false

0001166003

0001166003

2025-02-06

2025-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): February 6, 2025

XPO,

INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-32172 |

|

03-0450326 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

Five

American Lane, Greenwich,

Connecticut 06831

(Address of principal executive offices)

(855)

976-6951

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

XPO |

|

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405

of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| Emerging

growth company ¨ |

| |

| If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

| Item 7.01. | Regulation FD Disclosure. |

On February 6, 2025, XPO, Inc. (the “Company”)

released a slide presentation expected to be used by the Company in connection with certain future investor presentations. A copy of

the presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The slide presentation should be read together and with the Company’s

filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the fiscal quarter and year ended

December 31, 2024.

The information furnished in this Item 7.01, including Exhibit 99.1,

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed to be incorporated by reference into any

filing of the Company under the Exchange Act or the Securities Act of 1933, as amended, except to the extent that the registrant specifically

incorporates any such information by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 6, 2025 |

XPO, INC. |

| |

|

|

| |

By: |

/s/ Kyle Wismans |

| |

|

Kyle Wismans |

| |

|

Chief Financial Officer |

Exhibit 99.1

Investor Overview Q4 2024 February 2025

2 Forward - looking statements This document includes forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, including statements relating to our full year 2025 expectations of gross capex, interest expense, pension income, adjusted effective tax rate, and diluted share count, and future financial targets of North American LTL revenue CAGR, adjusted EBITDA CAGR, adjusted operating ratio improvement, and capex as a percentage of revenue . All statements other than statements of historical fact are, or may be deemed to be, forward - looking statements . In some cases, forward - looking statements can be identified by the use of forward - looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms . These forward - looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances . These forward - looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward - looking statements . Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC, and the following : the effects of business, economic, political, legal, and regulatory impacts or conflicts upon our operations ; supply chain disruptions and shortages, strains on production or extraction of raw materials, cost inflation and labor and equipment shortages ; our ability to align our investments in capital assets, including equipment, service centers, and warehouses to our customers’ demands ; our ability to implement our cost and revenue initiatives ; the effectiveness of our action plan, and other management actions, to improve our North American LTL business ; our ability to continue insourcing linehaul in ways that enhance our network efficiency and service ; the anticipated impact of a freight market recovery on our business ; our ability to benefit from a sale, spin - off or other divestiture of one or more business units or to successfully integrate and realize anticipated synergies, cost savings and profit opportunities from acquired companies ; goodwill impairment ; issues related to compliance with data protection laws, competition laws, and intellectual property laws ; fluctuations in currency exchange rates, fuel prices and fuel surcharges ; the expected benefits of the spin - offs of GXO Logistics, Inc . and RXO, Inc .; our ability to develop and implement suitable information technology systems ; the impact of potential cyber - attacks and information technology or data security breaches or failures ; our indebtedness ; our ability to raise debt and equity capital ; fluctuations in interest rates ; seasonal fluctuations ; our ability to maintain positive relationships with our network of third - party transportation providers ; our ability to attract and retain management talent and key employees including qualified drivers ; labor matters ; litigation ; and competition and pricing pressures . All forward - looking statements set forth in this document are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations . Forward - looking statements set forth in this document speak only as of the date hereof, and we do not undertake any obligation to update forward - looking statements except to the extent required by law . Non - GAAP financial measures This presentation contains non - GAAP financial measures . For a description of these non - GAAP financial measures, including a reconciliation to the most comparable measure under GAAP, see the Appendix to this presentation .

Fourth quarter 2024 highlights $148 million of operating income, up 24% YoY $303 million of adjusted EBITDA, up 15% YoY $0.89 of adjusted diluted EPS 1 , up 16% YoY LTL adjusted operating ratio of 86.2%, improved by 30 bps YoY LTL adjusted EBITDA of $280 million, up 20% YoY LTL purchased transportation expense reduced by 47% YoY LTL yield, excluding fuel, up 6.3% YoY LTL revenue per shipment, excluding fuel, up 5.8% YoY LTL damage claims ratio of 0.2% Improved full - year LTL adjusted OR by 260 bps, better than our target range 1 Diluted earnings from continuing operations per share Refer to “Financial Reconciliations” and “Non - GAAP Financial Measures” sections in Appendix for related information 3

