Alamos Gold Inc. (

TSX:AGI;

NYSE:AGI) (“Alamos” or the “Company”) today reported

results of the positive internal economic study completed on its

Puerto Del Aire (“PDA”) project located within the Mulatos District

in Sonora, Mexico. PDA is a higher-grade underground deposit

adjacent to the Mulatos open pit.

Given PDA’s attractive economics and proximity

to the existing Mulatos infrastructure, the Company anticipates

starting development of PDA in 2025 with first production expected

mid-2027. The project is expected to nearly triple the mine life of

the Mulatos District, extending production into 2035. There are

excellent opportunities currently being tested that could extend

the mine life further and enhance already robust economics through

the significant exploration upside potential at both PDA and Cerro

Pelon, as outlined earlier today.

PDA Project Highlights

- Average

annual gold production of 127,000 ounces over the first four years

and 104,000 ounces over the current mine life, based on

Mineral Reserves as at December 31, 2023

- Low cost

profile: total cash costs of $921 per payable ounce and mine-site

all-in sustaining costs of $1,003 per payable ounce,

consistent with the Company’s overall low cost structure

- Mine life tripled to

2035: PDA mine life of eight years based on current

Mineral Reserves, extending the Mulatos District mine life from

2027 to 2035

- High-return project with

significant upside potential

- After-tax Internal Rate of Return (“IRR”) of 46% and

after-tax Net Present Value (“NPV”) (5%) of $269 million

(using base case gold price assumption of $1,950 per ounce and a

MXN/USD foreign exchange rate of 18:1)

-

After-tax IRR of 73% and after-tax NPV (5%) of $492

million at current gold prices of approximately $2,500 per

ounce and a MXN/USD foreign exchange rate of 18:1

- Payback

of two years at the base case gold price of $1,950/oz and

1.5 years at current gold prices

- Low

initial capital to be internally funded by strong ongoing free cash

flow generation at the Mulatos District

- Initial

capital of $165 million to be spent over a two-year period starting

mid-2025. Life of mine capital is expected to total $231

million including $66 million of sustaining capital

- Low

initial capital intensity of $195 per ounce produced, or

$273 per ounce based on total life of mine capital

- PDA will

benefit from the use of existing crushing and mill infrastructure

from Cerro Pelon and Island Gold, supporting lower initial

capital and project execution risk

- La Yaqui

Grande is expected to finance the development of PDA at base case

gold prices of $1,950 per ounce, following which PDA is

expected to generate strong free cash flow. Through the first half

of 2024, the Mulatos District generated $120 million of mine-site

free cash flow

- Lower

execution risk with PDA located within existing operation

-

Experienced team in Mexico with strong track record of

building projects on schedule and within budget including

La Yaqui Phase I, Cerro Pelon and La Yaqui Grande

- PDA will

represent the second underground mine developed and operated in the

Mulatos District following San Carlos

- Lower

development and permitting risk with PDA located within

the existing operating footprint in the Mulatos District and

utilizing existing infrastructure

-

Significant exploration upside at PDA and Cerro

Pelon

-

Higher-grade mineralization continues to be extended beyond

existing Mineral Reserves and Resources at PDA and the

deposit remains open in multiple directions, highlighting the

potential for further growth

-

Higher-grade mineralization intersected below the past

producing Cerro Pelon open pit which is expected to support an

initial underground Mineral Resource with the year-end Mineral

Reserve and Resource update to be released in February

2025. Cerro Pelon represents upside as a potential source

of additional feed to the PDA sulphide mill that could extend the

higher rates of production beyond the first four years of the

current mine plan

“Mulatos has been operating for nearly 20 years

reflecting a long-term track record of exploration success with the

discovery of multiple new deposits in the District. PDA is an

extension of that success, having discovered and outlined another

attractive, high-return project that we expect will extend the

Mulatos District mine life to at least 2035, representing 30 years

since it began producing. The development of PDA and transition to

underground sulphide milling operations will open up additional

opportunities for growth in the Mulatos District. Given our ongoing

exploration success at PDA, and newly defined and growing

higher-grade zones of mineralization at Cerro Pelon, we see

excellent potential to further extend the mine life and add to

already attractive economics,” said John A. McCluskey, President

and Chief Executive Officer.

