Athabasca Oil Corporation Announces Renewal of its Credit Facility

June 01 2020 - 8:00AM

Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

announces that it has completed the annual review of its credit

facilities. The Company’s banking syndicate has renewed the

reserve-based facility until November 30, 2020. The credit facility

has been reduced to $42 million which reflects the currently

outstanding letters of credit for long term transportation

commitments and is secured by the Company’s cash balances.

The Company continues to pursue opportunities to

access credit support offered by the Government of Canada during

this uncertain economic environment created by the COVID-19

pandemic.

Athabasca remains focused on maximizing

corporate funds flow and maintaining strong corporate liquidity. As

at May 31, 2020 the Company has cash and cash equivalents of

approximately $330 million inclusive of restricted cash.

Athabasca maintains long‐term optionality across

a deep inventory of high‐quality Thermal Oil projects and flexible

Light Oil development opportunities.

About Athabasca Oil Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

For more information, please contact:Matthew TaylorChief

Financial Officer1-403-817-9104mtaylor@atha.com

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. The forward-looking information is not historical fact,

but rather is based on the Company’s current plans, objectives,

goals, strategies, estimates, assumptions and projections about the

Company’s industry, business and future operating and financial

results. This information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. No assurance can be given that these

expectations will prove to be correct and such forward-looking

information included in this News Release should not be unduly

relied upon. This information speaks only as of the date of this

News Release. In particular, this News Release contains

forward-looking information pertaining to, but not limited to, the

following: our strategic plans and growth strategies; and

government support programs related to COVID-19,. The Company does

not undertake any obligation to publicly update or revise any

forward‐looking information except as required by applicable

securities laws.

With respect to forward‐looking information

contained in this News Release, assumptions have been made

regarding, among other things: commodity outlook; the

regulatory framework in the jurisdictions in which the Company

conducts business; the Company’s financial and operational

flexibility; the Company’s, capital expenditure outlook,

financial sustainability and ability to access sources of funding;

geological and engineering estimates in respect of Athabasca’s

reserves and resources; and other matters.

Actual results could differ materially from

those anticipated in this forward-looking information as a result

of the risk factors set forth in the Company’s Annual Information

Form (“AIF”) dated March 4, 2020 available on SEDAR at

www.sedar.com, including, but not limited to: fluctuations in

commodity prices, foreign exchange and interest rates; political

and general economic, market and business conditions in Alberta,

Canada, the United States and globally; changes to royalty regimes,

environmental risks and hazards; the potential for management

estimates and assumptions to be inaccurate; the dependence on

Murphy as the operator of the Company’s Duvernay assets; the

capital requirements of Athabasca’s projects and the ability to

obtain financing; operational and business interruption risks,

including those that may be related

to the COVID pandemic; failure by counterparties to make

payments or perform their operational or other obligations to

Athabasca in compliance with the terms of contractual arrangements;

aboriginal claims; failure to obtain regulatory approvals or

maintain compliance with regulatory requirements; uncertainties

inherent in estimating quantities of reserves and resources;

litigation risk; environmental risks and hazards; reliance on third

party infrastructure; hedging risks; insurance risks; claims made

in respect of Athabasca’s operations, properties or assets; risks

related to Athabasca’s amended credit facilities and senior secured

notes; and risks related to Athabasca’s common

shares.

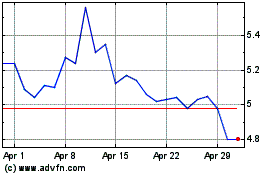

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Oct 2024 to Nov 2024

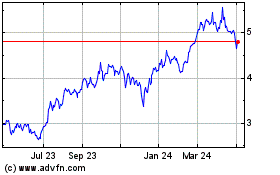

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Nov 2023 to Nov 2024