Fourth Quarter Highlights

CCL Industries Inc. (TSX:CCL.A) (TSX:CCL.B) (“the Company”), a

world leader in specialty label, security and packaging solutions

for global corporations, government institutions, small businesses

and consumers, today reported record fourth quarter and annual

financial results for 2017.

Sales for the fourth quarter of 2017 increased

16.6% to $1,234.5 million, compared to $1,058.4 million for the

fourth quarter of 2016, with 3.9% organic growth and 14.9%

acquisition growth, primarily driven by the Innovia Group of

Companies (“Innovia”) acquired on February 28, 2017, partially

offset by 2.2% negative foreign currency translation.

Operating income(1) for the fourth quarter of 2017

was $205.1 million, an increase of 27.7% compared to $160.6 million

for the comparable quarter of 2016.

Restructuring and other items increased income by

$4.2 million due the reversal of a pre-acquisition $15.6 million

legal accrual in the Checkpoint Segment’s fourth quarter of 2017

partially offset by $11.4 million of reorganization costs

associated with the 2016 acquisition of Checkpoint Systems Inc. and

the 2017 acquisition of Innovia. There was a net expense for

restructuring and other items of $6.7 million in the 2016 fourth

quarter.

Tax expense for the fourth quarter of 2017 was $4.8

million compared to $33.6 million in the prior year period. The

TCJA legislation, effective January 1, 2018, resulted in a $40

million decrease in tax expense due to a reduction in deferred tax

liabilities. Excluding the TCJA impact the effective tax rate

was 25.9% compared to 25.7% for the 2016 fourth quarter. Of

this $40 million TCJA reduction to deferred tax liabilities, $15

million primarily related to book and tax timing differences and

other discreet items. However, $25 million related to indefinite

life intangibles recognized for accounting purposes that had no

corresponding tax basis and were therefore excluded from adjusted

basic earnings per share.

Net earnings were $169.4 million for the 2017

fourth quarter compared to $98.3 million for the 2016 fourth

quarter. Basic and adjusted basic earnings per Class B share(3)

were $0.97 and $0.83, respectively, compared to basic and

adjusted basic earnings per Class B share(3) of $0.56 and $0.59,

respectively, in the prior year fourth quarter.

For the 2017 year, sales, operating income and net

earnings improved 19.6%, 22.2% and 36.9% to $4.8 billion, $737.5

million and $474.1 million, respectively, compared to December 31,

2016. Expensed through the 2017 cost of goods sold was a $15.2

million non-cash acquisition accounting adjustment to the acquired

finished goods inventory from the Innovia acquisition.

Excluding this non-cash adjustment, operating income was $752.7

million. The 2016 year included non-cash acquisition accounting

adjustments related to acquired finished goods inventories of $33.9

million; therefore, comparative adjusted operating income was

$637.2 million. The year ending December 31, 2017, included results

from twelve acquisitions completed since January 1, 2016,

delivering acquisition related sales growth for the period of

19.1%. Organic sales growth of 2.1% provided the foundation for

solid profit improvement and foreign currency translation had a

negative impact of $0.04 per share. For the year ended December 31,

2017, basic and adjusted basic earnings per Class B share(3) were

$2.70 and $2.69, respectively, compared to basic and adjusted basic

earnings per Class B share(3) of $1.98 and $2.28,

respectively, in the prior year.

Geoffrey T. Martin, President and Chief Executive

Officer, commented, “Strong operating performance and changes to

U.S. tax rates combined to deliver record earnings performance for

both the fourth quarter and 2017. CCL’s 7.7% fourth quarter

organic growth on top of 6.9% in the prior year period exceeded

expectations as gains in most geographies and business lines,

including CCL Secure, drove exceptional profitability. Checkpoint

posted solid 4.0% organic growth and improved profitability while

both Avery and Container delivered increased operating margins

despite top line challenges. Innovia continues to wrestle with raw

material inflation and recorded higher amortization expense as we

finalized the Innovia purchase accounting equation. As we move into

2018, global economic growth appears to be on the rise, especially

in Emerging Markets, but accompanied by cost inflation in raw

materials which will need to be recovered by pricing actions in a

tough environment for many customers. Lower U.S. tax rates offer a

welcome offset to this challenge giving us balanced confidence for

the year ahead.”

Mr. Martin continued, “Foreign currency translation

had a negative impact of $0.01 and $0.04 on earnings per Class B

share for both the fourth quarter and full year 2017. At

today’s Canadian dollar exchange rates, currency translation would

be a headwind, if sustained, for the first quarter of 2018.”

Mr. Martin concluded, “2017 debt repayments totaled

$384.5 million including $169.2 million in the fourth quarter.

