UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

UNITED STATES STEEL CORPORATION

|

(Name of Registrant as Specified In Its Charter)

|

| |

ANCORA CATALYST INSTITUTIONAL, LP

ANCORA BELLATOR FUND, LP

ANCORA CATALYST, LP

ANCORA MERLIN INSTITUTIONAL, LP

ANCORA MERLIN, LP

ANCORA ALTERNATIVES LLC

ANCORA HOLDINGS GROUP, LLC

FREDRICK D. DISANTO

JAMIE BOYCHUK

ROBERT P. FISHER, JR.

DR. JAMES K. HAYES

ALAN KESTENBAUM

ROGER K. NEWPORT

SHELLEY Y. SIMMS

PETER T. THOMAS

DAVID J. URBAN

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Ancora Catalyst Institutional,

LP, together with the other participants named herein (collectively, “Ancora”), intend to file a preliminary proxy

statement and accompanying universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit

votes for the election of Ancora’s slate of director nominees at the 2025 annual meeting of stockholders (the “Annual Meeting”)

of United States Steel Corporation, a Delaware corporation (the “Company”).

Item 1: On January 27,

2025, Alan Kestenbaum, a director nominee of Ancora, was quoted in the following article published by Bloomberg:

Activist Pick for US Steel CEO Eyes Major Stake

If Given Job

Bloomberg

By Crystal Tse, Joe Deaux, and Simon

Casey

January 26, 2025, updated January 27, 2025

| · | Former Stelco CEO plans to take major stake to fix company |

| · | Kestenbaum says he’s prepared to become the top investor |

Steel industry veteran Alan Kestenbaum said

he’s willing to make a significant personal investment in United States Steel Corp. if it abandons a merger with Nippon

Steel Corp. and he’s selected to become its chief executive.

“I want to have a stake in something that I’m

going to be involved in,” the former Stelco Holdings Inc. CEO said Monday in an interview. “If I get the chance to run the

show, I’ll invest in myself.”

His comments come after activist investor Ancora Holdings

Group said it intends to force US Steel to abandon its deal with Nippon Steel. Ancora nominated nine candidates for US Steel’s

board including Kestenbaum, who the firm wants to install as a replacement to current CEO David Burritt. Nippon Steel’s $14.1

billion takeover was blocked this month by former US President Joe Biden, though the companies are pursuing legal measures to save the

deal.

To be sure, there’s no guarantee Kestenbaum

will ever see the inside of the US Steel boardroom, let alone become its next CEO. Ancora’s position is just 0.18% of all outstanding

shares, and they’ll need to convince existing shareholders that the plan is worth it.

Kestenbaum said he favors Ancora’s plan and

would put in place an operational plan to “fix” the Pittsburgh-based company. While he wouldn’t reveal details, the

63-year-old said his track record shows he knows how to install the right people, boost employee morale and make operations more efficient.

Kestenbaum, currently the CEO of private equity firm

Bedrock Industries Group, is known as a turnaround artist. At one time known for an attempted bid for the National Football

League’s Carolina Panthers, the Brooklyn-born native is highly regarded in the steel industry.

In 2017, he bought US Steel’s Canadian assets

out of bankruptcy, restored the name Stelco and pursued a seven-year reorganization that ended with the company’s $2.7 billion sale to Cleveland-Cliffs

Inc. in November. Cliffs sought to buy the Hamilton, Ontario-based steelmaker months after losing a bidding war for US Steel.

Kestenbaum said he’s not willing to buy US Steel

shares at the current price — which he considers too high — and won’t back current management. Assuming the stock price

is right, he said he’s willing to invest enough to become US Steel’s largest shareholder.

“I intend to take a major position in US Steel,”

he said.

Questions among US Steel investors swirled Monday

as to whether Ancora’s announcement was related to Cliffs and its CEO Lourenco Goncalves, who two weeks ago said he would mount

another bid for the company. Kestenbaum denied the speculation, saying “I can definitely tell you that that’s not the case.”

Cleveland-Cliffs wasn’t immediately available

for comment.

Since leaving after the Stelco sale, Kestenbaum has

been telling investors he’s looking for his next big project. He said this is one of his ambitions among others still in the works,

without revealing specifics.

US Steel said in a statement it was concerned

by Kestenbaum’s and Ancora’s motivations given each one’s recent dealings with Cliffs. The company said it remained

confident the deal with Nippon Steel is best.

--

Item 2: Also on January

27, 2025, Mr. Kestenbaum was interviewed on CNBC. A written transcript of the interview is included below:

Morgan Brennan:

>> Well we're going to stick with steel. U.S.

Steel finishing in the red today after the latest twist in its steel making drama. Shareholder and activist investor Ancora releasing

a letter to the board announcing it has nominated a majority slate of nine candidates, is calling for the company to abandon its blocked

– and currently being challenged in court – merger with Nippon Steel and is seeking the ouster of CEO David Burritt for the

CEO role. Ancora is putting forward Alan Kestenbaum, who most recently ran Stelco, which was sold to Cleveland-Cliffs last year. Now U.S.

