Arizona Sonoran Copper Company Inc. (TSX:ASCU |

OTCQX:ASCUF) (“ASCU” or the “Company”), an emerging U.S. copper

developer, is pleased to highlight the significant progress made at

the Cactus Project in 2024, and outline its fully-funded strategic

goals for 2025. ASCU is committed to advancing its brownfield

Cactus Project through technical studies, building upon the

positive updated 2024 Preliminary Economic Assessment (“2024 PEA”)

issued this past August. The 2024 PEA highlighted a compelling

31-year open pit, heap leach and solvent extraction and

electrowinning (“SXEW”) operation in Arizona. Upcoming studies,

including the Pre-Feasibility Study (“2025 PFS”) already in

progress and the planned follow-on Definitive Feasibility Study

(“DFS”), will focus on optimizing asset-level operations to enhance

value while driving key project-level milestones.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250204240882/en/

FIGURE 1: Cactus Project Mineral Resource

Growth (Graphic: Business Wire)

Key 2024 and 2025 YTD Achievements

1. No lost time incidents

2. Financial strength and support by

sponsors, having raised c. $59.2 million CAD financing in

October and November 2024, and January 2025

- C$34.5M (October) bought deal financing (see PR dated OCT 9,

2024)

- C$3.1M (November) private placement (see PR dated NOV 13,

2024)

- C$21.6M (January) private placement (see PR dated JAN 31,

2025)

3. Successful updated Preliminary Economic

Assessment at Cactus (2024 PEA), with an average cathode

production of 116k short tons per annum over the first 20 years of

a 31-year mine life (see PR dated AUG 7, 2024 | 2024 PEA

Technical Report)

- After-tax project economics at US$3.90/lb Copper:

- Net Present Value (8%) of US$2.03 billion

- IRR of 24%

- Initial Capex of US$668M over a two-year construction

period

- Free Cash Flow (unlevered) of US$7.3 billion

- US$1.88/lb C1 cash cost and US$2.00/lb all in sustaining

cost

- As highlighted by the 2024 PEA, Cactus Project is well

positioned to add value in a variety of copper price

environments

Revenue, NPV and IRR

Sensitivity Based on Copper Price

Metal

Price

Copper

Price

Revenue

(US$000)

NPV, before tax @

8% (US$000)

NPV, after tax @

8% (US$000)

IRR

after Tax

Base

Case

$3.90

$20,820,863

$2,769,280

$2,031,671

24%

20%

$4.68

$24,985,035

$4,237,162

$3,196,838

32%

10%

$4.29

$22,902,949

$3,503,221

$2,612,817

28%

-10%

$3.51

$18,738,777

$2,035,338

$1,450,505

20%

-20%

$3.12

$16,656,690

$1,301,397

$861,488

16%

4. Exploration program excellence –

Completed the Company’s largest drilling program to date, for

174,370 ft (53,148 m) of drilling. Drilling included the definition

of the southern extension of the Parks/Salyer deposit by 2,953 ft

(900 m) south of the mineral resource shell in the 2024 PEA, and

within 138 ft (42 m) of surface, onto the newly acquired MainSpring

property.

- Significant increase in Cactus Project Mineral Resource

Estimate (“2024 MRE”) (see PR dated JUL 16, 2024)*:

- Total M&I: 7.3 billion pounds at a grade of 0.58% Total

Copper (633 million tons)

- Total Inf: 3.8 billion pounds of copper at a grade of 0.41%

Total Copper (474 million tons)

- The contiguous MainSpring property was critical to rescoping of

the Parks/Salyer deposit to an open pit mining scenario within the

2024 PEA. Rescoping to an open pit positively affected the

technical execution, costs and economics of the Cactus Project

contemplate by the 2024 PEA.

*See applicable Cautionary Statements and ensuing Technical

Notes at the end of this press release.

