facilities Mr. Burritt

has threatened to close. It’s important to highlight that Mr.

Kestenbaum’s track record as a CEO includes increasing employment

everywhere he has been.

- Not soliciting acquisition proposals from Cleveland-Cliffs,

Inc. or any other partner (domestic or foreign).

Please note that despite the sale to Nippon being blocked this

month, you – the Board – decided to keep a January deadline for

director candidate nominations in an apparent effort to insulate

yourselves. We complied with your deadline despite being in the

process of amassing a meaningful stake that will be disclosed in

due course. Make no mistake, Ancora, as well as Mr. Kestenbaum,

intend to build meaningful positions as sale pipe dreams fade and

the Company’s share price continues resetting from what have been

artificially inflated levels.

In closing, our goal here is straightforward: make U.S. Steel

great again for the benefit of employees, customers, shareholders

and all other stakeholders who want a bright future for this

American icon. Only under a new Board and management team do we

believe this is possible.

Regards,

Fredrick D. DiSanto

Chairman and Chief Executive Officer

Ancora Holdings Group, LLC

James Chadwick

President

Ancora Alternatives LLC

***

DIRECTOR CANDIDATE

BIOS

Jamie Boychuk

Mr. Boychuk is an experienced public company executive with a

relevant background in logistics, operations and supply chain

management as well as valuable perspectives from his tenure at a

major customer of U.S. Steel (Canadian National Railway

Company).

- Most recently served as Executive Vice President of Operations

at CSX Transportation (NASDAQ: CSX) from October 2019 to August

2023, leading to best-in-class operating efficiency.

- Held various operations leadership roles at CSX, including

Senior Vice President of Network Operations and Mechanical,

Engineering, Intermodal, since joining the company in May

2017.

- Previously served in various leadership roles, including

General Manager and General Superintendent, at Canadian National

Railway Company (TSX: CNR, NYSE: CNI) from September 1997 to March

2017.

- Received business and leadership certificates from the

University of Notre Dame and Northwestern University’s Kellogg

School of Management.

Fredrick D. DiSanto

Mr. DiSanto is a shareholder and experienced public company

director with expertise in capital allocation, corporate finance,

and the debt and equity markets.

- Currently serves as Chairman and Chief Executive Officer at

Ancora Holdings, the parent company of Ancora Alternatives, a U.S.

Steel shareholder.

- Previously served as the Chief Executive Officer of Regional

Brands Inc. (OTC: RGBD), a publicly traded holding company, from

November 2016 to March 2021.

- Currently serves on the boards of directors of Ampco-Pittsburgh

Corporation (NYSE: AP), a specialty metal products and customized

equipment company; The Eastern Company (NASDAQ: EML), a company

that manages industrial businesses; and Regional Brands.

- Holds a B.S. in Management Science from Case Western Reserve

University and an M.B.A. from the Weatherhead School of Management

at Case Western Reserve University.

Robert P. Fisher, Jr.

Mr. Fisher is a seasoned investment manager, investment

banker and public company director with significant experience in

dealmaking and the metals and mining sector.

- Currently serves as President and CEO of George F. Fisher,

Inc., a private investment company that manages a portfolio of

public and private investments, since January 2002.

- Previously served in various leadership positions at Goldman

Sachs Group Inc. (NYSE: GS) from 1982 to 2001, including as

Managing Director and head of the Investment Banking Mining Group

and earlier as head of the Canadian Corporate Finance and

Investment Banking units.

- Served on the board of directors of Cleveland-Cliffs Inc.

(NYSE: CLF) from July 2014 to May 2024, where he was Chair of the

Compensation Committee from 2014 to 2018. Also served on the board

of directors of CML Healthcare, Inc. (formerly TSX: CLC) from 2010

to 2013, where he was Chair of the Human Resources and Compensation

Committee.

- Received a B.A. from Dartmouth College and an M.A. in Law and

Diplomacy from Tufts University.

Dr. James K. Hayes

Dr. Hayes is a proven senior executive and board member with

experience implementing growth initiatives and a relevant

background in manufacturing and strategic planning.

- Currently serves on the board of directors of Marine Electric

Systems, Inc., a privately held manufacturer of monitoring and

control systems, since October 2019.

- Previously served as Vice President of Westinghouse Air Brake

Technologies Corporation (NYSE: WAB), a provider of

technology-based equipment, systems and services for the freight

rail and passenger transit vehicle industries, from August 2015 to

January 2019. Prior to that, he served as Assistant Vice President

of the Federal Reserve Bank of Richmond from October 2009 to August

2015.

- Served as a senior executive of Eaton Corporation PLC (NYSE:

ETN), a multinational power management company; Tyco Fire &

Security, LLC (a subsidiary of Tyco International plc, n/k/a

Johnson Controls International PLC (NYSE: JCI)), a provider of fire

safety and fire suppression solutions; and Motorola Solutions, Inc.

