- New member: Industry expert Stefan Pierer to join

Supervisory Board

- Successor proposed: Martin Brudermueller put forward by

Bernd Pischetsrieder as candidate to succeed him as chairman of the

Supervisory Board

- Shareholder approval: Actions of the Board of Management

and Supervisory Board endorsed

- Dividend increased: Shareholders approve €5.20 per share

(previous year: € 5.00) proposed

- Representation: 61.15% of the share capital

The shareholders of Mercedes-Benz Group AG (ticker symbol: MBG)

approved all of the items on the agenda of the Annual General

Meeting.

Bernd Pischetsrieder will, following the expiration of

his current mandate as Chaiman of the Supervisory Board of

Mercedes-Benz Group AG, not make himself available for a further

term of office. His term ends at the end of the Annual General

Meeting next year (2024). In keeping with long-term orderly

succession planning, Bernd Pischetsrieder has already proposed

Martin Brudermueller as his successor for the post of

Chairman of the Supervisory Board at the constituent meeting of the

Supervisory Board today. An election will take place at the

constituent Supervisory Board meeting after the 2024 Annual General

Meeting.

Since 2018, Dr. Martin Brudermueller is the Chairman of the

Board of Executive Directors of BASF SE. He is responsible for the

divisions Corporate Legal, Compliance & Insurance, Corporate

Development, Corporate Communications & Government Relations,

Corporate Human Resources, Corporate Investor Relations, Senior

Project Net Zero Accelerator. He started his career with BASF in

1988. Since 2006, he has been a member of the Board of Executive

Directors in various roles, including Chief Technology Officer and

Member of the Executive Board responsible for the Asia-Pacific

region, based in Hong Kong.

Item 2 Appropriation of distributable profit - accepted

653.398.821

Casted valid votes (= 61,07 % of the share capital)

652.237.007

Yes votes

99,82 %

1.161.814

No votes

0,18 %

826.986

Abstain votes Item 3 Ratification of Board of Management members’

actions in the financial year 2022 - accepted

620.752.305

Casted valid votes (= 58,02 % of the share capital)

615.697.332

Yes votes

99,19 %

5.054.973

No votes

0,81 %

33.473.952

Abstain votes Item 4 Ratification of Supervisory Board members’

actions in financial year 2022 - accepted

640.537.372

Casted valid votes (= 59,87 % of the share capital)

631.615.838

Yes votes

98,61 %

8.921.534

No votes

1,39 %

13.685.950

Abstain votes Item 5a Appointment of the auditor for the annual

financial statements and the auditor for the consolidated financial

statements - financial year 2023 including interim financial

reports - accepted

653.292.024

Casted valid votes (= 61,06 % of the share capital)

607.602.135

Yes votes

93,01 %

45.689.889

No votes

6,99 %

932.648

Abstain votes Item 5b Appointment of the auditor for the annual

financial statements and the auditor for the consolidated financial

statements - interim financial reports for the financial year 2024

in the period until the Annual General Meeting 2024 - accepted

653.252.549

Casted valid votes (= 61,06 % of the share capital)

652.241.564

Yes votes

99,85 %

1.010.985

No votes

0,15 %

970.316

Abstain votes Item 5c Appointment of the auditor for the annual

financial statements and the auditor for the consolidatedfinancial

statements - financial year 2024 including interim financial

reports in the period after the Annual General Meeting 2024 -

accepted

653.233.157

Casted valid votes (= 61,06 % of the share capital)

652.324.327

Yes votes

99,86 %

908.830

No votes

0,14 %

992.514

Abstain votes Item 6 Election of a member of the Supervisory Board

- Stefan Pierer - accepted

653.125.298

Casted valid votes (= 61,05 % of the share capital)

538.403.406

Yes votes

82,43 %

114.721.892

No votes

17,57 %

1.100.621

Abstain votes Item 7 Remuneration for Supervisory Board members and

corresponding amendment of Art. 10 (§ 10) of the Articles of

Incorporation - accepted

653.077.003

Casted valid votes (= 61,04 % of the share capital)

641.035.258

Yes votes

98,16 %

12.041.745

No votes

1,84 %

1.148.272

Abstain votes Item 8 Approval of the remuneration system for the

members of the Board of Management - accepted

647.687.937

Casted valid votes (= 60,54 % of the share capital)

589.407.078

Yes votes

91,00 %

58.280.859

No votes

9,00 %

6.536.201

Abstain votes Item 9 Approval of the remuneration report for

financial year 2022 - accepted

624.261.698

Casted valid votes (= 58,35 % of the share capital)

538.309.673

Yes votes

86,23 %

85.952.025

No votes

13,77 %

29.964.384

Abstain votes Item 10 Creation of a new Approved Capital 2023 and

related amendment to Art. 3(2) (§ 3(2)) of the Articles of

Incorporation - accepted

653.385.272

Casted valid votes (= 61,07 % of the share capital)

602.569.846

Yes votes

92,22 %

50.815.426

No votes

7,78 %

840.270

Abstain votes Item 11 Add an authorization to Art. 11 (§ 11) of the

Articles of Incorporation for the Board of Management to hold a

virtual shareholders’ meeting - accepted

653.377.888

Casted valid votes (= 61,07 % of the share capital)