4 Fourth quarter 2024 performance $1.92 billion REVENUE $148 million OPERATING INCOME $76 million NET INCOME $0.63 DILUTED EARNINGS PER SHARE $107 million ADJUSTED NET INCOME $ 0.89 ADJUSTED DILUTED EPS $ 303 million ADJUSTED EBITDA $189 million CASH FLOW FROM OPERATING ACTIVITIES NORTH AMERICAN LTL $1.16 billion REVENUE $280 million ADJUSTED EBITDA 86.2% ADJUSTED OPERATING RATIO Refer to “Financial Reconciliations” and “Non - GAAP Financial Measures” sections in Appendix for related information Note: Operating income, net income, diluted earnings per share, adjusted net income, adjusted diluted EPS, and adjusted EBITD A i nclude gains from sales of real estate of $26 million ($34 million pre - tax) or $0.21 per diluted share EUROPEAN TRANSPORTATION $765 million REVENUE $27 million ADJUSTED EBITDA BY SEGMENT

Our LTL strategy is driving significant margin and earnings expansion 5 Provide best - in - class service 2 3 4 Invest in network for the long - term Accelerate yield growth Drive cost efficiencies Targets for LTL Growth, Profitability and Efficiency, 2021 - 2027 1 Revenue CAGR of 6% to 8% Adjusted EBITDA CAGR of 11% to 13% Adjusted operating ratio improvement of a t least 600 bps Refer to “Non - GAAP Financial Measures” section in Appendix for related information

Strong position in North American LTL 6 6

A leading carrier in a compelling industry • $52 billion bedrock industry for the US economy, with nearly 75% share held by top 10 LTL players • Diverse demand across verticals, with secular growth drivers • Attractive pricing environment for over a decade, with positive YoY industry pricing each year • Strong service quality is key gating factor for yield growth and margin expansion • Industry service center capacity stayed nearly flat for a decade 1 5% CAGR: North American LTL industry revenue Sources: Third - party research; company filings Note: Revenue CAGR for periods 2010 – 2023; industry size and market share data for 2023 1 US service centers, includes ARCB, FDX, ODFL, SAIA, XPO and YELL 7

A major player in the supply - chain ecosystem Note: Company data for North American LTL segment only as of December 31, 2024, unless otherwise noted as 2024 (full year) 3 rd largest LTL carrier by 2023 revenue 14.6% of 2024 revenue allocated to gross capex 13 million 2024 s hipments 36,000 customers served $4.9 billion 2024 revenue 9 % 2023 industry share 8 13,0 0 0 d rivers 34,0 0 0 t railers 18 billion 2024 pounds of freight 661 million 2024 l inehaul miles run 2 3 ,0 0 0 e mployees 303 service centers quarterly (bring back

9 Expansive network covering 99% of US zip codes • 303 service centers 2 • Cross - border and offshore capabilities • Strategic investments in high - demand markets 1 Acquisition of strategic service center sites in December 2023 is driving landmark network expansion; on track for all sites to be operational by early 2025 2 Operational service centers as of December 31, 2024 Acquired Service Centers 1 Service Centers

Strategic mix of blue - chip and local customers 10 Note: Company data for North American LTL segment only as of December 31, 2024; selected customers Long - standing relationships – average tenure of top 10 customers is 17 years

LTL growth plan and levers 11

Provide best - in - class service Accelerate yield growth Drive cost efficiencies • Aligning price earned with increasing service excellence • Expanding accessorial revenue from value - add services • Growing share of higher - yielding local channel with scaled - up local salesforce • Insourcing linehaul miles to enhance service quality, network density and fluidity at lower cost • Using proprietary technology with predictive AI to improve labor productivity • Rationalizing corporate cost structure 12 Executing on four key levers • Strengthening the value we offer our customers through world - class service • Incentivizing employees to deliver outstanding service quality • Investing in new tools for field operations and enhancing training programs Invest in network for the long - term • Targeting capex of 8% to 12% of revenue on average through 2027 • Expanding linehaul fleet with tractors and in - house trailer manufacturing • Investing in capacity to further improve service and drive network efficiencies

