Bri-Chem Announces 2013 First Quarter Results

May 13 2013 - 6:03PM

Marketwired Canada

Bri-Chem Corp. ("Bri-Chem" or "Company") (TSX:BRY), a leading North American

wholesale distributor and manufacturer of oil and gas drilling fluids and steel

pipe is pleased to announce its financial results for the first quarter ended

March 31, 2013.

During the first quarter of 2013, Bri-Chem has continued to sustain exceptional

year over year sales growth in its USA fluids distribution division, a 176%

increase, and in its steel pipe manufacturing division, a 113% increase. Despite

the overall Q1 2013 decline in drilling and completion activity across the

Western Canadian Sedimentary Basin ("WCSB"), Bri-Chem's consolidated revenues

remained solid at $49,695,536 for the quarter ended March 31, 2013, compared to

$52,706,137 in Q1 2012, a decrease of 5.7%. Net earnings for the three months

ended March 31, 2013 were $1,834,704 or $0.11 diluted earnings per share

compared to net earnings of $2,893,604 or $0.18 diluted earnings per share for

2012, a decrease of 36.6%. Adjusted earnings before interest, taxes,

amortization and share-based payments expense ("Adjusted EBITDAC") was

$4,389,964 or $0.25 per share, a decrease of $910,481 compared to 2012. The

decrease in earnings and Adjusted EBITDAC is mainly due to two significant

non-cash related items being foreign exchange, as the US dollar rose in

comparison to the Canadian dollar, resulting in a $513,775 foreign exchange

difference from the prior period, as well as a $242,126 increase in stock-based

compensation.

The Company's North American oil and gas drilling fluids divisions recorded

sales of $41,525,559 for the three months ended March 31, 2013, a decrease of

4.7% compared to the same period in 2012. In Canada, drilling rig utilization

averaged 60.9% for the quarter ended March 31, 2013, a decrease of 6.8% from

2012 when utilization rates average 67.7%. The Canadian fluids division

generated sales of $33,782,959 for the quarter ended March 31, 2013, compared to

sales of $40,627,807 over the comparable period in 2012. The decrease in

Canadian fluid sales was mainly due to the lower rig utilization and a decline

in quarter over quarter liquid invert sales.

With the completion of the December 31, 2012 acquisition of General Supply

Company and their three key Oklahoma warehouse locations, Bri-Chem has now

expanded to fourteen warehouses in the USA. Although the USA rig count has

decreased 11.7% quarter over quarter, the Company's USA drilling fluids division

grew by 176% to $7,742,600 for quarter ended March 31, 2013 compared to sales of

$2,798,103 for the same period in 2012. This increase is the result of the

strategic warehouse and infrastructure investment that occurred throughout 2012.

With fourteen warehouses operating in all the major resource plays in the USA,

the division will focus on continuing to grow its market share.

The steel pipe distribution division recorded sales of $3,836,292 for the three

months ended March 31, 2013, compared to revenues of $7,115,801 for the same

period in 2012. The steel distribution division experienced a decrease in demand

for seamless pipe in November 2012 and it continues to be negatively affected by

reduced demand from steel pipe service suppliers into Q1 2013. The Canadian

market has excess steel pipe inventory as many distributors were anticipating a

more robust demand for steel pipe product during the winter drilling season. The

steel pipe distribution division will concentrate on reducing inventory and

increasing turns while maintaining superior customer service, with the

appropriate quantities and sizes of steel pipe to meet the demand of its

customers.

The steel pipe manufacturing division continued to build efficiencies to its

manufacturing process which will result in a more consistent production output

in future quarters. The steel manufacturing division generated sales of

$4,333,685 for the three months ended March 31, 2013 compared to sales of

$2,034,247 for the comparable period in 2012, an increase of 113%.

Notwithstanding the increase in sales, the Company continues to be challenged by

volatile crude oil prices, increasing crude oil price differentials and

distribution and pipeline constraints. These factors are contributing to

exploration and production companies deferring or curtailing 2013 capital

spending programs which has deferred demand for large diameter steel in Q1 2013.

