- Performance: Solid sales for Mercedes-Benz Cars and

Vans. Mercedes-Benz Cars profitability impacted by subdued macro

environment and fierce competition. Mercedes-Benz Vans continued to

deliver good results. Mercedes-Benz Mobility navigated challenging

market conditions.

- Capital Allocation: Strong cash generation continued. Share

buyback cash outs reach €4.3 billion year-to-date.

- Outlook: Group outlook on EBIT and Free Cash Flow remains in

line with September 19th update.

Mercedes-Benz Group AG generated solid sales in the third

quarter despite product transitions, a challenging market

environment and fierce competition, particularly in China.

Continued Free Cash Flow generation from the industrial business

reached €2.39 billion for Q3 (Q3 2023: €2.35 billion) supported by

favourable working capital development. Net liquidity reached

€28.73 billion (Q3 2023: €28.49 billion).

“The Q3 results do not meet our ambitions.

Nonetheless Mercedes-Benz continues to generate solid cash flows

even in challenging times. We are taking a prudent view about

market evolution going forward and we will step up all efforts on

further efficiency increases and cost improvements across the

business.” Harald Wilhelm, Chief Financial Officer of Mercedes-Benz

Group AG

Divisional results For Mercedes-Benz Cars weaker

macroeconomic conditions and fierce competition, mainly in Asia,

outweighed improved product availability leading to adjusted

earnings before interest and taxes (EBIT) of €1.2 billion (Q3 2023:

€3.4 billion). As previously announced in September, Q3 EBIT was

weaker compared with the second quarter due to softer net pricing

and a less favourable sales mix, leading to an adjusted Return on

Sales (RoS) of 4.7% in the quarter. In addition to tougher market

conditions, the Q3 sales mix was also impacted by product

transitions, for example the all-new ICE and BEV versions of the

G-Class, which will be available in major markets in Q4.

The adjusted Return on Sales (RoS) for Mercedes-Benz Vans

was below the previous year with 13.5% (Q3 2023: 15%), driven by

lower sales and in line with expectations. A healthy sales mix

supported by improved product substance partially compensated lower

sales volumes. Furthermore, cost improvements continued.

The adjusted EBIT for Mercedes-Benz Mobility decreased to

€285 million mainly driven by a lower interest margin (Q3 2023:

€363 million). The interest margin was impacted by the interest

rate development in a competitive environment. As a result, the

adjusted return on equity (RoE) reached 8.9% (Q3 2023: 10.4%).

Outlook At Mercedes-Benz Cars full-year sales are seen

slightly below 2023. Sales in Q4 are expected in the vicinity of

Q3. Global Top-End Vehicle (TEV) sales in Q4 are seen with positive

momentum supported by availability of the G-Class, the Mercedes-AMG

E-Class, Mercedes-AMG GT and the SL. The share of BEV and plug-in

hybrid vehicles (xEV’s) is seen between 18% to 19% in 2024.

The guidance for the adjusted return on sales is seen at 7.5% to

8.5%. Mercedes-Benz Vans adjusted RoS is seen in the range between

14% and 15%.

The adjusted return on equity for Mercedes-Benz Mobility is seen

in the range of 8.5% to 9.5% for 2024.

Group revenue is seen slightly below the prior year. As

communicated on September 19th, Mercedes-Benz Group EBIT and Cash

Flow are seen significantly below the prior-year level.

