Bri-Chem Announces 2018 Second Quarter Financial Results

August 14 2018 - 7:07PM

Bri-Chem Corp. (“Bri-Chem” or “Company”) (TSX:

BRY), a leading North American oilfield chemical

distribution and blending company, is pleased to announce its

second quarter financial results.

|

In $'000s |

For the three months ended June 30, |

Change |

For the six months ended June 30 |

Change |

|

(except per share amounts) |

|

2018 |

|

|

2017 |

|

$ |

% |

|

2018 |

|

|

2017 |

|

$ |

% |

|

Revenue |

$ |

27,255 |

|

$ |

23,761 |

|

$ |

3,494 |

|

15 |

% |

$ |

62,572 |

|

$ |

57,751 |

|

$ |

4,821 |

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

Adjusted Operating income (loss)

(1) |

|

(640 |

) |

|

444 |

|

|

(1,084 |

) |

(244 |

%) |

|

331 |

|

|

2,292 |

|

|

(1,961 |

) |

(86 |

%) |

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(2) |

|

(366 |

) |

|

788 |

|

|

(1,154 |

) |

(146 |

%) |

|

559 |

|

|

2,823 |

|

|

(2,264 |

) |

80 |

% |

|

Adjusted EBITDA as a percentage of revenue |

|

-1 |

% |

|

3 |

% |

|

- |

|

|

|

1 |

% |

|

5 |

% |

|

- |

|

|

|

Adjusted Net (loss)/earnings

(3) |

|

(1,101 |

) |

|

(250 |

) |

|

(851 |

) |

(340 |

%) |

|

(1,207 |

) |

|

431 |

|

|

(1,638 |

) |

380 |

% |

|

Net (loss)/earnings |

$ |

(3,740 |

) |

$ |

(250 |

) |

$ |

(3,490 |

) |

(1396 |

%) |

$ |

(3,846 |

) |

$ |

431 |

|

$ |

(4,277 |

) |

992 |

% |

|

Per Share Data (Diluted) |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

(0.02 |

) |

$ |

0.03 |

|

$ |

(0.04 |

) |

(116 |

%) |

$ |

0.02 |

|

$ |

0.12 |

|

$ |

(0.09 |

) |

80 |

% |

|

Adjusted Net (Loss)/earnings |

$ |

(0.05 |

) |

$ |

(0.01 |

) |

$ |

(0.04 |

) |

(341 |

%) |

$ |

(0.05 |

) |

$ |

0.02 |

|

$ |

(0.07 |

) |

384 |

% |

|

Net (Loss)/earnings |

$ |

(0.16 |

) |

$ |

(0.01 |

) |

$ |

(0.15 |

) |

(1398 |

%) |

$ |

(0.16 |

) |

$ |

0.02 |

|

$ |

(0.18 |

) |

993 |

% |

|

Shares Outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

23,932,981 |

|

|

23,632,981 |

|

|

|

|

23,932,981 |

|

|

23,632,981 |

|

|

|

|

Diluted |

|

23,932,981 |

|

|

23,962,981 |

|

|

|

|

23,932,981 |

|

|

23,962,981 |

|

|

|

|

Financial Position |

|

|

|

|

|

|

|

|

|

Total Assets |

$ |

74,171 |

|

$ |

61,251 |

|

$ |

12,920 |

|

21 |

% |

|

|

|

|

|

Working Capital |

|

20,409 |

|

|

14,513 |

|

|

5,896 |

|

41 |

% |

|

|

|

|

|

Long-term debt |

|

8,616 |

|

|

143 |

|

|

8,473 |

|

5925 |

% |

|

|

|

|

|

Shareholders Equity |

|

25,388 |

|

|

28,282 |

|

|

(2,894 |

) |

(10 |

%) |

|

|

|

|

(1) Represents operating income before

financing costs, foreign exchange, and income taxes and adjusted

for restructuring charges, share-based payments and lost margin on

one-time sales of product below cost (See page 15 of the Q2 2018

MD&A for a further explanation of this non-IFRS measure).(2)

Represents earnings before interest, taxes, depreciation,

amortization, impairment and restructuring charges, share-based

payments and lost margin on one-time sales of product below cost

(See page 15 for a further explanation of this non-IFRS

measure).(3) Represents net earnings adjusted for one-time

sales below cost and restructuring costs, net of tax. (See page

15of the Q2 2018 MD&A for a further explanation of this

non-IFRS measure).

