HEALWELL AI INC. (“

HEALWELL” or the

“

Company”) (TSX: AIDX) is pleased to announce

today that it has closed its previously announced “bought deal”

private placement offering and issued 14,815,000 units of the

Company (the “

Units”) at a price of $1.35 per

Unit, for aggregate gross proceeds of $20,000,250 (the

“

Offering”).

Dr. Alexander Dobranowski, CEO of HEALWELL

commented, “In addition to strengthening the

Company’s balance sheet, the completion of the Offering positions

the Company well to carry out the remainder of its 2024 growth

initiatives. This milestone marks not just a financial achievement

but a significant step towards realizing our mission to improve

healthcare and save lives through the early identification and

detection of disease.”

Each Unit is comprised of one Class A

subordinate voting share of the Company (a

“Share”) and one-half of one Share purchase

warrant (each whole warrant, a “Warrant”) of the

Company. Each Warrant entitles the holder thereof to purchase one

additional Share at an exercise price of $1.80 for a period of two

(2) years following the closing of the Offering.

The Offering was conducted on a “bought deal”

basis by Clarus Securities Inc. and Eight Capital, as co-lead

underwriters, together with Beacon Securities Limited, Canaccord

Genuity Corp., Stifel Nicolaus Canada Inc., Ventum Financial Corp.,

Cormark Securities Inc., Raymond James Ltd. and Maxim Group LLC, as

underwriters (collectively, the

“Underwriters”).

In connection with the Offering, the

Underwriters received a cash commission equal to 6.0% of the gross

proceeds of the Offering (the “Cash Commission”)

and that number of non-transferable broker warrants (the

“Broker Warrants”) as is equal to 6.0% of the

aggregate number of Units sold under the Offering. Each Broker

Warrant is exercisable to acquire one Share at a price of $1.35 per

Share for a period two (2) years after the closing of the Offering.

Each of the Cash Commission paid and Brokers Warrants issued to the

Underwriters was reduced to 3% with respect to subscribers

identified on the Company’s president’s list, which president’s

list was in the amount of $13,600,035.

The Company intends to use the net proceeds of

the Offering for growth initiatives and general corporate and

working capital purposes. All securities issued pursuant to the

Offering are subject to a four-month and one day hold period from

the closing date of the Offering in accordance with applicable

securities legislation.

This news release does not constitute an

offer to sell or a solicitation of an offer to buy any securities

in the United States or any other jurisdiction in which such offer,

solicitation or sale would be unlawful. No securities may be

offered or sold to, or for the account or benefit of persons in the

United States or to any U.S. persons or in any other jurisdiction

in which such offer or sale would be unlawful absent registration

under the U.S. Securities Act, and any applicable state securities

laws or an exemption therefrom or qualification under the

securities laws of such other jurisdiction or an exemption

therefrom. “United States” and “U.S. persons” shall have the

meaning given to them in Regulation S under the U.S. Securities

Act.

About HEALWELL AI Inc.

HEALWELL is a healthcare technology company

focused on AI and data science for preventative care. Its mission

is to improve healthcare and save lives through early

identification and detection of disease. Using its own proprietary

technology, the Company is developing and commercializing advanced

clinical decision support systems that can help healthcare

providers detect rare and chronic diseases, improve efficiency of

their practice and ultimately help improve patient health outcomes.

HEALWELL is executing a strategy centered around developing and

acquiring technology and clinical sciences capabilities that

complement the Company's road map. HEALWELL is publicly traded on

the Toronto Stock Exchange under the symbol “AIDX” and on the OTC

Exchange under the symbol “HWAIF”. To learn more about HEALWELL,

please visit: https://healwell.ai/

Contact Information

Alexander DobranowskiChief Executive

Officer416-440-4040 x.201ir@healwell.ai

Cautionary Note Regarding Forward-Looking

Information

Certain statements in this press release

constitute “forward-looking information” and "forward-looking

statements" (collectively, "forward-looking statements") within the

meaning of applicable Canadian securities laws and are based on

assumptions, expectations, estimates and projections as of the date

of this press release. Forward-looking statements in this press

release include statements with respect to, among others, the

Company’s business strategy, plans and other expectations, beliefs,

goals, objectives, and information and statements about possible

future events, including the intended use of proceeds of the

Offering and final approval of the Toronto Stock Exchange and any

other regulatory approvals with respect to the Offering.

Forward-looking statements are often, but not always, identified by

words or phrases such as "expects", "is expected", "anticipates",

"believes", "plans", "projects", "estimates", "assumes", "intends",

"strategies", "targets", "goals", “mission”, "forecasts",

"objectives", "budgets", "schedules", "potential" or variations

thereof or stating that certain actions, events or results "may",

"could", "would", "might" or "will" be taken, occur or be achieved,

or the negative of any of these terms and similar

expressions. Forward-looking statements are necessarily based

upon management’s perceptions of historical trends, current

conditions and expected future developments, as well as a number of

specific factors and assumptions that, while considered reasonable

by the Company as of the date of such statements, are outside of

the Company’s control and are inherently subject to significant

business, economic and competitive uncertainties and contingencies

which could result in the forward-looking statements ultimately

being entirely or partially incorrect or untrue. Forward-looking

statements contained in this press release are based on various

assumptions and factors, including, but not limited to, the

following: the assumption that the Toronto Stock Exchange will

provide final approve the Offering and that the risk factors noted

below, collectively, do not have a material impact on the Company’s

business, operations, revenues and/or results. By their nature,

forward-looking statements are subject to inherent risks and

uncertainties that may be general or specific and which give rise

to the possibility that expectations, forecasts, predictions,

projections or conclusions will not prove to be accurate, that

assumptions may not be correct, and that objectives, strategic

goals and priorities will not be achieved.

Known and unknown risk factors, many of which

are beyond the control of the Company, could cause the actual

results of the Company to differ materially from the results,

performance, achievements or developments expressed or implied by

such forward-looking statements. Such risk factors include but are

not limited to those factors which are discussed under the section

entitled “Risk Factors” in the Company’s most recent annual

information form which is available under the Company’s SEDAR+

profile at www.sedarplus.com. The risk factors are not intended to

represent a complete list of the factors that could affect the

Company and the reader is cautioned to consider these and other

factors, uncertainties and potential events carefully and not to

put undue reliance on forward-looking statements. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements.

Forward-looking statements are provided for the purpose of

providing information about management’s expectations and plans

relating to the future. The Company disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

or to explain any material difference between subsequent actual

events and such forward-looking statements, except to the extent

required by applicable law. All of the forward-looking statements

contained in this press release are qualified by these cautionary

statements.

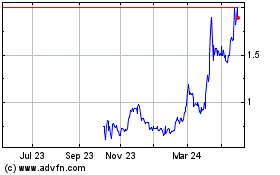

HealWell AI (TSX:AIDX)

Historical Stock Chart

From Dec 2024 to Jan 2025

HealWell AI (TSX:AIDX)

Historical Stock Chart

From Jan 2024 to Jan 2025