Additionally, improved profitability measures including the

trailing results of the acquired Innovia business, reduced the

Company’s leverage ratio(4), to 1.81 times EBITDA(2). Combined

$557.5 million cash-on-hand and US$397.7 million undrawn capacity

on our syndicated revolving credit facility strengthened the

Company’s balance sheet and liquidity positions. With a

strong free cash flow outlook for 2018, the Board of Directors

declared a 13.0% increase in the quarterly dividend to $0.13 per

Class B non-voting share and $0.1275 per Class A voting share,

payable to shareholders of record at the close of business on March

16, 2018, to be paid on March 30, 2018. Acquisitions continue to be

a focus for excess free cash flow; both bolt-on transactions such

as the announced Fascia Graphics transaction that closed in January

2018 and larger opportunities as they come up for

consideration.”

2017 Reporting Changes

Reporting Segment Update: Subsequent to the

acquisition of Innovia on February 28, 2017, the Company modified

its Segment reporting disclosure. The Label Segment, or CCL

Label, was renamed the CCL Segment or CCL, and now includes the

results of the former Innovia Security operations. The new

Innovia Segment includes the results of the Innovia films

operations as well as the legacy films business previously included

in the CCL Segment. Commencing the first quarter of 2018, the

Container Segment will be reported within the Home & Personal

Care business of the CCL Segment. Lastly, on June 5, 2017,

the Company effected a 5:1 stock split on its Class A and Class B

common shares. Unless otherwise noted, impacted amounts and share

information included in this press release have been retroactively

adjusted for the stock split as if such stock split occurred on the

first day of the first period presented. Certain amounts in this

press release may be slightly different than previously reported

due to rounding of fractional shares as a result of the stock

split.

2017 Fourth Quarter Highlights

CCL (formerly CCL Label)

- Sales increased 16.2% to $733.9 million, with 7.7% organic

growth, 10.0% acquisition contribution and 1.5% negative currency

translation

- Regional organic sales growth: low single digit in North

America, mid-single digit in Latin America, high single digit in

Europe and low-twenties in Asia Pacific

- 17.2% return on sales(1) including a strong CCL Secure

performance

- Label joint ventures added $0.01 earnings per Class B

share

- Restructuring and transaction costs totaled $3.2 million in the

quarter predominantly related to the acquired CCL Secure

business

Avery

- Sales down 5.3% to $171.0 million, with 1.9% acquisition

contribution offset by 3.9% organic decline and 3.3% negative

currency translation

- Operating income(1) improved 14.6% on mix to $40.7 million,

23.8% return on sales(1)

- European acquisitions met expectations

Checkpoint

- Sales up 0.7% to $192.3 million, on organic growth of 4.0%,

partially offset by 3.3% negative currency translation

- Operating income(1) improved 13.2% to $30.9 million; 16.1%

return on sales(1)

- $8.0 million restructuring cost; total spending now $35.5

million since acquisition, expect to conclude the programme in the

first half of 2018

- A pre-acquisition legal reserve of $15.6 million was settled in

favour of the Company and included as income within restructuring

and other costs

Innovia

- Sales were $91.2 million

- Raw materials inflation persisted in the quarter; combined with

higher amortization expense resulted in nominal profitability

Container

- Sales down 16.5% to $46.1 million with 13.8% organic sales

decline and 2.7% negative currency translation

- Operating income(1) down nominally but return on sales(1)

improved to 15.2%

- Rheinfelden Americas aluminum slug joint venture continues to

record start-up losses

CCL will hold a conference call at 8:00 a.m. EST on

February 22, 2018, to discuss these results. The analyst

presentation will be posted on the Company’s website.

To access this call, please dial:

1–844-347-1036 Toll Free1–209-905-5911

International Dial-In NumberOptional Conference Passcode:

8979028

Audio replay service will be available from

February 22, 2018, at 11:00 a.m. EST until March 12, 2018, at 12:00

p.m. EDT.

To access Conference Replay, please

dial:1–855-859-2056 Toll Free 1–404-537-3406

International Dial-In NumberConference Passcode: 8979028

For more information on CCL, visit our website -

www.cclind.com or contact:

Sean

Washchuk

Senior Vice President

and Chief Financial

Officer416-756-8526

Forward-looking Statements

This press release contains forward-looking

information and forward-looking statements (hereinafter

collectively referred to as “forward-looking statements”), as

defined under applicable securities laws, that involve a number of

risks and uncertainties. Forward-looking statements include

all statements that are predictive in nature or depend on future

events or conditions. Forward-looking statements are

typically identified by the words “believes,” “expects,”

“anticipates,” “estimates,” “intends,” “plans” or similar

expressions. Statements regarding the operations, business,

financial condition, priorities, ongoing objectives, strategies and

outlook of the Company, other than statements of historical fact,

are forward-looking statements. Specifically, this press release

contains forward-looking statements regarding the anticipated

growth in sales, the impact of foreign currency exchange rates

would be a headwind for the 2018 first quarter; income and

profitability of the Company’s segments; and the Company’s

expectations regarding general business and economic

conditions.