|

Puerto Del Aire Project Highlights |

Life of Mine1 |

|

Production |

|

|

Mine life (years) |

8 |

|

|

|

|

Total gold production (000 ounces) |

848 |

|

Total payable gold production (000 ounces) |

806 |

|

Average annual gold production (000 ounces) |

|

|

Years 1 to 4 |

127 |

|

Years 1 to 8 |

104 |

|

|

|

|

Total ore mined (000 tonnes) |

5,375 |

|

|

|

|

Average gold grade mined (grams per tonne) |

5.61 |

|

|

|

|

Average mill throughput (tonnes per day (“tpd”)) |

2,000 |

|

|

|

|

Gold recovery (%) |

85% |

|

Gold payability (%) |

95% |

|

|

|

|

Operating Costs |

|

|

Mining cost per tonne of ore mined |

$88 |

|

Processing cost per tonne of ore milled |

$20 |

|

G&A cost per tonne of ore milled |

$20 |

|

Total site operating cost per tonne of ore milled |

$120 |

|

|

|

|

Total operating cost per tonne of ore milled (including concentrate

treatment & transportation) |

$127 |

|

|

|

|

Total cash cost (per payable ounce)2 |

$921 |

|

Mine-site all-in sustaining cost (per payable ounce)2 |

$1,003 |

|

Capital Costs (millions) 1 |

|

|

Initial capital expenditure |

$165 |

|

Sustaining capital expenditure |

$66 |

|

Total capital expenditure |

$231 |

|

Initial capital intensity (per ounce produced) |

$195 |

|

Base Case Economic Analysis1 |

|

|

IRR (after-tax) |

46% |

|

|

|

|

NPV @ 0% discount rate (millions, after-tax) |

$383 |

|

NPV @ 5% discount rate (millions, after-tax) |

$269 |

|

|

|

|

Gold price assumption (per payable ounce) |

$1,950 |

|

Exchange Rate (MXN/USD) |

18.0 |

|

Economic Analysis at $2,500 per ounce Gold

Price1 |

|

|

IRR (after-tax) |

73% |

|

|

|

|

NPV @ 0% discount rate (millions, after-tax) |

$676 |

|

NPV @ 5% discount rate (millions, after-tax) |

$492 |

|

|

|

|

Gold price assumption (per payable ounce) |

$2,500 |

|

Exchange Rate (MXN/USD) |

18.0 |

1 Capital spending and economic

analysis (NPV and IRR) are calculated starting January 1, 20252

Total cash costs and mine-site all-in sustaining costs include

silver as a by-product credit, the 0.5% government royalty on

revenue, and are per payable ounce

Mineral Reserves and

Resources

The PDA mine plan and economic analysis are

based on Mineral Reserves as of December 31, 2023 which total 5.4

million tonnes (“Mt”), grading 5.61 grams per tonne of gold (“g/t

Au”), containing 969,000 ounces of gold. Additionally, the project

hosts Measured and Indicated Mineral Resources which total 2.1 Mt,

grading 3.54 g/t Au, containing 240,000 ounces of gold. Only

Mineral Reserves were included in the mine plan with Mineral

Resources representing potential upside.

Mineral Reserves – Effective as of December 31,

2023

|

Classification |

Tonnage (000’s) |

Grade (g/t Au) |

Contained oz(000’s Au) |

|

Proven |

833 |

4.71 |

126 |

|

Probable |

4,542 |

5.77 |

843 |

|

Total Proven & Probable |

5,375 |

5.61 |

969 |

- Mineral Reserves reported are

consistent with the CIM Definition Standards for Mineral Resources

and Mineral Reserves.

- Mineral Reserves are reported to a

cut-off grade of 3.0 g/t Au.

- The cut-off grades are based on a

gold price of $1,400/oz Au.

- Metallurgical Au recovery is

85%.

- Totals may not add up due to

rounding.

- Chris Bostwick, FAusIMM, Senior Vice President, Technical

Services is the Qualified Person for the Mineral Reserve estimate.

Mr. Bostwick is a Qualified Person within the meaning of Canadian

Securities Administrator's National Instrument 43-101 ("NI

43-101").

Mineral Resources – Effective as of December 31,

2023

|

Category |

Tonnage (000’s) |

Grade (g/t Au) |

Contained oz (000’s Au) |

|

MeasuredIndicated |

3261,780 |

3.293.59 |

35205 |

|

Measured & Indicated |

2,106 |

3.54 |

240 |

|

Inferred |

73 |

5.97 |

14 |

- Mineral Resources reported are

consistent with the CIM Definition Standards for Mineral Resources

and Mineral Reserves.

- The Mineral Resources are reported at

an assumed gold price of US$1,600/oz.

- Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability. There is

no certainty that all or any part of the Mineral Resources

estimated will be converted into Mineral Reserves.

- Contained Au ounces are in-situ and do

not include metallurgical recovery losses.

- Mineral Resources are exclusive of

Mineral Reserves.

- Totals may not add up due to

rounding.

- Marc

Jutras P.Eng., Principal, Ginto Consulting Inc. is the Qualified

Person for the Mineral Resource estimate. Mr. Jutras is a Qualified

Person within the meaning of Canadian Securities Administrator's

National Instrument 43-101 ("NI 43-101").

Economic Analysis

PDA’s estimated after-tax IRR is 46% and

after-tax NPV (5%) is $269 million assuming a gold price of $1,950

per payable ounce and MXN/USD foreign exchange rate of 18:1.

Assuming spot gold prices of approximately $2,500 per ounce and

MXN/USD foreign exchange rate of 18:1, the after-tax IRR increases

to 73% and after-tax NPV (5%) increases to $492 million.

The mine plan, operating parameters, and capital

estimates incorporated in the study are based on actual operating

experience, and mining contractor quotations. Capital estimates for

the processing circuit are based on Class 5 estimates from the

third-party engineering firm that designed the processing circuit

at La Yaqui Grande.

The project economics are sensitive to metal

price assumptions, foreign exchange rates, and input costs as

detailed in the tables below.