Key Q2 2018 & YTD highlights include:

- Bri-Chem generated consolidated revenue of $27.3 million, an

increase of 15% from the second quarter in 2017, resulting

primarily from higher business activity levels in the US fluids

distribution segment;

- Revenue decreased by 47% in the Canadian fluids distribution as

a result of an early and prolonged spring breakup period and a

corresponding reduction of wells drilled in the second quarter of

2018 and the Canadian blending division revenue increased 8%. The

USA fluids distribution division and blending division revenue

increased 46% and 52% respectively over the second quarter of

2017;

- Adjusted operating loss was $0.64 million for the three months

ended June 30, 2018 compared to operating earnings of $0.44 million

in Q2 2017, representing a $1.1 million decrease;

- Adjusted EBITDA for the second quarter was negative $0.4

million versus $0.8 million in the comparable period in 2017. This

decrease is mainly due to the decrease in Canadian fluids

distribution sales. In addition, the Company invested in the

increase of its infrastructure to keep up with the increased demand

in the USA throughout the first half of 2018;

- Bri-Chem reported an adjusted net loss of $1.1 million or $0.05

loss per share diluted compared to net loss of $0.250 million or

$0.01 loss per share diluted in 2017.

- During Q2, Bri-Chem discontinued operating from Kermit and

Three Rivers, Texas and moved from Enid, Oklahoma to Ada, Oklahoma

in an effort to redeploy its inventory and equipment in higher

margin opportunities. This restructuring resulted in one-time sales

of product below cost amounting to $1.7 million of negative gross

margin and shut down and moving costs of $0.648 million during Q2.

As a result of these one-time restructuring costs our non-adjusted

operating loss was $3.3 million for the three months ended June 30,

2018 compared to operating earnings of $0.44 million in Q2 2017,

representing a $3.7 million decrease, while year to date, the

Company reported a non-adjusted net loss of $3.8 million or $0.16

loss per share compared to net earnings of $0.431 million or $0.02

earnings per share for the same period in 2017;

- Working capital, as at June 30, 2018, was $20.4 million

compared to $24.3 million at December 31, 2017. The Company’s

current ratio (defined as current assets divided by current

liabilities) was 1.51 to 1 compared to 1.56 to 1 as at December 31,

2017.

Summary for the three and six months ended June

30, 2018:

During Q2 2018, drilling activity levels

remained stable in the United States as the USA rig count averaged

1,038 rigs operating during Q2 2018, while Canada experienced a

slower start to summer drilling program due to wet weather

conditions in June. Bri-Chem’s Q2 2018 consolidated revenues

from its North American oil and gas drilling fluids distribution,

blending and packaging businesses was $27.3 million compared to

$23.8 million in the same prior period in 2017, while the Company

had sales of $62.6 million for the first half of 2018 compared to

$57.8 million for the first half of 2017. This revenue

increase is a result of an increase in drilling fluid demand in the

United States, while Western Canada experienced an earlier than

expected and prolonged spring break up.

Bri-Chem's Canadian drilling fluids distribution

division generated sales of $3.7 million and $15.5 million for the

three and six months ended June 30, 2018, compared to sales of $7

million and $23 million over the comparable periods in 2017.

Q2 2018 and year to date sales were lower as many customers were

adequately stocked with their own inventories for the winter

drilling season given consistent drilling activity levels over the

past few quarters. In addition, the industry experienced a

prolonged spring break and wet weather conditions throughout

Alberta caused delays to summer drilling programs. The number

of wells drilled in Western Canada for the three month period ended

June 30, 2018 was 906, representing a decrease of 11% over the

comparable quarter in 2017. Bri-Chem’s United States drilling

fluids distribution division generated sales of $18.7 million and

$36.7 million for the three month and months ended June 30, 2018,

compared to revenues of $12.9 million and $25.1 million in the

comparable periods of 2017, representing increases of 46% and 46%

respectively.

