Arizona Sonoran Copper Company Inc. (TSX:ASCU |

OTCQX:ASCUF) (“ASCU” or the “Company”) is pleased to announce

that initial Parks/Salyer infill drilling results are confirming

the continuity of mineralization at tighter drill spacings, and

additionally, have extended the high grade core at the Parks/Salyer

copper deposit, onto the MainSpring property at the Cactus Project,

in Arizona (see FIGURES 1-10). Results from the program are

in line with expectations, with a few positive outliers notably

from ECM-289, ECM-299 and ECM-244. Three drill rigs are focused on

mineral resource infill drilling, while a fourth rig is focused on

both mineral resource infill drilling at Cactus West and providing

downhole data for the geotechnical and hydrological programs

necessary for the planned Pre-Feasibility Study (“2025 PFS”)

expected in the second half of 2025.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250225820514/en/

Additionally, Doug Bowden will be stepping down as Vice

President Exploration, effective April 1, 2025. Christopher White

will be stepping into his place as Manager, Geology to lead the

infill drilling programs at Cactus, as ASCU moves through technical

studies. Chris joined in 2023 as Chief Mine Geologist and has

worked closely alongside Doug since then, overseeing the geology

and exploration programs.

Drilling Highlights:

- ECM-299: 1,283* ft (391 m) @ 0.74% CuT of continuous

mineralization

- 795* ft (242 m) @ 0.98% CuT, 0.75% Cu TSol, 0.041% Mo

(enriched)

- Incl. 50 ft (15 m) @ 1.91% CuT, 1.87% Cu TSol, 0.009% Mo

(enriched)

- 488 ft (149 m) @ 0.48% CuT, 0.009% Mo (primary)

- ECM-289: 1,527 ft (465 m) @ 0.74% CuT of continuous

mineralization

- 669 ft (204 m) @ 1.01% CuT, 0.79% Cu TSol, 0.017% Mo

(enriched)

- Incl. 122 ft (37 m) @ 1.72% CuT, 1.64% Cu TSol, 0.034% Mo

(enriched)

- 505 ft (154 m) @ 0.55% CuT, 0.008% Mo (primary)

- ECM-287: 1,574 ft (480 m) @ 0.47% CuT of near continuous

mineralization

- 117 ft (36 m) @ 1.04% CuT, 1.03% Cu TSol, 0.011% Mo

(enriched)

- 146 ft (45 m) @ 1.20% CuT, 0.96% Cu TSol, 0.034% Mo

(enriched)

- 637 ft (194 m) @ 0.43% CuT, 0.018% Mo (primary)

- ECM-244: 688 ft (210 m) @ 0.50% CuT of continuous

mineralization

- 437 ft (133 m) @ 0.59% CuT, 0.57% Cu TSol, 0.001% Mo

(enriched)

- ECM-285: 940 ft (287 m) @ 0.36% CuT of continuous

mineralization

- 428 ft (131 m) @ 0.41% CuT, 0.36% Cu TSol, 0.008% Mo

(enriched)

- 512 ft (156 m) @ 0.33% CuT, 0.006% Mo (primary)

- ECM-302: 1,295* ft (395 m) @ 0.41% CuT of near continuous

mineralization

- 627 ft (191 m) @ 0.45% CuT, 0.36% Cu TSol, 0.006% Mo

(enriched)

- 669* ft (204 m) @ 0.38% CuT, 0.008% Mo (primary)

NOTE: True widths are not known, *includes 1.9ft core loss in

ECM-299 and 3.7ft core loss in ECM-302

George Ogilvie, Arizona Sonoran President and CEO

commented, “The integration of the MainSpring property into the

Parks/Salyer deposit is moving along extremely well through both

engineering and geology. Since 2021, and under the guidance of our

geology team, conversion rates from inferred to the indicated and

measured classifications at the Cactus project have been quite high

and we anticipate another strong conversion in the planned 2025

updated mineral resource estimate. Additionally, I am impressed

with the growing high-grade core at Parks/Salyer. The geology team

continues to define strong grade thicknesses trending to the

southwest, while our engineering team is exploring the potential to

move the pit centroid further north in the 2025 PFS. The impact of

pit centroid and the high-grade core moving closer together could

translate to higher-grade material accessed earlier in the mine

life with a positive effect to the economics.”