Steel responding to Ancora, saying in part, quote, we remain confident that our partnership with Nippon Steel is the best deal for American

steel, American jobs, American communities and American supply chains. Also adding that, quote, it's also concerned about the motivations

behind these nominations given Ancora's and Alan Kestenbaum's recent dealings with failed bidder Cleveland-Cliffs. Well, joining me exclusively

is Alan Kestenbaum, former Stelco CEO and chairman and Ancora’s nominee to be the new head of U.S. Steel. It's great to have you

here on set. Welcome.

Alan Kestenbaum:

>> Thank you very much for having me.

Morgan Brennan:

>> So there's a lot to dig into, but the first

thing I want to start with is the fact that what's being put forward by Ancora and what you're proposing to do as the nominee, their nominee

for CEO, is to turn U.S. Steel around and to do so as a publicly traded, standalone company that does not need to be acquired by somebody

else. How do you do that? Especially when everybody, including U.S. Steel, is saying there needs to be some sort of acquisition because

there needs to be some sort of infusion of capital to update the plants.

Alan Kestenbaum:

>> Yeah. Well, let me start by saying the Nippon

deal is dead. It's been killed. President Biden killed it. The folks in the Trump administration have spoken out against it for a very

very long time. So, you know the notion that the Nippon deal is an option is gone. So now it's left is you have a company run by a CEO

who has done a very, very poor job in running the company. And it kind of breaks my heart because I grew up in the steel industry, and

I actually know that I could take this company and actually restore it to its greatness. And I came up with this acronym – MUSSGA

– make us steel great again. And why I'm the person to do it, and how I’m going to do it – it’s very simple. I

bought Stelco from U.S. Steel. It was in the exact same condition. Very, very low morale, very poor earnings. High cost of production.

And I bought that company in 2017 from them. At the time it was just losing money. They lost $1.4 billion in that investment. I bought

it for $53 million from them. Four months later, I took it public for a valuation of $1.7 billion. I then made and returned to shareholders

$2 billion. I put a billion into CapEx and I made it the lowest cost steel producer in North America. And so when you ask me about what

I can do with these plants, Dave Burritt has said he's going to shut these plants down. Well, first of all he's just shooting from the

hip, because if you shut those plants down, you also need to shut the mines down, and the mines are one of the most valuable assets that

the company has. So it's just a sort of, you know, an irresponsible statement that he made. And my plan would be to do exactly what I

did at Stelco and to rebuild those plants, particularly the ones he talked about. Mon Valley and Gary have the opportunity to be even

lower cost than Stelco. So I can take those plants, make them very, very profitable, turn them around from where they are today with some

very similar techniques as I did at Stelco.

Morgan Brennan:

>> You mentioned the Nippon deal is dead. It's

not actually dead. I mean, it was it was hung at CFIUS. And then President Biden at the time was the deciding vote and basically blocked

the deal. But CFIUS has since extended the implementation of that block by six months so this can go through a court process. So if they

decide to, they still need to proceed through that channel. We've heard from U.S. Steel. We just read it at the beginning of this. And

there have even been some analysts that have raised this, and that is questions about dealings with Cleveland-Cliffs and whether you're,

quote unquote, doing the bidding, essentially, of Cleveland-Cliffs in this process, which we know has put offers forward and is still

very interested in buying U.S. Steel. Your response?

Alan Kestenbaum:

>> Yes. Well, first of all, let me respond to

the first point. The deal actually is dead. The court process that is being pursued, there is no precedent of any court process prevailing

in such a situation. So the fact that they decided to start a lawsuit does not make the deal not dead. The deal is dead. There's no basis

for the lawsuit. To say that the that the president didn't have the authority when he clearly did have the authority is not really a lawsuit.

So I expect they're going to lose the lawsuit. In terms of Cleveland-Cliffs, I have nothing to do with Cleveland-Cliffs. I'm an independent

businessman. I just sold my business to Cleveland-Cliffs. And I love the steel industry, and I have a tremendous track record. As I mentioned

before, in turning around steel companies, not just Stelco before that was global specialty metals. I turned around, which was also left

for dead, and so to me, looking at the storied history of this company and thinking about the employees I encountered at Stelco and at

Globe, who were depressed and thinking they're going to be out of jobs. And then you read their own CEO, their own boss, telling them

they're going to be out of jobs, when actually you can go fix the company, and make it super profitable – that's what drives me.

I have nothing to do with Cliffs. This is what I want to do and this is what I plan to do, which is to keep it as a standalone public

company and make it successful.

Morgan Brennan:

>> So you have been in steel for a while, and

so I do want to just take a step back, a more macro question about what we're seeing in the steel industry right now, and that is the

fact that you have President Trump now in the helm. We know he wants to continue to spur U.S. manufacturing. He's talked up things like

coal, including at Davos last week. On the one hand. On the other hand, the possibility, the growing possibility of more tariffs in this

particular case on Mexico and Canada as soon as this weekend. Your outlook for steel.

Alan Kestenbaum:

>> My outlook for steel actually is positive

because of Donald Trump. So, he imposed tariffs in 2017. Biden continued those tariffs and most of the steel companies actually became

very, very successful. Speak about Nucor, Steel Dynamics, Cliffs – who hasn't been successful? U.S. Steel. So despite a great macro

environment, the only company that couldn't turn themselves around is U.S. Steel. And so I'm very optimistic about the steel industry.

