Canadian Banc Corp. Announces TSX Acceptance of Normal Course Issuer Bid

May 27 2024 - 6:30AM

Canadian Banc Corp. (the “Company’) announced today that the

Toronto Stock Exchange (the “TSX”) has accepted its notice of

intention to make a Normal Course Issuer Bid (the “NCIB”) to

purchase its Preferred Shares and Class A Shares through the

facilities of the TSX and/or alternative Canadian trading systems.

The NCIB will commence on May 29, 2024 and terminate on May 28,

2025.

Pursuant to the NCIB, the Company proposes to

purchase, from time to time, if it is considered advisable, up to

3,029,772 Preferred Shares and 2,968,093 Class A Shares of the

Company, representing 10% of the public float of 30,297,724

Preferred Shares and 29,680,939 Class A Shares. As of May 15, 2024,

there were 30,320,295 Preferred Shares and 29,714,699 Class A

Shares issued and outstanding. The Company will not purchase, in

any given 30-day period, in the aggregate, more than 606,405

Preferred Shares or more than 594,293 Class A Shares, being 2% of

the issued and outstanding Preferred Shares and Class A Shares as

of May 15, 2024. Under the previous normal course

issuer bid that commenced on May 29, 2023 and will terminate on May

28, 2024, no purchases of Preferred Shares or Class A Shares were

made.

The Board of Directors of the Company, on the

advice of Quadravest Capital Management Inc., the Company’s

investment manager, believes that such purchases are in the best

interests of the Company and are a desirable use of its funds. All

purchases will be made through the facilities and in accordance

with the rules and policies of the TSX. All Preferred Shares or

Class A Shares purchased by the Company pursuant to the NCIB will

be cancelled.

The Company invests in a portfolio of six

publicly traded Canadian Banks as follows:

|

Bank of Montreal |

Canadian Imperial Bank of Commerce |

Royal Bank of Canada |

|

The Bank of Nova Scotia |

National Bank of Canada |

The Toronto-Dominion Bank |

Certain statements included in this news release

constitute forward-looking statements, including, but not limited

to, those identified by the expressions “expect”, “intend”, “will”

and similar expressions to the extent they relate to the Company.

The forward-looking statements are not historical facts but reflect

the Company’s current expectations regarding future results or

events. These forward-looking statements are subject to a number of

risks and uncertainties that could cause actual results or events

to differ materially from current expectations. Although the

Company believes that the assumptions inherent in the

forward-looking statements are reasonable, forward-looking

statements are not guarantees of future performance and,

accordingly, readers are cautioned not to place undue reliance on

such statements due to the inherent uncertainty therein. The

Company undertakes no obligation to update publicly or otherwise

revise any forward-looking statement or information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law.

Investor Relations: 1-877-478-2372

Local: 416-304-4443

www.canadianbanc.cominfo@quadravest.com

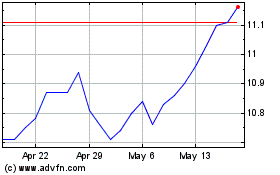

Canadian Banc (TSX:BK)

Historical Stock Chart

From Jan 2025 to Feb 2025

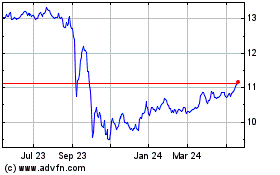

Canadian Banc (TSX:BK)

Historical Stock Chart

From Feb 2024 to Feb 2025