(NYSE: MSI), a technology, communications and security

company.

- Received a B.S. in Foreign Service in International Economics

from Georgetown University, an M.P.A. in Economics and Policy from

Princeton University, an M.B.A. in Finance and Accounting from the

University of Chicago and a D.B.A. in Management from Case Western

Reserve University.

Alan Kestenbaum

Mr. Kestenbaum is a seasoned steel industry leader and board

member with significant expertise when it comes to turnarounds,

strategy, operations, M&A, and labor and stakeholder

relations.

- Currently serves as Founder and Chief Executive Officer of

Bedrock Industries Group LLC, a privately funded holding company

that owns and operates assets in the metals, mining and natural

resources sectors, since January 2016.

- Previously served as Chief Executive Officer of Stelco Holdings

Inc. (formerly TSX: STLC), a Canadian steel company, from July 2017

to February 2019, and returned to the position in February 2020

until its acquisition by Cleveland-Cliffs Inc. (NYSE: CLF) in

December 2024.

- Also served as Founder and Chief Executive Officer of Globe

Specialty Metals, Inc. (n/k/a Ferroglobe PLC) (NASDAQ: GSM), a

producer of silicon metal and silicon-based specialty alloys. Prior

to that, he was Founder and Chief Executive Officer of Marco

International Corp. and its affiliates, a finance trading group

specializing in metals, minerals and other raw materials.

- Served as Executive Chairman of the boards of directors of

Stelco from July 2017 to December 2024, Globe Specialty Metals from

December 2004 to December 2015 and Ferroglobe from December 2015 to

December 2016.

- Received a B.A. in Economics from Yeshiva University.

Roger K. Newport

With 35 years of experience in the steel industry, Mr.

Newport brings the background of a public company director and

former steel company CEO with expertise in strategy, finance,

M&A, operations, regulatory matters, and labor and stakeholder

relations.

- Previously served as Chief Executive Officer of AK Steel

Holding Corporation (formerly NYSE: AKS), an American steelmaking

and manufacturing company, from January 2016 until it was acquired

in March 2020. Prior to becoming CEO, he held various executive

roles in the finance department from 2010 to 2015.

- Previously served as a member of the board of directors of AK

Steel from January 2016 to March 2020. Also served as Chairman of

the board of directors of the American Iron and Steel Institute, a

trade association of North American steel producers, from January

2016 to March 2020, and as a member of the Executive Board of the

World Steel Association and the Steel Market Development Institute

CEO Group.

- Currently serves on the boards of directors of American

Financial Group, Inc. (NYSE: AFG), a financial services holding

company, since February 2024, as well as Alliant Energy Corporation

(NASDAQ: LNT), a public utility holding company, since July

2018.

- Received a B.A. in Accounting from the University of Cincinnati

and an M.B.A. from the Williams College of Business at Xavier

University.

Shelley Y. Simms

Ms. Simms is a regulatory, compliance and public policy

expert who has held leadership roles at several Pennsylvania-based

corporations and formerly served as a top ethics official for the

state.

- Currently serves as General Counsel and Chief Compliance

Officer of Philadelphia-based Xponance, Inc., a multi-strategy

investment firm, since August 2004, as well as Chief Compliance

Officer of Xponance Alts Solutions, LLC, Xponance’s affiliated

private equity advisor, since September 2021.

- Previously served as an independent legal consultant to

Philadelphia-based Aramark (NYSE: ARMK), a food services and

facilities management provider; Assistant Deputy General Counsel of

Philadelphia-based Comcast Corporation (NASDAQ: CMCSA), a global

media and technology company; and an Associate at Ballard Spahr

Andrews & Ingersoll, LLP, a national law firm.

- Currently serves as a member of the board of directors of 1st

Colonial Community Bank, a subsidiary of 1st Colonial Bancorp, Inc.

(OTC: FCOB), since July 2021, as well as an Independent Trustee of

City National Rochdale Funds, a mutual fund series, since September

2023, and The Pop Venture Fund, a closed-end investment management

company, since July 2024.

- Appointed Commissioner and later elected Chairperson of the

Commonwealth of Pennsylvania State Ethics Commission from January

2018 to November 2023.

- Received a B.A. from Brown University and a J.D. from Harvard

Law School.

Peter T. Thomas

Mr. Thomas is a senior executive and public company director

with decades of relevant experience and insight in manufacturing

from his leadership roles at several public companies across the

industrials sector.

- Currently serves on the board of directors of Berry Global

Group Inc. (NYSE: BERY), a global manufacturer and marketer of

plastic packaging products, since February 2023.

