Bri-Chem Announces 2017 Third Quarter Financial Results

November 08 2017 - 7:13PM

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE

SERVICES OR FOR DISSEMINATION IN THE U.S.

Bri-Chem Corp. (“Bri-Chem” or “Company”)

(TSX:BRY), a leading North American wholesale distributor and

manufacturer of oil and gas drilling fluids is pleased to announce

its third quarter financial results.

SELECTED FINANCIAL AND OPERATIONAL

INFORMATION

|

|

|

In $'000s |

For the three months endedSeptember 30, |

Change |

For the nine months endedSeptember 30 |

Change |

|

(except per share amounts) |

|

2017 |

|

|

2016 |

|

$ |

% |

|

2017 |

|

|

2016 |

|

$ |

% |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

30,542 |

|

$ |

16,999 |

|

$ |

13,543 |

|

80 |

% |

$ |

88,293 |

|

$ |

39,994 |

|

$ |

48,299 |

121 |

% |

|

Operating income (loss) |

|

1,935 |

|

|

(448 |

) |

|

2,383 |

|

532 |

% |

|

4,227 |

|

|

(3,076 |

) |

|

7,303 |

237 |

% |

|

EBITDA(1) |

|

2,337 |

|

|

99 |

|

|

2,238 |

|

2261 |

% |

|

5,158 |

|

|

(2,238 |

) |

|

7,396 |

330 |

% |

|

EBITDA as a percentage of

revenue (1) |

|

8 |

% |

|

1 |

% |

|

- |

|

7 |

% |

|

6 |

% |

|

(6% |

) |

|

- |

12 |

% |

|

Net Earnings (loss) |

|

921 |

|

|

(689 |

) |

|

1,610 |

|

234 |

% |

|

1,352 |

|

|

(4,223 |

) |

|

5,575 |

132 |

% |

|

Per Share Data (Diluted) |

|

|

|

|

|

|

|

|

|

EBITDA |

$ |

0.10 |

|

$ |

0.00 |

|

$ |

0.10 |

|

(2467 |

%) |

$ |

0.22 |

|

$ |

(0.09 |

) |

$ |

0.31 |

328 |

% |

|

Net Earnings (Loss) |

$ |

0.04 |

|

$ |

(0.03 |

) |

$ |

0.07 |

|

232 |

% |

$ |

0.06 |

|

$ |

(0.18 |

) |

$ |

0.24 |

132 |

% |

|

Shares Outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

23,632,981 |

|

|

23,632,981 |

|

|

|

|

23,632,981 |

|

|

23,632,981 |

|

|

|

|

Diluted |

|

23,962,981 |

|

|

23,632,981 |

|

|

|

|

23,932,981 |

|

|

23,632,981 |

|

|

|

|

Financial Position |

|

|

|

|

|

|

|

|

|

Total Assets |

$ |

74,406 |

|

$ |

65,578 |

|

$ |

8,828 |

|

13 |

% |

|

|

|

|

|

Working Capital |

|

15,282 |

|

|

13,793 |

|

|

1,489 |

|

11 |

% |

|

|

|

|

|

Long-term debt |

|

179 |

|

|

246 |

|

|

(67 |

) |

(27 |

%) |

|

|

|

|

|

Shareholders Equity |

|

28,700 |

|

|

28,273 |

|

|

427 |

|

2 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 HIGHLIGHTS

Key Q3 & YTD 2017 highlights include:

- Bri-Chem generated consolidated revenues of $30.5 million, an

increase of 80% from the third quarter in 2016, resulting primarily

from higher business activity levels throughout North America;

- Third quarter revenue increased by 100% in the Canadian fluids

distribution division and the USA fluids distribution and blending

and packaging divisions were up 90% and 94% respectively over the

third quarter of 2016;

- Operating income was $1.9 million and $4.2 million for the

three and nine months ended September 30, 2017 compared to negative

$0.5 million and negative $3.1 million in the same comparable

periods, representing a 532% and 237% increase;

- EBITDA was $2.3 million and $5.2 million respectively for the

three and nine months ended September 30, 2017 versus $0.1 million

and negative $2.2 million in the comparable periods in 2016. The

increases of 2,261% and 330% are as a result of significantly

improved drilling activity throughout our business segments in

third quarter and year to date in North America;

- Bri-Chem reported net earnings of $0.9 million or $0.04 diluted

earnings per share compared to a net loss of $0.7 million or $0.03

diluted loss per share in 2016, while year to date, the Company

reported net earnings of $1.4 million or $0.06 earnings per share

compared to a net loss of $4.2 million or $0.09 loss per share for

the same period in 2016;

- Working capital as at September 30, 2017, was $15.3 million

compared to $13.8 million at December 31, 2016. The Company’s

current ratio (defined as current assets divided by current

liabilities) was 1.33 to 1 compared to 1.37 to 1 at December 31,

2016; and

- The Company announced on November 7, 2017 that it has reached

an agreement with the Canadian Imperial Bank of Commerce (“CIBC”)

to increase its Asset Based Lending Facility (“ABL Facility”) from

$25 million to $35 million and extend the term of the ABL facility

for a period of three years to November 2020. In addition, the

Company has also refinanced its current subordinate debt loan with

a new five year term loan with GreyPoint Capital Inc.

Summary for the three and nine months ended

September 30, 2017:

The summer drilling program in Western Canada

rebounded from their lows of the past two years which resulted

stronger sales in Canada during the third quarter while drilling

activity remained consistent in the USA which drove increased year

over year revenue growth for the Company in the third

quarter. Canada experienced 190 average active rigs during

the third quarter of 2017, an increase of 71% over the prior year

quarter, while the active USA rig count increased 97% over the same

period with 947 average active rigs operating in Q3 2017.