I think he's going to continue these measures to give the steel companies and the steel industry time to recover. And when I get that

seat of CEO of U.S. Steel, I'm going to be able to take advantage of those environments.

Morgan Brennan:

>> Alan Kestenbaum, great to have you on set,

thanks for joining me.

Alan Kestenbaum:

>> Thank you so much.

Item 3: Also on January 27, 2025, David J. Urban, a director nominee of Ancora, published the following materials to X:

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Ancora Catalyst Institutional, LP (“Ancora

Catalyst Institutional”), together with the other participants named herein, intend to file a preliminary proxy statement and

accompanying universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for

the election of Ancora Catalyst Institutional’s slate of highly-qualified director nominees at the 2025 annual meeting of stockholders

of United States Steel Corporation, a Delaware corporation (the “Company”).

ANCORA CATALYST INSTITUTIONAL STRONGLY

ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT

HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE,

WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the anticipated proxy

solicitation are expected to be Ancora Catalyst Institutional, Ancora Bellator Fund, LP (“Ancora Bellator”), Ancora

Catalyst, LP (“Ancora Catalyst”), Ancora Merlin Institutional, LP (“Ancora Merlin Institutional”),

Ancora Merlin, LP (“Ancora Merlin”), Ancora Alternatives LLC, (“Ancora Alternatives”), Ancora Holdings

Group, LLC (“Ancora Holdings”), Fredrick D. DiSanto, Jamie Boychuk, Robert P. Fisher, Jr., Dr. James K. Hayes, Alan

Kestenbaum, Roger K. Newport, Shelley Y. Simms, Peter T. Thomas, and David J. Urban.

As of the date hereof, Ancora Catalyst

Institutional directly beneficially owns 121,589 shares of common stock, par value $1.00 per share (the “Common Stock”),

of the Company, 100 shares of which are held in record name. As of the date hereof, Ancora Bellator directly beneficially owns 62,384

shares of Common Stock. As of the date hereof, Ancora Catalyst directly beneficially owns 12,831 shares of Common Stock. As of the date

hereof, Ancora Merlin Institutional directly beneficially owns 123,075 shares of Common Stock. As of the date hereof, Ancora Merlin directly

beneficially owns 11,165 shares of Common Stock. As the investment advisor and general partner to each of Ancora Catalyst Institutional,

Ancora Bellator, Ancora Catalyst, Ancora Merlin Institutional, Ancora Merlin and certain separately managed accounts (the “Ancora

Alternatives SMAs”), Ancora Alternatives may be deemed to beneficially own the 121,589 shares of Common Stock beneficially

owned directly by Ancora Catalyst Institutional, 12,831 shares of Common Stock beneficially owned directly by Ancora Catalyst, 62,384

shares of Common Stock beneficially owned directly by Ancora Bellator, 123,075 shares of Common Stock beneficially owned directly by

Ancora Merlin Institutional, 11,165 shares of Common Stock beneficially owned directly by Ancora Merlin and 137,453 shares of Common

Stock held in the Ancora Alternatives SMAs. As the sole member of Ancora Alternatives, Ancora Holdings may be deemed to beneficially

own the 121,589 shares of Common Stock beneficially owned directly by Ancora Catalyst Institutional, 12,831 shares of Common Stock owned

directly by Ancora Catalyst, 62,384 shares of Common Stock beneficially owned directly by Ancora Bellator, 123,075 shares of Common Stock

beneficially owned directly by Ancora Merlin Institutional, 11,165 shares of Common Stock beneficially owned directly by Ancora Merlin,

and 137,453 shares of Common Stock held in the Ancora Alternatives SMAs. As the Chairman and Chief Executive Officer of Ancora Holdings,

Mr. DiSanto may be deemed to beneficially own the 121,589 shares of Common Stock beneficially owned directly by Ancora Catalyst Institutional,

12,831 shares of Common Stock owned directly by Ancora Catalyst, 62,384 shares of Common Stock beneficially owned directly by Ancora

Bellator, 123,075 shares of Common Stock beneficially owned directly by Ancora Merlin Institutional, 11,165 shares of Common Stock beneficially

owned directly by Ancora Merlin, and 137,453 shares of Common Stock held in the Ancora Alternatives SMAs. As of the date hereof, Messrs.

Boychuk, Fisher, Kestenbaum, Newport, Thomas, and Urban, Dr. Hayes and Ms. Simms do not beneficially own any shares of Common Stock.

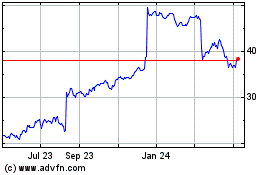

US Steel (NYSE:X)

Historical Stock Chart

From Feb 2025 to Mar 2025

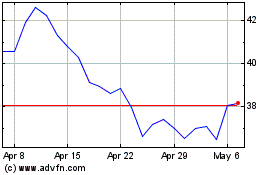

US Steel (NYSE:X)

Historical Stock Chart

From Mar 2024 to Mar 2025