592.247.001

Yes votes

90,64 %

61.130.887

No votes

9,36 %

846.754

Abstain votes Item 12 Amendment to Art. 11a (§ 11a) of the Articles

of Incorporation to include a new subsection 3 to enable

Supervisory Board members to participate in a virtual Shareholders’

Meeting by means of video and audio transmission - accepted

645.245.890

Casted valid votes (= 60,31 % of the share capital)

611.147.515

Yes votes

94,72 %

34.098.375

No votes

5,28 %

8.980.287

Abstain votes

Forward-looking statements:

This document contains forward-looking statements that reflect

our current views about future events. The words “anticipate”,

“assume”, “believe”, “estimate”, “expect”, “intend”, “may”, “can”,

“could”, “plan”, “project”, “should” and similar expressions are

used to identify forward-looking statements. These statements are

subject to many risks and uncertainties, including an adverse

development of global economic conditions, in particular a decline

of demand in our most important markets; a deterioration of our

refinancing possibilities on the credit and financial markets;

events of force majeure including natural disasters, pandemics,

acts of terrorism, political unrest, armed conflicts, industrial

accidents and their effects on our sales, purchasing, production or

financial services activities; changes in currency exchange rates,

customs and foreign trade provisions; a shift in consumer

preferences towards smaller, lower-margin vehicles; a possible lack

of acceptance of our products or services which limits our ability

to achieve prices and adequately utilize our production capacities;

price increases for fuel, raw materials or energy; disruption of

production due to shortages of materials or energy, labour strikes

or supplier insolvencies; a decline in resale prices of used

vehicles; the effective implementation of cost-reduction and

efficiency-optimization measures; the business outlook for

companies in which we hold a significant equity interest; the

successful implementation of strategic cooperations and joint

ventures; changes in laws, regulations and government policies,

particularly those relating to vehicle emissions, fuel economy and

safety; the resolution of pending governmental investigations or of

investigations requested by governments and the outcome of pending

or threatened future legal proceedings; and other risks and

uncertainties, some of which are described under the heading “Risk

and Opportunity Report” in the current Annual Report or in this

Interim Report. If any of these risks and uncertainties

materializes or if the assumptions underlying any of our

forward-looking statements prove to be incorrect, the actual

results may be materially different from those we express or imply

by such statements. We do not intend or assume any obligation to

update these forward-looking statements since they are based solely

on the circumstances at the date of publication.

Mercedes-Benz Group at a glance

Mercedes-Benz Group AG is one of the world's most successful

automotive companies. With Mercedes-Benz AG, the Group is one of

the leading global suppliers of high-end passenger cars and premium

vans. Mercedes-Benz Mobility AG offers financing, leasing, car

subscription and car rental, fleet management, digital services for

charging and payment, insurance brokerage, as well as innovative

mobility services. The company founders, Gottlieb Daimler and Carl

Benz, made history by inventing the automobile in 1886. As a

pioneer of automotive engineering, Mercedes-Benz sees shaping the

future of mobility in a safe and sustainable way as both a

motivation and obligation. The company's focus therefore remains on

innovative and green technologies as well as on safe and superior

vehicles that both captivate and inspire. Mercedes-Benz continues

to invest systematically in the development of efficient

powertrains and sets the course for an all-electric future: The

brand with the three-pointed star pursues the goal to go

all-electric by 2030, where market conditions allow. Shifting from

electric-first to electric-only, the world’s pre-eminent car

company is accelerating toward a fully electric and software-driven

future. The company's efforts are also focused on the intelligent

connectivity of its vehicles, autonomous driving and new mobility

concepts as Mercedes-Benz regards it as its aspiration and

obligation to live up to its responsibility to society and the

environment. Mercedes-Benz sells its vehicles and services in

nearly every country of the world and has production facilities in

Europe, North and Latin America, Asia and Africa. In addition to

Mercedes-Benz, the world's most valuable luxury automotive brand

(source: Interbrand study, 03 Nov. 2022), Mercedes-AMG,

Mercedes-Maybach, Mercedes-EQ and Mercedes me as well as the brands

of Mercedes-Benz Mobility: Mercedes-Benz Bank, Mercedes-Benz

Financial Services and Athlon. The company is listed on the

Frankfurt and Stuttgart stock exchanges (ticker symbol MBG). In

2022, the Group had a workforce of around 170,000 and sold around

2.5 million vehicles. Group revenues amounted to €150.0 billion and

Group EBIT to €20.5 billion.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230503005709/en/

Tobias Just, +49 711 17 41341, tobias.just@mercedes-benz.com

Johannes Leifert, +49 176 3090 4735,

johannes.leifert@mercedes-benz.com Edward Taylor, +49 176 3094

1776, edward.taylor@mercedes-benz.com Andrea Berg, +1 917 667 2391,

andrea.a.berg@mercedes-benz.com

Further information on Mercedes-Benz Group is available at:

group-media.mercedes-benz.com and group.mercedes-benz.com

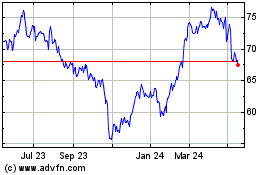

MercedesBenz (TG:MBG)

Historical Stock Chart

From Dec 2024 to Jan 2025

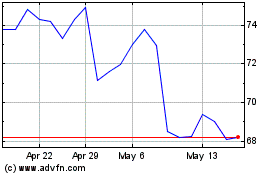

MercedesBenz (TG:MBG)

Historical Stock Chart

From Jan 2024 to Jan 2025