Bri-Chem’s Canadian drilling fluids blending and

packaging division generated sales of $2.9 million and $7 million

for the three and six months ended June 30, 2018 compared to the

prior year quarter sales of $2.7 million and $7.8 million

respectively, representing an 8% increase quarter over quarter and

an 11% decrease year over year. The increase relates to

customers requiring certain products in the quarter and the

division adding new blends to a few existing customers. The

year to date decrease is due to softer demand for blending services

particularly in the month of March as rig activity declined much

sooner than expected for spring breakup. Bri-Chem’s USA

fluids blending and packaging division, generated sales of $1.9

million and $3.4 million for the three and six month periods ended

June 30, 2018, compared to $1.2 million and $1.8 million for the

comparable periods in 2017 as the division has seen customer growth

with the return of well abandonment work in California.

Adjusted operating loss this quarter was $0.64

million compared with operating earnings of $0.44 million in the

second quarter of 2017. Operating results this quarter decreased

due to the late start of the summer drilling program in Western

Canada due to an unusually wet and prolonged spring breakup

period.

Adjusted EBITDA was negative $0.4 million and

$0.4 million for the three and six months ended June 30, 2018

compared to $0.8 million and $2.8 million in the same comparable

prior year periods; decreases of $1.1 million quarter over quarter

and $2.3 million year over year. The second quarter adjusted EBITDA

as a percentage of sales was negative 1% compared to 3% from the

prior year quarter. This decrease in quarter over quarter adjusted

EBITDA is mainly attributed to lower sales in the Canadian fluids

distribution division as the industry experienced a decrease in rig

activity during the quarter. In addition, the Company

reinstated its wage rollback and increased its employee base to

keep up with the increased demand in the USA. The Company had

non-adjusted net loss of $3.7 million for the quarter ended June

30, 2018 compared to a net loss of $0.250 million in the same prior

year period. Adjusting for one-time sales below cost and

restructuring costs, adjusted net loss was $1.1 million for the

second quarter while the adjusted net loss was $1.2 million for the

first half of 2018.

OUTLOOK

During Q1, management initiated a comprehensive

strategic review of all 30 warehouse locations to determine which

warehouses were not achieving target gross margins and EBITDA and

therefore not the best use of further cashflow resources. The

Company determined that two oil based mud facilities in Texas were

incurring substantial above average operating costs, increased

transportation costs due to a shortage of trucking and logistics

within the Texas region and due to the competitive environment in

those locations, target gross margins and EBITDA percentages were

well below other warehouses with no opportunity to achieve higher

margins in the future. As a result, an immediate plan was

implemented to discontinue operations in those warehouses and to

have the restructuring completed as quickly as possible. The focus

of the restructuring plan is to strengthen the Company and enhance

long-term shareholder value.

Looking to the third quarter and beyond, sales

are currently robust across all North American divisions and we

expect our consolidated margins to be at or above historical

normalized levels. Northern American oil and gas drilling activity

levels should remain consistent for the remainder of 2018, however,

PSAC has forecasted 3,586 wells to be drilled in Western Canada for

the second half of 2018 with 1,839 wells to be drilled in the third

quarter, representing a 5% forecasted decrease over Q3 2017.

Bri-Chem will continue to be proactive in seeking higher margin

opportunities throughout all its North America business

segments. We will aim to stay focused on our strategy,

maintain our market share and not sacrifice either to achieve our

margin goals in the near term.

About Bri-Chem

Bri-Chem has established itself, through a

combination of strategic acquisitions and organic growth, as the

North American industry leader for wholesale distribution and

blending of oilfield drilling, completion, stimulation and

production chemical fluids. We sell, blend, package and distribute

a full range of drilling fluid products from 28 strategically

located warehouses throughout Canada and the United States.

Additional information about Bri-Chem is available at www.sedar.com

or at Bri-Chem's website at www.brichem.com.

To receive Bri-Chem news updates send your email to

ir@brichem.com.

For further information, please contact:

| Jason

TheissBri-Chem Corp.CFOT: (780)

571-8587E: jtheiss@brichem.com |

|

|

|

Neither the TSX nor its Regulation Services

Provider (as that term is defined in the policies of the TSX)

accepts responsibility for the adequacy or accuracy of this

release.

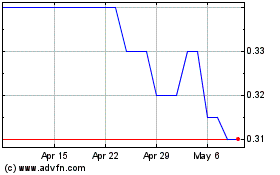

Bri Chem (TSX:BRY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bri Chem (TSX:BRY)

Historical Stock Chart

From Dec 2023 to Dec 2024