Puerto Del Aire After-Tax NPV (5%) Sensitivity ($

Millions)

|

|

-10% |

-5% |

Base Case |

5% |

10% |

|

Gold Price |

$190 |

$230 |

$269 |

$309 |

$348 |

|

Mexican Peso |

$288 |

$279 |

$269 |

$258 |

$245 |

|

Operating Costs |

$305 |

$287 |

$269 |

$251 |

$233 |

|

Capital Costs |

$286 |

$277 |

$269 |

$261 |

$252 |

Puerto Del Aire After-Tax NPV (5%) Sensitivity to Gold

Price and MXN/USD ($ Millions)

|

|

Mexican Peso |

|

Gold PriceUS$/oz |

|

17.0 |

18.0 |

19.0 |

20.0 |

|

$1,750 |

$175 |

$188 |

$199 |

$209 |

|

$1,850 |

$216 |

$229 |

$240 |

$250 |

|

$1,950 |

$257 |

$269 |

$280 |

$290 |

|

$2,100 |

$317 |

$330 |

$341 |

$351 |

|

$2,300 |

$398 |

$411 |

$422 |

$432 |

|

$2,500 |

$480 |

$492 |

$503 |

$513 |

Puerto Del Aire After-Tax IRR Sensitivity to Gold Price

and MXN/USD (%)

|

|

Mexican Peso |

|

Gold PriceUS$/oz |

|

17.0 |

18.0 |

19.0 |

20.0 |

|

$1,750 |

33.3% |

35.6% |

37.7% |

39.7% |

|

$1,850 |

38.8% |

41.1% |

43.2% |

45.2% |

|

$1,950 |

44.0% |

46.3% |

48.5% |

50.5% |

|

$2,100 |

51.4% |

53.9% |

56.1% |

58.1% |

|

$2,300 |

60.9% |

63.4% |

65.7% |

67.9% |

|

$2,500 |

69.9% |

72.5% |

74.9% |

77.2% |

Project Overview

The PDA underground deposit is located adjacent

to the main Mulatos pit and will be accessed via two portals

located in the east wall of the Mulatos Pit (Figures 1 and 2).

Underground ore mined will be processed through a flotation plant.

No cyanide will be utilized with a concentrate produced for final

gold recovery offsite. Tailings from onsite processing will be dry

stacked.

Higher-grade sulphide mineralization was

intersected at PDA more than 10 years ago. The focus at that time

was on finding additional oxide, heap leachable ore such that

follow up drilling at PDA did not resume until 2019. The

exploration program has been extremely successful with an initial

Mineral Reserve of 428,000 ounces (2.8 Mt grading 4.67 g/t Au)

declared at the end of 2021. Since then, the deposit has continued

to grow, more than doubling by the end of 2023 to 1.0 million

ounces with grades also increasing 20% (5.4 Mt grading 5.61 g/t

Au).

PDA will represent the second underground mining

operation within the Mulatos District following San Carlos

underground which successfully operated from 2014 to 2018. PDA will

be developed by an experienced team with a strong track record of

building projects on schedule and within budget including La Yaqui

Phase I, Cerro Pelon, and most recently La Yaqui Grande.

Production and Mine-Site AISC

Profile

Mining

PDA will be accessed via two portals located in

the east wall of the Mulatos Pit. Transverse long-hole open stoping

will be the primary mining method utilized, as well as underhand

drift and fill, with cemented rockfill supporting higher mining and

ore recovery rates. Ore will be mined at a rate of 2,000 tonnes per

day (“tpd”) over an eight-year mine life based on existing Mineral

Reserves. Contract mining will be utilized over the mine life.

Initial production from PDA is expected

mid-2027. Grades mined are expected to average approximately 7 g/t

Au over the first four years supporting higher average annual

production of 127,000 ounces over that time frame, and peak annual

production of 149,000 ounces

Grades are expected to decrease to average

approximately 4 g/t Au 2031 onward under the current mine plan.

Ongoing exploration success at PDA and Cerro Pelon represents an

upside opportunity to define additional higher-grade Mineral

Reserves and Resources that could maintain higher grades and

production well beyond the initial four years of the current mine

plan.

Processing

The processing circuit will include three-stage

crushing, utilizing the existing Cerro Pelon crushing circuit, and

two primary ball mills. One of the ball mills will come from Island

Gold as the mill will be decommissioned in 2025 with ore from

Island Gold to be fed through the larger Magino mill. Ore at PDA

will be crushed to 80% passing (P80) ¼ inch. Following crushing,

ore will be sent to the grinding circuit and then flotation circuit

that includes both rougher flotation and cleaner flotation (Figures

3 and 4).

The flow sheet incorporates the following major

process operations:

- Three-stage

crushing

- Two ball mills in parallel – one to

be supplied from the Island Gold mill

- Two regrind mills – supplied from

the Island Gold mill

- Flotation circuit

- Concentrate dewatering

- Tailings dewatering

A concentrate will be produced with gold to be

recovered off-site, eliminating the use of cyanide for on-site

processing. Over the life of mine, approximately 300,000 tonnes of

concentrate will be produced at average grades of 90 g/t Au.

Off-site treatment, refining and transportation costs are estimated

to be $130 per tonne of concentrate. Mill recoveries are expected

to average 85%, of which 95% is payable.

Power to site will be supplied from the existing

connection to the commercial electricity grid operated by the

state-owned electric utility of Mexico, the Comisión Federal de

Electricidad (“CFE”).

With the tailings dry stacked, no tailings dam

will be required. Tailings will be filtered and deposited where

low-grade stockpiles from Mulatos were previously located.