He continued, “On behalf of the Company, I would like to

thank Doug Bowden for his stewardship of the asset from acquisition

of a site with limited historic mineral resources, into a

significant copper porphyry project within the USA. Doug has done a

magnificent job in growing the mineral resource to a size and scale

that manifests itself in strong project economics that would not

have been possible without his leadership. We wish him well in his

next life adventure, and as he likes to say, “There is no thrill

like the thrill of discovery” (CB Glascock). We look forward to

Chris taking on more responsibility within the team. He has been a

large part of the journey, and his valuable large-scale mine

geology experience will be critical to advancing Cactus to an

eventual construction decision anticipated next year.”

Drilling and Geology Recap

The planned 2025 infill-to-indicated drill program at

Parks/Salyer is comprised of a minimum of 90,000 ft (27,400 m),

within a broader 130,000 ft (39,600 m) drilling program at the

Cactus Project (see PR dated FEB 4, 2025). All drilling is

expected to be completed by the end of May 2025, and is now ~50%

drilled, with assays pending. Three drills are focused on

Parks/Salyer targeting the conversion of inferred mineral resources

identified in the 2024 Preliminary Economic Assessment (“2024

PEA”), to the measured and indicated classification. An updated

Mineral Resource Estimate is expected ahead of the 2025 PFS, in H2

2025.

Three drill rigs resumed drilling in late 2024. The fourth drill

rig is concurrently working at Cactus West in support of the 2025

PFS. Numerous mineral resource holes coincide with Geotechnical and

Hydrological hole requirements allowing a number of the holes to

serve multiple purposes.

Infill drilling at the Parks/Salyer deposit, and south, along

the former Parks/Salyer / MainSpring land border (see link to

FIGURES 1-10) continues to refine and expand the high-grade

enriched mineralized trend seen in the north of the deposit as it

continues to the southwest. This drilling is expected to define a

larger high-grade zone in the north in addition to local

higher-grade zones within the shallow, lower grade mineralization

previously encountered by drilling in the south of Parks/Salyer.

Assay results have been consistent with expectations from the

inferred resource estimate, with several holes performing better

than predicted in the 2024 PEA model, most notably ECM-299, ECM-244

and ECM-289 as highlighted above.

