Osaka Securities Exchange and International Securities Exchange Terminate Memorandum of Agreement

August 01 2008 - 9:00AM

Business Wire

The Osaka Securities Exchange Co., Ltd. (OSE) and International

Securities Exchange Holdings, Inc. (ISE) today announced the

termination of their Memorandum of Agreement (MOA) to create a

jointly owned equity options trading platform for the Japanese

market. Given market developments in Japan, OSE has changed

strategic direction to concentrate on strengthening its core

business, and as such, elected to terminate the MOA that would have

led to the establishment of a new joint venture with ISE. Michio

Yoneda, President and CEO of OSE, said, �This adoption of a new

strategic direction will allow us to concentrate on growing our

core business and further improving our technology platform. We

deeply regret the announcement of the termination of the MOA with

ISE and offer our sincere appreciation for ISE�s understanding in

the matter.� Gary Katz, President and CEO of ISE, said, �Although

we are very disappointed that our joint venture with OSE did not

come to fruition, we recognize OSE�s corporate priorities have

changed, and we respect their decision to end discussions related

to our joint project.� About OSE The Osaka Securities Exchange Co.,

Ltd. is Japan�s largest derivatives exchange. In 2007 total trading

volume of all derivative products hit the record high of

108,916,811 units, up about 79.6% compared to the previous year.

This year, the year 2008, is the 20th anniversary of the

introduction of Nikkei 225 futures, the flagship product of OSE.

OSE is the first listed exchange in Japan whose shares have been

traded on it�s own market, �Hercules,� since April 2004. For more

information about OSE, visit www.ose.or.jp/e/. About ISE The

International Securities Exchange operates a family of fully

electronic trading platforms, creating efficient markets through

innovative technology and market structure. ISE�s markets portfolio

consists of an options exchange and a stock exchange. As the

world�s largest equity options trading venue, ISE offers equity,

ETF, index, and FX options. The ISE Stock Exchange trades

approximately 6,000 products, and is the only fully electronic

equities platform that provides the opportunity for continuous

price improvement through the interaction of its non-displayed

liquidity pool, MidPoint Match, and its displayed stock market. ISE

Alternative Markets is scheduled to launch in 2008 and will offer

an events market trading platform for derivatives auctions. To

complement its markets and enable investors to trade smarter, ISE

creates innovative new products including a portfolio of

proprietary indexes and enhanced market data products for

sophisticated investors. ISE is a wholly owned subsidiary of Eurex,

a leading global derivatives exchange. Eurex itself is jointly

owned and operated by Deutsche B�rse AG (Ticker: DB1) and SWX Swiss

Exchange. Together, Eurex and ISE are the global market leader in

individual equity and equity index derivatives. For more

information about ISE, visit www.ise.com.

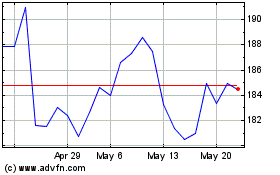

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Feb 2025 to Mar 2025

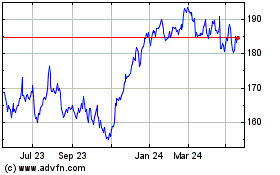

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Mar 2024 to Mar 2025