Operating Costs

Total cash costs are expected to average $921

per payable ounce and mine-site all-in sustaining costs $1,003 per

payable ounce over the life of the operation. Total unit operating

costs are expected to average $127 per tonne of ore milled,

including concentrate treatment and transportation costs. This

includes average mining costs of $88 per tonne of ore mined,

processing costs of $20 per tonne of ore milled, and G&A costs

of $20 per tonne of ore milled.

The breakdown of unit costs is summarized as

follows.

|

Operating

Costs1 |

|

US$/t |

LOM US$M |

|

Mining |

$/t mined |

$88 |

$473 |

|

Processing |

$/t milled |

$20 |

$117 |

|

G&A |

$/t milled |

$20 |

$117 |

|

Total On-Site Operating Costs |

$/t milled |

$120 |

$707 |

|

|

|

|

|

|

Concentrate Treatment & Transportation |

$/t conc. |

$130 |

$38 |

|

Total Operating Costs |

$/t milled |

$127 |

$746 |

|

|

|

|

|

|

Total Cash

Costs2.3 |

$/oz |

$921 |

|

|

Mine-site All-in Sustaining

Costs2.3 |

$/oz |

$1,003 |

|

1 Operating costs exclude silver by-product

credit, 0.5% government royalty on revenue and working capital 2

Total cash costs and mine-site all-in sustaining costs include

silver as a by-product credit, the 0.5% government royalty on

revenue, and are per payable ounce3 Please refer to the Cautionary

Notes on non-GAAP Measures and Additional GAAP Measures

Capital Costs

Total initial capital is estimated to be $165

million and expected to be spent over a two-year period starting

mid-2025. This includes $51 million for underground development,

and $109 million for the processing facility which includes a 25%

contingency.

The crushing circuit that was previously

utilized for Cerro Pelon will be re-located and integrated into the

PDA circuit, and one primary ball mill and two regrind mills from

Island Gold will be refurbished and shipped to site. The remaining

life of mine capital includes $66 million of sustaining capital,

predominantly for underground development.

A breakdown of the initial and total capital

requirements is detailed as follows.

|

Capital Cost ($ millions) |

|

|

Processing Facility1 |

$109 |

| Mine

Development & Fixed Assets |

$56 |

|

|

|

|

Total Initial Capital |

$165 |

|

|

|

|

Sustaining capital |

$66 |

|

|

|

|

Total Capital |

$231 |

1 Includes a 25% contingency

Taxes and Royalties

Earnings at PDA are subject to the corporate tax

rate of 30%, as well as the Mexican Mining Royalty (7.5% EBITDA

royalty). Additionally, the project is subject to the 0.5%

government royalty on revenue. The Mulatos District, including PDA

is not subject to any third party royalties. Over the current mine

life and using a base case gold price assumption of $1,950 per

ounce, PDA is expected to pay $215 million in taxes.

Permitting

An amendment to the existing environmental

impact assessment (“MIA”) will be required for PDA. The amended MIA

application has been submitted with approval expected by the end of

2024. PDA is expected to be a straightforward project to permit

given:

- PDA will be an

underground mine located next to the Mulatos pit, within the

existing Mulatos District concessions

- No Change of Land

Use (“CUS”) permit is expected to be required with PDA located

within the existing Mulatos operating footprint

- No tailings dam

will be required with dry stacked tailings

- No use of cyanide

with a concentrate to be produced and shipped off-site for

treatment

Additional Upside

Opportunities

Addition of a paste plant

The addition of a paste plant will be evaluated

as an upside opportunity. The use of paste backfill would allow for

increased mining recovery, contributing to higher life of mine

production, as well as faster stope cycle times providing improved

operational flexibility.

Ongoing near-mine exploration success at

PDA

Through ongoing exploration success, PDA’s

Mineral Reserves base had increased to 1.0 million ounces (5.4 mt

grading 5.61 g/t Au) at the end of 2023, more than doubling over

the previous two years with grades also increasing 20%. This growth

to the end of 2023 was incorporated into the PDA development

plan.

The initial focus of the surface exploration

program in 2024 has been on the GAP-Victor zones, and in the

relatively untested area between the PDA zones and Gap-Victor. The

program has been successful in further extending high-grade gold

mineralization beyond Mineral Reserves and Resources. Given ongoing

exploration success in 2024, and with the deposit open in multiple

directions, there is excellent potential for further growth in

higher-grade Mineral Reserves and Resources which represents upside

to the project.

New highlights reported earlier today

include1:

GAP-Victor Zone

-

5.43 g/t Au over 18.05 m (23MUL278);

-

23.60 g/t Au over 3.00 m (24MUL302);

-

27.62 g/t Au (23.06 g/t cut) over 2.25 m

(24MUL332);

-

12.28 g/t Au over 4.95 m (24MUL363); and

-

5.77 g/t Au over 8.65 m (24MUL304).

PDA3 Zone

-

3.03 g/t Au over 28.40m (24MUL347); and

-

6.63 g/t Au over 5.50 m (24MUL365).

PDA Extension Zone

-

36.20 g/t Au over 0.90 m (24MUL341);

-

3.51 g/t Au over 5.05 m (24MUL315); and

-

4.16 g/t Au over 4.20 m (24MUL283).

1All reported composite widths are estimated

true width of the mineralized zones. Drillhole composite gold

grades reported as “cut” at PDA include higher grade samples which

have been cut to 40 g/t Au.

