Infrastructure Dividend Split Corp. Files Final Prospectus

May 06 2024 - 7:26PM

Infrastructure Dividend Split Corp. (the “Company”), is pleased to

announce that it has filed a final prospectus in relation to an

initial public offering of preferred shares. The maximum amount of

the offering is $52,643,700.

The Company will invest in a diversified,

actively managed portfolio of dividend-paying securities of issuers

operating in the infrastructure sector. The investment strategy of

the Company will be to initially invest in a portfolio of

approximately 15 dividend-paying issuers operating in the

infrastructure sector that Middlefield Capital Corporation (the

“Advisor”), the investment advisor of the Company, believes offers

investors the potential for both income through attractive dividend

yields and capital appreciation and that it believes are

undervalued and well-positioned to benefit from the Advisor’s

outlook for a gradual reduction in interest rates, the continuation

of global decarbonization, and favourable demographics (such as a

growing middle class and urbanization).

The Company’s investment objectives for the:

Class A shares are to provide holders with:

(i) non-cumulative

monthly cash distributions; and(ii) the opportunity for capital

appreciation through exposure to the Portfolio

Preferred shares are to:

(i) provide holders

with fixed cumulative preferential quarterly cash distributions;

and(ii) return the original issue price of $10.00 to holders upon

maturity

The initial target distribution yield for the

class A shares is 10.0% per annum based on the notional $15 issue

price (or $0.125 per month or $1.50 per annum).

The initial target distribution yield for the

preferred shares is 7.2% per annum based on the original

subscription price (or $0.18 per quarter or $0.72 per annum).

The syndicate of agents is being co-led by CIBC

Capital Markets, RBC Capital Markets, and Scotiabank, and includes

Canaccord Genuity Corp., National Bank Financial Inc., Hampton

Securities Limited, BMO Capital Markets, iA Private Wealth Inc.,

Raymond James Ltd., Manulife Wealth Incorporated, Echelon Wealth

Partners Inc., Wellington-Altus Private Wealth Inc., Desjardins

Securities Inc. and Research Capital Corporation.

For further information, please visit our

website at www.middlefield.com or contact Nancy Tham in our Sales

and Marketing Department at 1.888.890.1868.

This offering is only made by

prospectus. The prospectus contains important detailed information

about the securities being offered. Copies of the prospectus may be

obtained from your CIRO registered financial advisor using the

contact information for such advisor. Investors should read the

prospectus before making an investment decision.

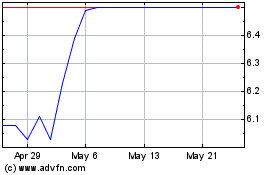

International Clean Powe... (TSX:CLP.UN)

Historical Stock Chart

From Dec 2024 to Jan 2025

International Clean Powe... (TSX:CLP.UN)

Historical Stock Chart

From Jan 2024 to Jan 2025