1.1% 1.2% 1.1% 0.9% 0.9% 1.0% 1.0% 1.2% 1.1% 0.9% 0.9% 0.6% 0.7% 0.7% 0.4% 0.3% 0.3% 0.2% 0.2% 0.2% Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 1 Based on claims payment data 2 Based on damage frequency data 13 Service initiatives have driven over 80% improvement in damages 2 since Q4’21 Delivering meaningful service improvements Damage claims declining as a % of LTL revenue 1 LTL 2.0

$145 $197 $145 $197 $424 $581 $715 3.8% 5.2% 4.1% 4.8% 9.1% 12.4% 14.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% $- $200 $400 $600 $800 $1,000 2018 2019 2020 2021 2022 2023 2024 Gross capex as a % of revenue Gross capex ($ millions) Investing in capacity that supports growth and high returns 14 Tractor age in years As of December 31 5.3 5.1 5.4 5.9 5.9 Note: Gross capex and revenue for North American LTL only 1 Excludes the company’s December 2023 acquisition of 28 service centers 5.0 1 Reduced average fleet age to 4.1 years with addition of nearly 2,400 new tractors in 2024 4.1 LTL 2.0

$18.34 $18.45 $18.90 $18.82 $19.11 $19.29 $20.02 $20.90 $20.76 $21.34 $21.43 $21.19 $21.06 $21.63 $22.81 $23.37 $23.13 $23.56 $24.34 $24.84 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Earning price by delivering value through service excellence 15 Note: Gross revenue per hundredweight excludes the adjustment required for financial statement purposes in accordance with th e c ompany's revenue recognition policy Yield, excluding fuel, improved 6.3% year - over - year in Q4’24 Gross revenue per hundredweight (excluding fuel surcharges) LTL 2.0

25.5% 25.3% 25.7% 24.4% 23.8% 23.9% 23.6% 22.7% 24.5% 24.7% 23.5% 22.5% 21.8% 20.7% 21.5% 19.6% 18.1% 15.9% 13.6% 10.7% Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Insourcing linehaul is a key cost and service opportunity 16 Reduced linehaul miles outsourced to third - party carriers by nearly 900 bps year - over - year in Q4’24 Linehaul miles outsourced to third - party carriers, as a % of total linehaul miles LTL 2.0

17 11% to 13% adjusted EBITDA CAGR in North American LTL 2021 - 2027 Combination of volume gains + pricing over inflation 6% to 7% 3% to 4% 2% Operating costs optimized through technology Linehaul insourced from third parties Expected components and contributions 11% to 13% Generated 29% YoY increase in LTL adjusted EBITDA in 2024

Appendix 18

European Transportation segment • In France: the #1 full truckload (FTL) broker and the #1 pallet network (LTL) provider • In Iberia (Spain and Portugal): the #1 FTL broker and the #1 LTL provider • In the UK: a top - tier dedicated truckload provider, and the largest single - owner LTL network • Serves a diverse base of customers with consumer, trade and industrial markets, including many sector leaders that have long - tenured relationships with XPO • Range of services includes dedicated truckload, LTL, FTL brokerage, managed transportation, last mile, freight forwarding and warehousing, as well as multimodal solutions that are customized to reduce CO 2 e emissions Unique pan - European transportation platform holds leading positions in key geographies 19 19

20 For the full year

2025, the company expects: • Total company gross capex of $600 million to $700 million • Interest expense of $220 million

to $230 million • Pension income of approximately $6 million • Adjusted effective tax rate of 24% to 25% • Diluted

share count of 120 million 2025 planning assumptions Refer to “Non - GAAP Financial Measures” on page 24 of this document