Forward-looking statements are not guarantees of

future performance. They involve known and unknown risks and

uncertainties relating to future events and conditions including,

but not limited to, the impact of competition; consumer confidence

and spending preferences; general economic and geopolitical

conditions; currency exchange rates; interest rates and credit

availability; technological change; changes in government

regulations; risks associated with operating and product hazards;

and the Company’s ability to attract and retain qualified

employees. Do not unduly rely on forward-looking statements as the

Company’s actual results could differ materially from those

anticipated in these forward-looking statements.

Forward-looking statements are also based on a number of

assumptions, which may prove to be incorrect, including, but not

limited to, assumptions about the following: global economic

environment and higher consumer spending; improved customer demand

for the Company’s products; continued historical growth trends,

market growth in specific sectors and entering into new sectors;

the Company’s ability to provide a wide range of products to

multinational customers on a global basis; the benefits of the

Company’s focused strategies and operational approach; the

achievement of the Company’s plans for improved efficiency and

lower costs, including stable aluminum costs; the

availability of cash and credit; fluctuations of currency

exchange rates; fluctuations in resin prices; the Company’s

continued relations with its customers; the Company’s estimated

annual cost reductions and financial impact from the restructuring

of the Checkpoint and Innovia acquisitions; and economic

conditions. Should one or more risks materialize or should any

assumptions prove incorrect, then actual results could vary

materially from those expressed or implied in the forward-looking

statements. Further details on key risks can be found in the

2016 Annual Report, Management’s Discussion and Analysis,

particularly under Section 4: “Risks and Uncertainties.” CCL

Industries Inc.’s annual and quarterly reports can be found online

at www.cclind.com and www.sedar.com or are available upon

request.

Except as otherwise indicated, forward-looking

statements do not take into account the effect that transactions or

non-recurring or other special items announced or occurring after

the statements are made may have on the Company’s business. Such

statements do not, unless otherwise specified by the Company,

reflect the impact of dispositions, sales of assets, monetizations,

mergers, acquisitions, other business combinations or transactions,

asset write-downs or other charges announced or occurring after

forward-looking statements are made. The financial impact of these

transactions and non-recurring and other special items can be

complex and depends on the facts particular to each of them and

therefore cannot be described in a meaningful way in advance of

knowing specific facts. The forward-looking statements are provided

as of the date of this press release and the Company does not

assume any obligation to update or revise the forward-looking

statements to reflect new events or circumstances, except as

required by law.

The financial information presented herein has been

prepared on the basis of IFRS for financial statements and is

expressed in Canadian dollars unless otherwise stated.

