Athabasca Oil Corporation Announces a US$350 Million Notes Offering, Issuance of a Conditional Redemption Notice for its US$450 Million of Notes due 2022 and an Amended and Restated C$110 Million Credit Facility

October 07 2021 - 1:36PM

Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

announced today a private placement offering (the “Offering”) of

350,000 units. Each unit will consist of $1,000 principal amount of

senior secured second lien notes due 2026 (each a “Note”) which

bear interest at 9.75% per annum, and one five-year warrant (each

“Warrant”) to purchase 227 common shares (“Warrant Shares”) at an

exercise price of $0.9441 per Warrant Share (representing the 5-day

volume weighted average trading price of the Company’s common

shares on the Toronto Stock Exchange (“TSX”) ended October 6). The

Warrants have a cashless exercise feature to minimize future

dilution. Listing of the Warrant Shares issuable upon exercise of

the Warrants will be subject to TSX approval. Closing of the

Offering is anticipated on or about October 22, 2021. Athabasca

will provide a strategic update and corporate guidance

incorporating the Offering on closing.

Athabasca intends to use the net proceeds of the

Offering, and cash on hand to redeem its US$450 million aggregate

principal amount of 9.875% senior secured second lien notes due

February 24, 2022 (the “2022 Notes”). Athabasca will issue a notice

today to conditionally redeem its 2022 Notes at a redemption price

of 100.0% of the principal amount of the 2022 Notes plus accrued

and unpaid interest to, but excluding, the redemption date. The

redemption is expected to be completed on or about November 6, 2021

and is conditioned upon the completion of the Offering. This press

release does not constitute notice of the redemption.

Athabasca also announced today that, conditional

upon the completion of the Offering and the redemption of the 2022

Notes, it will enter into an amended and restated credit agreement

with a syndicate of financial institutions. The amended and

restated credit agreement will provide for a C$110 million

reserves-based secured credit facility with a maturity date in

October 2023. The Company maintains its C$40 million unsecured

letter of credit facility that is supported by a performance

security guarantee from Export Development Canada.

The Notes, Warrants and Warrant Shares issuable

upon exercise of the Warrants (collectively, the “Securities”) will

not be registered under the U.S. Securities Act of 1933, as amended

(the "U.S. Securities Act"), and may not be offered or sold in the

United States absent registration or an applicable exemption from

registration requirements. The Securities have not been and will

not be qualified for sale to the public under applicable Canadian

securities laws and, accordingly, any offer and sale of the

Securities in Canada will be made on a basis which is

exempt from the prospectus requirements of such securities laws.

The Securities are being offered only to persons reasonably

believed to be qualified institutional buyers in the United States

under Rule 144A and outside the United States in compliance with

Regulation S under the U.S. Securities Act and pursuant to certain

prospectus exemptions in Canada.

This news release does not constitute an offer

to sell, or a solicitation of an offer to buy, any security and

shall not constitute an offer, solicitation or sale in any

jurisdiction in which such an offer, solicitation, or sale would be

unlawful.

About Athabasca Oil

Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

For more information, please contact:

Matthew TaylorChief Financial

Officer1-403-817-9104mtaylor@atha.com

Robert BroenPresident and CEO1-403-817-9190rbroen@atha.com

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “forecast”, “continue”, “estimate”, “expect”,

“may”, “will”, “project”, “target”, “should”, “believe”, “predict”,

“pursue”, “potential”, “view” and “contemplate” and similar

expressions are intended to identify forward-looking information.

The forward-looking information is not historical fact, but rather

is based on the Company’s current plans, objectives, goals,

strategies, estimates, assumptions and projections about the

Company’s industry, business and future operating and financial

results. This information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. No assurance can be given that these

expectations will prove to be correct and such forward-looking

information included in this News Release should not be unduly

relied upon. This information speaks only as of the date of this

News Release and, except as required by applicable securities laws,

the Company undertakes no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which such statement is made or to reflect the occurrence of

unanticipated events. In particular, this News Release contains

forward-looking information pertaining to, but not limited to, the

following: the completion, size and other attributes of the

Offering; the proceeds and use of proceeds of the Offering; the

redemption of the 2022 Notes and the timing thereof; the amendment

and restatement our credit agreement and the terms and timing

thereof; and other matters. With respect to forward-looking

information contained in this News Release, assumptions have been

made regarding, among other things, the completion of the Offering.

No assurance can be given that these expectations will prove to be

correct and such forward-looking statements included in this news

release should not be unduly relied upon. Actual results could

differ materially from those anticipated in these forward-looking

statements as a result of numerous risks and uncertainties

including, but not limited to, the risks and uncertainties

described in “Forward-Looking Statements” and “Risk Factors”

included in the Company’s Annual Information Form for the year

ended December 31, 2020, as filed on SEDAR and available on the

Athabasca website at www.atha.com.

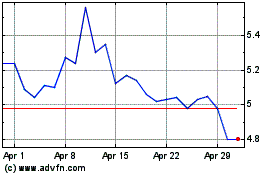

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Oct 2024 to Nov 2024

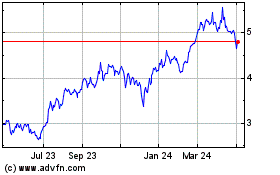

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Nov 2023 to Nov 2024