5. Leading ESG and Permitting program

demonstrating community and regulatory support for restarting the

Cactus Project

- Community polling based on the 2024 PEA indicates 87% support

to restart operations at the Cactus Mine, representing a 4%

increase in support from the 2021 polling results

- Received the Industrial Air Permit from Pinal County, with

respect to the prior pre-feasibility study completed in early 2024

(the “2024 PFS”), now superseded by the 2024 PEA

- An assessment of the 2024 PFS, presented an economic impact of

$15 billion to Casa Grande and the state of Arizona over the life

of mine projected in that prior study

Fully-Funded 2025 Work Plan Highlights

1. Drilling Programs – A minimum of

130,000 ft (39,624 m) infill to indicated drilling at Parks/Salyer

and Cactus West required for 2025 PFS.

2. Advancing Technical Studies:

- Continuing with technical study work initiated in 2024 that

will contribute to the 2025 PFS

- Continuing with site maintenance and support of drilling

activities

- Trade-off studies and metallurgical testing (see PR dated

DEC 10, 2024), hydrological and geotechnical work

- Technical study timeline

- Updated MRE expected early 2H-2025

- 2025 PFS expected in 2H-2025

- Initiate the planned Definitive Feasibility Study

3. Permitting and Land – Following on

from the 2025 PFS, amendments to the Aquifer Protection Permit,

Industrial Air Permit and Mined Land Reclamation Permit are

expected to begin in the second half of 2025

- Final payment of US$6 million to finalize the MainSpring

acquisition was made on January 31

4. Project Financing – Identify and

initiate engagement with potential financial partners with respect

to project financing options

5. Definitive Feasibility Study –

Requirements for the DFS to advance to be identified in the 2025

PFS, including applicable drilling, geotechnical, metallurgical and

engineering work.

George Ogilvie, ASCU President and CEO commented, “We

promised and delivered a transformational year in 2024. Our 2024

work programs reflected tremendous growth for the Company; the

biggest deliverable resulting from the MainSpring acquisition,

where we acquired title, drilled it to inferred mineral resource

categorization as the up-dip extension of Parks/Salyer, and

rescoped the Parks/Salyer deposit to an open pit reducing technical

and execution risks in the 2024 PEA. The 2024 PEA step changes

improved project economics while maintaining a low initial and life

of mine capital intensity. In short, we simplified our American

Copper Cathode project, by pulling together a significant open pit

operation on private land in Arizona, which uses conventional heap

leaching of oxide and enriched material

Socially, our community is largely supportive of our Project

continuing to advance towards production with 87% support, and our

permitting strategy continues to deliver amendments, based on the

growing Cactus Project. Looking to 2025, we are well funded through

corporate and institutional support, to build on the 2024 PEA while

optimizing the Company at the asset level. The key focus will be

trade‑off studies as part of the 2025 PFS targeted to be delivered

in the second half of this year. The permit amending process will

be defined by the 2025 PFS, with the intension to have all major

permits in hand by the completion of the DFS. Our team will

initiate request for proposal processes with respect to completing

a DFS, after the 2025 PFS is issued.”

Drilling

The exploration team’s 2025 plan is to upgrade the inferred

mineral resource as defined by the 2024 PEA, to the indicated

category for the standalone 2025 PFS. To do so, a total of 66 holes

over ~90,000 ft (27,756 m) at the Parks/Salyer deposit are required

and a minimum of 20,000 ft (6,200 m) at each of Cactus West and

Cactus East for a minimum of 130,000 ft (40,000 m) of drilling. All

drilling is expected to be completed within the summer of 2025. In

support of the program, three of four drills have been active at

Parks/Salyer with a total of 20 holes for 34,658 ft (10,564 m) now

complete. Additionally, many of these holes are also being used to

help the geotechnical and hydrogeological studies associated with

the upcoming PFS. The fourth drill rig is currently stationed at

Cactus, having completed one hole at Cactus East for 2,040 ft (622

m) and one hole at Cactus West for 1,123 ft (342 m) from the 2025

plan. DFS drilling will be informed by potential recommendations in

the 2025 PFS.

Advancing Technical Studies

The project team will be focused on all activities related to

the completion of the 2025 PFS in 2H-2025. Activities to complete

include geotechnical and hydrology studies, mineral resource

modeling, and mine operation optimization studies that evaluate new

technology focused on lowering cost per ton mined and environmental

considerations. Any additional studies required for a DFS will be

informed by the 2025 PFS.