Financial Information

| |

| CCL

Industries Inc. |

|

Consolidated statements of financial

position |

|

Unaudited |

| |

| In millions of Canadian

dollars |

|

|

|

|

|

|

|

|

| |

|

|

As at December 31, 2017 |

|

|

|

As at December 31, 2016 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

557.5 |

|

|

$ |

585.1 |

|

| Trade and

other receivables |

|

|

821.3 |

|

|

|

672.2 |

|

|

Inventories |

|

|

425.1 |

|

|

|

351.5 |

|

| Prepaid

expenses |

|

|

33.6 |

|

|

|

25.8 |

|

| Income

taxes recoverable |

|

|

13.1 |

|

|

|

26.2 |

|

|

Derivative instruments |

|

|

1.0 |

|

|

|

0.1 |

|

|

Total current assets |

|

|

1,851.6 |

|

|

|

1,660.9 |

|

| Non-current

assets |

|

|

|

|

|

|

|

|

| Property,

plant and equipment |

|

|

1,514.7 |

|

|

|

1,216.9 |

|

|

Goodwill |

|

|

1,580.7 |

|

|

|

1,131.8 |

|

|

Intangible assets |

|

|

1,082.7 |

|

|

|

549.6 |

|

| Deferred

tax assets |

|

|

28.8 |

|

|

|

21.2 |

|

| Equity

accounted investments |

|

|

54.0 |

|

|

|

64.1 |

|

| Other

assets |

|

|

31.5 |

|

|

|

34.3 |

|

|

Total non-current assets |

|

|

4,292.4 |

|

|

|

3,017.9 |

|

|

Total assets |

|

$ |

6,144.0 |

|

|

$ |

4,678.8 |

|

|

Liabilities |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

| Trade and

other payables |

|

$ |

1,018.4 |

|

|

$ |

844.5 |

|

| Current

portion of long-term debt |

|

|

230.6 |

|

|

|

4.2 |

|

|

Income taxes payable |

|

|

50.7 |

|

|

|

58.3 |

|

|

Total current liabilities |

|

|

1,299.7 |

|

|

|

907.0 |

|

| Non-current

liabilities |

|

|

|

|

|

|

|

|

| Long-term

debt |

|

|

2,100.8 |

|

|

|

1,597.1 |

|

| Deferred

tax liabilities |

|

|

183.5 |

|

|

|

67.8 |

|

| Employee

benefits |

|

|

333.6 |

|

|

|

279.3 |

|

|

Provisions and other long-term liabilities |

|

|

17.8 |

|

|

|

52.4 |

|

|

Derivative instruments |

|

|

50.7 |

|

|

|

- |

|

|

Total non-current liabilities |

|

|

2,686.4 |

|

|

|

1,996.6 |

|

|

Total liabilities |

|

|

3,986.1 |

|

|

|

2,903.6 |

|

|

Equity |

|

|

|

|

|

|

|

|

| Share

capital |

|

|

279.4 |

|

|

|

261.4 |

|

|

Contributed surplus |

|

|

78.0 |

|

|

|

64.2 |

|

| Retained

earnings |

|

|

1,853.4 |

|

|

|

1,450.5 |

|

|

Accumulated other comprehensive loss |

|

|

(52.9 |

) |

|

|

(0.9 |

) |

| Total equity

attributable to shareholders of the Company |

|

|

2,157.9 |

|

|

|

1,775.2 |

|

|

Total liabilities and equity |

|

$ |

6,144.0 |

|

|

$ |

4,678.8 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

CCL Industries Inc. |

|

Consolidated income statements |

|

Unaudited |

|

|

| |

|

Three Months Ended December 31 |

|

|

|

Twelve Months Ended December

31 |

|

| In millions of Canadian

dollars, except per share information |

|

2017 |

|

|

2016 |

|

|

|

2017 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

$ |

1,234.5 |

|

$ |

1,058.4 |

|

|

$ |

4,755.7 |

|

$ |

3,974.7 |

|

| Cost of

sales |

|

851.5 |

|

|

735.8 |

|

|

|

3,319.4 |

|

|

2,806.8 |

|

| Gross profit |

|

383.0 |

|

|

322.6 |

|

|

|

1,436.3 |

|

|

1,167.9 |

|

| Selling, general and

administrative expenses |

|

190.5 |

|

|

173.0 |

|

|

|

751.5 |

|

|

612.8 |

|

| Restructuring and other

items |

|

(4.2 |

) |

|

6.7 |

|

|

|

11.3 |

|

|

34.6 |

|

| Earnings

in equity accounted investments |

|

(1.3 |

) |

|

(1.2 |

) |

|

|

(3.7 |

) |

|

(4.5 |

) |

|

|

|

198.0 |

|

|

144.1 |

|

|

|

677.2 |

|

|

525.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finance cost |

|

32.5 |

|

|

13.7 |

|

|

|

87.4 |

|

|

41.8 |

|

| Finance

income |

|

(8.7 |

) |

|

(1.5 |

) |

|

|

(12.2 |

) |

|

(3.9 |

) |

| Net

finance cost |

|

23.8 |

|

|

12.2 |

|

|

|

75.2 |

|

|

37.9 |

|

| Earnings before

income tax |

|

174.2 |

|

|

131.9 |

|

|

|

602.0 |

|

|

487.1 |

|

| Income

tax expense |

|

4.8 |

|

|

33.6 |

|

|

|

127.9 |

|

|

140.8 |

|

|

Net earnings |

$ |

169.4 |

|

$ |

98.3 |

|

|

$ |

474.1 |

|

$ |

346.3 |

|

| Attributable

to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders of the Company |

$ |

169.4 |

|

$ |

98.4 |

|

|

$ |

474.1 |

|

$ |

346.8 |

|

|

Non-controlling interest |

|

- |

|

|

(0.1 |

) |

|

|

- |

|

|

(0.5 |

) |

|

Net earnings |

$ |

169.4 |

|

$ |

98.3 |

|

|

$ |

474.1 |

|

$ |

346.3 |

|

