Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

May 06 2024 - 8:23AM

Edgar (US Regulatory)

SUPPLEMENT TO PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

MAY 22, 2024

May 6, 2024

Dear Fellow Shareholders:

In advance of our 2024 Annual Meeting of Shareholders

scheduled for May 22, 2024 (the “2024 Annual Meeting”), I am writing to you on behalf of the Board of Directors (the “Board”)

of Zoetis Inc. (“Zoetis”) to provide you with some further context on our process and engagement in response to two proposals

on special meeting rights that were both approved by shareholders at the 2023 Annual Meeting of Shareholders (the “2023 Annual Meeting”).

Shareholders Indicated a Strong Preference for a Special Meeting

Right With a 25% Threshold at the 2023 Annual Meeting

At the 2023 Annual Meeting of Shareholders, shareholders voted

on two proposals regarding the adoption of special meeting rights: (i) Proposal 4, a management proposal that asked shareholders to approve

an amendment to Zoetis’ charter to allow shareholders holding 25% of outstanding Zoetis common stock to request special meetings,

which the Board recommended on the basis of feedback received from shareholders, and (ii) Proposal 5, a non-binding shareholder proposal

submitted by John Chevedden (the “Chevedden Proposal”) requesting the Board take the steps necessary to amend Zoetis’

governing documents to give shareholders owning 10% of outstanding Zoetis common stock the power to call a special shareholder meeting

regardless of length of stock ownership.

Both proposals passed,

with the management proposal receiving significantly higher shareholder support than the Chevedden Proposal. Over 99% of the votes

cast (abstentions excluded) supported the management proposal compared to just over 52% of the votes cast (abstentions excluded) that

supported the Chevedden Proposal. And even though the Chevedden Proposal narrowly passed at the 2023 Annual Meeting by receiving

approximately 52% of the votes cast, Zoetis noted that it received the support of less than 50% of outstanding Zoetis common stock eligible

to vote, creating doubt over whether it would pass if proposed as a charter amendment, which would be required to implement such a special

meeting right.

Zoetis Conducted Extensive Shareholder Outreach and Engagement Prior

to the 2023 Annual Meeting and Received Strong Shareholder Feedback Favoring a Special Meeting Right With a 25% Threshold

Prior to the 2023 Annual Meeting, members of management

and the Board, engaged 16 of our largest shareholders, comprising over 30% of our outstanding shares, on a variety of governance topics,

including special meeting rights and the appropriate threshold at which such right should be implemented. Shareholders overwhelmingly

indicated their preference for a special meeting right with a 25% threshold rather than a 10% threshold. In supporting the 25% threshold,

several of our shareholders expressed the need to balance the right for shareholders to raise issues of importance against the risk that

a low threshold of 10% could permit a relatively small group of shareholders to take action without support from the broader shareholder

base, thus resulting in an ineffective use of corporate resources.

Shareholders Did Not Express Any Concerns After Zoetis Amended Its

Charter to Adopt a Special Meeting Right With a 25% Threshold

Following the passage of the management proposal

on special meeting rights at the 2023 Annual Meeting, Zoetis promptly amended its charter, as required by law, to adopt a special meeting

right with a 25% threshold. Zoetis did not receive any feedback from any of our shareholders (including the shareholder proponent of the

Chevedden Proposal) that any further action needed to be taken on the matter.

Zoetis Conducted Shareholder Outreach and Engagement Prior to the

2024 Annual Meeting and Received Strong Shareholder Support for Its Governance Practices

In the fall of 2023, following adoption of the

charter amendment allowing shareholders to call a special meeting with a 25% threshold, members of management engaged additional shareholders

on various topics, including Zoetis’ governance policies and practices. Once again, no shareholder expressed any concern regarding

the right of shareholders to call special meetings at the 25% threshold. The feedback Zoetis received was uniformly positive, with Vanguard

(our largest shareholder) featuring its engagement with Zoetis on the issue as an example of successful engagement in its 2023 Annual

Report. The report noted that two proposals on special meeting rights had been submitted to a shareholder vote, with management proposing

a threshold of 25%. Vanguard wholeheartedly concurred with management, stating in such report:

“The board’s proposal to establish shareholders’

right to call a special meeting at a 25% threshold was aligned with the funds’ preferred threshold. The holding requirement of one

year, in our assessment, did not constitute a material restriction on this right and was a common market practice. Given that the management

proposal indicated a level of board responsiveness to shareholder feedback and was aligned with the funds’ voting policies, the

funds supported management’s proposal and did not support the shareholder proposal.”

Key Investor Proxy Voting Guidelines Support Special Meeting Rights

At the Current 25% Threshold

Several of Zoetis’ largest shareholders have

also adopted proxy voting policies that will likely oppose lowering special meeting rights to a 10% threshold:

| · | Vanguard: “If a company already has the right to call a special meeting

at a threshold of 25% or lower, a fund will generally vote . . .[a]gainst shareholder proposals to lower the ownership threshold below

the current threshold.” |

| · | BlackRock: “[S]hareholders should have the right to call a special

meeting in cases where a reasonably high proportion of shareholders (typically a minimum of 15% but no higher than 25%) are required to

agree to such a meeting before it is called.” |

| · | Capital Group: “The ability to call a special meeting is also a valuable

right for shareholders that we generally support. However, we consider the details of these shareholder proposals, particularly the proposed

ownership thresholds, and attempt to assess whether a low limit (e.g., 10%) would allow actions by a relatively small group that might

not be in the best interests of the majority of shareholders.” |

| · | T. Rowe Price: “AGAINST proposals to reduce the threshold of shareholders

required if the company has in place a standard of no more than 25 percent.” |

***

Based on the feedback received from shareholders

over the past several months, the Board believes it is in the best interests of Zoetis and its shareholders to provide for a special meeting

right with a 25% threshold. For these reasons, the Board urges all shareholders to vote “FOR” the re-election of all of

our directors in Proposal 1.

Sincerely,

Michael McCallister

Chair of the Board

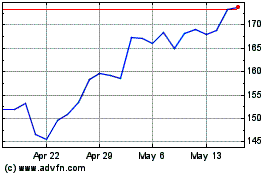

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Apr 2024 to May 2024

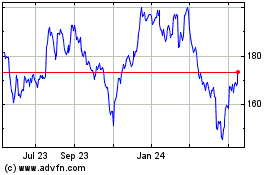

Zoetis (NYSE:ZTS)

Historical Stock Chart

From May 2023 to May 2024