Metallurgy

Metallurgical testing programs for the 2025 PFS are underway, as

per 2024 PEA recommendations. The metallurgical testing will cover

material mostly from the Parks/Salyer deposit, with two columns

from Cactus West. All metallurgical tests will be completed by

commercial metallurgical laboratories, as was the case for 2024.

For additional details on the 2025 metallurgical plans, see the

ASCU press release dated December 10, 2024. Any additional

metallurgical work required for a DFS will be informed by the 2025

PFS.

Permitting

All major permitting based on the Cactus 2021 PEA is complete,

including the Aquifer Protection Permit, Industrial Air Permit and

Mined Land Reclamation Permit. Water rights and access to water are

secured and the Company reapplies annually for the SWPPP and dust

permits. Based on the 2024 PFS, the Industrial Air permit was

amended in Q4 2024, and the Aquifer Protection amendment is under

review. In the second half of 2025, amendments to the Aquifer

Protection Permit, Industrial Air Permit and Mined Land Reclamation

Permit will begin based on the pending 2025 PFS. Amendments from

the 2025 PFS to DFS may be required, any potential amendments will

be informed by advancing through to DFS.

Links to documents referenced in this Press Release:

January 9, 2025 PR:

https://arizonasonoran.com/news-releases/arizona-sonoran-announces-c-19.9-million-strategic-private-placement-with-hudbay/

December 10, 2024 PR:

https://arizonasonoran.com/news-releases/arizona-sonoran-achieves-average-of-87-extraction-rates-of-soluble-copper-in-the-enriched-material/

November 13, 2024 PR:

https://arizonasonoran.com/news-releases/arizona-sonoran-closes-c-3.1-million-private-placement-with-nuton-llc-a-rio-tinto-venture/

October 9, 2024 PR:

https://arizonasonoran.com/news-releases/arizona-sonoran-announces-closing-of-c-34.5-million-upsized-bought-deal-offering/

August 7, 2024 PR:

https://arizonasonoran.com/news-releases/arizona-sonoran-standalone-pea-for-cactus-open-pit-project-reports-post-tax-npv8-of-us-2.03-billion-c-2.77-billion-and-irr-of/

July 16, 2025 PR:

https://arizonasonoran.com/news-releases/arizona-sonoran-updates-cactus-project-mineral-resource-estimate-to-7.3-b-lbs-of-copper-in-m-i-and-3.8-b-lbs-of-copper-in/

2024 PEA Technical Report:

https://arizonasonoran.com/projects/technical-reports/

Neither the TSX nor the regulating authority has approved or

disproved the information contained in this press release.

About Arizona Sonoran Copper Company (www.arizonasonoran.com |

www.cactusmine.com)

ASCU is a copper exploration and development company with a 100%

interest in the brownfield Cactus Project. The Project, on

privately held land, contains a large-scale porphyry copper

resource and a recent 2024 PEA proposes a generational open pit

copper mine with robust economic returns. Cactus is a lower risk

copper developer benefitting from a State-led permitting process,

in place infrastructure, highways and rail lines at its doorstep

and onsite permitted water access. The Company’s objective is to

develop Cactus and become a mid-tier copper producer with low

operating costs, that could generate robust returns and provide a

long-term sustainable and responsible operation for the community,

investors and all stakeholders. The Company is led by an executive

management team and Board which have a long-standing track record

of successful project delivery in North America complemented by

global capital markets expertise.