| Earnings per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic

earnings per Class B share |

$ |

0.97 |

|

$ |

0.56 |

|

|

$ |

2.70 |

|

$ |

1.98 |

|

| Diluted

earnings per Class B share |

$ |

0.95 |

|

$ |

0.55 |

|

|

$ |

2.66 |

|

$ |

1.95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CCL Industries Inc. |

|

Consolidated statements of cash flows |

|

Unaudited |

|

|

| |

|

|

|

| |

Three Months EndedDecember

31 |

|

Twelve Months Ended December 31 |

| In millions of Canadian

dollars |

|

2017 |

|

|

2016 |

|

|

|

2017 |

|

|

2016 |

|

| Cash provided

by (used for) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

$ |

169.4 |

|

$ |

98.3 |

|

|

$ |

474.1 |

|

$ |

346.3 |

|

| Adjustments for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

66.5 |

|

|

54.7 |

|

|

|

259.2 |

|

|

203.7 |

|

| Earnings

from equity accounted investments, net of dividends

received |

|

(1.3 |

) |

|

(1.3 |

) |

|

|

(1.2 |

) |

|

(1.7 |

) |

| Net

finance costs |

|

23.8 |

|

|

12.2 |

|

|

|

75.2 |

|

|

37.9 |

|

| Current

income tax expense |

|

40.4 |

|

|

20.6 |

|

|

|

155.2 |

|

|

126.0 |

|

|

Deferred taxes |

|

(35.6 |

) |

|

13.0 |

|

|

|

(27.3 |

) |

|

14.8 |

|

|

Equity-settled share-based payment transactions |

|

1.3 |

|

|

3.9 |

|

|

|

19.7 |

|

|

15.4 |

|

|

Loss (gain) on sale of property, plant and equipment |

|

0.5 |

|

|

(0.2 |

) |

|

|

(0.9 |

) |

|

(1.4 |

) |

|

|

|

265.0 |

|

|

201.2 |

|

|

|

954.0 |

|

|

741.0 |

|

| Change in

inventories |

|

15.7 |

|

|

35.9 |

|

|

|

8.1 |

|

|

61.3 |

|

| Change in

trade and other receivables |

|

27.5 |

|

|

62.0 |

|

|

|

(36.1 |

) |

|

22.8 |

|

| Change in

prepaid expenses |

|

6.1 |

|

|

4.0 |

|

|

|

(7.5 |

) |

|

(4.4 |

) |

| Change in

trade and other payables |

|

37.7 |

|

|

(0.2 |

) |

|

|

3.6 |

|

|

(100.1 |

) |

| Change in

income taxes receivable and payable |

|

3.6 |

|

|

(5.4 |

) |

|

|

8.4 |

|

|

(2.5 |

) |

| Change in

employee benefits |

|

(3.7 |

) |

|

3.8 |

|

|

|

10.7 |

|

|

16.6 |

|

|

Change in other assets and liabilities |

|

(2.3 |

) |

|

(3.5 |

) |

|

|

(8.1 |

) |

|

(9.9 |

) |

| |

|

349.6 |

|

|

297.8 |

|

|

|

933.1 |

|

|

724.8 |

|

| Net interest paid |

|

(15.5 |

) |

|

(3.0 |

) |

|

|

(67.3 |

) |

|

(36.0 |

) |

| Income

taxes paid |

|

(47.8 |

) |

|

(40.7 |

) |

|

|

(154.6 |

) |

|

(124.8 |

) |

|

Cash provided by operating activities |

|

286.3 |

|

|

254.1 |

|

|

|

711.2 |

|

|

564.0 |

|

| Financing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds on issuance of

long-term debt |

|

- |

|

|

(2.9 |

) |

|

|

1,186.6 |

|

|

835.2 |

|

| Repayment of debt |

|

(169.2 |

) |

|

(69.9 |

) |

|

|

(384.5 |

|

|

(302.2 |

) |

| Proceeds from issuance

of shares |

|

0.6 |

|

|

- |

|

|

|

12.1 |

|

|

5.6 |

|

| Purchase of shares held

in trust |

|

- |

|

|

- |

|

|

|

- |

|

|

(28.8 |

) |

| Dividends

paid |

|

(20.4 |

) |

|

(17.6 |

) |

|

|

(81.2 |

|

|

(70.2 |

) |

|

Cash provided by (used for) financing

activities |

|

(189.0 |

) |

|

(90.4 |

) |

|

|

733.0 |

|

|

439.6 |

|

| Investing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additions to property,

plant and equipment |

|

(47.0 |

) |

|

(33.9 |

) |

|

|

(285.7 |

) |

|

(234.7 |

) |

| Proceeds on disposal of

property, plant and equipment |

|

0.4 |

|

|

2.7 |

|

|

|

12.8 |

|

|

9.3 |

|

| Business

acquisitions and other long-term investments |

|

(7.6 |

) |

|

(2.8 |

) |

|

|

(1,191.4 |

) |

|

(571.4 |

) |

|

Cash used for investing activities |

|

(54.2 |

) |

|

(34.0 |

) |

|

|

(1,464.3 |

) |

|

(796.8 |

) |

| Net increase (decrease)

in cash and cash equivalents |

|

43.1 |

|

|

129.7 |

|

|

|

(20.1 |

) |

|

206.8 |

|

| Cash and cash

equivalents at beginning of period |

|

512.9 |

|

|

458.3 |

|

|

|

585.1 |

|

|

405.7 |

|

|

Translation adjustments on cash and cash equivalents |

|

1.5 |

|

|

(2.9 |

) |

|

|

(7.5 |

) |

|

(27.4 |

) |

|

Cash and cash equivalents at end of the

period |

$ |

557.5 |

|

$ |

585.1 |

|

|

$ |

557.5 |

|

$ |

585.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| CCL Industries Inc. |

| Segment Information |

| Unaudited |

| |

| In

millions of Canadian dollars |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