Cerro Pelon and other regional

targets

Cerro Pelon was an open pit operation that

successfully operated between 2019 and 2021 with 127,000 ounces of

gold produced at an average grade of 1.7 g/t Au. Open pit oxide ore

was trucked from the Cerro Pelon pit to the existing Mulatos

crushing and heap leach infrastructure, which included a dedicated

Cerro Pelon crushing plant.

Between 2008 and 2017 high-grade mineralization

was intersected below the Cerro Pelon pit across multiple drill

holes including the following previously reported highlights from

2015 and 20162:

-

15.35 g/t Au (14.04 g/t cut) over 25.04 m

(15PEL012);

-

9.16 g/t Au over 19.22 m (16PEL018);

-

10.36 g/t Au over 17.40 m (15PEL020);

-

6.95 g/t Au over 13.53 m (15PEL069); and

-

13.47 g/t Au over 3.47 m (15PEL085).

2All reported historic composite

widths are estimated true width of the mineralized

zones. Drillhole composite gold grades reported as “cut”

include higher grade samples which have been cut to 40 g/t

Au.

The 2024 drill program at Cerro Pelon has

expanded high-grade mineralization beyond the historical drilling

in multiple oxide and sulphide zones. Step-out drilling below the

open pit has identified significant high-grade feeder structures

that range in size from 45 to 125 metres (“m”) in width and up to

170 m vertically. New highlights reported earlier today

include1:

-

5.45 g/t Au over 27.90 m, including 31.07 g/t Au over 1.25

m (24PEL048);

-

12.47 g/t Au (9.41 g/t cut) over 6.46 m, including 58.10

g/t Au (40.00 g/t cut) over 1.09 m (24PEL048);

-

4.79 g/t Au over 15.82 m (24PEL071);

-

4.46 g/t Au over 15.40 m (24PEL051);

-

5.64 g/t Au over 12.16 m (24PEL059);

-

5.77 g/t Au over 9.81 m (24PEL067); and

-

4.01 g/t Au over 13.85 m (24PEL054).

1All reported

composite widths are estimated true width of the mineralized

zones. Drillhole composite gold grades reported as “cut” at

Cerro Pelon include higher grade samples which have been cut to 40

g/t Au.

Drilling to date indicates that more than five

pipes with lateral dimensions ranging from 150 m by 100 m, to 75 m

by 60 m, and vertical extents ranging between 40 m and 150 m. There

is significant potential to expand the mineralization in all

directions with limited drilling completed beyond the five feeders

identified to date.

Cerro Pelon is located nine kilometres (“km”) by

road from the planned PDA mill, similar to the distance that lower

grade open pit ore from Cerro Pelon was trucked to the Mulatos

circuit (Figure 5). An initial underground Mineral Resource is

expected to be declared on Cerro Pelon with the 2024 year-end

update which will be evaluated as a source of additional high-grade

mill feed.

Under the current PDA mine plan, grades are

expected to decrease from 2031 onward. Cerro Pelon represents an

opportunity to mine and process higher relative grades, extending

higher rates of gold production beyond the first four years of the

current mine plan.

Technical Disclosure

Chris Bostwick, FAusIMM, Alamos Gold's

Senior Vice President, Technical Services, has reviewed and

approved the scientific and technical information contained in this

news release. Mr. Bostwick is a Qualified Person within

the meaning of Canadian Securities

Administrator's National Instrument 43-101 ("NI 43-101").

About Alamos

Alamos is a Canadian-based intermediate gold

producer with diversified production from three operating mines in

North America. This includes the Young-Davidson mine and Island

Gold District in northern Ontario, Canada and the Mulatos District

in Sonora State, Mexico. Additionally, the Company has a

significant portfolio of development stage projects, including the

Phase 3+ Expansion at Island Gold, and the Lynn Lake project in

Manitoba, Canada. Alamos employs more than 2,400 people and is

committed to the highest standards of sustainable development. The

Company’s shares are traded on the TSX and NYSE under the symbol

“AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. Parsons

Senior Vice President, Corporate Development

& Investor Relations

(416) 368-9932 x 5439

The TSX and NYSE have not reviewed and do not

accept responsibility for the adequacy or accuracy of this

release.

Cautionary Note Regarding Forward

Looking Statements

Cautionary Note

This news release contains or incorporates by

reference “forward-looking statements” and “forward-looking

information” as defined under applicable Canadian and U.S.

securities laws. All statements in this news release, other than

statements of historical fact, which address events, results,

outcomes or developments that the Company expects to occur are, or

may be deemed to be, forward-looking statements and are generally,

but not always, identified by the use of forward-looking

terminology such as "expect", “assume”, “anticipate”, “potential”,

“plan”, “opportunity”, “estimate”, “continue”, “ongoing”,

“evaluate”, “budget”, “target” or variations of such words and

phrases and similar expressions or statements that certain actions,

events or results “may", “could”, “would”, "might" or "will" be

taken, occur or be achieved or the negative connotation of such

terms. Forward-looking statements contained in this news release

are based on information, expectations, estimates and projections

as of the date of this news release.

