adidas Group: First Half Year 2007 Results

August 08 2007 - 12:33AM

Business Wire

adidas Group (FWB:ADS): Currency-neutral Group sales grow 6% in the

first half year First half net income attributable to shareholders

increases 3% adidas currency-neutral backlogs increase 9% with

growth in all regions Reebok currency-neutral backlogs stable

versus prior year Full year guidance confirmed Second quarter

adidas Group currency-neutral sales grow 3% During the second

quarter of 2007, Group revenues grew 3% on a currency-neutral basis

despite a tough comparison with the prior year as a result of high

sales related to the 2006 FIFA World Cup�. This development was

driven by a strong sales increase at brand adidas as well as

underlying sales growth in the TaylorMade-adidas Golf segment.

Reebok sales, however, declined in the second quarter. Currency

movements negatively impacted reported revenues. In euro terms,

Group sales decreased by 1% to � 2.400 billion in the second

quarter of 2007 from � 2.428 billion in 2006. Second quarter net

income attributable to shareholders up 27% Second quarter gross

margin increased 2.8 percentage points to 47.4% (2006:�44.6%) as a

result of integration-driven cost synergies which positively

impacted the cost of sales of both adidas and Reebok and underlying

improvements in the Reebok segment. The non-recurrence of negative

impacts from purchase price allocation in the Reebok segment also

positively impacted gross margin development. Group gross profit

increased 5% to ��1.138 billion (2006: � 1.084 billion). As a

result of the strong gross margin increase, which more than offset

higher operating expenses as a percentage of sales, the Group�s

operating margin increased 0.7 percentage points to 7.8% in the

second quarter of 2007 versus 7.1% in the prior year. Operating

profit grew 9% to � 188 million versus � 173 million in 2006. In

the second quarter of 2007, the Group�s net income attributable to

shareholders increased 27% to ��104�million (2006: � 82 million)

due to higher operating profit as well as lower net financial

expenses and a lower tax rate. adidas Group currency-neutral sales

grow 6% in the first half of 2007 During the first six months of

2007, Group revenues increased 6% on a currency-neutral basis,

driven by sales growth in the adidas segment, the inclusion of an

additional month in the Reebok segment versus the prior year and

underlying sales increases at TaylorMade-adidas Golf. On a reported

basis, however, TaylorMade-adidas Golf revenues declined,

negatively impacted by the divestiture of the Greg Norman

Collection (GNC) wholesale business. From a regional perspective,

adidas Group currency-neutral sales grew in all regions except

North America. In euro terms, Group revenues grew 1% to � 4.938

billion in the first half of 2007 from � 4.887 billion in 2006. On

a like-for-like basis, including Reebok�s revenues for the full

six-month periods and excluding the effect from the divestiture of

the GNC wholesale business, Group sales increased 4% on a

currency-neutral basis. �In the first six months of 2007, we have

built on the tremendous success of the prior year,� commented

adidas AG Chairman and CEO Herbert Hainer. �Ongoing strength in key

performance categories has driven solid top-line growth at adidas

and like-for-like sales increases at TaylorMade-adidas Golf. We

have made important investments at Reebok as we continue to

implement our strategies to bring the brand back to the top of its

game.� adidas segment drives top-line growth in the first half of

2007 The adidas segment set the pace for the Group�s organic sales

growth in the first six months of 2007. Currency-neutral adidas

revenues increased 9% in the first half of 2007. Currency-neutral

sales in the Reebok segment grew 4% driven by the inclusion of

January, which was not consolidated in 2006. On a like-for-like

basis, comparing sales for the full six-month periods and excluding

the transfer of the NBA and Liverpool licensed businesses to brand

adidas, however, currency-neutral sales declined by 6% in the first

six months of 2007. At TaylorMade-adidas Golf, currency-neutral

revenues decreased 3%, negatively impacted by the divestiture of

the GNC wholesale business. On a like-for-like basis, sales

increased 5%. Currency translation effects negatively impacted

sales at all brands in euro terms. adidas sales increased 4% to �

3.454 billion in the first half of 2007 from � 3.308 billion in

2006. Sales at Reebok decreased 1% to � 1.038 billion versus �

1.050 billion in the prior year. TaylorMade-adidas Golf sales

declined 10% to � 419 million in 2007 from � 464 million in 2006.