TABLE 1: Significant Drilling Intercepts

Hole ID

Zone

Feet

Meters

CuT

Cu

TSol

Mo

From

to

Length

from

to

length

%

%

%

ECM-239

enriched

338.0

366.0

28.0

103.0

111.6

8.5

0.80

0.79

0.001

enriched

485.0

564.0

79.0

147.8

171.9

24.1

0.25

0.20

0.001

primary

564.0

598.0

34.0

171.9

182.3

10.4

0.14

0.02

0.001

primary

725.0

755.0

30.0

221.0

230.1

9.1

0.10

0.04

0.002

ECM-240

leached

185.0

215.0

30.0

56.4

65.5

9.1

0.11

0.02

0.001

enriched

282.0

330.0

48.0

86.0

100.6

14.6

0.46

0.44

0.001

oxide

348.0

438.0

90.0

106.1

133.5

27.4

0.22

0.14

0.001

oxide

487.0

740.0

253.0

148.4

225.6

77.1

0.31

0.23

0.003

including

519.0

573.0

54.0

158.2

174.7

16.5

0.65

0.53

0.005

ECM-242

oxide

229.0

258.3

29.3

69.8

78.7

8.9

0.28

0.27

0.002

enriched

268.0

327.0

59.0

81.7

99.7

18.0

0.45

0.44

0.001

enriched

355.0

649.0

294.0

108.2

197.8

89.6

0.46

0.43

0.001

including

355.0

401.0

46.0

108.2

122.2

14.0

1.07

1.06

0.002

and

425.3

467.0

41.7

129.6

142.3

12.7

0.87

0.86

0.001

primary

649.0

1,044.0

395.0

197.8

318.2

120.4

0.15

0.02

0.001

including

799.0

847.0

48.0

243.5

258.2

14.6

0.25

0.02

0.002

ECM-244

oxide

240.0

292.0

52.0

73.2

89.0

15.8

1.12

1.08

0.005

enriched

292.0

728.9

436.9

89.0

222.2

133.2

0.59

0.57

0.001

including

295.9

310.0

14.1

90.2

94.5

4.3

2.93

2.92

0.001

and

484.0

609.4

125.4

147.5

185.7

38.2

1.07

1.05

0.001

primary

728.9

928.2

199.3

222.2

282.9

60.7

0.15

0.02

0.001

ECM-247

oxide

384.0

525.0

141.0

117.0

160.0

43.0

0.11

0.07

0.001

enriched

525.0

671.4

146.4

160.0

204.6

44.6

0.34

0.31

0.001

including

525.0

602.3

77.3

160.0

183.6

23.6

0.52

0.49

0.002

primary

671.4

828.3

156.9

204.6

252.5

47.8

0.10

0.02

0.001

ECM-248

Oxide/

enriched

213.3

416.4

203.1

65.0

126.9

61.9

0.46

0.43

0.001

including

316.0

344.6

28.6

96.3

105.0

8.7

1.97

1.95

0.002

enriched

447.0

538.0

91.0

136.2

164.0

27.7

0.22

0.21

0.001

primary

582.4

648.6

66.2

177.5

197.7

20.2

0.15

0.02

0.001

primary

699.0

731.0

32.0

213.1

222.8

9.8

0.19

0.02

0.001

ECM-249

oxide

143.0

301.0

158.0

43.6

91.7

48.2

0.12

0.07

0.001

oxide

351.0

390.0

39.0

107.0

118.9

11.9

0.46

0.34

0.001

enriched

441.0

485.0

44.0

134.4

147.8

13.4

0.73

0.72

0.001

primary

524.0

707.9

183.9

159.7

215.8

56.1

0.24

0.04

0.003

including

566.6

667.0

100.4

172.7

203.3

30.6

0.32

0.03

0.004

ECM-250

enriched

706.4

1,080.8

374.4

215.3

329.4

114.1

0.43

0.42

0.008

including

876.0

934.5

58.5

267.0

284.8

17.8

0.55

0.54

0.007

and

1,008.0

1,048.0

40.0

307.2

319.4

12.2

1.24

1.23

0.011

enriched

1,176.0

1,314.0

138.0

358.4

400.5

42.1

0.12

0.09

0.006

primary

1,314.0

1,758.0

444.0

400.5

535.8

135.3

0.18

0.02

0.008

including

1,534.0

1,614.0

80.0

467.6

491.9

24.4

0.30

0.03

0.008

ECM-254

enriched

375.0

650.3

275.3

114.3

198.2

83.9

0.52

0.50

0.003

including

508.3

570.0

61.7

154.9

173.7

18.8

1.05

1.03

0.003

enriched

812.2

892.0

79.8

247.6

271.9

24.3

0.11

0.11

0.002

primary

1,150.0

1,200.0

50.0

350.5

365.8

15.2

0.10

0.06

0.002

primary

1,270.0

1,440.0

170.0

387.1

438.9

51.8

0.10

0.01

0.002

ECM-285

oxide

988.0

1,009.6

21.6

301.1

307.7

6.6

1.06

0.92

0.003