Forward-looking statements in this news release

include, but may not be limited to, information as to strategy,

plans, expectations or future financial or operating performance

pertaining to, or anticipated to result from, the PDA development

project, such as expectations, assumptions and estimations

regarding: the project and its attractive economics and significant

exploration upside; development of the project; the mine plan; the

method of mining the project and the intended method of processing

ore from the PDA deposit; initial underground Mineral Resource at

Cerro Pelon; expected timing of approval of the amended MIA

application for the PDA project; mine life and expected mine life

extension at Mulatos; exploration potential, programs and targets;

anticipated production; gold grades; mineralization; Mineral

Reserves and Resources (and potential growth in Mineral Reserves as

exploration continues); Proven and Probable Mineral Reserves;

Inferred Mineral Resources; operating costs including mine-site

all-in sustaining costs; capital costs; capital costs; economic

analysis including anticipated after-tax net present value and

internal rate of return; applicable taxes; gold price, other metal

prices and foreign exchange rates; project execution risk; returns

to stakeholders; and other statements that express management's

expectations or estimates of future performance, operational,

geological or financial results.

Exploration results that include geophysics,

sampling, and drill results on wide spacings may not be indicative

of the occurrence of a mineral deposit. Such results do not provide

assurance that further work will establish sufficient grade,

continuity, metallurgical characteristics and economic potential to

be classed as a category of Mineral Resource. A Mineral Resource

that is classified as "Inferred" or "Indicated" has a great amount

of uncertainty as to its existence and economic and legal

feasibility. It cannot be assumed that any or part of an "Indicated

Mineral Resource" or "Inferred Mineral Resource" will ever be

upgraded to a higher category of Mineral Resource. Investors are

cautioned not to assume that all or any part of mineral deposits in

these categories will ever be converted into Proven and Probable

Mineral Reserves.

The Company cautions that forward-looking

statements are necessarily based upon several factors and

assumptions that, while considered reasonable by management at the

time of making such statements, are inherently subject to

significant business, economic, technical, legal, political, and

competitive uncertainties, and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements, and undue reliance

should not be placed on such statements and information.

Such factors include (without limitation): the

actual results of current exploration activities; conclusions of

economic and geological evaluations; changes in project parameters

as plans continue to be refined; any impacts of any illnesses,

diseases, epidemics or pandemics on operations and the broader

market, including the nature and duration of any regulatory

responses; state and federal orders or mandates (including with

respect to mining operations generally or auxiliary businesses or

services required for the Company’s operations) in Mexico; changes

in national and local government legislation, controls or

regulations; failure to comply with environmental and health and

safety laws and regulations; labour and contractor availability

(and being able to secure the same on favourable terms); ability to

sell or deliver gold doré bars; disruptions in the maintenance or

provision of required infrastructure and information technology

systems; fluctuations in the price of gold or certain other

commodities such as, diesel fuel, natural gas, and electricity;

operating or technical difficulties in connection with mining or

development activities, including geotechnical challenges and

changes to production estimates (which assume accuracy of projected

ore grade, mining rates, recovery timing and recovery rate

estimates and may be impacted by unscheduled maintenance); changes

in foreign exchange rates (particularly the Canadian dollar, U.S.

dollar, and Mexican peso); the impact of inflation; employee and

community relations; litigation and administrative proceedings;

disruptions affecting operations; availability of and increased

costs associated with mining inputs and labour; delays in the

development or updating of mine and/or development plans; delays in

receiving approval of the amended MIA application for the PDA

project; changes that may be required to the intended method of

accessing and mining the deposit at Puerto Del Aire and changes

related to the intended method of processing any ore from the

deposit at Puerto Del Aire; inherent risks and hazards associated

with mining and mineral processing including environmental hazards,

industrial accidents, unusual or unexpected formations, pressures

and cave-ins; the risk that the Company’s mines may not

perform as planned; uncertainty with the Company's ability to

secure additional capital to execute its business plans; the

speculative nature of mineral exploration and development, risks in

obtaining and maintaining necessary licenses, permits and

authorizations, contests over title to properties; expropriation or

nationalization of property; political or economic developments in

Canada or Mexico and other jurisdictions in which the Company may

carry on business in the future; increased costs and risks related

to the potential impact of climate change; the costs and timing of

construction and development of new deposits; risk of loss due to

sabotage, protests and other civil disturbances; the impact of

global liquidity and credit availability and the values of assets

and liabilities based on projected future cash flows; and business

opportunities that may be pursued by the Company.

For a more detailed discussion of such risks and

other risk factors that may affect the Company's ability to achieve

the expectations set forth in the forward-looking statements

contained in this news release, see the Company’s latest

40-F/Annual Information Form and Management’s Discussion and

Analysis, each under the heading “Risk Factors” available on the

SEDAR website at www.sedarplus.ca or on EDGAR at www.sec.gov. The

foregoing should be reviewed in conjunction with the information,

risk factors and assumptions found in this news release.

The Company disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except as required by applicable law.

Cautionary Note to U.S.

Investors

Alamos prepares its disclosure in accordance

with the requirements of securities laws in effect in Canada.

Unless otherwise indicated, all Mineral Resource and Mineral

Reserve estimates included in this document have been prepared in

accordance with Canadian National Instrument 43-101 - Standards of

Disclosure for Mineral Projects (“NI 43-101”) and the Canadian

Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM

Definition Standards on Mineral Resources and Mineral Reserves,

adopted by the CIM Council, as amended (the “CIM Standards”). NI

43-101 is a rule developed by the Canadian Securities

Administrators, which established standards for all public

disclosure an issuer makes of scientific and technical information

concerning mineral projects. Mining disclosure in the United States

was previously required to comply with SEC Industry Guide 7 (“SEC

Industry Guide 7”) under the United States Securities Exchange Act

of 1934, as amended. The U.S. Securities and Exchange Commission

(the “SEC”) has adopted final rules, to replace SEC Industry Guide

7 with new mining disclosure rules under sub-part 1300 of

Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”)

which became mandatory for U.S. reporting companies beginning with

the first fiscal year commencing on or after January 1, 2021. Under

Regulation S-K 1300, the SEC now recognizes estimates of “Measured

Mineral Resources”, “Indicated Mineral Resources” and “Inferred

Mineral Resources”. In addition, the SEC has amended its

definitions of “Proven Mineral Reserves” and “Probable Mineral

Reserves” to be substantially similar to international

standards.