Financial reconciliations The following table reconciles XPO’s net income from continuing operations for the periods ended December 31, 2024 and 2023 t o adjusted EBITDA for the same periods. 21 Reconciliation of net income to adjusted EBITDA Amounts may not add due to rounding 1 Relates to California Environmental Matters as described in Note 18 to the Company's Annual Report on Form 10 - K for the year end ed December 31, 2024 Refer to “Non - GAAP Financial Measures” section on page 24 of this document In millions (Unaudited) Change % Change % Net income from continuing operations $ 76 $ 58 31.0% $ 387 $ 192 101.6% Debt extinguishment loss - 2 - 25 Interest expense 53 42 223 168 Income tax provision 26 20 86 68 Depreciation and amortization expense 124 114 490 432 Litigation matter (1) - 8 - 8 Transaction and integration costs 14 11 53 58 Restructuring costs 10 9 27 44 Other - - - 1 Adjusted EBITDA $ 303 $ 264 14.8% $ 1,266 $ 996 27.1% Years Ended December 31, 2024 2023 Three Months Ended December 31, 2024 2023

Financial reconciliations (cont.)

The following table reconciles XPO’s net income from continuing operations for the periods ended December 31, 2024 and 2023 t o

adjusted net income from continuing operations for the same periods. 22 Amounts may not add due to rounding 1 Includes gains from sales

of real estate of $26 million ($34 million pre - tax) or $0.21 per diluted share in the fourth quarter o f 2024 2 Relates to California

Environmental Matters as described in Note 18 to the Company's Annual Report on Form 10 - K for the year end ed December 31, 2024 3 The

income tax rate applied to reconciling items is based on the GAAP annual effective tax rate, excluding discrete items, no n - deductible

compensation, and contribution - and margin - based taxes 4 Reflects a tax benefit recognized in the second quarter of 2024 and the subsequent

adjustments recognized during the second h al f of 2024 related to a legal entity reorganization within our European Transportation business

Refer to “Non - GAAP Financial Measures” section on page 24 of this document Reconciliation of adjusted net income and adjusted

diluted earnings per share In millions, except per share data (Unaudited) Net income from continuing operations (1) $ 76 $ 58 $ 387 $

192 Debt extinguishment loss - 2 - 25 Amortization of acquisition-related intangible assets 14 13 57 55 Litigation matter (2) - 8 - 8

Transaction and integration costs 14 11 53 58 Restructuring costs 10 9 27 44 Income tax associated with the adjustments above (3) (6)

(8) (24) (36) European legal entity reorganization (4) (1) - (41) - Adjusted net income from continuing operations (1) $ 107 $ 93 $ 460

$ 346 Adjusted diluted earnings from continuing operations per share (1) $ 0.89 $ 0.77 $ 3.83 $ 2.92 Weighted-average common shares outstanding

Diluted weighted-average common shares outstanding 120 120 120 118 Years Ended December 31, 2024 20232024 2023 Three Months Ended December

31,

Financial reconciliations (cont.) The following table reconciles XPO’s operating income attributable to its North American less - than - truckload ("LTL") segment for the periods ended December 31, 2024 and 2023 to adjusted operating income, adjusted operating ratio and adjusted EBITDA. 23 Reconciliation of N orth American LTL adjusted operating income, adjusted operating ratio and adjusted EBITDA Amounts may not add due to rounding NM - Not meaningful 1 Fuel, operating expenses and supplies includes fuel - related taxes 2 Operating ratio is calculated as (1 - (operating income divided by revenue)) using the underlying unrounded amounts 3 Adjusted operating ratio is calculated as (1 - (adjusted operating income divided by revenue)) using the underlying unrounded am ounts; adjusted operating margin is the inverse of adjusted operating ratio 4 Adjusted EBITDA is used by our chief operating decision maker to evaluate segment profit (loss) in accordance with ASC 280 Refer to “Non - GAAP Financial Measures” on page 24 of this document In millions (Unaudited) Change % Change % Revenue (excluding fuel surcharge revenue) $ 985 $ 966 2.0% $ 4,115 $ 3,814 7.9% Fuel surcharge revenue 171 221 -22.6% 785 857 -8.4% Revenue 1,156 1,187 -2.6% 4,899 4,671 4.9% Salaries, wages and employee benefits 621 602 3.2% 2,515 2,346 7.2% Purchased transportation 44 83 -47.0% 248 366 -32.2% Fuel, operating expenses and supplies (1) 218 238 -8.4% 928 956 -2.9% Operating taxes and licenses 16 13 23.1% 65 48 35.4% Insurance and claims 18 21 -14.3% 80 102 -21.6% (Gains) losses on sales of property and equipment (34) 2 NM (27) 8 NM Depreciation and amortization 89 77 15.6% 346 291 18.9% Transaction and integration costs - - 0.0% 1 - NM Restructuring costs 5 2 150.0% 7 12 -41.7% Operating income 179 149 20.1% 735 542 35.6% Operating ratio (2) 84.5% 87.4% 85.0% 88.4% Other income - 1 - 1 Amortization expense 9 8 36 34 Transaction and integration costs - - 1 - Restructuring costs 5 2 7 12 Gains on real estate transactions (34) - (34) - Adjusted operating income $ 159 $ 160 -0.6% $ 746 $ 589 26.7% Adjusted operating ratio (3) 86.2% 86.5% 84.8% 87.4% Depreciation expense 80 69 310 257 Pension income 6 4 25 17 Gains on real estate transactions 34 - 34 - Other - - - 1 Adjusted EBITDA (4) $ 280 $ 233 20.2% $ 1,115 $ 864 29.1% 2024 2023 Three Months Ended December 31, Years Ended December 31, 2024 2023