enriched

1,378.0

1,806.0

428.0

420.0

550.5

130.5

0.41

0.36

0.008

including

1,448.0

1,488.0

40.0

441.4

453.5

12.2

1.04

1.02

0.005

primary

1,806.0

2,318.0

512.0

550.5

706.5

156.1

0.33

0.03

0.006

including

1,917.0

2,027.0

110.0

584.3

617.8

33.5

0.42

0.03

0.005

ECM-287

oxide

582.0

627.0

45.0

177.4

191.1

13.7

1.05

0.57

0.001

enriched

726.0

761.5

35.5

221.3

232.1

10.8

0.64

0.60

0.004

enriched

807.7

887.5

79.8

246.2

270.5

24.3

0.62

0.60

0.011

including

807.7

835.3

27.6

246.2

254.6

8.4

1.18

1.15

0.006

enriched

1,011.8

1,129.0

117.2

308.4

344.1

35.7

1.04

1.03

0.011

including

1,011.8

1,055.2

43.4

308.4

321.6

13.2

1.49

1.48

0.009

enriched

1,216.0

1,317.0

101.0

370.6

401.4

30.8

0.32

0.31

0.034

enriched

1,373.0

1,519.0

146.0

418.5

463.0

44.5

1.20

0.96

0.034

including

1,373.0

1,399.0

26.0

418.5

426.4

7.9

4.47

4.43

0.025

primary

1,519.0

2,156.4

637.4

463.0

657.3

194.3

0.43

0.03

0.018

including

1,519.0

1,736.0

217.0

463.0

529.1

66.1

0.55

0.04

0.040

ECM-289

oxide

532.0

638.0

106.0

162.2

194.5

32.3

0.52

0.50

0.011

including

608.0

638.0

30.0

185.3

194.5

9.1

1.14

1.09

0.009

enriched

638.0

748.0

110.0

194.5

228.0

33.5

0.79

0.56

0.020

oxide

782.2

842.2

60.0

238.4

256.7

18.3

0.51

0.49

0.007

enriched

885.3

1,554.0

668.7

269.8

473.7

203.8

1.01

0.79

0.017

including

1,128.0

1,208.0

80.0

343.8

368.2

24.4

1.38

0.73

0.015

and

1,402.0

1,524.0

122.0

427.3

464.5

37.2

1.72

1.64

0.034

primary

1,554.0

2,058.6

504.6

473.7

627.5

153.8

0.55

0.04

0.008

including

1,565.1

1,595.0

29.9

477.0

486.2

9.1

0.94

0.07

0.011

and

1,653.0

1,706.0

53.0

503.8

520.0

16.2

0.96

0.05

0.009

ECM-299

oxide

508.7

634.0

125.3

155.1

193.2

38.2

0.38

0.37

0.007

including

588

623.7

35.7

179.2

190.1

10.9

0.84

0.83

0.006

enriched

744.0

1,539.0

795.0

226.8

469.1

242.3

0.98

0.75

0.041

including

978.0

1,028.0

50.0

298.1

313.3

15.2

1.91

1.87

0.009

and

1133.5

1,223.0

89.5

345.5

372.8

27.3

2.11

1.91

0.023

primary

1539.0

2,027.0

488.0

469.1

617.8

148.7

0.48

0.04

0.009

including

1539.0

1,720.0

181.0

469.1

524.3

55.2

0.80

0.06

0.015

and

1559.0

1,629.0

70.0

475.2

496.5

21.3

0.91

0.07

0.014

oxide

528.0

569.4

41.4

160.9

173.6

12.6

0.16

0.14

0.008

enriched

619.2

1,246.3

627.1

188.7

379.9

191.1

0.45

0.36

0.006

including

1045.0

1,246.3

201.3

318.5

379.9

61.4

1.00

0.73

0.009

primary

1246.3

1,915.1

668.8

379.9

583.7

203.9

0.38

0.03

0.008

including

1246.3

1,365.0

118.7

379.9

416.1

36.2

0.57

0.05

0.009

and

1440.0

1,505.0

65.0

438.9

458.7

19.8

0.50

0.03

0.012

1.

Intervals are presented in core length and

are drilled mostly vertically except where holes specifically

support geotechnical programs.

2.

Drill assays assume a mineralized cut-off

grade of 0.1% CuT reflecting the potential for heap leaching of

open pit material in the case of Oxide and Enriched or in the case

of Primary material to provide typical average grades. Holes were

terminated below the basement fault.

3.

Assay results are not capped. Intercepts

are aggregated within geological confines of major mineral

zones.

4.

Includes 1.7ft (0.52 m) core loss in

ECM-299 and 3.7ft (1.13 m) core loss in ECM-302

5.

True widths are not known.

