Altus Group Limited (“Altus” or the “Company”) (TSX: AIF), a

leading provider of asset and fund intelligence for commercial real

estate, announced today that the Toronto Stock Exchange (“TSX”) has

approved its notice of intention to renew its normal course issuer

bid (“NCIB”) for its common shares as appropriate opportunities

arise from time to time. Altus’ NCIB will be made in accordance

with the policies of the TSX. Altus may purchase its common shares

during the period from February 8, 2023 to February 7, 2024.

Under the NCIB and subject to the market price

of its common shares and other considerations, over the next 12

months Altus may purchase for cancellation up to 1,364,718 common

shares, representing approximately 3% of its issued and outstanding

common shares as of January 31, 2023. There were 45,490,587 common

shares outstanding as of January 31, 2023. The average daily

trading volume through the facilities of the TSX during the 26-week

period ending January 31, 2023 was 71,734 common shares. Daily

purchases will be limited to 17,933 common shares, representing 25%

of the average daily trading volume, other than block purchase

exemptions. Purchases may be made on the open market through the

facilities of the TSX and/or alternative Canadian trading systems

at the market price at the time of acquisition, as well as by other

means as may be permitted by TSX rules and applicable securities

laws. Any tendered shares taken up and paid for by Altus will be

cancelled. The Company plans to fund the NCIB purchases from its

existing cash balance.

Under its previous NCIB which commenced on

February 8, 2022 and expires on February 7, 2023, Altus obtained

approval from the TSX to purchase up to 1,345,142 common shares. As

of January 31, 2023, Altus had purchased an aggregate of 155,400

common shares for cancellation under an NCIB in the past 12 months

at a weighted average price of approximately $48.54 per common

share. All repurchases under an NCIB within the past 12 months were

conducted through the facilities of the TSX and/or alternative

Canadian trading systems.

The Company intends to enter into an automatic

share purchase plan with a designated broker in relation to the

NCIB following the end of its current blackout period that would

allow for the purchase of its common shares, subject to certain

trading parameters, at times when Altus ordinarily would not be

active in the market due to its own internal trading black-out

period, insider trading rules or otherwise. Any such plan entered

into with a broker will be adopted in accordance with applicable

Canadian securities law. Outside of these periods, common shares

will be repurchased in accordance with management’s discretion and

in compliance with applicable law.

The Company is renewing the NCIB because it

believes that it provides flexibility around its capital allocation

investments, particularly during periods when its common shares may

trade in a price range that does not adequately reflect their

underlying value based on the Company’s business and strong

financial position. As a result, to maximize shareholder value,

Altus believes that an investment in its outstanding common shares

may represent an attractive use of available funds while continuing

to balance other growth investments, including investing in

operations and in potential M&A. Decisions regarding the amount

and timing of future purchases of common shares will be based on

market conditions, share price and other factors and will be at

management’s discretion. The Company's Board of Directors will

regularly review the NCIB in connection with a balanced capital

allocation strategy focused primarily on funding growth.

About Altus Group

Altus Group is a leading provider of asset and

fund intelligence for commercial real estate. We deliver

intelligence as a service to our global client base through a

connected platform of industry-leading technology, advanced

analytics, and advisory services. Trusted by the largest CRE

leaders, our capabilities help commercial real estate investors,

developers, proprietors, lenders, and advisors manage risks and

improve performance returns throughout the asset and fund

lifecycle. Altus Group is a global company headquartered in Toronto

with approximately 2,700 employees across North America, EMEA and

Asia Pacific. For more information about Altus (TSX: AIF) please

visit altusgroup.com.

Forward-Looking Information

Certain information in this press release may

constitute “forward-looking information” within the meaning of

applicable securities legislation, including statements related to

the NCIB and intention to enter into an automatic share purchase

plan. All information contained in this press release, other than

statements of current and historical fact, is forward-looking

information. Generally, forward-looking information can be

identified by use of words such as “believe, “expect”,

“anticipate”, “estimate”, “intend”, “may”, “will”, “would”,

“could”, “should”, “continue”, “plan”, “goal”, “objective”,

“remain” and other similar expressions and the negative of such

expressions, although not all forward-looking information contain

these identifying words. All of the forward-looking information in

this press release is qualified by this cautionary statement.

Forward-looking information is not, and cannot

be, a guarantee of future results or events. Forward-looking

information is based on, among other things, opinions, assumptions,

estimates and analyses that, while considered reasonable by us at

the date the forward-looking information is provided, inherently

are subject to significant risks, uncertainties, contingencies and

other factors that may cause actual results, performance or

achievements, industry results or events to be materially different

from those expressed or implied by the forward-looking information.

Those risks, uncertainties and other factors that could cause

actual results to differ materially from the forward-looking

information include those described in our annual publicly filed

documents, including the Annual Information Form for the year ended

December 31, 2021 (which are available on SEDAR at www.sedar.com).

We believe that the expectations reflected in forward-looking

information are based upon reasonable assumptions; however, we can

give no assurance that actual results will be consistent with the

forward-looking information. Not all factors which affect the

forward-looking information are known, and actual results may vary

from the projected results in a material respect, and may be above

or below the forward-looking information presented in a material

respect.

Given these risks, uncertainties and other

factors, investors should not place undue reliance on

forward-looking information as a prediction of actual results. The

forward-looking information contained herein is current as of the

date of this press release and, except as required under applicable

law, we do not undertake to update or revise it to reflect new

events or circumstances.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Camilla Bartosiewicz Chief Communications

Officer, Altus Group (416) 641-9773

camilla.bartosiewicz@altusgroup.com

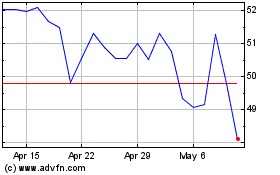

Altus (TSX:AIF)

Historical Stock Chart

From Jan 2025 to Feb 2025

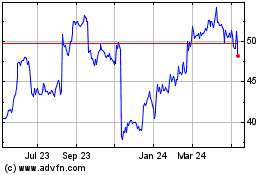

Altus (TSX:AIF)

Historical Stock Chart

From Feb 2024 to Feb 2025