Mercedes-Benz Group

Q3 2024

Q3 2023

Change

24/23

Q1-Q3

2024

Q1-Q3

2023

Change

24/23

Revenue*

34,528

37,001

-6.7%

107,144

112,414

-4.7%

Earnings before interest and taxes

(EBIT)*

2,517

4,842

-48.0%

10,417

15,334

-32.1%

Net profit/loss*

1,719

3,719

-53.8%

7,806

11,371

-31.4%

Free Cash Flow industrial business

(FCF)*

2,394

2,347

+2.0%

6,256

7,874

-20.5%

Earnings per share (EPS) in EUR

1.81

3.44

-47.5%

7.62

10.47

-27.2%

*in millions of €

Mercedes-Benz Cars

Q3 2024

Q3 2023

Change

24/23

Q1-Q3

2024

Q1-Q3

2023

Change

24/23

Sales in units

503,573

510,564

-1.4%

1,463,263

1,529,793

-4.3%

- thereof xEV

87,232

102,292

-14.7%

267,372

289,900

-7.8%

- thereof BEV

42,544

61,621

-31.0%

135,908

174,471

-22,1%

Share of xEV in unit sales in %

17.3

20.0

-

18.3

19.0

-

Revenue*

25,602

27,131

-5.6%

78,485

83,187

-5.7%

Earnings before interest and taxes

(EBIT)*

1,198

3,312

-63.8%

6,410

11,312

-43.3%

Adjusted earnings before interest and

taxes (EBIT)*

1,207

3,357

-64.0%

6,293

11,282

-44.2%

Adjusted return on sales (RoS) in

%

4.7

12.4

-7.7%pts

8.0

13.6

-5.6%pts

Cash flow before interest and taxes

(CFBIT)*

2,412

2,148

+12.3%

6,865

8,898

-22.8%

Adjusted cash conversion rate

(CCR)

2.0

0.7

-

1.1

0.8

-

*in millions of €

Mercedes-Benz Vans

Q3 2024

Q3 2023

Change

24/23

Q1-Q3

2024

Q1-Q3

2023

Change

24/23

Sales in units

91,063

105,083

-13.3%

299,923

323,473

-7.3%

- thereof BEV

4,375

6,348

-31.1%

12,564

14,972

-16.1%

Share of BEV in unit sales in %

4.8

6.0

-

4.2

4.6

-

Revenue*

4,657

4,939

-5.7%

14,324

14,677

-2.4%

Earnings before interest and taxes

(EBIT)*

618

715

-13.6%

2,381

2,283

+4.3%

Adjusted earnings before interest and

taxes (EBIT) *

628

743

-15.5%

2,262

2,254

+0.4%

Adjusted return on sales (RoS) in

%

13.5

15.0

-1.5%pts

15.8

15.4

+0.4%pts

Cash flow before interest and taxes

(CFBIT)*

893

980

-8.9%

2,127

2,167

-1.8%

Adjusted cash conversion rate

1.5

1.4

-

1.0

1.0

-

*in millions of €

Mercedes-Benz Mobility

Q3 2024

Q3 2023

Change

24/23

Q1-Q3

2024

Q1-Q3

2023

Change

24/23

Revenue*

6,007

6,302

-4.7%

19,209

18,931

+1.5%

New business*

14,235

15,183

-6.2%

43,080

45,299

-4.9%

Contract volume (September,

30)*

134,298

133,840

+0.3%

134,298

135,027**

-0.5%

Earnings before interest and taxes

(EBIT)*

285

363

-21.5%

835

1,074

-22.3%

Adjusted earnings before interest and

taxes (EBIT) *

285

363

-21.5%

835

1,350

-38.1%

Return on equity (RoE) in %

8.9

10.4

-1.5%pts

8.6

10.3

-1.7%pts

Adjusted return on equity (RoE) in

%

8.9

10.4

-1.5%pts

8.6

12.9

-4.3%pts

*in millions of €

** Year-end figure 2023

Further information on Mercedes-Benz Group AG is available at:

media.mercedes-benz.com and group.mercedes-benz.com

Link to press information “Sales figures Q3 2024”:

media.mercedes-benz.com/sales Link to capital market presentation

Q3 2024: group.mercedes-benz.com/q3-2024/en

Forward-looking statements: This document contains

forward-looking statements that reflect our current views about

future events. The words “anticipate,” “assume,” “believe,”

“estimate,” “expect,” “intend,” “may,” “can,” “could,” “plan,”