Cautionary Statements regarding Forward-Looking Statements

and Other Matters

Forward-Looking Statements

All statements, other than statements of historical fact,

contained or incorporated by reference in this press release

constitute “forward-looking statements” and “forward-looking

information” (collectively, “forward-looking statements”) within

the meaning of applicable Canadian and United States securities

legislation. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as

“advancing”, “assumptions”, “become”, “building”, “contemplated”,

“continue”, “could”, “deliver”, “developer”, “driving”, “emerging”,

“enhance”, “estimate”, “exploration”, “eventual”, “expected”,

“feasibility”, “focus”, “following”, “forward”, “future”,

“generational”, “goals”, “growth”, “intention”, “initiate”,

“leading”, “long-term”, “looking”, “modeling”, “objective”,

“optimizing”, “options”, “pending”, “plan”, “potential”, “program”,

“progress”, “proposes”, “risk”, “schedule”, “strategic”, “study”,

“subject to”, “targeted”, “timeline”, “to be”, “upcoming”,

“upgrade”, and “will”, or variations of such words, and similar

such words, expressions or statements that certain actions, events

or results can, could, may, should, would, will (or not) be

achieved, occur, provide, result or support in the future, or

which, by their nature, refer to future events. In some cases,

forward-looking information may be stated in the present tense,

such as in respect of current matters that may be continuing, or

that may have a future impact or effect. Forward-looking statements

include those relating to the 2025 work plan and details and

results thereof (including drilling programs, technical studies

(including trade-off studies, metallurgical studies, 2025 PFS and

DFS, related milestones and other details, and the requirements,

focus, related work, and the timing, any optimizations, value and

other results of any such studies), permitting (including

amendments and other requirements, and timing thereof), 2025

strategic goals (including building off the 2024 PEA and advancing

the 2025 PFS, any eventual DFS including any requests for proposal

related thereto, and any and all other technical studies, project

financing including engagement of potential financiers, and

timeline thereof and results thereof) and other advancement of the

Cactus Project (including any other work in 2025 and other

operations); the 2024 PEA, the 2025 PFS and any DFS and results

thereof (including mine life, production, mineral resource

estimates, and NPV, IRR, capex, cash flow, cash costs, impact on

Casa Grande and State of Arizona, and other economics); the amount

of funding and timeline required to complete the 2025 work plan and

2025 strategic goals; mineral resource estimates (including any

upgrade of inferred or other mineral resource estimates, related

drill program and timing and results thereof); any upside in value

and/or delivered back to shareholders, sustainability and risk; the

Company’s objectives (including the Cactus Project becoming a

significant producer of copper cathodes in Arizona and the U.S.);

and the future plans or prospects of the Company (including

sustainability of the Cactus Project and becoming a mid-tier copper

producer). Although the Company believes that such statements are

reasonable, there can be no assurance that those forward-looking

statements will prove to be correct, and any forward-looking

statements by the Company are not guarantees of future actions,

results or performance. Forward-looking statements are based on

assumptions, estimates, expectations and opinions, which are

considered reasonable and represent best judgment based on

available facts, as of the date such statements are made. If such

assumptions, estimates, expectations and opinions prove to be

incorrect, actual and future results may be materially different

than expressed or implied in the forward-looking statements. The

assumptions, estimates, expectations and opinions referenced,

contained or incorporated by reference in this press release which

may prove to be incorrect include those set forth or referenced in

this press release, as well as those stated in the technical report

for the Cactus Project filed on August 27, 2024 (the “2024 PEA

Technical Report”), the Company’s Annual Information Form dated

April 1, 2024 (the “AIF”), Management’s Discussion and Analysis

(together with the accompanying financial statements) for the year

ended December 31, 2023 and the quarters already ended in 2024

(collectively, the “2023-24 Financial Disclosure”) and the

Company’s other applicable public disclosure (collectively,

“Company Disclosure”), all available on the Company’s website at

www.arizonasonoran.com and under its issuer profile at

www.sedarplus.ca. Forward-looking statements are inherently subject

to known and unknown risks, uncertainties, contingencies and other

factors which may cause the actual results, performance or

achievements of ASCU to be materially different from any future

results, performance or achievements expressed or implied by the

forward-looking statements. Such risks, uncertainties,

contingencies and other factors include, among others, the “Risk

Factors” in the AIF, and the risks, uncertainties, contingencies

and other factors identified in the 2024 PEA Technical Report and

the 2023-24 Financial Disclosure. The foregoing list of risks,

uncertainties, contingencies and other factors is not exhaustive;

readers should consult the more complete discussion of the

Company’s business, financial condition and prospects that is

provided in the AIF, the 2023-24 Financial Disclosure and other

Company Disclosure. Although ASCU has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended. Forward-looking statements contained herein

are made as of the date of this press release (or as otherwise

expressly specified) and ASCU disclaims any intention or obligation

to update or revise any forward-looking statements, whether as a

result of new information, future events or results or otherwise,

except as required by applicable securities laws. There can be no

assurance that such information will prove to be accurate, as

actual results and future events could differ materially from

forward-looking statements. Accordingly, readers should not place

undue reliance on forward-looking statements. The forward-looking

statements referenced or contained in this press release are

expressly qualified by these Cautionary Statements as well as the

Cautionary Statements in the AIF, the 2024 PEA Technical Report,

the 2023-24 Financial Disclosure and other Company Disclosure.