dNon - GAAP financial measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non - GAAP

financial measures contained in this document to the most directly comparable measure under GAAP, which are set forth in the financial

tables attached to this document . This document contains the following non - GAAP financial measures : adjusted earnings before interest,

taxes, depreciation and amortization (“adjusted EBITDA”) on a consolidated basis ; adjusted net income from continuing operations

; adjusted diluted earnings from continuing operations per share ("adjusted EPS") ; adjusted operating income for our North American

Less - Than - Truckload segment ; adjusted operating ratio for our North American Less - Than - Truckload segment ; and adjusted effective

tax rate . We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they

exclude items that may not be reflective of, or are unrelated to, XPO and its business segments’ core operating performance, and

may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate

these non - GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other

companies . These non - GAAP financial measures should only be used as supplemental measures of our operating performance . Adjusted

EBITDA, adjusted net income from continuing operations, adjusted EPS, adjusted operating income and adjusted operating ratio include

adjustments for transaction and integration costs, as well as restructuring costs, and other adjustments as set forth in the attached

tables . Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture

or spin - off and may include transaction costs, consulting fees, stock - based compensation, retention awards, internal salaries and

wages (to the extent the individuals are assigned full - time to integration and transformation activities) and certain costs related

to integrating and converging IT systems . Restructuring costs primarily relate to severance costs associated with business optimization

initiatives . Management uses these non - GAAP financial measures in making financial, operating and planning decisions and evaluating

XPO’s and each business segment’s ongoing performance . We believe that adjusted EBITDA improves comparability from period

to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization),

tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating

activities and thereby assist investors with assessing trends in our underlying businesses . We believe that adjusted net income from

continuing operations and adjusted EPS improve the comparability of our operating results from period to period by removing the impact

of certain costs and gains that management has determined are not reflective of our core operating activities, including amortization

of acquisition - related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in

the attached tables . We believe that adjusted operating income and adjusted operating ratio improve the comparability of our operating

results from period to period by removing the impact of certain transaction and integration costs and restructuring costs, as well as

amortization expenses . We believe that adjusted effective tax rate improves comparability of our effective tax rate, by excluding the

tax effect of special items . With respect to our targets for : ( i ) the North American less - than - truckload segment’s adjusted

EBITDA CAGR and adjusted operating ratio for the six - year period 2021 through 2027 and (ii) the 2025 adjusted effective tax rate, a

reconciliation of these non - GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the

variability and complexity of the reconciling items described above that we exclude from these non - GAAP target measures . The variability

of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward

- looking statement of income and statement of cash flows in accordance with GAAP that would be required to produce such a reconciliation

. 24

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

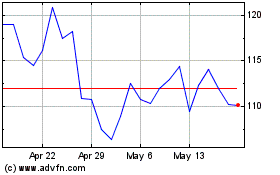

XPO (NYSE:XPO)

Historical Stock Chart

From Jan 2025 to Feb 2025

XPO (NYSE:XPO)

Historical Stock Chart

From Feb 2024 to Feb 2025