“project,” “should” and similar expressions are used to identify

forward-looking statements. These statements are subject to many

risks and uncertainties, including an adverse development of global

economic conditions, in particular a negative change in market

conditions in our most important markets; a deterioration of our

refinancing possibilities on the credit and financial markets;

events of force majeure including natural disasters, pandemics,

acts of terrorism, political unrest, armed conflicts, industrial

accidents and their effects on our sales, purchasing, production or

financial services activities; changes in currency exchange rates,

customs and foreign trade provisions; changes in laws, regulations

and government policies (or changes in their interpretation),

particularly those relating to vehicle emissions, fuel economy and

safety or to ESG reporting (environmental, social or governance

topics); price increases for fuel, raw materials or energy;

disruption of production due to shortages of materials or energy,

labour strikes or supplier insolvencies; a shift in consumer

preferences towards smaller, lower-margin vehicles; a limited

demand for all-electric vehicles; a possible lack of acceptance of

our products or services which limits our ability to achieve prices

and adequately utilize our production capacities; a decline in

resale prices of used vehicles; the effective implementation of

cost-reduction and efficiency-optimization measures; the business

outlook for companies in which we hold a significant equity

interest; the successful implementation of strategic cooperations

and joint ventures; the resolution of pending governmental

investigations or of investigations requested by governments and

the outcome of pending or threatened future legal proceedings; and

other risks and uncertainties, some of which are described under

the heading “Risk and Opportunity Report” in the current Annual

Report. If any of these risks and uncertainties materializes or if

the assumptions underlying any of our forward-looking statements

prove to be incorrect, the actual results may be materially

different from those we express or imply by such statements. We do

not intend or assume any obligation to update these forward-looking

statements since they are based solely on the circumstances at the

date of publication.

Mercedes-Benz Group at a glance Mercedes-Benz Group AG is

one of the world's most successful automotive companies. With

Mercedes-Benz AG, the Group is one of the leading global suppliers

of high-end passenger cars and premium vans. Mercedes-Benz Mobility

AG offers financing, leasing, car subscription and car rental,

fleet management, digital services for charging and payment,

insurance brokerage, as well as innovative mobility services. The

company founders, Gottlieb Daimler and Carl Benz, made history by

inventing the automobile in 1886. As a pioneer of automotive

engineering, Mercedes-Benz sees shaping the future of mobility in a

safe and sustainable way as both a motivation and obligation. The

company's focus therefore remains on innovative and green

technologies as well as on safe and superior vehicles that both

captivate and inspire. Mercedes-Benz continues to invest

systematically in the development of efficient powertrains and sets

the course for an all-electric future. Mercedes-Benz is

consistently implementing its strategy to transform itself toward a

fully electric and software-driven future. The company's efforts

are also focused on the intelligent connectivity of its vehicles,

autonomous driving and new mobility concepts as Mercedes-Benz

regards it as its aspiration and obligation to live up to its

responsibility to society and the environment. Mercedes-Benz sells

its vehicles and services in nearly every country of the world and

has production facilities in Europe, North and Latin America, Asia

and Africa. In addition to Mercedes-Benz, the world's most valuable

luxury automotive brand (source: Interbrand study, 22 Nov. 2023),

Mercedes-AMG, Mercedes-Maybach and Mercedes me as well as the

brands of Mercedes-Benz Mobility: Mercedes-Benz Bank, Mercedes-Benz

Financial Services and Athlon. The company is listed on the

Frankfurt and Stuttgart stock exchanges (ticker symbol MBG). In

2023, the Group had a workforce of around 166,000 and sold around

2.5 million vehicles. Group revenues amounted to €153.2 billion and

Group EBIT to €19.7 billion.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024155368/en/

Willem Spelten, +49 151 58624395,

willem.spelten@mercedes-benz.com Edward Taylor, +49 176 30941776,

edward.taylor@mercedes-benz.com Benjamin Kraft, +49 176 30957277,

benjamin.b.kraft@mercedes-benz.com Andrea Berg, phone +1 917 667

2391, andrea.a.berg@mercedes-benz.com

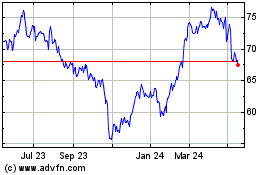

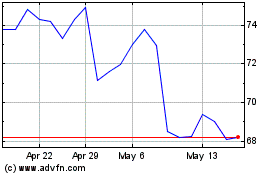

MercedesBenz (TG:MBG)

Historical Stock Chart

From Feb 2025 to Mar 2025

MercedesBenz (TG:MBG)

Historical Stock Chart

From Mar 2024 to Mar 2025