3rd China-Europe Equity Forum Opens in Shanghai

September 28 2010 - 3:00AM

Business Wire

Today, the 3rd Deutsche B�rse China-Europe Equity Forum was

successfully held in Shanghai. Investment banks, PE-investors, law

firms, IPO-advisors, financial intermediaries, audit firms and

entrepreneurs from both China and Europe participated to analyse

the market trend and exchange industry experiences. In-depth

discussions on current hot topics were held, such as the Europe’s

commitment to the euro and its influence on the European capital

market, sustainability in capital markets and opportunities for

Chinese companies in the European market with a special highlight

on the healthcare industry.

Mr. Alexander H�ptner, Head of Markets Services, Deutsche B�rse

AG said: “With the gradual recovery of the global economy, we have

seen more Chinese companies entering the global stage through

Deutsche B�rse’s platform this year, injecting brand new vitality

into global capital markets. As one of the world's top stock

exchanges, Deutsche B�rse is committed to not only provide a

stable, professional and efficient trading environment for the

Chinese enterprises, but also hopes to integrate our rich resources

to create a communication platform for companies and international

investment specialists. We aim to help these companies obtain

sustainable growth and success via our unique listing partners

system.”

Chinese companies accerlerate pace in listing in

Germany

Currently, 24 Chinese companies have been successfully listed at

Deutsche B�rse, seven of which were listed in 2010, accounting for

nearly 30 percent of the total. On 30 March, 2010, Joyou AG became

the first Chinese manufacturer of sanitary ware products listed in

Europe. Following its path, companies including High Win PLC Inc.,

Euro Asia Premier Real Estate Company Limited, Cheung Wing

Biotechnology Company Ltd, China Zongbao Clean Tech Ltd., Kinghero

AG and Madison Property AG have all been listed at Deutsche B�rse

within five months, proving further that Deutsche B�rse is

gradually becoming an attractive choice for Chinese companies to

get listed overseas.

The seven companies listed this year were based in Shandong,

Guangdong, Hong Kong and Fujian. They represent a variety of

different industries such as greentech, hightech-engineering,

healthcare, chemical industry, and real estate; and also

traditional industries such as consumer products and furniture.

This proves that the efforts of Deutsche B�rse in the Chinese

market are achieving results. Mr. Alexander H�ptner said: “We are

very optimistic about further listings in 2010. We expect up to

five more Chinese companies to come to Frankfurt this year. Our

goal is to become the best partner for Chinese companies listing

abroad, and help them to achieve growth in value with our

customized services. Based on our rich experience with German

“Mittelstand-“companies we are connecting industrial and financial

giants with investors wordwide, and we are also specialists in

providing liquidity and added value for small and medium-sized

companies. We have organized a series of activities in China this

year, and we will continue to strengthen cooperation with Chinese

partners and further explore the potential of the Chinese

market.“

China Concept sees strong potential

In July 2007, the first China Concept Stock ZhongDe Waste

Technology AG was listed on the Prime Standard of Deutsche B�rse,

followed successively by Asian Bamboo AG, Vtion Wireless Technology

AG, Joyou AG. In particular, Joyou AG which was just listed on

Deutsche B�rse’s Prime Standard this year has raised 105 million

Euro in total, becoming the largest public placement of capital

increase for a Chinese company on Deutsche B�rse so far. Recently,

Kinghero AG was listed on the Entry Standard, raising 15 million

euros in total, selling 1 million shares. Kinghero became the first

Chinese fashion company to be listed at Deutsche B�rse.

In addition, three Chinese companies are constituents of the DAX

International index family, with Asian Bamboo AG being included in

the DAX International 100 (the 100 most liquid national and

international stocks on the Frankfurt Stock Exchange), whereas

Joyou AG and Vtion Wireless Technologies AG are part of the DAX

international Mid100 index, demonstrating the excellent performance

of China Concept companies in the German capital market.

Unique business model grants post-IPO success

Deutsche B�rse (FWB: DB1) is an exchange organization that

provides the widest range of services. Its business model covers

the entire chain of security market services: from listing,

securities and derivatives trading, clearing, settlement and

custody to the operation of high liquidity electronic trading as

well as the provision of market related data and indices. Different

from other international exchanges, Deutsche B�rse’s business model

is not based on listing fees but on stock liquidity. Its unique

business model offers companies a one-stop access to services for

going and remaining public, as well as maintaining the high

liquidity of their stocks.

Mr. Alexander H�ptner said: “High liquidity is very important

for listed companies and investors alike. Therefore we pay great

attention to promoting liquidity, especially increasing the

liquidity of SMEs. Our objective is to help listed companies to

improve their stocks’ liquidity and expand their transaction

volume; and at the same time reducing financing costs.”

Deutsche B�rse supports companies at every stage of the process:

before, during and after listing. The network of Deutsche B�rse

listing partners gives both IPO candidates and listed companies

direct access to experienced capital market specialists in all

areas of going and being public. Mr. Alexander H�ptner added. “Our

listing partners have accumulated rich experiences from both Asia

and Europe, and can offer listed companies specialized consulting

service and relevant investment banking supports. We sincerely wish

all Chinese companies listed at Deutsche B�rse to achieve long-term

and sustainable growth.”

Note to editorial staff:

Deutsche B�rse Group is one of the world’s leading service

providers for the securities industry with a product and service

offering for issuers, investors, intermediaries and data vendors.

The Group covers the entire process chain from trading, through

clearing, to settlement and securities custody. Furthermore,

Deutsche B�rse offers market data, indices and analyses and is a

service provider for the development and operation of IT

systems.

Deutsche B�rse Group is based in Frankfurt/Main and has offices

in key financial centers around the globe: in Europe in London,

Luxembourg, Moscow, Paris and Zurich; in the US in Chicago and New

York; and in Asia in Beijing, Dubai, Hong Kong, Dubai, Singapore

and Tokyo.

Deutsche B�rse has launched a Chinese website which provides all

information about listing in Frankfurt. Among other things the

website offers indices like DAXglobal China and includes a schedule

of Deutsche B�rse events in China.

http://deutsche-boerse.com/dbag/dispatch/cn/kir/gdb_navigation_other_languages/lc

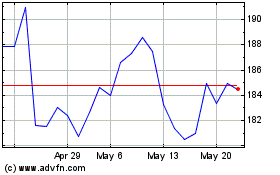

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Feb 2025 to Mar 2025

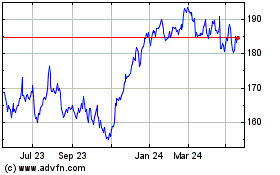

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Mar 2024 to Mar 2025