Osaka Securities Exchange and International Securities Exchange Sign Memorandum of Agreement, to Launch New Options Platform

February 24 2008 - 5:15PM

Business Wire

The Osaka Securities Exchange Co., Ltd. (OSE) and International

Securities Exchange Holdings, Inc. (ISE) today announced that they

have signed a Memorandum of Agreement (MOA), in which the two

exchanges agreed to build a cooperative relationship as the first

step towards the formation of a joint venture and the launch of a

new, jointly owned trading platform that promises to revitalize the

Japanese equity options market. "We are extremely excited about our

partnership with ISE, the innovative market leader in the U.S.

equity options market,� said Michio Yoneda, President and CEO of

OSE. �We believe there is a tremendous opportunity to create a

world-class options trading venue in Japan, where the combination

of a robust underlying equities market and increasingly

sophisticated active investors is solidifying demand for

exchange-listed equity options. With ISE�s unparalleled expertise

in building a fully-electronic options marketplace from the ground

up, this initiative will help to revitalize the Japanese equity

options market and to establish it as a useful investment tool for

investors.� ISE President and CEO Gary Katz said, �We are very

pleased to enter into this partnership with OSE. OSE�s track record

of success in the Japanese market and their well-established

relationships with both their customers and local regulators will

complement ISE�s options market model and market making structure.

With our MOA now signed, we look forward to working with our

partners at OSE and the Japanese Securities Industry to launch an

exciting new options trading platform. It is a privilege for ISE to

join OSE in a shared commitment to redefining equity options

trading in Japan.� About OSE The Osaka Securities Exchange Co.,

Ltd. is Japan�s largest derivatives exchange. In 2007 total trading

volume of all derivative products hit the record high of

108,916,811 units, up about 79.6 % compared to the previous year.

This year, the year 2008, is the 20th anniversary of the

introduction of Nikkei 225 futures, the flagship product of OSE.

OSE is the first listed exchange in Japan whose shares have been

traded on it�s own market, �Hercules,� since April 2004. For more

information about OSE, visit www.ose.or.jp/e/ About ISE The

International Securities Exchange operates a family of fully

electronic trading platforms, creating efficient markets through

innovative technology and market structure. ISE�s markets portfolio

consists of an options exchange and a stock exchange. As the

world�s largest equity options trading venue, ISE offers equity,

ETF, index, and FX options. The ISE Stock Exchange trades

approximately 6,000 products, and is the only fully electronic

equities platform that provides the opportunity for continuous

price improvement through the interaction of its non-displayed

liquidity pool, MidPoint Match, and its displayed stock market. ISE

Alternative Markets is scheduled to launch in 2008 and will offer

an events market trading platform for derivatives auctions. To

complement its markets and enable investors to trade smarter, ISE

creates innovative new products including a portfolio of

proprietary indexes and enhanced market data products for

sophisticated investors. ISE is a wholly owned subsidiary of Eurex,

a leading global derivatives exchange. Eurex itself is jointly

owned and operated by Deutsche B�rse AG (Ticker: DB1) and SWX Swiss

Exchange. Together, Eurex and ISE are the global market leader in

individual equity and equity index derivatives. For more

information about ISE, visit www.ise.com

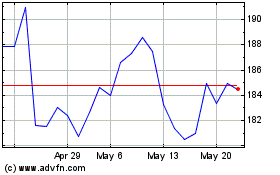

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Feb 2025 to Mar 2025

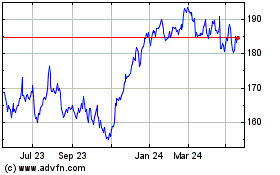

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Deutsche Boerse AG (Tradegate (DE)): 0 recent articles

More International Securities Exchange Holdings, Inc. News Articles