Outlook Summary

The Petroleum Services Association of Canada (PSAC) has forecasted 11,976 wells

to be drilled in Western Canada for 2013, a forecasted increase of 7.8% over

2012. That being said, the 2013 Q1 winter drilling season in the WCSB

experienced a decline of 6.8% from the first quarter of 2012, however, it is

anticipated to improve in the second half of 2013. Spring break up may be longer

due to the unusual slow melt from winter which may have an adverse impact on

second quarter Canadian fluid sales. Looking beyond Q2, it is difficult to

determine if demand for oilfield activity will increase as economic concerns are

still impacting the stability of commodity prices. Bri-Chem will continue to

invest into its USA drilling fluid market expansion plan where significant

market share is vastly obtainable. As we continue to gain market share, more

product and acquisition opportunities become available. We will also continue to

closely monitor North American steel pipe demand and seek to increase production

capacity at the Thermal Pipe Expansion manufacturing facility when demand

returns to more normal levels. The Company has also announced a letter of intent

to acquire a specialty cement blending company which management anticipates the

closing of the acquisition during the second quarter of 2013.

About Bri-Chem

Since our formation in 1985, Bri-Chem has established two primary segments of

business through a combination of internal growth and acquisitions: Bri-Chem's

Drilling Fluid Division is North America's largest independent wholesale

supplier of drilling fluids for the oil and gas industry. We provide over 100

drilling fluid products, cementing, acidizing and stimulation additives from 29

strategically located warehouses throughout Canada and the United States;

Bri-Chem's Steel Pipe Division is the first company to introduce and construct a

Thermal Pipe Expansion (TPE) facility in North America for manufacturing,

testing and supply of large diameter seamless steel pipe for the energy

industry. Additional information about Bri-Chem is available at www.sedar.com or

at Bri-Chem's website at www.brichem.com.

Forward Looking Statements

Certain information set forth in this news release contains forward-looking

statements or information ("forward-looking statements"), including statements

which may contain words such as "could", "should", "expect", "anticipate",

"believe", "will", and similar expressions and statements relating to matters

that are not historical facts are forward looking statements. By their nature,

forward-looking statements are subject to numerous risks and uncertainties, some

of which are beyond the Company's control, including the impact of general

economic conditions, industry conditions, volatility of commodity prices,

currency fluctuations, environmental risks, demand for oilfield services for

drilling and completion of oil and natural gas wells; volatility in market

prices for steel, oil, natural gas, and natural gas liquids and the effect of

this volatility on the demand for oilfield services generally, competition from

other industry participants, the lack of availability of qualified personnel or

management, stock market volatility and the ability to access sufficient capital

from internal and external sources. Although the Company believes that the

expectations in our forward-looking statements are reasonable, our

forward-looking statements have been based on factors and assumptions concerning

future events which may prove to be inaccurate. Those factors and assumptions

are based upon currently available information. Such statements are subject to

known and unknown risks, uncertainties and other factors that could influence

actual results or events and cause actual results or events to differ materially

from those stated, anticipated or implied in the forward looking information. As

such, readers are cautioned not to place undue reliance on the forward looking

information, as no assurance can be provided as to future results, levels of

activity or achievements. The risks, uncertainties, material assumptions and

other factors that could affect actual results are discussed in our Annual

Information Form and other documents available at www.sedar.com. Furthermore,

the forward-looking statements contained in this document are made as of the

date of this document and, except as required by applicable law, the Company

does not undertake any obligation to publicly update or to revise any of the

included forward-looking statements, whether as a result of new information,

future events or otherwise. The forward-looking statements contained in this

document are expressly qualified by this cautionary statement.

To receive Bri-Chem news updates send your email to ir@brichem.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bri-Chem Corp.

Jason Theiss

CFO

(780) 577-0595

jtheiss@brichem.com

CHF Investor Relations

Juliet Heading

Account Manager

(416) 868-1079 x239

juliet@chfir.com

CHF Investor Relations

Cathy Hume

CEO

(416) 868-1079 x231

cathy@chfir.com

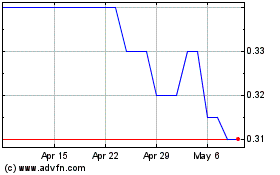

Bri Chem (TSX:BRY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Bri Chem (TSX:BRY)

Historical Stock Chart

From Mar 2024 to Mar 2025