Operating income |

|

|

Sales |

|

Operating income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31 |

|

|

Twelve Months Ended December 31 |

| |

|

2017 |

|

|

|

2016 |

|

2017 |

|

2016 |

|

|

2017 |

|

2016 |

|

2017 |

|

|

2016 |

|

| CCL |

$ |

733.9 |

|

|

$ |

631.8 |

|

$ |

126.4 |

|

|

$ |

90.7 |

|

|

$ |

2,823.1 |

|

$ |

2,497.6 |

|

$ |

444.8 |

|

|

$ |

378.0 |

|

| Avery |

|

171.0 |

|

|

|

180.5 |

|

|

40.7 |

|

|

|

35.5 |

|

|

|

752.9 |

|

|

787.7 |

|

|

164.5 |

|

|

|

166.8 |

|

| Checkpoint |

|

192.3 |

|

|

|

190.9 |

|

|

30.9 |

|

|

|

27.3 |

|

|

|

675.2 |

|

|

459.0 |

|

|

87.4 |

|

|

|

28.2 |

|

| Innovia |

|

91.2 |

|

|

|

- |

|

|

0.1 |

|

|

|

- |

|

|

|

308.2 |

|

|

- |

|

|

14.6 |

|

|

|

- |

|

| Container |

|

46.1 |

|

|

|

55.2 |

|

|

7.0 |

|

|

|

7.1 |

|

|

|

196.3 |

|

|

230.4 |

|

|

26.2 |

|

|

|

30.3 |

|

| Total operations |

$ |

1,234.5 |

|

|

$ |

1,058.4 |

|

$ |

205.1 |

|

|

$ |

160.6 |

|

|

$ |

4,755.7 |

|

$ |

3,974.7 |

|

$ |

737.5 |

|

|

$ |

603.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate expense |

|

|

|

|

|

|

|

|

(12.6 |

) |

|

|

(11.0 |

) |

|

|

|

|

|

|

|

|

(52.7 |

) |

|

|

(48.2 |

) |

| Restructuring and other

items |

|

|

|

|

|

|

|

|

4.2 |

|

|

|

(6.7 |

) |

|

|

|

|

|

|

|

|

(11.3 |

) |

|

|

(34.6 |

) |

| Earnings in equity

accounted investments |

|

|

|

|

|

|

|

|

1.3 |

|

|

|

1.2 |

|

|

|

|

|

|

|

|

|

3.7 |

|

|

|

4.5 |

|

| Finance cost |

|

|

|

|

|

|

|

|

(32.5 |

) |

|

|

(13.7 |

) |

|

|

|

|

|

|

|

|

(87.4 |

) |

|

|

(41.8 |

) |

| Finance income |

|

|

|

|

|

|

|

|

8.7 |

|

|

|

1.5 |

|

|

|

|

|

|

|

|

|

12.2 |

|

|

|

3.9 |

|

| Income tax expense |

|

|

|

|

|

|

|

|

(4.8 |

) |

|

|

(33.6 |

) |

|

|

|

|

|

|

|

|

(127.9 |

) |

|

|

(140.8 |

) |

| Net earnings |

|

|

|

|

|

|

|

$ |

169.4 |

|

|

$ |

98.3 |

|

|

|

|

|

|

|

|

$ |

474.1 |

|

|

$ |

346.3 |

|

|

|

| |

Total

assets |

|

|

Total liabilities |

|

Depreciation and amortization |

|

Capital expenditures |

| |

December

31 |

|

|

December 31 |

|

December 31 |

|

December 31 |

| |

2017 |

|

2016 |

|

2017 |

|

|

2016 |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CCL |

$ |

3,172.9 |

|

$ |

2,451.9 |

|

$ |

775.4 |

|

$ |

639.5 |

|

$ |

172.5 |

|

$ |

152.6 |

|

$ |

218.6 |

|

$ |

194.8 |

| Avery |

|

593.4 |

|

|

566.6 |

|

|

197.1 |

|

|

201.3 |

|

|

16.1 |

|

|

16.1 |

|

|

13.8 |

|

|

16.2 |

| Checkpoint |

|

941.0 |

|

|

935.8 |

|

|

417.4 |

|

|

441.8 |

|

|

29.0 |

|

|

18.7 |

|

|

23.3 |

|

|

5.9 |

| Innovia |

|

751.5 |

|

|

- |

|

|

160.5 |

|

|

- |

|

|

27.4 |

|

|

- |

|

|

10.9 |

|

|

- |

| Container |

|

140.1 |

|

|

156.1 |

|

|

46.2 |

|

|

42.3 |

|

|

13.3 |

|

|

15.3 |

|

|

18.7 |

|

|

17.8 |

| Equity

accounted investments |

|

54.0 |

|

|

64.1 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| Corporate |

|

491.1 |

|

|

504.3 |

|

|

2,389.5 |

|

|

1,578.7 |

|

|

0.9 |

|

|

1.0 |

|

|

0.4 |

|

|

- |

| Total |

$ |

6,144.0 |

|

$ |

4,678.8 |

|

$ |

3,986.1 |

|

$ |

2,903.6 |

|

$ |

259.2 |

|

$ |

203.7 |

|

$ |

285.7 |

|

$ |

234.7 |

|

|

Non-IFRS Measures

(1) Operating income and operating income margin

are key non-IFRS financial measures used to assist in understanding

the profitability of the Company’s business units. Operating income

is defined as earnings before corporate expenses, net finance cost,

goodwill impairment loss, earnings in equity accounted investments,

restructuring and other items, and taxes. Operating income margin,

also known as return on sales, is defined as operating income over

sales.