Investors are cautioned that while the above

terms are “substantially similar” to CIM Definitions, there are

differences in the definitions under Regulation S-K 1300 and the

CIM Standards. Accordingly, there is no assurance any mineral

reserves or mineral resources that the Company may report as

“proven mineral reserves”, “probable mineral reserves”, “measured

mineral resources”, “indicated mineral resources” and “inferred

mineral resources” under NI 43-101 would be the same had the

Company prepared the mineral reserve or mineral resource estimates

under the standards adopted under Regulation S-K 1300. U.S.

investors are also cautioned that while the SEC recognizes

“measured mineral resources”, “indicated mineral resources” and

“inferred mineral resources” under Regulation S-K 1300, investors

should not assume that any part or all of the mineralization in

these categories will ever be converted into a higher category of

mineral resources or into mineral reserves. Mineralization

described using these terms has a greater degree of uncertainty as

to its existence and feasibility than mineralization that has been

characterized as reserves. Accordingly, investors are cautioned not

to assume that any measured mineral resources, indicated mineral

resources, or inferred mineral resources that the Company reports

are or will be economically or legally mineable.

Cautionary non-GAAP Measures and

Additional GAAP Measures

Note that for purposes of this section, GAAP

refers to IFRS. The Company believes that investors use certain

non-GAAP and additional GAAP measures as indicators to assess gold

mining companies. They are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared with GAAP.

“Cash flow from operating activities before

changes in non-cash working capital” is a non-GAAP performance

measure that could provide an indication of the Company’s ability

to generate cash flows from operations and is calculated by adding

back the change in non-cash working capital to “cash provided by

(used in) operating activities” as presented on the Company’s

consolidated statements of cash flows. “Cash flow per share” is

calculated by dividing “cash flow from operations before changes in

working capital” by the weighted average number of shares

outstanding for the period. “Free cash flow” is a non-GAAP

performance measure that is calculated as cash flows from

operations net of cash flows invested in mineral property, plant

and equipment and exploration and evaluation assets as presented on

the Company’s consolidated statements of cash flows and that would

provide an indication of the Company’s ability to generate cash

flows from its mineral projects. “Mine site free cash flow” is a

non-GAAP measure which includes cash flow from operating activities

at, less capital expenditures at each mine site. “Return on equity”

is defined as earnings from continuing operations divided by the

average total equity for the current and previous year. “Mining

cost per tonne of ore” and “cost per tonne of ore” are non-GAAP

performance measures that could provide an indication of the mining

and processing efficiency and effectiveness of the mine. These

measures are calculated by dividing the relevant mining and

processing costs and total costs by the tonnes of ore processed in

the period. “Cost per tonne of ore” is usually affected by

operating efficiencies and waste-to-ore ratios in the period.

“Total capital expenditures per ounce produced” is a non-GAAP term

used to assess the level of capital intensity of a project and is

calculated by taking the total growth and sustaining capital of a

project divided by ounces produced life of mine. “Total cash costs

per ounce”, “all-in sustaining costs per ounce”, “mine-site all-in

sustaining costs”, and “all-in costs per ounce” as used in this

analysis are non-GAAP terms typically used by gold mining companies

to assess the level of gross margin available to the Company by

subtracting these costs from the unit price realized during the

period. These non-GAAP terms are also used to assess the ability of

a mining company to generate cash flow from operations. There may

be some variation in the method of computation of these metrics as

determined by the Company compared with other mining companies. In

this context, “total cash costs” reflects mining and processing

costs allocated from in-process and doré inventory and associated

royalties with ounces of gold sold in the period. Total cash costs

per ounce are exclusive of exploration costs. “All-in sustaining

costs per ounce” include total cash costs, exploration, corporate

and administrative, share based compensation and sustaining capital

costs. “Mine-site all-in sustaining costs” include total cash

costs, exploration, and sustaining capital costs for the mine-site,

but exclude an allocation of corporate and administrative and share

based compensation. “Adjusted net earnings” and “adjusted earnings

per share” are non-GAAP financial measures with no standard meaning

under IFRS. “Adjusted net earnings” excludes the following from net

earnings: foreign exchange gain (loss), items included in other

loss, certain non-reoccurring items, and foreign exchange gain

(loss) recorded in deferred tax expense. “Adjusted earnings per

share” is calculated by dividing “adjusted net earnings” by the

weighted average number of shares outstanding for the period.

Additional GAAP measures that are presented on

the face of the Company’s consolidated statements of comprehensive

income and are not meant to be a substitute for other subtotals or

totals presented in accordance with IFRS, but rather should be

evaluated in conjunction with such IFRS measures. This includes

“Earnings from operations”, which is intended to provide an

indication of the Company’s operating performance and represents

the amount of earnings before net finance income/expense, foreign

exchange gain/loss, other income/loss, and income tax expense.

