via NetworkWire – Black Iron Inc. (“Black Iron”)

(TSX: BKI; OTC: BKIRF; FRANKFURT: BIN) reaffirms the economic

projections for its Shymanivske project, citing a weeks-long surge

in iron ore prices after one of the world’s largest iron ore

producers took 11 mines offline, significantly crimping

supply.

On January 25, 2019, one of Vale’s mines in

Brazil experienced a disastrous tailings dam failure, causing the

producer to voluntarily shut ten of its iron ore mines (~40Mtpa

production) to minimize the risk of additional upstream tailings

dam failure. On February 4, 2019, as reported by several news

outlets, regulatory authorities in Brazil ordered Vale to shut its

second-largest iron ore mine, taking an additional 30Mtpa of

production offline and causing Vale to claim force majeure on its

ability to supply iron ore to some of its customers.

The shut-down of Vale’s mines resulted in a

combined production loss of 70Mtpa, representing ~6% of global

consumption. In response, iron ore prices spiked to the current

US$87/T for benchmark 62% iron content fines and US$106/T for 65%

iron content fines.

While analysts have mixed projections on how

long the iron content benchmark price will stay at elevated levels,

there is consensus that prices of iron content products - more

specifically iron ore pellets – will increase for at least the next

few years as the industry responds to lower supply. As a result,

premium 68% iron pellet feed product, as planned to be produced by

Black Iron, is expected to sell for a significantly higher price

than benchmark iron ore for at least the next two to three

years.

Shymanivske Project

Economics

Producing high grade iron ore (i.e. >65%

iron) and pellets requires substantial investment and time to

permit and construct suitable production facilities.

Black Iron, however, plans to produce pellet

feed containing 68% iron, which is in the top 4% iron content

globally. The Company’s Shymanivske project is expected to be

built in two phases, taking advantage of its proximity to rail,

power, ports and skilled labor to reduce upfront capital and time

required to generate cashflows. A capital investment of

US$436 million is required for the first phase of the Shymanivske

project, expected to produce 4 million tonnes a year. An additional

US$312 million is required to double the production capacity of

Shymanivske project to 8 million tonnes a year and this could

potentially be fully funded from the free cash generated by phase 1

production.

On November 21, 2017, Black Iron released its

rescoped preliminary economic assessment (the “PEA”) based on a

long-term price for benchmark 62% iron ore selling for US$62/T and

its expected high grade 68% iron content pellet feed at a price of

US$97/T delivered to China. Using these sale prices and the

estimated US$31/T cost to mine, process, rail and load ocean going

vessels with iron ore plus US$11.50/T for shipping to China, the

PEA estimated that the Shymanivske project will have an

unlevered after-tax net present value of US$1.66 billion using a

10% discount rate and an internal rate of return of 36%.

An available chart shows the after-tax projected

project economic returns, assuming 60% debt financing for the

mine’s construction across a range of iron ore (“Fe”) prices,

including current much higher actual prices of US$87/T and ~US$6/1%

Fe. The chart can be viewed

here: http://www.globenewswire.com/NewsRoom/AttachmentNg/b8bfa39d-d3dd-4dfd-a907-98f4c24e3236

This chart shows the after-tax projected project

economic returns, assuming 60% debt financing for the mine’s

construction across a range of iron ore (“Fe”) prices, including

current much higher actual prices of US$87/T and ~US$6/1% Fe.

About Black IronBlack Iron is

an iron ore exploration and development company advancing its

100%-owned Shymanivske project located in Kryvyi Rih, Ukraine. The

Shymanivske project contains a NI 43-101 compliant resource

estimated to be 646 Mt Measured and Indicated mineral resources,

consisting of 355 Mt Measured mineral resources grading 31.6% total

iron and 18.8% magnetic iron, and Indicated mineral resources of

290 Mt grading 31.1% total iron and 17.9% magnetic iron, using a

cut-off grade of 10% magnetic iron. Additionally, the Shymanivske

project contains 188 Mt of Inferred mineral resources grading 30.1%

total iron and 18.4% magnetic iron. Full mineral resource details

can be found in the NI 43-101 compliant technical report entitled

“Preliminary Economic Assessment of the Re-scoped Shymanivske Iron

Ore Deposit” effective November 21, 2017, under the Company's

profile on SEDAR at www.sedar.com. The Shymanivske project is

surrounded by five other operating mines, including ArcelorMittal's

iron ore complex. Please visit the Company's website at

www.BlackIron.com for more information.

The technical and scientific contents of this

press release have been prepared under the supervision of and have

been reviewed and approved by Matt Simpson, P.Eng., CEO of Black

Iron, who is a Qualified Person as defined by NI 43-101.

Cautionary StatementThe PEA is

preliminary in nature, and it includes inferred mineral resources

that are considered too speculative geologically to have the

economic considerations applied to them that would enable them to

be categorized as mineral reserves. There is no certainty that the

PEA will be realized.

For more information, please contact:

Black Iron

Inc.

Matt

Simpson

Chief Executive OfficerTel: +1 (416) 309-2138

info@BlackIron.com

Corporate Communications:

NetworkWire (NW) New York, New Yorkwww.NetworkNewsWire.com

212.418.1217 OfficeEditor@NetworkWire.com

Forward-Looking InformationThis

press release contains forward-looking information. Forward-looking

information is based on what management believes to be reasonable

assumptions, opinions and estimates of the date such statements are

made based on information available to them at that time, including

those factors discussed in the section entitled ‘‘Risk Factors’’ in

the Company’s annual information form for the year ended December

31, 2017 or as may be identified in the Company’s public disclosure

from time to time, as filed under the Company’s profile on SEDAR at

www.sedar.com. Forward-looking information may include, but

is not limited to, statements with respect to the Shymanivske

project, the mineralization of the Shymanivske project, the results

of the PEA, the realization of the PEA, the price of iron ore, the

impact of Vale shutting down its mines, the Company’s ability to

construct the Shymanivske project and future plans for the

Company’s development. Generally, forward looking information can

be identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the actual results of current exploration

activities; other risks of the mining industry and the risks

described in the annual information form of the Company. Although

the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

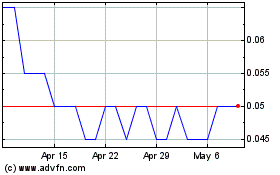

Black Iron (TSX:BKI)

Historical Stock Chart

From Feb 2025 to Mar 2025

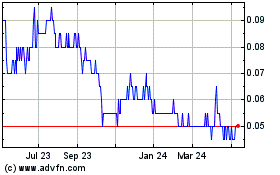

Black Iron (TSX:BKI)

Historical Stock Chart

From Mar 2024 to Mar 2025