ISE Reports Monthly Volume for February 2008

March 03 2008 - 8:15AM

Business Wire

The International Securities Exchange (ISE) today reported that in

February 2008, its options exchange traded an average daily volume

of 3.7 million contracts. The ISE Stock Exchange traded an average

daily volume of 76.1 million shares in the same period. Average

daily trading volume for equity and index options contracts

increased 36.3% to 3.7 million contracts in February as compared to

2.7 million contracts during the same period in 2007. Total equity

and index options volume for the month increased 43.5% to 73.3

million contracts from 51.1 million contracts in the same year-ago

period. On a year-to-date basis, average daily trading volume of

equity and index options increased 55.7% to 4.3 million contracts

traded as compared to 2.7 million contracts traded in the prior

year. Total year-to-date equity and index volume through February

2008 increased 63.7% to 174.9 million contracts from 106.9 million

contracts in the same period last year. � Equity and Index Options

Volume Statistics � Current Month � Year-to-Date (000s) � Feb-08 �

Feb-07 � % Change � Feb-08 � Feb-07 � % Change ISE Average Daily

Volume 3,666.2 � 2,689.9 � 36.3% 4,266.2 � 2,740.2 � 55.7% ISE

Total Volume 73,324.0 51,109.0 43.5% 174,913.0 106,867.9 63.7%

Industry Average Daily Volume 12,221.0 9,644.7 26.7% 14,672.8

9,764.8 50.3% Market Share � 30.0% � 27.9% � 2.1 pts � 29.1% �

28.1% � 1.0 pts Market Share: Customer 30.7% 29.5% 1.2 pts 30.5%

29.7% 0.8 pts Market Share: Firm 33.8% 24.1% 9.7 pts 30.8% 23.9%

6.9 pts Market Share: Market Maker � 28.2% � 27.8% � 0.4 pts �

27.4% � 28.2% � (0.8) pts � Equity Options Volume Statistics �

Current Month � Year-to-Date (000s) � Feb-08 � Feb-07 � % Change �

Feb-08 � Feb-07 � % Change ISE Average Daily Volume 3,611.1 �

2,642.3 � 36.7% 4,194.8 � 2,697.4 � 55.5% ISE Total Volume 72,221.2

50,204.0 43.9% 171,987.9 105,198.2 63.5% Industry Average Daily

Volume 11,246.8 8,767.2 28.3% 13,510.8 8,938.0 51.2% Market Share �

32.1% � 30.1% � 2.0 pts � 31.1% � 30.2% � 0.9 pts Market Share:

Customer 32.6% 32.0% 0.6 pts 32.5% 31.9% 0.6 pts Market Share: Firm

37.0% 26.2% 10.8 pts 33.5% 25.8% 7.7 pts Market Share: Market Maker

� 30.2% � 29.9% � 0.3 pts � 29.1% � 30.2% � (1.1) pts � Index

Options Volume Statistics � Current Month � Year-to-Date (000s) �

Feb-08 � Feb-07 � % Change � Feb-08 � Feb-07 � % Change ISE Average

Daily Volume 55.1 � 47.6 � 15.8% 71.3 � 42.8 � 66.6% ISE Total

Volume 1,102.8 905.0 21.9% 2,925.1 1,669.8 75.2% Industry Average

Daily Volume 956.6 876.2 9.2% 1,136.9 825.7 37.7% Market Share �

5.8% � 5.4% � 0.4 pts � 6.3% � 5.2% � 1.1 pts ISE�s market share

statistics continue to be negatively impacted by trading strategies

that are permitted based on a non-economic rationale. These

strategies include dividend trades and synthetic short interest

trades. These trades temporarily inflate and distort trading volume

and market share when transacted. Monthly Highlights Options

Exchange ISE was the largest U.S. equity options exchange in

February. On February 21, 2008, ISE began trading options on two

new ISE FX Options� currency pairs, the U.S. dollar/Australian

dollar (Symbol: AUX) and the U.S. dollar/Swiss franc (Symbol: SFC).

Timber Hill LLC serves as Primary Market Maker for these new

products. On February 24, 2008, the Osaka Securities Exchange Co.,

Ltd. (OSE) and ISE announced that they signed a Memorandum of

Agreement (MOA), in which the two exchanges agreed to build a

cooperative relationship as the first step towards the formation of

a joint venture and the launch of a new, jointly owned trading

platform that promises to revitalize the Japanese equity options

market. ISE traded more volume than any other options exchange in

1,134 of 1,891 issues in its listings. ISE Stock Exchange An

average daily volume of 76.1 million shares traded on the ISE Stock

Exchange in February 2008. The ISE Stock Exchange offers

opportunities for price improvement through its non-displayed

liquidity pool, MidPoint MatchSM. Total price improvement in

February 2008 was $4.6 million, and price improvement for all

displayed market taker orders that interacted with MidPoint Match

was greater than $0.01 per share. ISE Background The International

Securities Exchange operates a family of fully electronic trading

platforms, creating efficient markets through innovative technology

and market structure. ISE�s markets portfolio consists of an

options exchange and a stock exchange. As the world�s largest

equity options trading venue, ISE offers equity, ETF, index, and FX

options. The ISE Stock Exchange trades approximately 6,000

products, and is the only fully electronic equities platform that

provides the opportunity for continuous price improvement through

the interaction of its non-displayed liquidity pool, MidPoint

Match, and its displayed stock market. ISE Alternative Markets is

scheduled to launch in 2008 and will offer an events market trading

platform for derivatives auctions. To complement its markets and

enable investors to trade smarter, ISE creates innovative new

products including a portfolio of proprietary indexes and enhanced

market data products for sophisticated investors. ISE is a wholly

owned subsidiary of Eurex, a leading global derivatives exchange.

Eurex itself is jointly owned and operated by Deutsche B�rse AG

(Ticker: DB1) and SWX Swiss Exchange. Together, Eurex and ISE are

the global market leader in individual equity and equity index

derivatives. For more information, please visit www.ise.com. ISE FX

OPTIONS is a registered trademark of International Securities

Exchange, LLC.

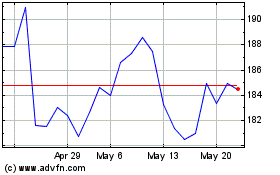

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Feb 2025 to Mar 2025

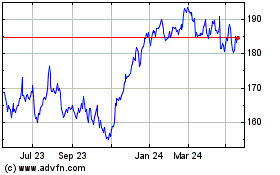

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Mar 2024 to Mar 2025