Non-GAAP and additional GAAP measures do not have a standardized

meaning prescribed under IFRS and therefore may not be comparable

to similar measures presented by other companies. A reconciliation

of historical non-GAAP and additional GAAP measures are detailed in

the Company’s latest Management’s Discussion and Analysis available

online on the SEDAR website at www.sedar.ca or on EDGAR at

www.sec.gov and at www.alamosgold.com.

| Table 1: PDA

Life of Mine Production

Schedule |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOM |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

|

Mining |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tonnes Mined (000 tonnes) |

5,375 |

|

|

434 |

723 |

719 |

721 |

730 |

730 |

730 |

588 |

- |

|

Mined Grade (g/t Au) |

5.61 |

|

|

6.94 |

7.54 |

7.47 |

6.35 |

4.74 |

4.38 |

3.85 |

3.85 |

- |

|

Processing |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tonnes Milled (000 tonnes)1 |

5,872 |

|

|

516 |

730 |

730 |

730 |

730 |

730 |

730 |

730 |

247 |

|

Milled Grade (g/t Au) |

5.29 |

|

|

6.10 |

7.48 |

7.38 |

6.29 |

4.74 |

4.38 |

3.85 |

3.46 |

1.85 |

|

Mill Recovery (% Au)2 |

85% |

|

|

85% |

85% |

85% |

85% |

85% |

85% |

85% |

85% |

85% |

|

Gold Production (000 oz) |

848 |

|

|

86 |

149 |

147 |

126 |

95 |

87 |

77 |

69 |

12 |

|

Payable Gold Production (000

oz)2 |

806 |

|

|

79 |

139 |

137 |

116 |

86 |

79 |

69 |

62 |

11 |

|

Operating Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mining (US$/tonne mined) |

$87 |

|

|

$66 |

$99 |

$97 |

$93 |

$85 |

$84 |

$84 |

$82 |

- |

|

Processing (US$/tonne milled) |

$20 |

|

|

$24 |

$19 |

$19 |

$19 |

$19 |

$19 |

$19 |

$19 |

$25 |

|

G&A (US$/tonne milled) |

$20 |

|

|

$20 |

$20 |

$20 |

$20 |

$20 |

$20 |

$20 |

$20 |

$20 |

|

Total Cash Costs (US$/oz)

3,4 |

$921 |

|

|

$747 |

$743 |

$743 |

$841 |

$1,056 |

$1,132 |

$1,284 |

$1,174 |

$1,058 |

|

Mine-Site All-in Sustaining Costs (US$/oz)

3,4 |

$1,003 |

|

|

$1,016 |

$758 |

$848 |

$974 |

$1,129 |

$1,189 |

$1,284 |

$1,174 |

$1,058 |

|

Capital Expenditures |

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial Capital (US$M) |

$165 |

$20 |

$93 |

$52 |

- |

- |

- |

- |

- |

- |

- |

- |

|

Sustaining Capital (US$M) |

$66 |

- |

- |

$22 |

$2 |

$15 |

$16 |

$7 |

$5 |

- |

- |

- |

|

Total Capital (US$M) |

$231 |

$20 |

$93 |

$74 |

$2 |

$15 |

$16 |

$7 |

$5 |

- |

- |

- |

1 Processed tonnes

exceed mined tonnes and Mineral Reserves reflecting the inclusion

of lower grade development ore2 Mill recoveries

are expected to average 85% of which 95% are

payable3 Please refer to Cautionary Notes on

non-GAAP Measures and Additional GAAP Measures4

Total cash costs and mine-site all-in sustaining costs are per

payable ounce and inclusive of silver credits, government

royalties, and concentrate treatment and transportation costs while

unit operating costs are reported exclusive of these costs

Figure 1: PDA Deposit and Mill

Location

Figure 2: PDA Long Section Including

Planned Underground Development

Figure 3: PDA Crushing and Flotation

Plant

Figure 4: PDA Project Layout

Figure 5: PDA and Cerro Pelon Location

Map, Mulatos District

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/18faa915-6092-42ba-b22c-78d283020fea

https://www.globenewswire.com/NewsRoom/AttachmentNg/8dfdb773-dad8-4fb8-9fd5-f5734af7db7f

https://www.globenewswire.com/NewsRoom/AttachmentNg/d6a81dd6-e621-48c9-80a7-1104a7d48152

https://www.globenewswire.com/NewsRoom/AttachmentNg/d3e2415b-81ac-41d4-9d4f-fcd7a9ba188c

https://www.globenewswire.com/NewsRoom/AttachmentNg/be9c547c-067b-4db5-ac8f-84d9b294e0ab

https://www.globenewswire.com/NewsRoom/AttachmentNg/92100ea6-66a8-48f4-afaf-93ffe91f257b

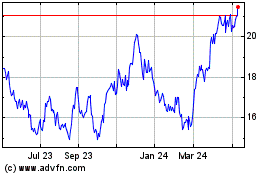

Alamos Gold (TSX:AGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

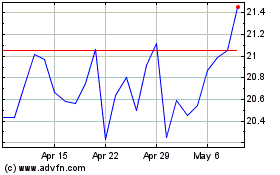

Alamos Gold (TSX:AGI)

Historical Stock Chart

From Dec 2023 to Dec 2024