Ascendant Resources Inc. (TSX: ASND, OTCQB: ASDRF)

(“

Ascendant” or the “

Company”) is

very pleased to announce it has entered into a US$15 million metals

stream agreement (the “

Stream Agreement”) with

Sprott Private Resource Streaming and Royalty Corp.

(“

Sprott Streaming”) for its Lagoa Salgada VMS

project located close to Lisbon, Portugal (the

“

Project”).

Proceeds will be used to i) complete the ongoing

43-101 compliant feasibility study for the Project; ii) advance

permitting activities; iii) to fund the last instalment related to

the earn-in for an 80% interest in the Project; and iii) general

corporate and working capital purposes.

The Stream Agreement provides for the sale and

delivery to Sprott Streaming of 1.75% of all metals produced from

the Project at a rate of 15% of the market price until the delivery

of 45,000 gold equivalent ounces, at which point the rate will be

increased to 75% of the market price. Ascendant also has the

ability to buy down up to 50% of the stream on or before 2 years

following the date of commencement of commercial production at the

Project (as further set out in the Stream Agreement) for up to

US$10.5 million.

Mark Brennan, Executive Chairman of Ascendant

commented, “We are thrilled to be partnering with the very

experienced and talented team at Sprott Streaming to fully finance

our feasibility study at Lagoa Salgada in a non-dilutive and timely

manner allowing us to continue development of the project to a

construction decision. We look forward to a constructive and

growing relationship with the team at Sprott Streaming.” He

continued, “Ascendant has made tremendous progress on its technical

studies for the Feasibility Study at Lagoa Salgada, which leads us

to expect a very robust outcome.”

Mike Harrison, Managing Partner of Sprott

Streaming commented, “Sprott Streaming is pleased to make this

initial investment in Ascendant to advance the project to a

construction and financing decision. We recognize the potential of

the deposit as defined to date, and the exploration potential that

would extend the mine life substantially. Portugal has a long

mining history, and Lagoa Salgada benefits from the expertise of

the experienced in-country team and consultants. We are pleased to

be working with Ascendant to advance this significant project.”

To facilitate funding in advance of commercial

production, an affiliate of Sprott Streaming issued a US$15 million

secured note (the “Note”) that bears interest at a

rate of 10% per annum, calculated and payable quarterly and will

mature on the earlier of: i) the achievement of commercial

production at the Project together with certain other conditions;

and ii) November 25, 2031.

Subject to the final approval of the TSX

Exchange (the “TSX”), the Company may elect to

satisfy the payment of any accrued and unpaid interest on the Note

by the issuance of common shares of the Company (the

“Common Shares”) at a price per Common Share equal

to 95% of the volume weighted average price (the

“VWAP”) of the Common Shares for the 5 trading

days immediately prior to the date payment of interest is due or

any combination of cash and Common Shares in the Company’s sole

discretion up to a maximum of 32,617,109 Common Shares (subject to

customary adjustment). Pledges of shares and intercompany

indebtedness were provided by the Company, its wholly owned

subsidiary, Ascendant Resources Portugal, Unipessoal LDA, and

Redcorp (as defined below) as security for the Note. The Note

security is intended to subordinate to future project financing for

the Project.

The Company has provided Sprott Streaming a

first right of approval to participate in any future stream or

royalty type financing until certain delivery thresholds are met.

Sprott has previously expressed interest in potential additional

financing of approximately US$60 million.

The Company also announces that it has amended

the terms of the unanimous shareholders agreement with Mineral

& Financial Investments AG (“M&FI”) to

provide, among other things, a right in favour of M&FI such

that M&FI may put all, but not less than, of its shares of

Redcorp (defined below) to Ascendant in consideration of an amount,

payable in cash, equal to 5% of the post-tax net present value of

the Project provided in the feasibility study completed prior to

the date of exercise using a 10.5% discount rate.

About Ascendant Resources

Inc.

Ascendant is a Toronto-based mining company

focused on the exploration and development of the highly

prospective Lagoa Salgada VMS project located on the prolific

Iberian Pyrite Belt in Portugal. Through focused exploration and

aggressive development plans, the Company aims to unlock the

inherent potential of the project, maximizing value creation for

shareholders.

The Venda Nova deposit at Lagoa Salgada contains

over 10.33 million tonnes of Measured and Indicated Resources @

9.06% ZnEq and 2.50 million tonnes of Inferred Resources @ 5.93%

ZnEq in the North Zone; and 4.42 million tonnes of Indicated

Resources @ 1.50% CuEq and 10.83 million tonnes of Inferred

resources @ 1.35% CuEq in the South Zone. The deposit demonstrates

typical mineralization characteristics of Iberian Pyrite Belt VMS

deposits containing zinc, copper, lead, tin, silver and gold.