(2) EBITDA is a critical non-IFRS financial measure

used extensively in the packaging industry and other industries to

assist in understanding and measuring operating results. EBITDA is

also considered as a proxy for cash flow and a facilitator for

business valuations. This non-IFRS financial measure is defined as

earnings before net finance cost, taxes, depreciation and

amortization, goodwill impairment loss, non-cash acquisition

accounting adjustments to finished goods inventory, earnings in

equity accounted investments and restructuring and other

items. Calculations are provided below to reconcile operating

income to EBITDA. The Company believes that this is an important

measure as it allows management to assess the ongoing business

without the impact of net finance cost, depreciation and

amortization and income tax expenses, as well as non-operating

factors and one-time items. As a proxy for cash flow, it is

intended to indicate the Company’s ability to incur or service debt

and to invest in property, plant and equipment, and it allows

management to compare the business to those of the Company’s peers

and competitors who may have different capital or organizational

structures. EBITDA is tracked by financial analysts and

investors to evaluate financial performance and is a key metric in

business valuations. EBITDA is considered an important

measure by lenders to the Company and is included in the financial

covenants included in the senior notes and bank lines of

credit.

Reconciliation of operating income to EBITDA

| |

|

|

|

|

Unaudited |

|

|

|

| (In millions of Canadian dollars) |

|

|

|

| |

Three months ended December 31 |

Twelve months

ended December

31 |

| Sales |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

| CCL |

$ |

733.9 |

|

$ |

631.8 |

|

$ |

2,823.1 |

|

$ |

2,497.6 |

|

| Avery |

|

171.0 |

|

|

180.5 |

|

|

752.9 |

|

|

787.7 |

|

| Checkpoint |

|

192.3 |

|

|

190.9 |

|

|

675.2 |

|

|

459.0 |

|

| Innovia |

|

91.2 |

|

|

- |

|

|

308.2 |

|

|

- |

|

|

Container |

|

46.1 |

|

|

55.2 |

|

|

196.3 |

|

|

230.4 |

|

| Total

sales |

$ |

1,234.5 |

|

$ |

1,058.4 |

|

$ |

4,755.7 |

|

$ |

3,974.7 |

|

| Operating income |

|

|

|

|

|

|

|

|

|

|

|

|

|

CCL |

$ |

126.4 |

|

$ |

90.7 |

|

$ |

444.8 |

|

$ |

378.0 |

|

|

Avery |

|

40.7 |

|

|

35.5 |

|

|

164.5 |

|

|

166.8 |

|

|

Checkpoint |

|

30.9 |

|

|

27.3 |

|

|

87.4 |

|

|

28.2 |

|

|

Innovia |

|

0.1 |

|

|

- |

|

|

14.6 |

|

|

- |

|

|

Container |

|

7.0 |

|

|

7.1 |

|

|

26.2 |

|

|

30.3 |

|

| Total

operating income |

|

205.1 |

|

|

160.6 |

|

|

737.5 |

|

|

603.3 |

|

| Less:

Corporate expenses |

|

(12.6 |

) |

|

(11.0 |

) |

|

(52.7 |

) |

|

(48.2 |

) |

| Add: Depreciation

& amortization |

|

66.5 |

|

|

54.7 |

|

|

259.2 |

|

|

203.7 |

|

|

Add: Non-cash acquisition accounting adjustment to finished

goods inventory |

|

- |

|

|

- |

|

|

15.2 |

|

|

33.9 |

|

|

EBITDA |

$ |

259.0 |

|

$ |

204.3 |

|

$ |

959.2 |

|

$ |

792.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(3) Adjusted basic earnings per Class B share is an

important non-IFRS measure to assist in understanding the ongoing

earnings performance of the Company excluding items of a one-time

or non-recurring nature. It is not considered a substitute

for basic net earnings per Class B share but it does provide

additional insight into the ongoing financial results of the

Company. This non-IFRS financial measure is defined as basic

net earnings per Class B share excluding gains on business

dispositions, goodwill impairment loss, non-cash acquisition

accounting adjustments to finished goods inventory, restructuring

and other items, and tax adjustments.

Reconciliation of Basic Earnings per Class B Share

to Adjusted Basic Earnings per Class B Share

| |

|

|

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

| |

Three months endedDecember 31 |

|

Twelve months endedDecember 31 |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Basic earnings per

Class B Share |

$ |

0.97 |

|

|

$ |

0.56 |

|

$ |

2.70 |

|

$ |

1.98 |

| Net loss from

restructuring and other items |

|

- |

* |

|

|

0.03 |

|

|

0.07 |

|

|

0.15 |

| Non-cash acquisition

accounting adjustment related to finished goods inventory |

|

- |

|

|

|

- |

|

|

0.06 |

|

|

0.15 |

| TCJA remeasurement of

deferred tax on indefinite life intangibles |

|

(0.14 |

) |

|

|

- |

|

|

(0.14 |

) |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Basic Earnings per Class B

Share |

$ |

0.83 |

|

|

$ |

0.59 |

|

$ |

2.69 |

|

$ |

2.28 |

*The net after tax impact of restructuring and

other items was nominal.