Table 2: Drilling Details

Hole

Easting

(m)

Northing

(m)

Elevation

(ft)

TD (ft)

TD (m)

Azimuth

Dip

ECM-239

422224.6

3644116.0

1,360.0

935.1

285.0

0.0

-90.0

ECM-240

422071.3

3643964.8

1,360.0

858.0

261.5

0.0

-90.0

ECM-242

421922.0

3644347.6

1,362.0

1,177.0

358.7

0.0

-90.0

ECM-244

421998.3

3644268.6

1,359.5

1,065.2

324.7

0.0

-90.0

ECM-247

422073.6

3644193.6

1,360.0

965.3

294.2

0.0

-90.0

ECM-248

422148.8

3644116.5

1,360.0

864.5

263.5

0.0

-90.0

ECM-249

422147.5

3643964.2

1,360.0

805.5

245.5

0.0

-90.0

ECM-250

421620.8

3644576.1

1,364.2

1,861.2

567.3

180.0

-75.0

ECM-254

421692.2

3644422.9

1,360.5

1,552.0

473.0

0.0

-90.0

ECM-285

421392.9

3644806.7

1,368.2

2,338.0

712.6

0.0

-90.0

ECM-287

421550.6

3644810.3

1,370.1

2,183.5

665.5

0.0

-90.0

ECM-289

421696.6

3644810.0

1,371.1

2,066.3

629.8

0.0

-90.0

ECM-299

421621.0

3644731.0

1368.0

2039.9

587.7

0.0

-90.0

ECM-302

421773.0

3644729.0

1370.0

1928.0

458.9

145.0

-85.0

Note: Drill locations are based on drill plans and hand-held GPS

locators and may be adjusted slightly with final survey

control.

Quality Assurance / Quality Control

Drilling completed on the project between 2020 and 2025 was

supervised by on-site ASCU personnel who prepared core samples for

assay and implemented a full QA/QC program using blanks, standards,

and duplicates to monitor analytical accuracy and precision. The

samples were sealed on site and shipped to Skyline Laboratories in

Tucson AZ for analysis. Skyline’s sample prep, analytical

methodologies, and quality control system complies with global

certifications for Quality ISO9001:2008.

The scientific and technical information in this press release

has been reviewed and verified by Allan Schappert – CPG #11758, who

is independent of the Company and a qualified person as defined by

National Instrument 43-101– Standards of Disclosure for Mineral

Projects.

Links from the Press Release

Figures 1-10:

https://arizonasonoran.com/projects/cactus-mine-project/press-release-images/

Feb 4:

https://arizonasonoran.com/news-releases/arizona-sonoran-provides-2024-recap-and-2025-work-plan/

Neither the TSX nor the regulating authority has approved or

disproved the information contained in this press release.

About Arizona Sonoran Copper Company (www.arizonasonoran.com |

www.cactusmine.com)

ASCU’s objective is to become a mid-tier copper producer with

low operating costs and to develop the Cactus and Parks/Salyer

Projects that could generate robust returns for investors and

provide a long term sustainable and responsible operation for the

community and all stakeholders. The Company's principal asset is a

100% interest in the Cactus Project (former ASARCO, Sacaton mine)

which is situated on private land in an infrastructure-rich area of

Arizona. Contiguous to the Cactus Project is the Company’s

100%-owned Parks/Salyer deposit that could allow for a phased

expansion of the Cactus Mine once it becomes a producing asset. The

Company is led by an executive management team and Board which have

a long-standing track record of successful project delivery in

North America complemented by global capital markets expertise.

Cautionary Statements regarding Forward-Looking Statements

and Other Matters

Forward-Looking Statements

All statements, other than statements of historical fact,

contained or incorporated by reference in this press release

constitute “forward-looking statements” and “forward-looking

information” (collectively, “forward-looking statements”) within

the meaning of applicable Canadian and United States securities

legislation. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as

“advancing”, “anticipate”, “assumptions”, “become”, “continue”,

“could”, “delivery”, “develop”, “estimate”, “eventual”,

“exploring”, “expected”, “feasibility”, “focused”, “forward”,

“future”, “growing”, “initial”, “leading”, “looking”, “model”,

“moving”, “next”, “objective”, “pending”, “planned”, “potential”,

“program”, “progress”, “risk”, “study”, “subject to”, “targeting”,

“to be”, “trending”, “upgrade”, and “will”, or variations of such

words, and similar such words, expressions or statements that

certain actions, events or results can, could, may, should, would,

will (or not) be achieved, occur, provide, result or support in the

future, or which, by their nature, refer to future events. In some

cases, forward-looking information may be stated in the present

tense, such as in respect of current matters that may be

continuing, or that may have a future impact or effect.

