Heineken N.V. reports 2024 full year results

February 12 2025 - 12:00AM

UK Regulatory

Heineken N.V. reports 2024 full year results

Heineken N.V. reports 2024 full year

results

Amsterdam, 12 February 2025 – Heineken

N.V. (HEINEKEN) [(EURONEXT: HEIA; OTCQX: HEINY)] announces:

Solid results with broad-based growth and

profit expansion in 2024

- Revenue €35,955

million

- Net revenue (beia)

5.0% organic growth, per hectolitre 3.5%

- Beer volume 1.6%

organic growth; Heineken® volume up 8.8%

- Operating profit

€3,517 million; operating profit (beia) 8.3% organic growth

- Operating profit

(beia) margin 15.1%, up 40 bps

- Net profit €978

million; net profit (beia) 7.3% organic growth

- Diluted EPS (beia)

€4.89

- Free Operating Cash

Flow €3,058 million

- HEINEKEN to launch

two-year €1.5 billion share buyback programme

- Full year 2025

outlook: 4% to 8% operating profit (beia) organic growth

Dolf van den Brink, Chairman of the Executive Board /

CEO, commented:

"We delivered solid results with broad-based growth and profit

expansion in 2024. Beer volume grew organically by 1.6%, and net

revenue (beia) was up 5.0% with strong operating profit (beia)

growth of 8.3%. Notably, our beer volume expanded in all four

regions, across both developed and emerging markets.

Our EverGreen strategy continued to shape operations. Premium

volume grew 5%, led globally by Heineken®, which was up

9%. Mainstream beer volume rose 2%, spearheaded by the leading

brands in our largest markets, including Amstel in Brazil,

Cruzcampo in the UK, and Kingfisher in India. The beyond beer

segment grew 4%, led by Desperados globally and Savanna cider in

Southern Africa. Heineken® 0.0 grew 10%, reinforcing our

global leadership in non-alcoholic beer.

Gross savings exceeded €0.6 billion, supporting a 40 bps

operating margin (beia) expansion. Marketing and selling investment

increased by €0.3 billion, a double-digit organic increase, and we

stepped up funding behind our digital and technology initiatives.

Capital productivity focus helped deliver a strong free operating

cash flow, exceeding €3 billion.

Looking ahead, we are well-positioned to further increase our

investment in marketing and selling and behind our EverGreen

priorities in 2025. We expect to grow operating profit (beia)

organically in the range of 4% to 8%."

|

Media |

|

Investors |

|

Christiaan Prins |

|

Tristan van Strien |

| Director of Global

Communication |

|

Global Director of Investor

Relations |

| Marlie

Paauw |

|

Lennart Scholtus /

Chris Steyn |

| Corporate Communications

Lead |

|

Investor Relations Manager /

Senior Analyst |

|

E-mail: pressoffice@heineken.com |

|

E-mail: investors@heineken.com |

| Tel: +31-20-5239355 |

|

Tel: +31-20-5239590 |

HEINEKEN will host an analyst and investor video webcast about

its 2024 FY results today, 12 February, at 14:00 CET/ 13:00 GMT/

08.00 EST. The live video webcast will be accessible via the

company’s website:

https://www.theheinekencompany.com/investors/results-reports-webcasts-and-presentations.

An audio replay service will also be made available after the

webcast at the above web address. Analysts and investors can

dial-in using the following telephone numbers:

| United Kingdom

(local): +44 20 3936 2999 |

| Netherlands

(local): +31 85 888 7233 |

| United States: +1

646 787 9445 |

| All other

locations: +44 20 3936 2999 |

| For the full list

of dial in numbers, please refer to the following link: Global

Dial-In Numbers |

| Participation

password for all countries: 962302 |

| |

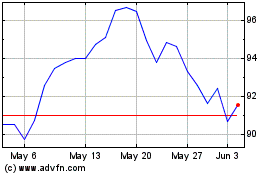

Heineken (TG:HNK1)

Historical Stock Chart

From Jan 2025 to Feb 2025

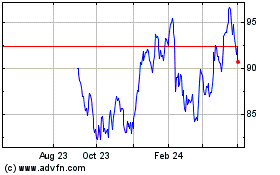

Heineken (TG:HNK1)

Historical Stock Chart

From Feb 2024 to Feb 2025