ISE Publishes Proposal for U.S. Regulatory Reform

March 25 2009 - 3:00PM

Business Wire

- ISE calls for creation of a new

Financial Markets Commission (FMC) to oversee all U.S. financial

markets and trading platforms.

- Regulatory regime should create

a level playing field for all trading venues, regardless of

exchange status.

- Regulation should be risk-based

with a results-oriented focus on compliance to ensure

comprehensiveness and promote efficiency.

The International Securities Exchange (ISE), the world�s largest

equity options exchange, today announced that it has published a

proposal outlining its recommendations for reforming the regulation

of U.S. financial markets. As one of only seven U.S. securities

exchange operators, ISE brings a unique perspective to the current

public debate and has set forth recommendations that specifically

focus on the oversight of market operations and trading venues. In

the proposal, ISE details a risk-based regulatory framework built

on clearly legislated regulatory objectives and designed to

proactively maintain an orderly and efficient marketplace for all

participants. This approach promotes comprehensive, consistent and

ongoing oversight for all types of trading venues while addressing

the global nature of the markets and promoting the innovative and

competitive edge of the U.S. financial industry.

�In addition to joining others in identifying the need for a

systemic risk regulator, ISE�s proposal outlines our views on the

most effective approach to overseeing the proper functioning of the

financial markets and trading platforms � an equally vital, yet

often overlooked, aspect of the current regulatory discussion,�

said Gary Katz, ISE�s President and Chief Executive Officer. �We

believe that all trading venues that execute orders from public

customers should be subject to consistent oversight and high

standards for setting and enforcing trading rules in the

marketplaces they operate. At the same time, there needs to be a

rationalization in the oversight of self-regulatory organizations

(SROs) that oversee trading venues in order to encourage

competitiveness and to bring more products into a transparent

market environment that is overseen by a proactive, risk-based

regulatory framework.�

ISE proposes a new regulatory structure that reallocates

responsibilities by function among three aspects of financial

regulation: (i) financial systemic risk (covering financial and

capital matters involving commercial and investment banks, futures

commission merchants, investment companies and hedge funds); (ii)

disclosure (overseeing disclosure/risk analysis for investors and

encompassing corporate issuers, investment companies and

product-specific risk); and (iii) financial industry operations

(covering the operation of financial markets, trading platforms and

financial service providers, including but not limited to the

services traditionally provided by broker-dealers, investment

advisors, hedge funds and futures commission merchants). ISE�s

specific recommendations focus on developing a risk-based framework

for regulating financial industry operations that addresses the

regulatory gaps and inconsistencies that exist today under the

bifurcated regulatory structure in the U.S. financial markets.

ISE�s proposal is available online at:

www.ise.com/regulatoryreform.

About ISE

The International Securities Exchange (ISE) operates the world�s

largest equity options exchange and offers options trading on over

2,000 underlying equity, ETF, index, and FX products. As the first

all-electronic options exchange in the U.S., ISE transformed the

options industry by creating efficient markets through innovative

market structure and technology. Regulated by the Securities and

Exchange Commission (SEC) and a member-owner of The Options

Clearing Corporation (OCC), ISE provides investors with a

transparent marketplace for price and liquidity discovery on

centrally cleared options products. ISE continues to expand its

marketplace through the ongoing development of enhanced trading

functionality, new products, and market data services. As a

complement to its options business, ISE has expanded its reach into

multiple asset classes through strategic investments in financial

marketplaces that foster technology innovation and market

efficiency. Through its two minority investments, ISE participates

in the securities lending and equities markets.

ISE is a wholly owned subsidiary of Eurex, a leading global

derivatives exchange. Eurex itself is jointly owned by Deutsche

B�rse AG (Ticker: DB1) and SIX Swiss Exchange AG. Together, Eurex

and ISE are the global market leader in individual equity and

equity index derivatives. For more information, visit

www.ise.com.

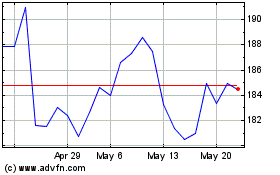

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Feb 2025 to Mar 2025

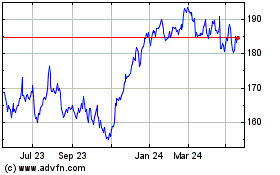

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Mar 2024 to Mar 2025