Forward-looking statements include those relating to mineral

resource infill drilling (including the results thereof); ongoing

geotechnical and hydrological programs (including the timing and

results thereof); the 2025 PFS (including delivery and the timing

thereof); Doug Bowden stepping down, and Chris White stepping in,

and the timing thereof; mineral resource estimates generally and

any conversion or upgrade of mineral resource estimates in the

planned 2025 updated mineral resource estimate (including the rate

of any such conversion, and delivery of such updated estimate and

the timing thereof); trending grade thickness; move of the pit

centroid further north in the 2025 PFS or otherwise; the 2025

infill-to-indicated drilling program and any broader drilling

program (including number of feet, and completion), conversion or

upgrade of inferred mineral resources, refinement and/or expansion

of enriched mineralized trend, definition of a larger high-grade

zone and any other results (including timing thereof); any

construction decision regarding the Cactus Project; the 2024 PEA

(including model); project economics; any upside in value and/or

delivered back to shareholders, sustainability and risk; the

Company’s objectives (including the Cactus Project becoming a

significant producer of copper cathodes in Arizona and the U.S.);

and the future plans or prospects of the Company (including

sustainability of the Cactus Project and becoming a mid-tier copper

producer). Although the Company believes that such statements are

reasonable, there can be no assurance that those forward-looking

statements will prove to be correct, and any forward-looking

statements by the Company are not guarantees of future actions,

results or performance. Forward-looking statements are based on

assumptions, estimates, expectations and opinions, which are

considered reasonable and represent best judgment based on

available facts, as of the date such statements are made. If such

assumptions, estimates, expectations and opinions prove to be

incorrect, actual and future results may be materially different

than expressed or implied in the forward-looking statements. The

assumptions, estimates, expectations and opinions referenced,

contained or incorporated by reference in this press release

(including referenced Figures linked from this press release) which

may prove to be incorrect include those set forth or referenced in

this press release, as well as those stated in the technical report

for the Cactus Project filed on August 27, 2024 (the “2024 PEA

Technical Report”), the Company’s Annual Information Form dated

April 1, 2024 (the “AIF”), Management’s Discussion and Analysis

(together with the accompanying financial statements) for the year

ended December 31, 2023 and the quarters in 2024 reported to date

(collectively, the “2023-24 Financial Disclosure”) and the

Company’s other applicable public disclosure including the press

releases referenced and/or linked herein (collectively, “Company

Disclosure”), all available on the Company’s website at

www.arizonasonoran.com and under its issuer profile at

www.sedarplus.ca. Forward-looking statements are inherently subject

to known and unknown risks, uncertainties, contingencies and other

factors which may cause the actual results, performance or

achievements of ASCU to be materially different from any future

results, performance or achievements expressed or implied by the

forward-looking statements. Such risks, uncertainties,

contingencies and other factors include, among others, the “Risk

Factors” in the AIF, and the risks, uncertainties, contingencies

and other factors identified in the 2024 PEA Technical Report and

the 2023-24 Financial Disclosure. The foregoing list of risks,

uncertainties, contingencies and other factors is not exhaustive;

readers should consult the more complete discussion of the

Company’s business, financial condition and prospects that is

provided in the AIF, the 2023-24 Financial Disclosure and other

Company Disclosure. Although ASCU has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended. Forward-looking statements contained herein

are made as of the date of this press release (or as otherwise

expressly specified) and ASCU disclaims any intention or obligation

to update or revise any forward-looking statements, whether as a

result of new information, future events or results or otherwise,

except as required by applicable securities laws. There can be no

assurance that such information will prove to be accurate, as

actual results and future events could differ materially from

forward-looking statements. Accordingly, readers should not place

undue reliance on forward-looking statements. The forward-looking

statements referenced or contained in this press release are

expressly qualified by these Cautionary Statements as well as the

Cautionary Statements in the AIF, the 2024 PEA Technical Report,

the 2023-24 Financial Disclosure and other Company Disclosure.

Preliminary Economic Assessments

The 2024 Preliminary Economic Assessment (or 2024 PEA)

referenced in this press release and summarized in the 2024 PEA

Technical Report is only a conceptual study of the potential

viability of the Cactus Project and the economic and technical

viability of the Cactus Project has not been demonstrated. The 2024

PEA is preliminary in nature and provides only an initial,

high-level review of the Cactus Project’s potential and design

options; there is no certainty that the 2024 PEA will be realized.