- Previously served as President and Chief Executive Officer of

Ferro Corporation (formerly NYSE: FOE), a producer of

technology-based performance materials, from November 2012, and as

Chairman of the board of directors, from April 2013 until April

2022, when it was acquired by Prince International

Corporation.

- Earlier in his career, he served in various roles at Witco

Corporation (formerly NYSE: WIT), a specialty chemical products

manufacturing company; Inland Leidy Inc., a specialty chemical

production and distribution company; and GAF Materials Corporation,

a manufacturer of specialty chemicals and roofing materials.

- Served as a member of the board of directors of Innophos

Holdings, Inc. (formerly NASDAQ: IPHS) from January 2016 until its

sale to One Rock Capital Partners, LLC in February 2020, including

serving as lead director from December 2017 to February 2020.

- Received a B.S. in Chemistry and Biochemistry from Duquesne

University and an M.B.A. in Finance and Marketing from Loyola

University.

David J. Urban

Mr. Urban is a legal, government affairs and stakeholder

relations expert with additive experience from his service as an

advisor, executive and public company director.

- Currently serves as Managing Director of BGR Group, a leading

lobbying and public relations firm, since April 2022, as well as Of

Counsel of Torridon Law PLLC, a law firm, since June 2024, and as a

Senior Advisor to Gothams LLC, a provider of emergency response

services, since January 2022.

- Also serves as a Senior Political Contributor for CNN, a global

media and news organization, since January 2018, and is part-owner

of PoliticsPA, a website covering Pennsylvania politics and

campaign news, since January 2007.

- Previously served as Executive Vice President, North American

Corporate Affairs of ByteDance Ltd., a global internet technology

company, from July 2020 to January 2022; President at American

Continental Group, Inc., a government affairs consulting firm, from

January 2002 to July 2020; and Chief of Staff and advisor to

Pennsylvania's longest-serving U.S. Senator, Arlen Specter.

- Currently serves on the board of directors of Eos Energy

Enterprises, Inc. (NASDAQ: EOSE), a provider of zinc-powered energy

storage solutions, since December 2024, and Virtu Financial, Inc.

(NASDAQ: VIRT), a global market maker and financial services firm,

since January 2019. Also serves as a member of the Global Advisory

Council at Coinbase Global, Inc. (NASDAQ: COIN), a cryptocurrency

exchange, since November 2023.

- Received a B.S. from the United States Military Academy at West

Point, a J.D. from Temple University Beasley School of Law and an

M.P.A. from the University of Pennsylvania.

- Mr. Urban’s father was a lifelong steelworker from Aliquippa,

PA and member of United Steelworkers Local #1211, who worked as a

metallurgist and boilermaker for J&L Steel and LTV.

***

About Ancora

Founded in 2003, Ancora Holdings Group, LLC offers integrated

investment advisory, wealth management, retirement plan services

and insurance solutions to individuals and institutions across the

United States. The firm is a long-term supporter of union labor and

has a history of working with union groups and public pension plans

to deliver long-term value. Ancora’s comprehensive service offering

is complemented by a dedicated team that has the breadth of

expertise and operational structure of a global institution, with

the responsiveness and flexibility of a boutique firm. For more

information about Ancora, please visit https://ancora.net.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Ancora Catalyst Institutional, LP (“Ancora

Catalyst Institutional”), together with the other

participants named herein, intend to file a preliminary proxy

statement and accompanying universal proxy card with the Securities

and Exchange Commission (“SEC”) to be

used to solicit votes for the election of Ancora Catalyst

Institutional’s slate of highly-qualified director nominees at the

2025 annual meeting of stockholders of United States Steel

Corporation, a Delaware corporation (the “Company”).

ANCORA CATALYST INSTITUTIONAL STRONGLY ADVISES ALL STOCKHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY

MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL

BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT

HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY

SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT

CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE

DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the anticipated proxy solicitation are

expected to be Ancora Catalyst Institutional, Ancora Bellator Fund,

LP (“Ancora Bellator”), Ancora

Catalyst, LP (“Ancora Catalyst”),

Ancora Merlin Institutional, LP (“Ancora

Merlin Institutional”), Ancora Merlin, LP (“Ancora Merlin”), Ancora Alternatives LLC,

(“Ancora Alternatives”), Ancora

Holdings Inc. (“Ancora Holdings”),

Fredrick D. DiSanto, Jamie Boychuk, Robert P. Fisher, Jr., Dr.

James K. Hayes, Alan Kestenbaum, Roger K. Newport, Shelley Y.

Simms, Peter T. Thomas, and David J. Urban.