Activity levels throughout Canada and USA have shown stabilization

from the recent lows of 2016 as commodity prices have rebounded

from their lows and appear to be also stabilizing. With

better technology in the field, companies are able to lower their

cost of production which has driven increased drilling activity in

2017. Bri-Chem’s three and nine month ended September 30,

2017 consolidated revenues from its North American oil and gas

drilling fluids distribution, blending and packaging businesses

were $30.5 million and $88.3 million compared to $17 million and

$40 million in the same prior periods in 2016. These

increases in quarterly and year to date revenues are a direct

result of an increase in oil and gas drilling activity throughout

North America and a stronger summer drilling program in Western

Canada.

Bri-Chem's Canadian drilling fluids distribution

division generated sales of $12 million and $35.1 million for the

three and nine months ended September 30, 2017, compared to sales

of $6 million and $12.8 million over the comparable periods in

2016. Q3 2017 and year to date sales were strengthened by the

continued increase in drilling activity, with a significant

recovery in summer drilling activity. The number of wells drilled

in Western Canada for the three month period ended September 30,

2017 was 1,983 representing an increase of 75% over the comparable

quarter in 2016. The number of wells drilled for the nine months of

2017 were 5,265 compared to 2,536 for the same period in 2016, an

increase of 108%. Bri-Chem’s United States drilling fluids

distribution division generated sales of $13.7 million and $38.7

million for the three and nine month periods ended September 30,

2017, compared to revenues of $7.2 million and $16.1 million in the

comparable periods of 2016, representing increases of 90% and 140%

respectively.

Bri-Chem’s Canadian drilling fluids blending and

packaging division generated sales of $3.4 million and $11.3

million for the three and nine months ended September 30, 2017

compared to the prior year sales of $3.1 million and $7.7 million

respectively, representing a 13% increase quarter over quarter and

a 46% year over year increase. This increase is directly

related to higher customer demand for blending services as a result

of the increase in drilling activity throughout 2017.

Bri-Chem’s USA fluids blending and packaging division, generated

sales of $1.4 million and $3.2 million for the three and nine month

periods ended September 30, 2017, compared to $0.7 million and $3.3

million for the comparable periods in 2016.

Operating income this quarter was $1.9 million

compared with an operating loss of $0.5 million in the third

quarter of 2016. Operating results this quarter were positively

impacted by the increased activity levels throughout our North

American business segments and a stronger summer drilling program

in Western Canada.

EBITDA was $2.3 million for the three months

ended September 30, 2017 compared to $0.1 million in the same

comparable prior year period; an increase of $2.2 million quarter

over quarter or 2,261%. EBITDA for the nine months of 2017 was $5.2

million or 6% of sales compared to negative EBITDA of $2.2 million

or negative 6% for the same period of 2016. The Company had

net earnings of $0.9 million for the quarter ended September 30,

2017 compared to net loss of $0.7 million in the same prior year

period. For the nine months ended June 30, 2017, the Company had

net earnings of $1.4 million compared to a net loss of $4.2 million

from the comparable prior year period.

OUTLOOK

Northern American oil and gas drilling activity

levels throughout 2017 have increased and recovered from their lows

in 2016, and we expect activity levels to remain at or near current

levels for fiscal 2018. We are cautiously optimistic about

activity levels in the fourth quarter of 2017, as many drilling

companies are nearing completion of their capital spend for fiscal

2017, which could trigger a marginal reduction in drilling activity

during the fourth quarter of 2017. PSAC has forecasted 2,153

wells to be drilled in Western Canada for the fourth quarter of

2017, representing a 45% increase over the fourth quarter of

2016. Furthermore, PSAC is forecasting 7,889 wells to be

drilled in Western Canada for 2018, an increase of 4% over

2017. This modest increase is expected to have a positive

impact on the demand for drilling fluids and is anticipated to

drive more demand for our drilling fluid products in 2018.

While the USA drilling market is showing signs of a small reduction

in active rigs operating in the fourth quarter of 2017, we feel

that drilling activity levels will remain consistent to that of

2017 or marginally improve in 2018. We also intend to look at

expanding deeper into certain active resource plays in the USA

drilling market, so we can continue to expand our growing client

base and secure more overall market share.

As a result of the closing of our recently

announced agreements to renew and increase our senior operating

facility and refinance our current subordinated debt with our new

committed five year term debt, our overall financial position has

now been solidified and we can focus on growing our business.

As activity levels continue to improve over the medium term, we

will seek new growth opportunities while remaining committed to

providing superior customer service while having sufficient

inventory levels to meet the demand of our customers through our

unmatched North American warehouse distribution network.

About Bri-Chem

Bri-Chem has established itself, through a

combination of strategic acquisitions and organic growth, as the

North American industry leader for wholesale distribution and

blending of oilfield drilling, completion, stimulation and

production chemical fluids. We sell, blend, package and distribute

a full range of drilling fluid products from 28 strategically

located warehouses throughout Canada and the United States.

Additional information about Bri-Chem is available at www.sedar.com

or at Bri-Chem's website at www.brichem.com.

To receive Bri-Chem news updates send your email to

ir@brichem.com.

For further information, please contact:

| Jason

TheissBri-Chem Corp.CFOT: (780)

571-8587E: jtheiss@brichem.com |

|

|

|

Neither the TSX nor its Regulation Services

Provider (as that term is defined in the policies of the TSX)

accepts responsibility for the adequacy or accuracy of this

release.

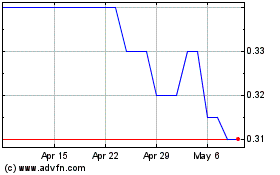

Bri Chem (TSX:BRY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bri Chem (TSX:BRY)

Historical Stock Chart

From Dec 2023 to Dec 2024