Strong sales increase in nearly all regions adidas Group sales grew

strongly in all regions except North America. This growth was

driven by positive development at brand adidas as well as the

consolidation of six months of Reebok�s revenues in the first half

of 2007 versus only five months in the prior year. adidas Group

sales in Europe during the first six months of 2007 grew 7% on a

currency-neutral basis. In North America, currency-neutral Group

sales declined 3%. Sales for the adidas Group in Asia increased 15%

on a currency-neutral basis in the first six months of 2007. In

Latin America, currency-neutral sales increased 36% in the first

half of the year. Currency translation effects negatively impacted

reported revenues in all regions. Sales in Europe increased 6% in

euro terms to � 2.116 billion in 2007 from � 2.004 billion in 2006.

Sales in North America decreased 10% to � 1.429 billion from �

1.592 billion in the prior year. Revenues in Asia grew 7% to �

1.036 billion from � 964 million in 2006. Sales in Latin America

grew 28% to � 310 million from ��241�million in the prior year.

Group gross margin increases by 2.3 percentage points The gross

margin of the adidas Group increased by 2.3 percentage points to

47.1% in the first six months of 2007 (2006: 44.8%), driven by

improvements in all segments. This mainly reflects first cost

synergies resulting from the integration of adidas and Reebok

sourcing activities, which positively affected both segments� cost

of sales, as well as the non-recurrence of negative impacts from

purchase price allocation in the Reebok segment. A higher gross

margin at TaylorMade-adidas Golf also contributed to the Group�s

gross margin increase. As a result, gross profit for the adidas

Group rose 6% in the first six months of 2007 to reach

��2.326�billion versus � 2.191 billion in the prior year. Operating

profit declines 1% The operating margin of the adidas Group

declined 0.2 percentage points to 8.5% in the first half of 2007

(2006: 8.6%). This decrease reflects higher operating expenses as a

percentage of sales primarily due to one-time costs associated with

the Reebok integration. Increased expenses in the Reebok segment

for advertising, product development and initiatives to grow the

brand in emerging markets also contributed to this development. The

operating expense increase more than offset gross profit

improvements. As a result, operating profit for the adidas Group

declined 1% in the first six months of 2007 to reach � 417 million

versus � 420 million in 2006. Net financial expenses increase 1%

Net financial expenses increased 1% to � 73 million in the first

half of 2007 from � 72 million in the prior year as a result of

lower financial income, which was only partly offset by lower

financial expenses. Income before taxes decreases by 1% In line

with the Group�s operating profit decline, income before taxes for

the adidas Group decreased 1% to � 344 million in the first six

months of 2007 from � 348 million in 2006. Net income attributable

to shareholders up 3% The Group�s net income attributable to

shareholders increased 3% to ��232�million in the first half of

2007 from � 226 million in 2006. The slight decline of the Group�s

operating profit was more than compensated for by lower minority

interests. The Group�s minority interests declined by 78% to

��2�million in the first half of 2007 (2006: � 8 million) due to

the buyout of the Group�s joint venture partner in Korea, which

became effective on September 1, 2006. A lower tax rate, which

decreased 0.9 percentage points to 32.0% in the first six months of

2007 from 32.9% in the prior year, also contributed to this

development. Basic and diluted earnings per share increase 3% In

line with the increase of the Group�s net income attributable to

shareholders, basic earnings per share also increased 3% to � 1.14

in the first six months of 2007 versus � 1.11 in 2006. Diluted

earnings per share in the first six months of 2007 also increased

3% to � 1.09 from � 1.06 in the prior year. The dilutive effect

mainly results from approximately sixteen million additional

potential shares that could be created in relation to the

outstanding convertible bond, for which conversion criteria were

met for the first time at the end of the fourth quarter of 2004.