As of the date hereof, Ancora Catalyst Institutional directly

beneficially owns 121,589 shares of common stock, par value $1.00

per share (the “Common Stock”), of the

Company, 100 shares of which are held in record name. As of the

date hereof, Ancora Bellator directly beneficially owns 62,384

shares of Common Stock. As of the date hereof, Ancora Catalyst

directly beneficially owns 12,831 shares of Common Stock. As of the

date hereof, Ancora Merlin Institutional directly beneficially owns

123,075 shares of Common Stock. As of the date hereof, Ancora

Merlin directly beneficially owns 11,165 shares of Common Stock. As

the investment advisor and general partner to each of Ancora

Catalyst Institutional, Ancora Bellator, Ancora Catalyst, Ancora

Merlin Institutional, Ancora Merlin and certain separately managed

accounts (the “Ancora Alternatives

SMAs”), Ancora Alternatives may be deemed to beneficially

own the 121,589 shares of Common Stock beneficially owned directly

by Ancora Catalyst Institutional, 12,831 shares of Common Stock

beneficially owned directly by Ancora Catalyst, 62,384 shares of

Common Stock beneficially owned directly by Ancora Bellator,

123,075 shares of Common Stock beneficially owned directly by

Ancora Merlin Institutional, 11,165 shares of Common Stock

beneficially owned directly by Ancora Merlin and 137,453 shares of

Common Stock held in the Ancora Alternatives SMAs. As the sole

member of Ancora Alternatives, Ancora Holdings may be deemed to

beneficially own the 121,589 shares of Common Stock beneficially

owned directly by Ancora Catalyst Institutional, 12,831 shares of

Common Stock owned directly by Ancora Catalyst, 62,384 shares of

Common Stock beneficially owned directly by Ancora Bellator,

123,075 shares of Common Stock beneficially owned directly by

Ancora Merlin Institutional, 11,165 shares of Common Stock

beneficially owned directly by Ancora Merlin, and 137,453 shares of

Common Stock held in the Ancora Alternatives SMAs. As the Chairman

and Chief Executive Officer of Ancora Holdings, Mr. DiSanto may be

deemed to beneficially own the 121,589 shares of Common Stock

beneficially owned directly by Ancora Catalyst Institutional,

12,831 shares of Common Stock owned directly by Ancora Catalyst,

62,384 shares of Common Stock beneficially owned directly by Ancora

Bellator, 123,075 shares of Common Stock beneficially owned

directly by Ancora Merlin Institutional, 11,165 shares of Common

Stock beneficially owned directly by Ancora Merlin, and 137,453

shares of Common Stock held in the Ancora Alternatives SMAs. As of

the date hereof, Messrs. Boychuk, Fisher, Kestenbaum, Newport,

Thomas, and Urban, Dr. Hayes and Ms. Simms do not beneficially own

any shares of Common Stock.

___________________________ 1 The New York Times article

entitled, “Trump’s Love for Tariffs Began in Japan’s '80s Boom,”

dated May 15, 2019. Link. 2 Statement from President Trump, dated

December 3, 2024. Link. 3 Letter from Senator Josh Hawley and

then-Senators Vance and Rubio to then-Secretary of the Treasury

Yellen, dated December 19, 2023. Link. 4 The Japan Times article

entitled, “Nippon Steel’s case against Biden probably unwinnable,

attorneys argue,” dated January 15, 2025. Link. 5 Law360 article

entitled, “Analysis: US Steel And Nippon's Lawsuit Seen As 'Hail

Mary' Attempt,” dated January 9, 2025. Link. 6 Law360 article

entitled, “Expert Analysis: Nippon, US Steel Face Long Odds On

Merger Challenge,” dated January 15, 2025. Link. 7 Statement from

Mr. Burritt, dated January 3, 2025. Link. 8 Statement from Mr.

Burritt, dated January 3, 2025. Link. 9 U.S. Steel-Nippon

Transaction Call, December 18, 2023. 10 U.S. Steel-Nippon

Transaction Call, December 18, 2023. 11 Company press release,

dated February 1, 2024. 12 Company press release, dated September

19, 2024. 13 Company press release, dated December 19, 2024. 14

Represents purchase price net of Stelco cash on hand at the

transaction close.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127847051/en/

Longacre Square Partners LLC Charlotte Kiaie / Ashley

Areopagita, 646-386-0091 ckiaie@longacresquare.com /

aareopagita@longacresquare.com

Saratoga Proxy Consulting LLC John Ferguson / Joseph Mills,

212-257-1311 info@saratogaproxy.com

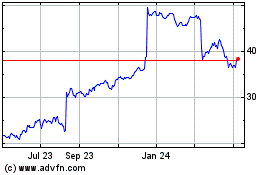

US Steel (NYSE:X)

Historical Stock Chart

From Feb 2025 to Mar 2025

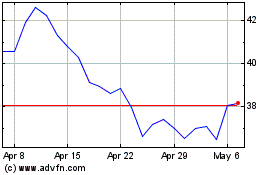

US Steel (NYSE:X)

Historical Stock Chart

From Mar 2024 to Mar 2025