Extensive exploration upside potential lies both near deposit and

at prospective step-out targets across the large 7,209ha property

concession. The project also demonstrates compelling economics with

scalability for future resource growth in the results of the

Preliminary Economic Assessment. Located just 80km from Lisbon,

Lagoa Salgada is easily accessible by road and surrounded by

exceptional infrastructure. Ascendant holds a 50% interest in the

Lagoa Salgada project through its position in Redcorp -

Empreendimentos Mineiros, Lda, ("Redcorp") and has

an earn-in opportunity to increase its interest in the Project to

80%. The Company's interest in the Lagoa Salgada project offers a

low-cost entry to a potentially significant exploration and

development opportunity, already demonstrating its mineable

scale.

The Company's common shares are principally

listed on the Toronto Stock Exchange under the symbol "ASND". For

more information on Ascendant, please visit our website

at www.ascendantresources.com.

Additional information relating to the Company,

including the Preliminary Economic Assessment referenced in this

news release, is available on SEDAR at www.sedar.com.

For further information, contact:

| Mark BrennanExecutive Chairman, FounderTel:

+1-647-796-0023mbrennan@ascendantresources.com |

David BallVice President, Corporate DevelopmentTel:

+1-647-796-0068dball@ascendantresources.com |

Forward Looking

Information

This press release contains statements that

constitute “forward-looking information” (collectively,

“forward-looking statements”) within the meaning of the applicable

Canadian securities legislation. All statements, other than

statements of historical fact, are forward-looking statements and

are based on expectations, estimates and projections as at the date

of this news release. Any statement that discusses predictions,

expectations, beliefs, plans, projections, objectives, assumptions,

future events or performance (often but not always using phrases

such as “expects”, or “does not expect”, “is expected”,

“anticipates” or “does not anticipate”, “plans”, “budget”,

“scheduled”, “forecasts”, “estimates”, “believes” or “intends” or

variations of such words and phrases or stating that certain

actions, events or results “may” or “could”, “would”, “might” or

“will” be taken to occur or be achieved) are not statements of

historical fact and may be forward-looking statements.

Forward-looking statements contained in this

press release include, without limitation, statements regarding the

use of proceeds. In making the forward- looking statements

contained in this press release, Ascendant has made certain

assumptions, including with respect to the operations of the

Company required to achieve commercial production at the Project.

Although Ascendant believes that the expectations reflected in

forward-looking statements are reasonable, it can give no assurance

that the expectations of any forward-looking statements will prove

to be correct. Known and unknown risks, uncertainties, and other

factors which may cause the actual results and future events to

differ materially from those expressed or implied by such

forward-looking statements. Such factors include, but are not

limited to general business, economic, competitive, political and

social uncertainties. Accordingly, readers should not place undue

reliance on the forward-looking statements and information

contained in this press release. Except as required by law,

Ascendant disclaims any intention and assumes no obligation to

update or revise any forward-looking statements to reflect actual

results, whether as a result of new information, future events,

changes in assumptions, changes in factors affecting such

forward-looking statements or otherwise.

Forward-looking information is subject to a

variety of risks and uncertainties, which could cause actual events

or results to differ from those reflected in the forward-looking

information, including, without limitation, the risks described

under the heading "Risks Factors" in the Company's Annual

Information Form dated March 24, 2022 and under the heading "Risks

and Uncertainties" in the Company's Management’s Discussion and

Analysis for the years ended December 31, 2021 and 2020 and other

risks identified in the Company's filings with Canadian securities

regulators, which filings are available on SEDAR at www.sedar.com.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. The Company's statements containing forward-looking

information are based on the beliefs, expectations and opinions of

management on the date the statements are made, and the Company

does not assume any obligation to update such forward-looking

information if circumstances or management's beliefs, expectations

or opinions should change, other than as required by applicable

law. For the reasons set forth above, one should not place undue

reliance on forward-looking information

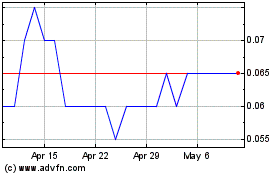

Ascendant Resources (TSX:ASND)

Historical Stock Chart

From Apr 2024 to May 2024

Ascendant Resources (TSX:ASND)

Historical Stock Chart

From May 2023 to May 2024