Working capital progress continues Group inventories decreased 2%

to � 1.716 billion at the end of the first half of 2007 versus �

1.754 billion in 2006. On a currency-neutral basis, inventories

increased 1%, which is below sales growth expectations for the

adidas Group. Group receivables increased 1% (+3% currency-neutral)

to � 1.689 billion at the end of the first half of 2007 versus �

1.679 billion in the prior year. This increase is in line with

sales growth during the second quarter of 2007. Net borrowings

reduced by � 435 million Net borrowings at June 30, 2007 were �

2.395 billion, down 15% or ��435�million versus � 2.829 billion in

the prior year. Strong bottom-line profitability and continued

tight working capital management were the drivers of this

reduction. adidas backlogs grow 9% on a currency-neutral basis

Backlogs for the adidas brand at the end of June 2007 increased 9%

versus the prior year on a currency-neutral basis. This improvement

highlights the brand�s strong product pipeline for the second half

of the year. First orders for the UEFA EURO 2008� also positively

impacted this development. In euro terms, adidas backlogs grew 6%.

Footwear backlogs grew 7% in currency-neutral terms (+5% in euros).

A modest decline in North America was more than offset by growth in

both Asia and Europe. Apparel backlogs grew 11% on a

currency-neutral basis (+ 8% in euros), driven by strong increases

in all regions. Reebok currency-neutral backlogs stable versus

prior year Backlogs for the Reebok brand at the end of the second

quarter of 2007 were stable versus the prior year on a

currency-neutral basis. In euro terms, this represents a decline of

3%. Footwear backlogs declined 17% in currency-neutral terms (�20%

in euros) primarily as a result of lower footwear orders from

mall-based retailers in North America in several categories such as

Classics and basketball. Apparel backlogs, however, grew by 21% on

a currency-neutral basis (+17% in euros), largely driven by strong

growth in seasonal categories such as hockey and American football.

Full year guidance confirmed adidas Group sales in 2007 are

expected to grow at a mid-single-digit rate on a currency-neutral

basis. Sales at brand adidas are also expected to increase at a

mid-single-digit rate on a currency-neutral basis in 2007.

Currency-neutral revenues at Reebok are forecasted to improve at a

low-single-digit rate compared to the prior year. Currency-neutral

TaylorMade-adidas Golf revenues will increase at a mid-single-digit

rate on a like-for-like basis. However, due to the divestiture of

the GNC wholesale business in November 2006, reported sales for

TaylorMade-adidas Golf will decline compared to the prior year. The

Group gross margin is expected to be in the range of between 45 and

47%, driven by underlying improvements in all three brand segments

and the non-recurrence of purchase price allocation charges

following the Reebok acquisition, which negatively impacted the

Reebok gross margin in 2006. The Group�s operating margin is

forecasted to be around 9%, which will be modestly higher than in

2006. Net income attributable to shareholders for the adidas Group

is expected to grow at a double-digit rate, approaching 15%.

Herbert Hainer stated: �Our strong first half year reflects the

strength and diversity of our Group despite challenging market

conditions in some of our key markets. Today marks the one-year

countdown to the 2008 Beijing Olympics which promises to be one of

the most exciting sporting events ever. And I am fully confident in

our ability to deliver sustained profitable momentum in 2007 and

beyond.� Please visit our corporate website: www.adidas-Group.com

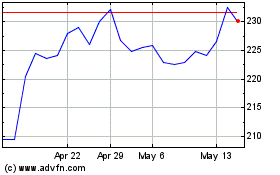

Adidas (TG:ADS)

Historical Stock Chart

From Jun 2024 to Jul 2024

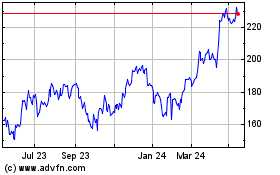

Adidas (TG:ADS)

Historical Stock Chart

From Jul 2023 to Jul 2024