Preliminary Economic Assessments

The Preliminary Economic Assessment (or PEA) referenced in this

press release and summarized in the 2024 PEA Technical Report is

only a conceptual study of the potential viability of the Cactus

Project and the economic and technical viability of the Cactus

Project has not been demonstrated. The PEA is preliminary in nature

and provides only an initial, high-level review of the Cactus

Project’s potential and design options; there is no certainty that

the PEA will be realized. For further detail on the Cactus Project

and the PEA, including applicable technical notes and cautionary

statements, please refer to the Company’s press release dated

August 7, 2024 and the 2024 PEA Technical Report, both available on

the Company’s website at www.arizonasonoran.com and under its

issuer profile at www.sedarplus.ca.

Mineral Resource Estimates

Until mineral deposits are actually mined and processed, copper

and other mineral resources must be considered as estimates only.

Mineral resource estimates that are not classified as mineral

reserves do not have demonstrated economic viability. The

estimation of mineral resources is inherently uncertain, involves

subjective judgement about many relevant factors and may be

materially affected by, among other things, environmental,

permitting, legal, title, taxation, socio-political, marketing, or

other known and unknown risks, uncertainties, contingencies and

other factors described in the foregoing Cautionary Statements on

Forward-Looking Statements. The quantity and grade of reported

“inferred” mineral resource estimates are uncertain in nature and

there has been insufficient exploration to define “inferred”

mineral resource estimates as an “indicated” or “measured” mineral

resource and it is uncertain if further exploration will result in

upgrading “inferred” mineral resource estimates to an “indicated”

or “measured” mineral resource category. Inferred mineral resource

estimates may not form the basis of feasibility or pre-feasibility

studies or economic studies except for preliminary economic

assessments. The accuracy of any mineral resource estimate is a

function of the quantity and quality of available data, and of the

assumptions made and judgments used in engineering and geological

interpretation, which may prove to be unreliable and depend, to a

certain extent, upon the analysis of drilling results and

statistical inferences that may ultimately prove to be inaccurate.

It cannot be assumed that all or any part of a “inferred”,

“indicated” or “measured” mineral resource estimate will ever be

upgraded to a higher category including a mineral reserve. The

mineral resource estimates declared by the Company were estimated,

categorized and reported using standards and definitions in

accordance with the Canadian Institute of Mining, Metallurgy and

Petroleum Definition Standards for Mineral Resources and Mineral

Reserves (the “CIM Standards”) in accordance with National

Instrument 43-101 of the Canadian Securities Administrators (“NI

43-101”), which governs the public disclosure of scientific and

technical information concerning mineral projects.

U.S. Readers

The terms “mineral resource”, “measured mineral resource”,

“indicated mineral resource” and “inferred mineral resource” as

disclosed by the Company are Canadian mining terms defined in the

CIM Standards (collectively, the “CIM Definitions”) in accordance

with NI 43-101. NI 43-101 establishes standards for all public

disclosure that a Canadian issuer makes of scientific and technical

information concerning mineral projects. These Canadian standards

differ from the requirements of the United States Securities and

Exchange Commission (the “SEC”) applicable to United States

domestic and certain foreign reporting companies under Subpart 1300

of Regulation S-K (“S-K 1300”). Accordingly, information describing

mineral resource estimates for the Cactus Project may not be

comparable to similar information publicly reported in accordance

with the applicable requirements of the SEC, and so there can be no

assurance that any mineral resource estimate for the Cactus Project

would be the same had the estimates been prepared per the SEC’s

reporting and disclosure requirements under applicable United

States federal securities laws, and the rules and regulations

thereunder, including but not limited to S-K 1300. Further, there

is no assurance that any mineral resource or mineral reserve

estimate that the Company may report under NI 43-101 would be the

same had the Company prepared such estimates under S-K 1300.