For further detail on the Cactus Project and the 2024 PEA,

including applicable technical notes and cautionary statements,

please refer to the Company’s press release dated August 7, 2024

and the 2024 PEA Technical Report, both available on the Company’s

website at www.arizonasonoran.com and under its issuer profile at

www.sedarplus.ca.

Mineral Resource Estimates

Until mineral deposits are actually mined and processed, copper

and other mineral resources must be considered as estimates only.

Mineral resource estimates that are not classified as mineral

reserves do not have demonstrated economic viability. The

estimation of mineral resources is inherently uncertain, involves

subjective judgement about many relevant factors and may be

materially affected by, among other things, environmental,

permitting, legal, title, taxation, socio-political, marketing, or

other known and unknown risks, uncertainties, contingencies and

other factors described in the foregoing Cautionary Statements on

Forward-Looking Statements. The quantity and grade of reported

“inferred” mineral resource estimates are uncertain in nature and

there has been insufficient exploration to define “inferred”

mineral resource estimates as an “indicated” or “measured” mineral

resource and it is uncertain if further exploration will result in

upgrading “inferred” mineral resource estimates to an “indicated”

or “measured” mineral resource category. Inferred mineral resource

estimates may not form the basis of feasibility or pre-feasibility

studies or economic studies except for preliminary economic

assessments. The accuracy of any mineral resource estimate is a

function of the quantity and quality of available data, and of the

assumptions made and judgments used in engineering and geological

interpretation, which may prove to be unreliable and depend, to a

certain extent, upon the analysis of drilling results and

statistical inferences that may ultimately prove to be inaccurate.

It cannot be assumed that all or any part of a “inferred”,

“indicated” or “measured” mineral resource estimate will ever be

upgraded to a higher category including a mineral reserve. The

mineral resource estimates declared by the Company were estimated,

categorized and reported using standards and definitions in

accordance with the Canadian Institute of Mining, Metallurgy and

Petroleum Definition Standards for Mineral Resources and Mineral

Reserves (the “CIM Standards”) in accordance with National

Instrument 43-101 of the Canadian Securities Administrators (“NI

43-101”), which governs the public disclosure of scientific and

technical information concerning mineral projects.

U.S. Readers

The terms “mineral resource”, “measured mineral resource”,

“indicated mineral resource” and “inferred mineral resource” as

disclosed by the Company are Canadian mining terms defined in the

CIM Standards (collectively, the “CIM Definitions”) in accordance

with NI 43-101. NI 43-101 establishes standards for all public

disclosure that a Canadian issuer makes of scientific and technical

information concerning mineral projects. These Canadian standards

differ from the requirements of the United States Securities and

Exchange Commission (the “SEC”) applicable to United States

domestic and certain foreign reporting companies under Subpart 1300

of Regulation S-K (“S-K 1300”). Accordingly, information describing

mineral resource estimates for the Cactus Project may not be

comparable to similar information publicly reported in accordance

with the applicable requirements of the SEC, and so there can be no

assurance that any mineral resource estimate for the Cactus Project

would be the same had the estimates been prepared per the SEC’s

reporting and disclosure requirements under applicable United

States federal securities laws, and the rules and regulations

thereunder, including but not limited to S-K 1300. Further, there

is no assurance that any mineral resource or mineral reserve

estimate that the Company may report under NI 43-101 would be the

same had the Company prepared such estimates under S-K 1300.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225820514/en/

For more information Alison Dwoskin, Director, Investor

Relations 647-233-4348 adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director 416-723-0458

gogilvie@arizonasonoran.com

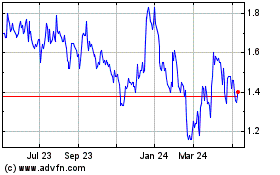

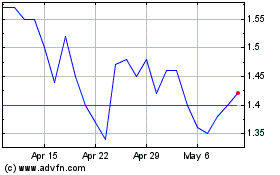

Arizona Sonoran Copper (TSX:ASCU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arizona Sonoran Copper (TSX:ASCU)

Historical Stock Chart

From Feb 2024 to Feb 2025