(4) Leverage ratio is a measure that indicates

the Company’s ability to service its existing debt. Leverage

ratio is calculated as net debt divided by EBITDA.

| |

|

|

|

December 31, 2017 |

| Unaudited (In millions

of Canadian dollars) |

|

|

|

|

| Current debt |

|

$ |

230.6 |

|

| Long-term

debt |

|

|

2,100.8 |

|

| Total debt |

|

|

2,331.4 |

|

| Cash and

cash equivalents |

|

|

(557.5 |

) |

| |

|

|

|

|

| Net debt |

|

$ |

1,773.9 |

|

| Proforma

EBITDA for 12 months ending December 31, 2017 (see

below) |

|

$ |

981.8 |

|

|

Leverage Ratio |

|

|

1.81 |

|

| |

|

|

|

|

|

|

|

|

|

|

| EBITDA for 12 months

ended December 31, 2017 |

|

$ |

959.2 |

|

|

add: Innovia EBITDA |

|

|

22.6 |

|

|

Proforma EBITDA for 12 months ended December 31,

2017 |

|

$ |

981.8 |

|

| |

|

|

|

|

| Supplemental Financial Information |

| Sales Change Analysis |

| Revenue Growth Rates (%) |

|

|

| |

|

|

| |

Three Months Ended December 31,

2017 |

Twelve Months Ended December 31,

2017 |

| |

Organic |

Acquisition |

FX |

|

Organic |

Acquisition |

FX |

|

| |

Growth |

Growth |

Translation |

Total |

Growth |

Growth |

Translation |

Total |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CCL |

7.7 |

% |

10.0% |

(1.5 |

%) |

16.2 |

% |

6.2 |

% |

8.3% |

(1.5 |

%) |

13.0 |

% |

| Avery |

(3.9 |

%) |

1.9% |

(3.3 |

%) |

(5.3 |

%) |

(4.6 |

%) |

1.9% |

(1.7 |

%) |

(4.4 |

%) |

|

Checkpoint |

4.0 |

% |

- |

(3.3 |

%) |

0.7 |

% |

(1.0 |

%) |

50.1% |

(2.0 |

%) |

47.1 |

% |

|

Innovia |

- |

|

100.0% |

- |

|

100.0 |

% |

- |

|

100.0% |

- |

|

100.0 |

% |

|

Container |

(13.8 |

%) |

- |

(2.7 |

%) |

(16.5 |

%) |

(12.9 |

%) |

- |

(1.9 |

%) |

(14.8 |

%) |

| Total |

3.9 |

% |

14.9% |

(2.2 |

%) |

16.6 |

% |

2.1 |

% |

19.1% |

(1.6 |

%) |

19.6 |

% |

| |

|

|

|

|

|

|

|

|

Business Description

CCL Industries Inc. employs

approximately 20,000 people operating 167 production facilities in

39 countries with corporate offices in Toronto, Canada, and

Framingham, Massachusetts. CCL is the world’s

largest converter of pressure sensitive and extruded film materials

for a wide range of decorative, instructional, functional and

security applications for government institutions and large global

customers in the consumer packaging, healthcare and chemicals,

consumer electronic device and automotive markets. Extruded and

laminated plastic tubes, folded instructional leaflets, precision

decorated and die cut components, electronic displays, polymer bank

note substrate and other complementary products and services are

sold in parallel to specific end-use markets.

Avery is the world’s largest supplier of labels,

specialty converted media and software solutions to enable

short-run digital printing in businesses and homes alongside

complementary products sold through distributors and mass market

retailers. Checkpoint is a leading developer of RF

and RFID based technology systems for loss prevention and inventory

management including labeling and tagging solutions for the global

retail and apparel industries. Innovia is a

leading global producer of specialty, high performance,

multi-layer, surface engineered films for label, packaging and

security applications. Container is a

leading producer of impact extruded aluminum aerosol cans and

specialty bottles for consumer packaged goods and healthcare

customers in the United States and Mexico. The

Company is also backward integrated into materials

science with capabilities in polymer extrusion, adhesive

development, coating and lamination, surface engineering and

metallurgy that are deployed across all five business segments.

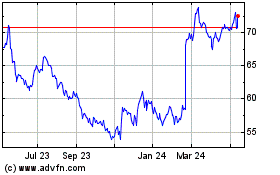

CCL Industries (TSX:CCL.B)

Historical Stock Chart

From Jan 2025 to Feb 2025

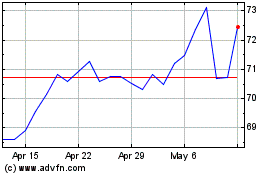

CCL Industries (TSX:CCL.B)

Historical Stock Chart

From Feb 2024 to Feb 2025