Technical Notes regarding Mineral Resource Estimates

1. Total soluble copper grades (Cu TSol) are reported using

sequential assaying to calculate the soluble copper grade. Tons are

reported as short tons.

2. Stockpile resource estimates have an effective date of 1st

March, 2022, Cactus mineral resource estimates have an effective

date of 29th April, 2022, Parks/Salyer-MainSpring mineral resource

estimates have an effective date of 11th July, 2024. All mineral

resources use a copper price of US$3.75/lb.

3. Technical and economic parameters defining mineral resource

pit shells: mining cost US$2.43/t; G&A US$0.55/t, 10% dilution,

and 44°-46° pit slope angle.

4. Technical and economic parameters defining underground

mineral resource: mining cost US$27.62/t, G&A US$0.55/t, and 5%

dilution. Underground mineral resources are only reported for

material located outside of the open pit mineral resource shells.

Designation as open pit or underground mineral resources are not

confirmatory of the mining method that may be employed at the mine

design stage.

5. Technical and economic parameters defining processing: Oxide

heap leach (“HL”) processing cost of US$2.24/t assuming 86.3%

recoveries, enriched HL processing cost of US$2.13/t assuming 90.5%

recoveries, sulphide mill processing cost of US$8.50/t assuming 92%

recoveries. HL selling cost of US$0.27/lb; Mill selling cost of

US$0.62/lb.

6. Royalties of 3.18% and 2.5% apply to the ASCU properties and

state land respectively. No royalties apply to the MainSpring

property.

7. Variable cut-off grades were reported depending on material

type, potential mining method, potential processing method, and

applicable royalties. For ASCU properties - Oxide open pit or

underground material = 0.099% or 0.549% TSol respectively; enriched

open pit or underground material = 0.092% or 0.522% TSol

respectively; primary open pit or underground material = 0.226% or

0.691% CuT respectively. For state land property – Oxide open pit

or underground material = 0.098 % or 0.545% TSol respectively;

enriched open pit or underground material = 0.092% or 0.518% TSol

respectively; primary openpit or underground material = 0.225% or

0.686% CuT respectively. For MainSpring properties – Oxide openpit

or underground material = 0.096% or 0.532% TSol respectively;

enriched open pit or underground material = 0.089% or 0.505% TSol

respectively; primary open pit or underground material = 0.219% or

0.669% CuT respectively. Stockpile cutoff = 0.095% TSol.

8. Mineral resources, which are not mineral reserves, do not

have demonstrated economic viability. The estimate of mineral

resources may be materially affected by environmental, permitting,

legal, title, sociopolitical, marketing, or other relevant

factors.

9. The quantity and grade of reported inferred mineral resources

in this estimation are uncertain in nature and there is

insufficient exploration to define these inferred mineral resources

as an indicated or measured mineral resource; it is uncertain if

further exploration will result in upgrading them to an indicated

or measured classification.

10. Totals may not add up due to rounding

For more detailed information on the Cactus Project's current

mineral resource estimates, please refer to the 2024 PEA Technical

Report, available on the Company’s website at

www.arizonasonoran.com and under its issuer profile at

www.sedarplus.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204240882/en/

Alison Dwoskin, Director, Investor Relations 647-233-4348

adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director 416-723-0458

gogilvie@arizonasonoran.com

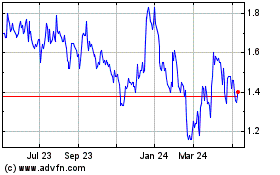

Arizona Sonoran Copper (TSX:ASCU)

Historical Stock Chart

From Jan 2025 to Feb 2025

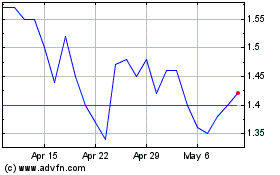

Arizona Sonoran Copper (TSX:ASCU)

Historical Stock Chart

From Feb 2024 to Feb 2025